Cosmos price prediction: Will growth of app-chains help Cosmos dethrone Ethereum?

ATOM has surged over 100% in the past three months. Will the coin see more gains?

Cosmos (ATOM) is quickly emerging as a major competitor to leading smart contract platform Ethereum (ETH) by offering developers the ability to create highly customisable, independent blockchains.

The migration of projects to the Cosmos (ATOM) ecosystem gained attention in June 2022 when leading Ethereum-based futures contracts exchange dYdX announced plans to build a standalone blockchain on Cosmos.

Crypto insiders expect many more decentralised applications (dApps) to follow dYdX, in search of customisability and scale, to form application chains or “app-chains”.

The ATOM price has reacted positively to the announcement from dYdX, gaining over 111% in the last three months, as of 15 September 2022.

Will ATOM see further price appreciation this year? Here we take a look at the Cosmos ecosystem and what factors are shaping the Cosmos price prediction in 2022 and beyond.

What is Cosmos?

Dubbed ‘the internet of blockchains’, Cosmos is a layer zero blockchain network that provides developers with open-source frameworks to build public Proof-of-Stake (PoS) blockchains.

Founded by Jae Kwon and Ethan Buchman in 2016, Cosmos aims to build an ecosystem of independent, customisable and interconnected blockchains. According to its website, popular Cosmos-based blockchains include the Binance Chain (BNB), THORChain (RUNE) and Crypto.org (CRO).

Cosmos blockchains can interact through its architecture of zones. Users can build multi-asset, public proof-of-authority (PoA) and proof-of-stake (PoS) blockchains. The network’s focus is on customisability and interoperability, which sets it apart from other blockchain networks, such as Ethereum.

The Cosmos software development kit (SDK) is at the heart of the project. SKD allows developers to easily create custom blockchains from scratch that can natively interoperate with other blockchains within the Cosmos ecosystem. The default consensus engine available within the Cosmos SDK is the Tendermint Byzantine Fault Tolerance (BFT) consensus algorithm.

Other features include the Cosmos Inter‐Blockchain Communication (IBC), which allows Cosmos-based blockchains to interact with each other, allowing token transfers and data sharing.

The Cosmos Hub is the primary blockchain in the ecosystem. It provides essential services to other chains. Some of the services provided by the Cosmos Hub include staking, voting, interchain accounts and interchain security.

Tokenomics: ATOM

ATOM is the native token of the Cosmos Hub. ATOMs are mainly used for staking and voting on the Cosmos Hub.

ATOM stakers are rewarded transaction fees and staking rewards are distributed to the Cosmos Hub. According to the project’s website, staking rewards will increase as additional services such as interchain security and inter-blockchain bridges are introduced.

According to Cosmos’ GitHub plan from 2017, ATOM tokens are not designed to be “a medium of exchange nor a store of value”.

ATOM critics have often pointed out that Cosmos-based chains can function within their sovereign blockchains without the ATOM token. The introduction of interchain security, which will allow smaller app-chains to lease security from ATOM-staking validators, is seen as a major step to increasing the utility of the ATOM token.

As of 14 September 2022, ATOM’s inflation rate stood at 5.74%, data from crypto research firm Messari showed. The current ATOM staking yield stands at 9.7% annually, according to the project’s website.

ATOM was the 22nd largest cryptocurrency, with a market capitalisation of over $4bn, as of 14 September. Over 286.3 million ATOM coins were in circulation, according to data from CoinMarketCap.

