Trading gold's volatile technical overview

The technical overview shifted to volatile before last Tuesday’s plunge putting breakout strategies in play, while in sentiment fresh longs remain exposed.

Plenty of factors have been cited in giving gold a massive boost to reach a record high, and while a couple of those reasons have softened a bit at times, there’s the matter of whether it went too far and resulted in profit-taking at the first sign of trouble. It’s always difficult putting a value on something used as a store of value especially when historic correlations with real yields seem to have completely broken down.

In terms of the latest fundamental items to digest, there were (1) trade worries resurfacing following U.S. Treasury Secretary Bessent’s comments regarding export goods restrictions to China that have key software, (2) the Senate’s 12th vote to end the government shutdown failing and is now the second-longest in U.S. history, (3) U.S. sanctions on Russia’s Rosneft and Lukoil reducing ceasefire agreement likelihoods though the real beneficiary of that news oil prices, and (4) general strength for company earnings in terms of influencing risk appetite.

Treasury yields fell back again and slightly so in real terms following a decent 20-year auction which was seen as a plus for bond values, and market pricing (CME’s FedWatch) is generally holding on nearly fully pricing in consecutive rate cuts out of the Federal Reserve (Fed) next week and in December, and via an insignificant majority for yet another one in January. On the FX front, the US dollar index moved further higher within the 98 handle thanks to weakness in both the Japanese yen ever since pro-stimulus PM Takaichi’s victory as well as the British pound on lighter UK pricing data taking gilt yields lower. Gold here is priced in dollars.

There hasn’t been a lot of economic data out of the U.S. to process thanks to the government shutdown with a very small decline for the weekly mortgage applications (out of MBA) yesterday, and there will be a couple (usually) low-impacting items today before tomorrow’s crucial CPI (Consumer Price Index) release. Also on offer will be preliminary PMIs (Purchasing Managers’ Index) out of S&P Global, and the revised figures for consumer sentient and inflation expectations out of UoM (University of Michigan).

