Most traded currencies in the world

Learn about the most traded currencies in the world, as well as how to trade them via CFDs on Capital.com.

What are the 10 most traded currencies?

The most traded currencies of the world are the US dollar (USD), followed by the euro (EUR), Japanese yen (JPY), and British pound (GBP). These currencies dominate global forex trading thanks to their stability, liquidity, and influence in international markets. Each plays a unique role, often impacted by their respective central banks, economic conditions, and global trade.

We’ll look at the top 10 currency list, why each is so widely traded, the major forex pairs in which they feature, and the key factors that make them essential to the forex market. All statistics used below are from the latest 2022 Bank for International Settlements triennial report, widely considered the leading primary information source for such data.

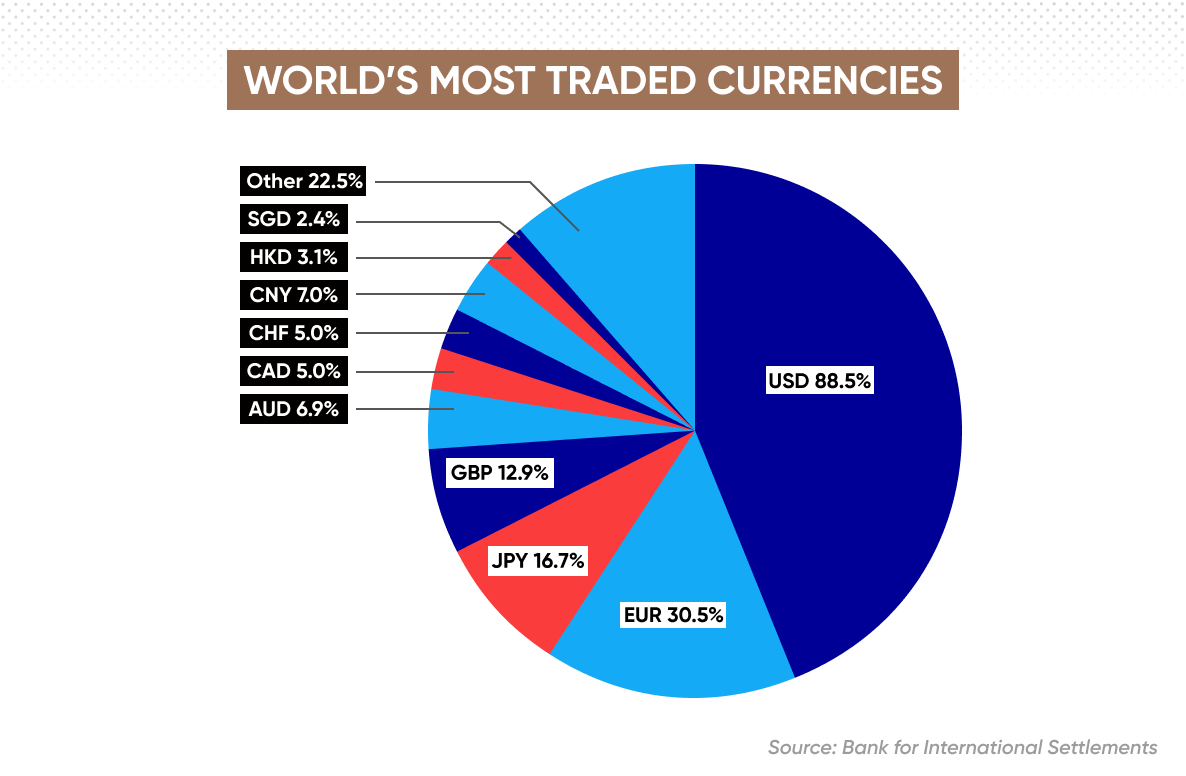

The below chart shows the world’s most traded currencies according to this data. Note that the percentages add up to 200, given the nature of currencies being traded in pairs.

US dollar (USD)

The top currency in the world by volume is the US dollar, with an average daily trading volume of $6.6tn in 2022. This high volume reflects its role in nearly 88% of global forex transactions, underlining the dollar's dominance in international finance. Its position as the world’s primary reserve currency lends it unique liquidity and stability, anchoring major currency pairs like EUR/USD, USD/JPY, and GBP/USD. The dollar’s movements are often influenced by US economic indicators, Federal Reserve policies, and international events, especially as many commodities, including oil and gold, are priced in USD.

Euro (EUR)

The euro saw an average daily trading volume of $2.29tn in 2022. Representing 20 European countries, this makes the euro the second most-traded currency worldwide. The euro’s value is shaped by the European Central Bank (ECB), economic conditions within the eurozone, and various political factors. Highly liquid and influential, the euro’s primary trading pair is EUR/USD, one of the most active pairs, serving as a key measure of euro strength against the dollar.

Japanese yen (JPY)

The Japanese yen is the third most traded currency with an average daily trading volume of $1.25tn in 2022. It’s the most traded currency in Asia and a symbol of stability in global markets. Japan’s low-interest rate environment makes the yen central to ‘carry trades’ where investors borrow yen to invest in higher-yield currencies. Its value is heavily impacted by Bank of Japan (BoJ) policies, Japanese economic data, and Asia’s regional economy. USD/JPY remains one of the most traded currency pairs globally.

British pound (GBP)

The British pound saw an average daily trading volume of $968bn in 2022, making it the fourth most-traded currency. Often called ‘sterling,” it’s one of the oldest and most frequently traded currencies. Known for its volatility, GBP is sensitive to UK-specific events, from Bank of England (BoE) policy changes to economic data and political developments, including Brexit. GBP/USD, or ‘Cable’, is a popular and often highly volatile pair, watched closely for its sharp price shifts.