Price analysis: ATOM’s rise and fall

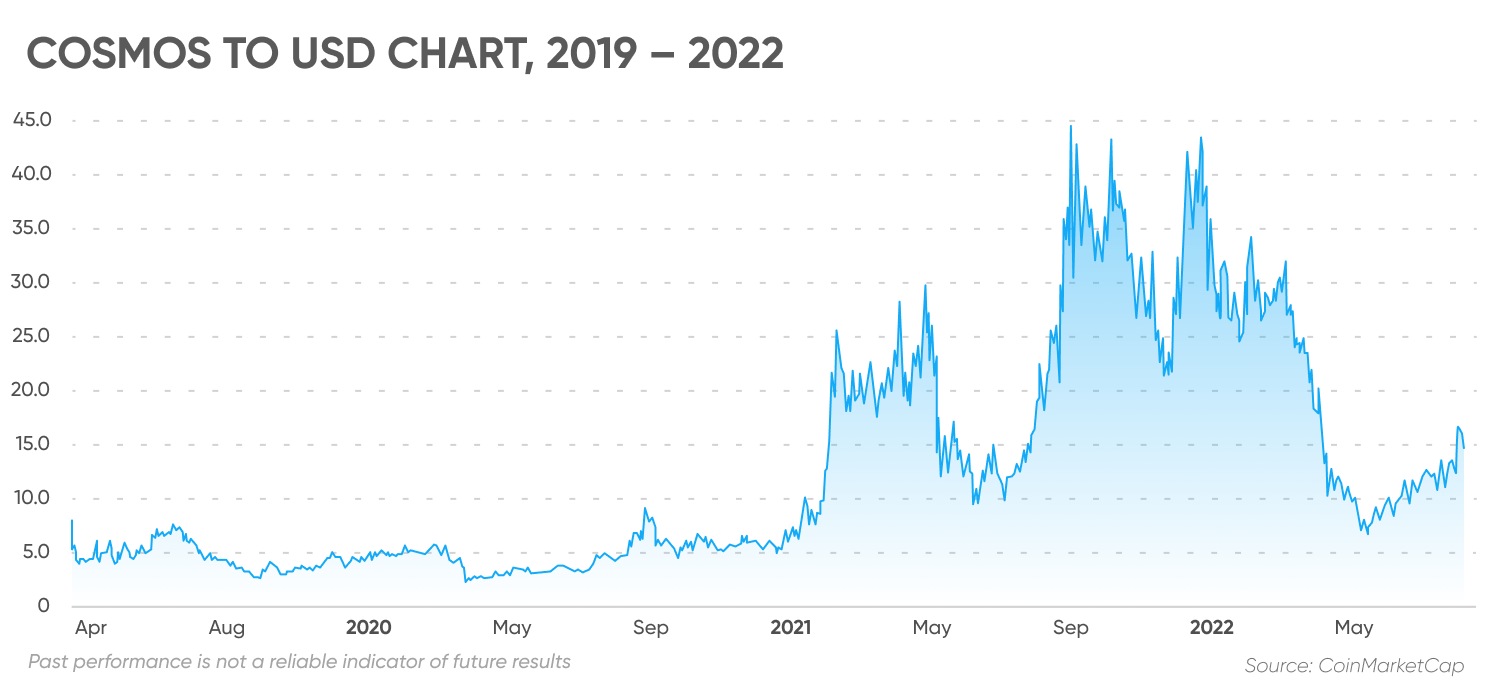

The coin traded range bound between $1 to $7 until July 2020. Its first big break came in August 2020, when the coin closed the month about 90% higher.

Things changed in 2021. ATOM opened the year at about $6.50 and surged nearly 600% to an all-time high of $44.70 by 20 September 2021.

Past performance is not a reliable indicator of future results

Much of ATOM’s price appreciation in 2021 was supported by progress in the development of the Gravity DEX (decentralised exchange), Gravity Bridge, interchain accounts and other features on the Cosmos Hub.

By January 2022, ATOM was retesting its all-time high, boosted by a booming Terra ecosystem that had established itself as one of the biggest chains in terms of total value locked (TVL). At the time, Terra was the largest Cosmos-based blockchain in terms of market cap.

However, ATOM fell short of a new record high, peaking at $44.70 in early January 2022, Binance data showed.

Following the implosion of the Terra ecosystem and a cryptocurrency bear market, ATOM posted four straight months of losses between March and June 2022. On 18 June 2022, ATOM fell to a one-and-a-half year low of $5.55.

