Silver’s dual engine: Safe-haven flows meet industrial demand

Silver outshines gold as lower real yields, AI and solar demand, and tight supply drive gains. Watch $46 support and $48.70 resistance as momentum stays firm

Precious metals have been on a tear in recent weeks as the debasement trade—diversifying away from fiat currencies such as the US dollar—gathers momentum. Ongoing US fiscal and political uncertainty has added to haven demand, while a drop in real yields—driven by expectations of continued monetary loosening from the Federal Reserve—has further supported prices.

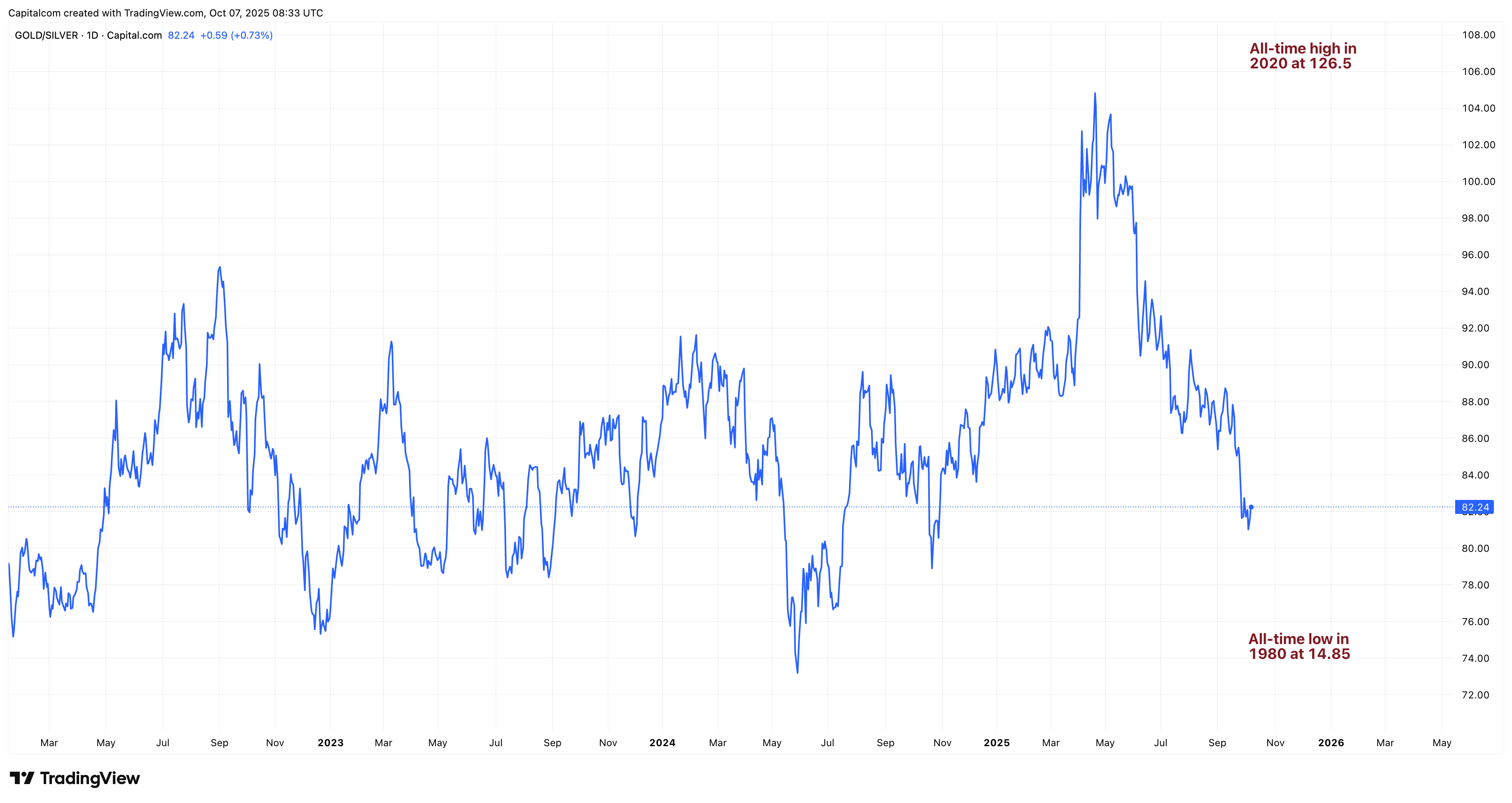

Both gold and silver posted their strongest monthly gains since the pandemic in September, up roughly 12% and 17.5% respectively, and the bullish momentum has extended into October. However, silver has been outshining gold, with the gold/silver ratio – which measures how many ounces of silver are needed to purchase an ounce of gold and is often used as a comparison between the two – steadily declining since early May.

Gold/Silver ratio daily chart

Past performance is not a reliable indicator of future results.

Why silver is outperforming

Silver’s advantage lies in its dual role. Unlike gold, it’s a key industrial input—particularly across solar, electronics and electric vehicles—linking its price more directly to the health of the global economy. With risk appetite buoyed by resilient US data, the blend of safe-haven interest and pro-cyclical demand has tilted the field in silver’s favour.

The AI and electrification tailwinds

Stronger returns across the AI complex have improved sentiment toward industrial metals tied to data centres and power infrastructure. Recent chip-supply headlines around OpenAI and AMD, together with Nvidia’s blockbuster results, underscore ongoing hyperscaler capex. That capex doesn’t just lift semis; it also pulls forward grid and generation investment—areas where silver is embedded in high-speed interconnects, solders and switches, and where solar deployment uses silver at meaningful scale. As the energy transition advances, this industrial demand trend is expected to grow.

Tight supply and fragile recycling

On the supply side, the pool of readily available silver remains constrained. A relatively small share of global output comes from primary silver mines; much is produced as a by-product of zinc, lead, copper and gold extraction, tying silver supply to the economics of other metals. Years of under-investment in exploration and development—amplified in places by regulatory scrutiny—leave the pipeline thin. At the same time, limited infrastructure for e-waste collection and processing hampers recovery and recycling of silver embedded in electronics and renewable technologies. So the bottom line is that supply growth looks slow just as structural demand is rising.

Technical picture

The combination of these factors suggests a continued upside for the precious metal. The short-term could see some volatility as traders react to the latest headlines, but the fundamentals support sustained growth in the longer term unless these factors change. For now, resistance lies just above $48.70 with some two-way trade appearing on Tuesday morning after another strong start to the week. The RSI has ventured deep into overbought territory so a technical pullback may be on the cards, with the $46 mark likely acting as continued support for buyers to come back in if profit-taking takes place.

Silver (XAG/USD) daily chart

Past performance is not a reliable indicator of future results.