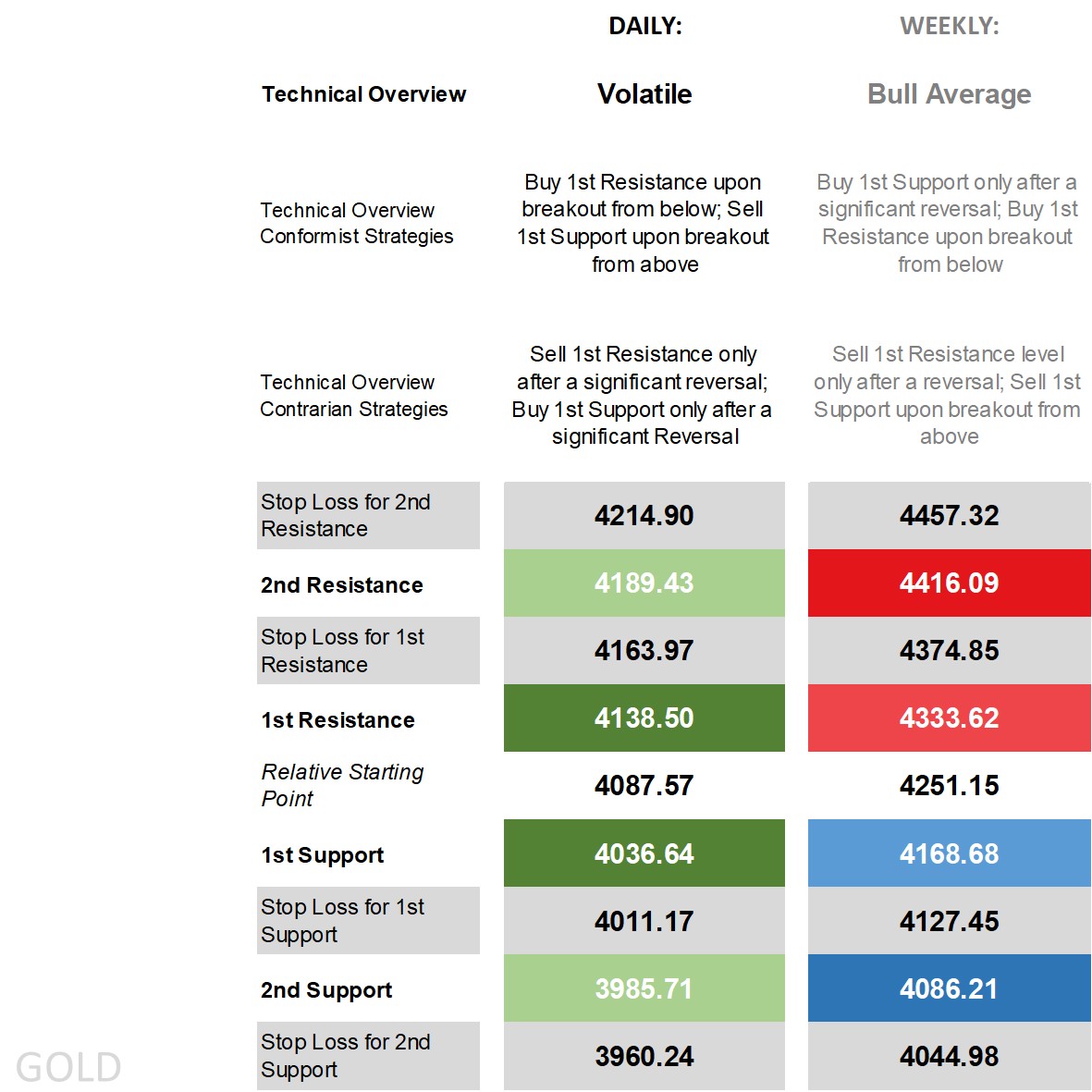

Gold’s technical overview, strategies and levels

Looking at the daily time frame and price is no longer above all its main short-term moving averages (MA) but still above its main long-term ones, hovering near the middle of the Bollinger Bands, on the DMI (Directional Movement Index) front the +DI remaining over the -DI even if that margin has narrowed significantly, an RSI (Relative Strength Index) falling out of massively overbought levels earlier this month and back closer to the middle, and an ADX (Average Directional Movement Index) still well in trending territory. It’s easy to label relatively positive technical indicators as bullish when it comes to the overview, but the moves prior that saw a record high and a clear uptick in volatility shifted the overview to ‘volatile’ and in turn gave conformist sell-breakout strategies the clear edge when Tuesday’s pullback occurred. It was a bit calmer yesterday but still offered enough to both conformist buy-breakouts off its previous 1st Resistance and sell-breakouts off its previous 1st Support before giving contrarian reversal strategies the edge (if they weren’t stopped out initially).

Zooming out to the weekly time frame and the technical overview remains bullish with most of its key technical indicators green and generally giving buy strategies the edge with this week the clear exception due to the pullback that went beneath this week’s weekly 2nd Support level before partially recovering to the key level, and a reminder that for conformists buying off the weekly 1st Support level only doing so after a significant reversal and if triggered keeping the stop loss ready in the event of a larger drop as witnessed earlier this week. Contrarian weekly strategies are selling after a reversal off the 1st Resistance and sell-breakouts off the 1st Support, the latter giving them a clear victory last Tuesday.