Since then, ATOM has rebounded over 136% from its low to trade at about $15, as of 14 September 2022.

ATOM has seen a recovery in investor sentiment following the announcement of Ethereum-based crypto futures contracts exchange dYdX’s decision to migrate to Cosmos as a standalone blockchain.

As of 15 September, ATOM is trading over 68% below its all-time high of $44.70. ATOM has lost about 55% year-to-date (YTD) in 2022.

dYdX’s migration sparks Cosmos-Ethereum rivalry

So far in 2022, the announcement of dYdX moving to Cosmos proved positive for the ecosystem and the cosmos crypto price prediction.

Currently, dYdX is built on top of an Ethereum-based layer 2 (L2) solution called StarkWare.

On 22 June 2022, dYdX announced that its latest version, dYdX V4, will be developed as a standalone blockchain based on the Cosmos SDK and Tendermint proof-of-stake consensus protocol.

dYdX added that it was looking for “full decentralisation” and was not satisfied with “existing off-chain orderbook systems”.

The news marked a bullish reversal in investor sentiment for ATOM as the token posted eight consecutive weeks of gains between mid-June to early-August.

So, is Cosmos a major threat to Ethereum’s dominance? Ben Giove, analyst at crypto newsletter Bankless, noted:

Cosmos price prediction for 2022 and beyond

Cosmos is “best positioned” to benefit from the “increasing number of app-chains” in the blockchain sector, said cryptocurrency research firm Delphi Digital, after announcing that its research and development arm will build on Cosmos.

Elsewhere, CoinCodex’s ATOM price prediction, as of 15 September, indicated that the token’s value could fall to about $12 in a month’s time.

Algorithm-based forecasting service Wallet Investor held a bearish view in its cosmos price prediction for 2022 and expected the token to fall to an average price of about $9 by the end of the year. Its long-term cosmos price prediction for 2025 expected ATOM to drop further to an average price of $1.80 by the end of 2025.

Meanwhile, DigitalCoinPrice gave a much more positive cosmos coin price prediction. It saw ATOM trading at an average price of over $199.27 in its cosmos price prediction for 2030.

Finally, Price Prediction’s cosmos coin price prediction saw ATOM trading at an average price of over $13.08 in 2022, $39.51 in 2025 and about $236.75 in 2030.

Note that any analyst and algorithm-based cosmos price predictions can be wrong. Forecasts shouldn’t be used as a substitute for your own research.

Always conduct your own due diligence. Your decision to trade or invest should depend on your risk tolerance, expertise in the market, portfolio size and investment goals. And never invest money that you cannot afford to lose.

FAQs

Is cosmos a good investment?

Whether a high-risk asset like Cosmos is a suitable investment for you would depend on your risk tolerance, investing goals and timeframes, experience in cryptocurrency markets and other personal circumstances. Always conduct your own due diligence before investing. And never invest money that you cannot afford to lose.

Will cosmos go up?

CoinCodex’s ATOM price prediction as of 15 September indicated that the coin’s value could fall to about $12 in a month’s time. Meanwhile, algorithm-based forecasting service Wallet Investor held a bearish view in its cosmos price prediction for 2022 and expected the coin to fall to an average price of about $9 by the end of the year. Its long-term cosmos price prediction for 2025 expected the coin to drop further to an average price of $1.80 by the end of 2025. Note that any analyst and algorithm-based cosmos price prediction can be wrong. Forecasts shouldn’t be used as a substitute for your own research.

How many cosmos coins are there?

ATOM is the native cryptocurrency of the Cosmos ecosystem. Over 286.3 million ATOM coins were in circulation, according to data from CoinMarketCap, as of 15 August.

Should I invest in cosmos?

Whether cosmos is a suitable investment for you would depend on your risk tolerance, investing goals and timeframes, experience in cryptocurrency markets and other personal circumstances. Always conduct your own due diligence before investing.