Canadian dollar (CAD)

The ‘loonie’, as the Canadian dollar is known as, saw a trading volume of some $526bn in 2022. It’s closely tied to oil prices, given Canada’s status as a major oil exporter. CAD tends to follow crude oil price trends, making it attractive to traders with a focus on commodities. The Bank of Canada (BoC) policies, economic data, and US economic conditions also impact CAD’s value. USD/CAD is one of the most frequently traded pairs, reflecting the close economic ties between the US and Canada.

Australian dollar (AUD)

The Australian dollar saw an average daily trading volume of $478bn in 2022. It’s a commodity-linked currency, heavily influenced by exports like iron ore, coal, and natural gas. It’s popular among traders looking for exposure to Asia-Pacific and global commodity trends. The AUD is impacted by commodity prices, China’s economy, and Reserve Bank of Australia (RBA) policies. AUD/USD is a commonly traded pair, favoured for its responsiveness to global risk sentiment.

Swiss franc (CHF)

The Swiss franc saw daily trading volumes of around $389bn in 2022. It’s often seen as a ‘safe haven’ currency, attracting traders in times of global uncertainty. The Swiss National Bank (SNB) closely manages the franc’s valuation to prevent excessive appreciation. CHF’s reputation as a safe-haven asset, alongside Switzerland’s stable economy and low inflation, make it unique. USD/CHF and EUR/CHF are the primary pairs used for franc trading.

Chinese yuan (CNY)

With China’s economic influence growing, the Chinese yuan is gaining prominence in global forex markets. While not fully convertible, the yuan is used in substantial trade transactions, especially with Asia and emerging markets. The People’s Bank of China (PBOC) manages the yuan’s value through a controlled float. As China expands its trade network, USD/CNY and other yuan pairs continue to see rising volumes.

Hong Kong dollar (HKD)

The Hong Kong Dollar ranks as one of the top traded currencies, primarily due to Hong Kong’s position as a major financial hub in Asia and its close trade ties with mainland China. The HKD is pegged to the USD within a tight range (7.75–7.85 HKD per USD), and this stability attracts international investment and supports high trading volumes. The currency's daily trading volume is significant, with much of it driven by Hong Kong’s extensive financial services sector, as well as its deep connection with mainland China’s economy.

New Zealand dollar (NZD)

The New Zealand Dollar (NZD) is a top commodity currency, linked closely to New Zealand’s robust agricultural and energy exports, particularly dairy, meat, and forestry. The Reserve Bank of New Zealand manages the currency, and fluctuations in global commodity prices impact the NZD's value. The NZD is particularly popular among traders who want exposure to the Asia-Pacific region’s market without the volatility seen in some larger Asian economies. The daily average turnover for the NZD underscores its importance in the forex market as a bridge currency for trade and investment in this region.

How do I find out more about the most traded currencies?

To find out more on the world’s most traded currencies, you can stay up to date with the latest market-moving forex news from our expert analysts, and read our guide to forex trading for a broader understanding of how currencies work. Also, the BIS triennial central bank survey provides deep insights into global forex activity. Major banks like JP Morgan and Goldman Sachs also release frequent currency analysis, while the IMF’s Global Financial Stability Report highlights macro currency trends.

How to trade the most traded currencies with CFDs

Trading the most traded currencies with CFDs allows you to speculate on price changes without owning the currencies themselves. CFDs offer flexibility to go long (buy) if you expect a forex pair’s price to rise, or short (sell) if you expect a fall. You can use leverage (known as margin trading) to gain exposure to larger positions with only a small outlay, although leverage is risky due to both profits and losses being amplified.

Major currencies are highly liquid, often offering tighter spreads, and are influenced by factors like central bank policies, economic data, and global events. Always trade with a plan and you could set stop-loss orders as part of a risk management strategy.

Learn more about CFD trading with our helpful guide, and find out more about how the forex market works.

FAQs

Why does it matter that a currency is highly traded?

When a currency is highly traded, it means there’s high liquidity in the market, making it easier for traders to enter and exit positions quickly with minimal price changes. This liquidity generally leads to tighter spreads (lower costs) and less price volatility, which can benefit retail traders by providing more predictable movements. Additionally, heavily traded currencies often reflect strong economies or are backed by central banks with stable policies, making them less susceptible to unexpected price swings compared to less liquid currencies.

What is the world’s most traded currency?

The US dollar is the world’s most traded currency, involved in approximately 88% of all forex transactions as of the 2022 BIS triennial central bank survey. The dollar’s dominance is due to its role as the global reserve currency and its use in international trade, finance, and commodities markets. As a result, currency pairs like EUR/USD and USD/JPY are among the most active, offering retail traders high liquidity and frequent trading opportunities.

What is the highest value currency?

As of 2025, the Kuwaiti Dinar (KWD) holds the title for the highest-valued currency in the world. Its exchange rate is consistently strong against other major currencies, with 1 Kuwaiti Dinar often valued at over 3 US dollars. The high value of the dinar is largely due to Kuwait's wealth from oil exports, its stable economy, and a carefully managed currency policy by the Central Bank of Kuwait.

What is the world’s least traded currency?

The world’s least traded currencies are typically those from small or isolated economies with limited international engagement. Examples might include currencies like the São Tomé and Príncipe dobra (STN) or the Malagasy ariary (MGA). These currencies have low trading volumes and limited availability in the global forex market, making them much less accessible to retail traders and prone to wider spreads and higher volatility.

Visit our other complete guides

How to trade the US Dollar Index