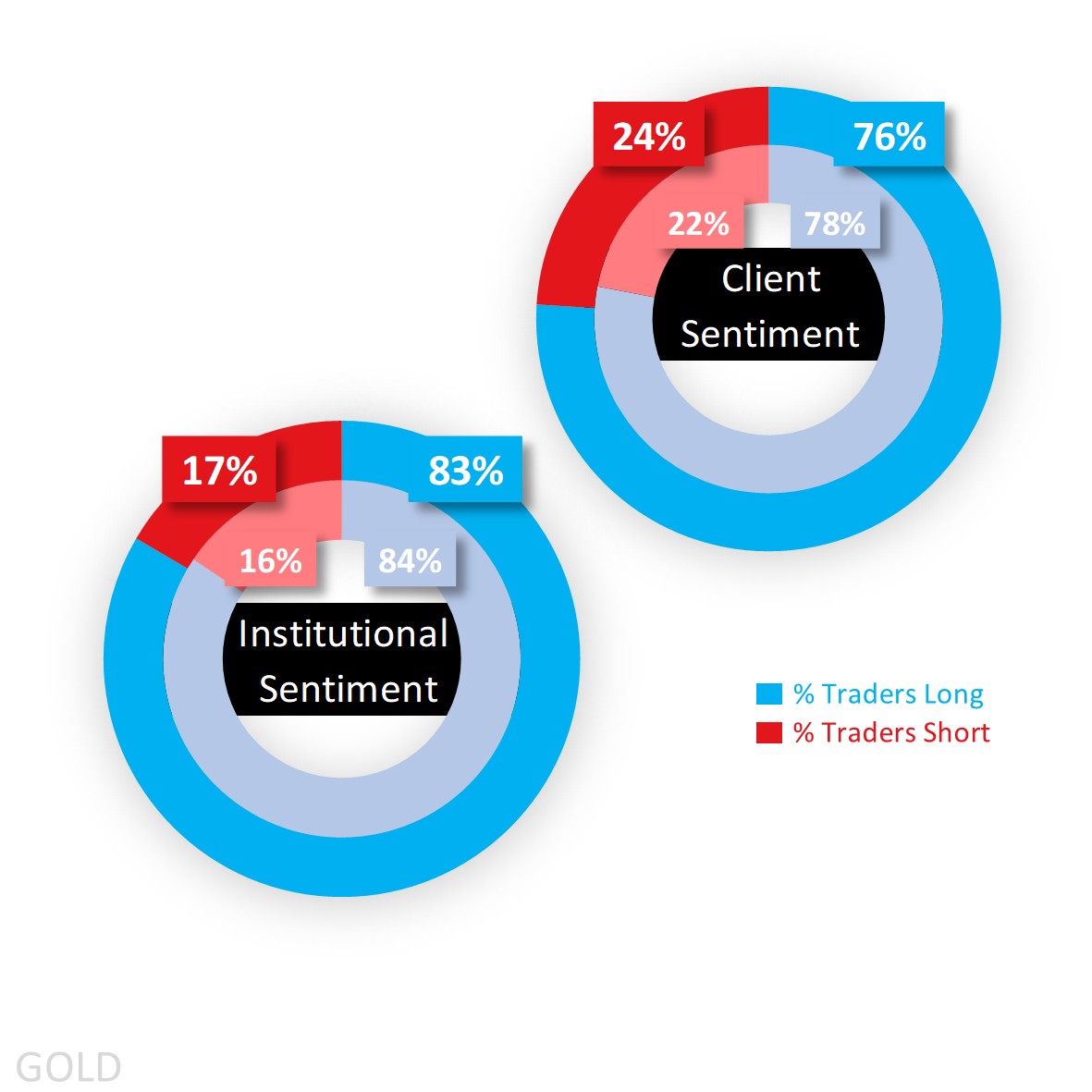

Capital.com’s client sentiment for Gold

As for sentiment, it’s still a story of heavy to extreme buy bias when it comes to Capital.com’s clients with fresh longs squeezed on the latest pullback in price, but looking at sentiment mapped on the chart (yellow-dotted line using the left axis) and plenty were long at lower price levels meaning they’ve still got a decent margin to work with. Any further retreat or tilting of key technicals might see shorts emerge and range-traders look for areas to initiate after what has been a strong run aiding trend-traders.

The U.S. government shutdown means a lack of CoT (Commitment of Traders) reports from the CFTC, but before they stopped the releases the latest figures showed larger speculators sticking with net long bias, and where a sizable portion of longs were initiated at far, far lower price levels.

