BlackRock stock forecast: Third-party price targets

BlackRock (BLK) was trading at $1,176.38 as of 2:06pm (UTC) on 7 October 2025, within the day’s intraday range of $1,157.45-$1,182.10.

The stock reached a new one-year high on 6 October, after Morgan Stanley raised its price target from $1,224 to $1,362 and reaffirmed an overweight rating (MarketBeat, 6 October 2025).

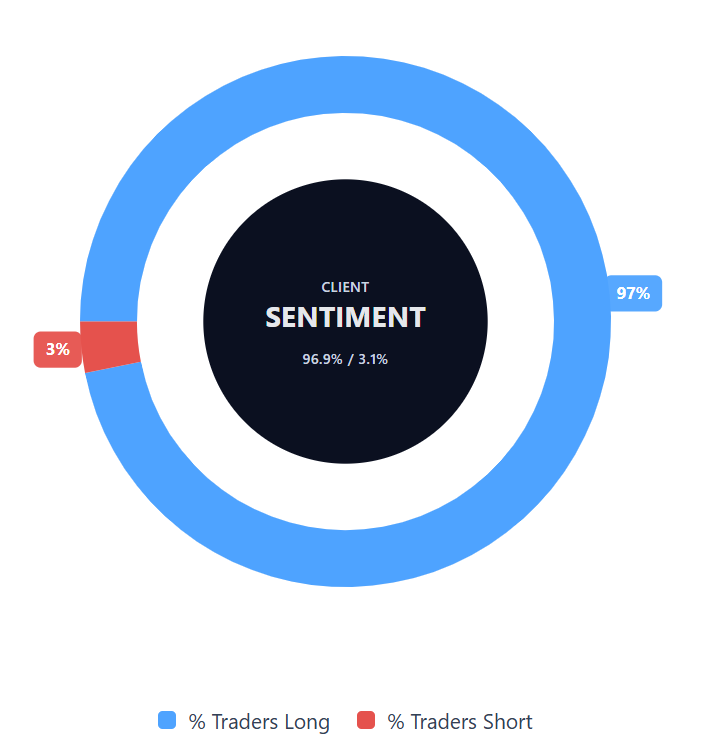

Client sentiment on Capital.com remains strongly bullish, with 96.88% of traders holding long positions in BlackRock CFDs (7 October 2025). This information is provided for general purposes only and does not constitute investment advice. You should always conduct your own research before making any trading decisions.

BlackRock stock forecast: Analyst price target view

BofA Securities (house view)

BofA Securities lowered its BLK price target to $1,394, citing ongoing fee pressure and uncertainty around AUM growth in its latest analyst note (Investing.com, 7 October 2025).

Goldman Sachs (house view)

Goldman Sachs raised its BLK price target to $1,312 as of 6 October 2025, pointing to stronger net inflows and margin expansion during periods of market volatility (GuruFocus, 6 October 2025).

Morgan Stanley (equity strategy)

Morgan Stanley increased its year-end 2025 target for BLK to $1,362, up from $1,224, based on resilient ETF inflows and expectations of Fed rate cuts (MarketBeat, 6 October 2025).

Benzinga (consensus roundup)

Benzinga’s analyst consensus sets the 12-month median BLK price target at $1,146.32, reflecting assumptions of stable fee growth and limited market volatility (Benzinga, 8 October 2025).

MarketBeat (consensus forecast)

MarketBeat reports an average BLK price target of $1,222.87 across 17 analysts, supported by projected inflows into passive and active products as monetary policy eases (MarketBeat, 8 October 2025).

Forecasts and market projections are inherently uncertain and subject to change. They do not account for unexpected economic or geopolitical developments. Past performance is not a reliable indicator of future outcomes.

BLK stock price: Technical overview

On the daily chart, BLK was trading at $1,176.38 as of 2:06pm (UTC) on 7 October 2025, holding above its cluster of key moving averages – approximately the 20/50/100/200-DMAs at 1,140 / 1,131 / 1,078 / 1,020. The 20-over-50-day alignment remains in place, with RSI(14) at 63.3, signalling continued momentum.

A daily close above the 1,203 pivot could bring the 1,240 area into focus, while initial support lies at 1,146, followed by the 100-DMA near 1,078. A break below this level may suggest a deeper pullback (TradingView, 7 October 2025).

This is technical analysis for informational purposes only and does not constitute financial advice or a recommendation to buy or sell any instrument.

BlackRock share price history

BlackRock shares were trading near $643 in early October 2023, having eased from summer highs of around $685. Following this, the share price moved generally higher into 2024, supported by continued asset inflows and the performance of BlackRock’s diversified fund range, including increased interest in sustainable and technology-focused investments. Prices rose through early 2024, fluctuating between approximately $1,019 and $1,064, influenced by record assets under management and positive sentiment towards products such as BlackRock’s digital asset and ESG funds. The shares then declined to a low near $783 in June, amid broader sector volatility driven by changing market expectations on interest rates and a more cautious investor outlook in response to global macroeconomic conditions.

2025 saw BLK regain the $1,000 level by spring, reaching an intraday high of $1,183 on 6 October 2025.

Past performance is not a reliable indicator of future results.

Capital.com’s client sentiment for BlackRock CFDs

Client positioning on Capital.com in BlackRock CFDs is currently strongly skewed towards long positions, with 96.9% of traders holding buys and 3.1% holding sells – a difference of nearly 94 percentage points (7 October 2025). This snapshot reflects open positions on the platform and is subject to change.

FAQ

Is BlackRock a good stock to buy?

Capital.com does not provide investment advice. While analyst sentiment has been broadly positive, market outcomes depend on a range of external and company-specific factors, including risk appetite.

Could BlackRock stock go up or down?

Yes. Like all stocks, BLK may rise or fall based on factors such as earnings, sector performance, macroeconomic indicators, and overall investor sentiment.

Should I invest in BlackRock stock?

We don’t provide investment advice. Before making any trading decision, it’s important to consider your financial goals, market knowledge, and risk tolerance.

What is Capital.com’s client sentiment on BlackRock?

As of 7 October 2025, 96.9% of Capital.com clients held long positions in BlackRock CFDs, compared with 3.1% short. This reflects current positioning and is subject to change. This information is provided for general purposes only and does not constitute investment advice.