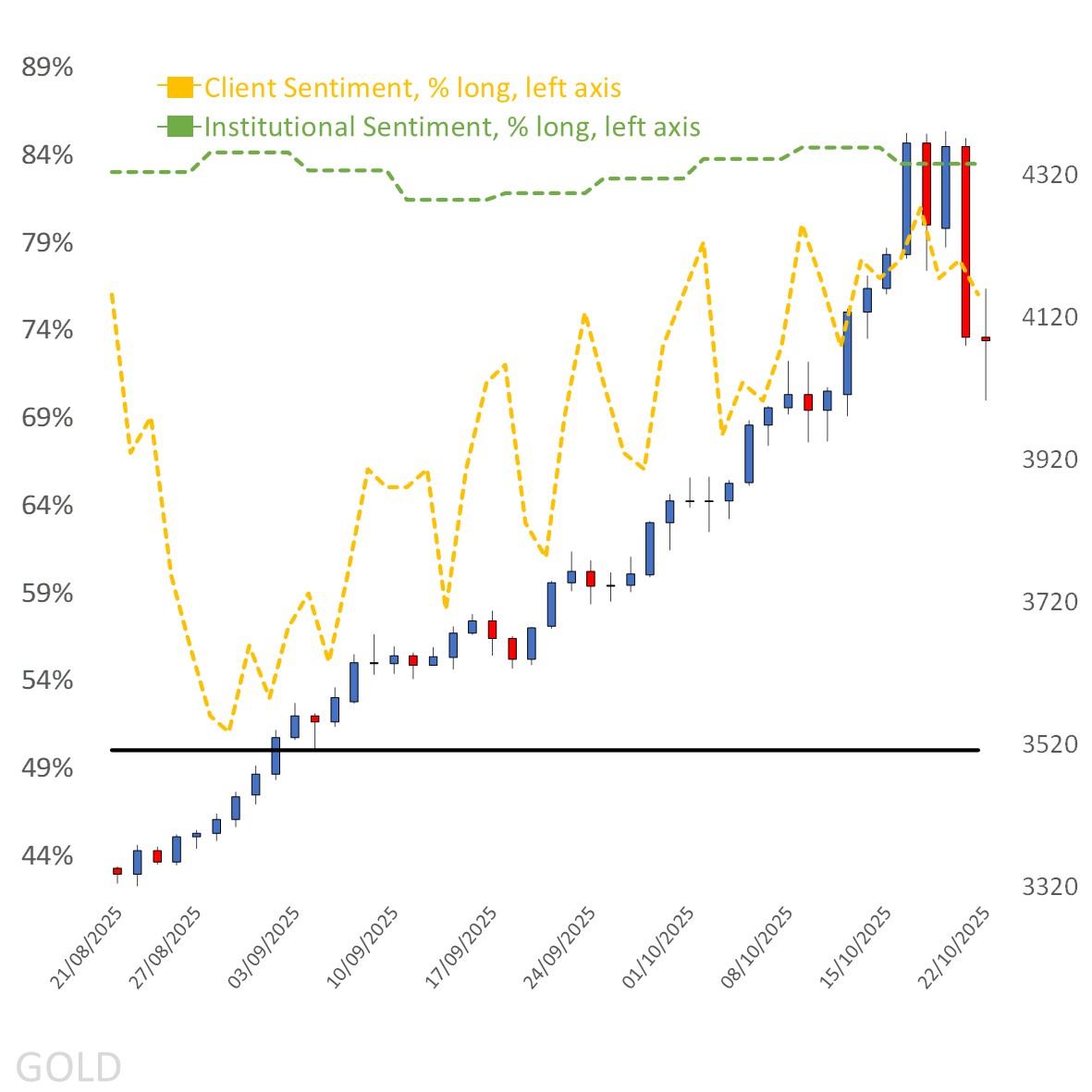

Client sentiment mapped on the daily chart

Source: Capital.com

Period: AUGUST 2025 – OCTOBER 2025

Past performance is not an indicator of future results.

Gold’s chart on Capital.com’s platform with key technical indicators

Source: Capital.com

Period: JULY 2025 – OCTOBER 2025

Past performance is not an indicator of future results.