Camber Energy (CEI) stock forecast: Oil prices prompting rally?

Higher crude prices prompted an uptick in Camber Energy’s stock. What’s next?

The price of Camber Energy (CEI) stock started the year by dropping steadily until bottoming at around $0.45 per share as the company has kept missing multiple deadlines to publish its financial reports covering the last quarter of the 2020 fiscal year and the three first quarters of the 2021 fiscal year.

So far, the New York Stock Exchange (NYSE) has granted the company multiple extensions to file these delinquent reports, but a definite deadline has been established on 20 May 2022 after which the exchange could initiate procedures to delist CEI.

Moreover, the company has not held the required annual stockholders meeting for the 2020 and 2021 fiscal years.

Despite the absence of these relevant financial documents, the CEI stock value spiked at the beginning of March as oil prices have climbed significantly on the back of the sanctions imposed on Russia and their expected effect on the market’s supply and demand dynamics.

Meanwhile, on 11 March, Camber Energy said it redeemed around $23.75m (£17.93m) worth of principal of its Series G preferred shares, which were due in March 2022.

Could the payment of these promissory notes serve as a sign that the company remains solvent despite failing to inform the investment community about its actual situation in a timely manner?

What could be expected from this oil stock in light of these latest developments? In this article, we will be assessing the latest Camber Energy stock news along with its price action and fundamentals to outline plausible scenarios for the future.

CEI stock analysis: Price drivers and technical views

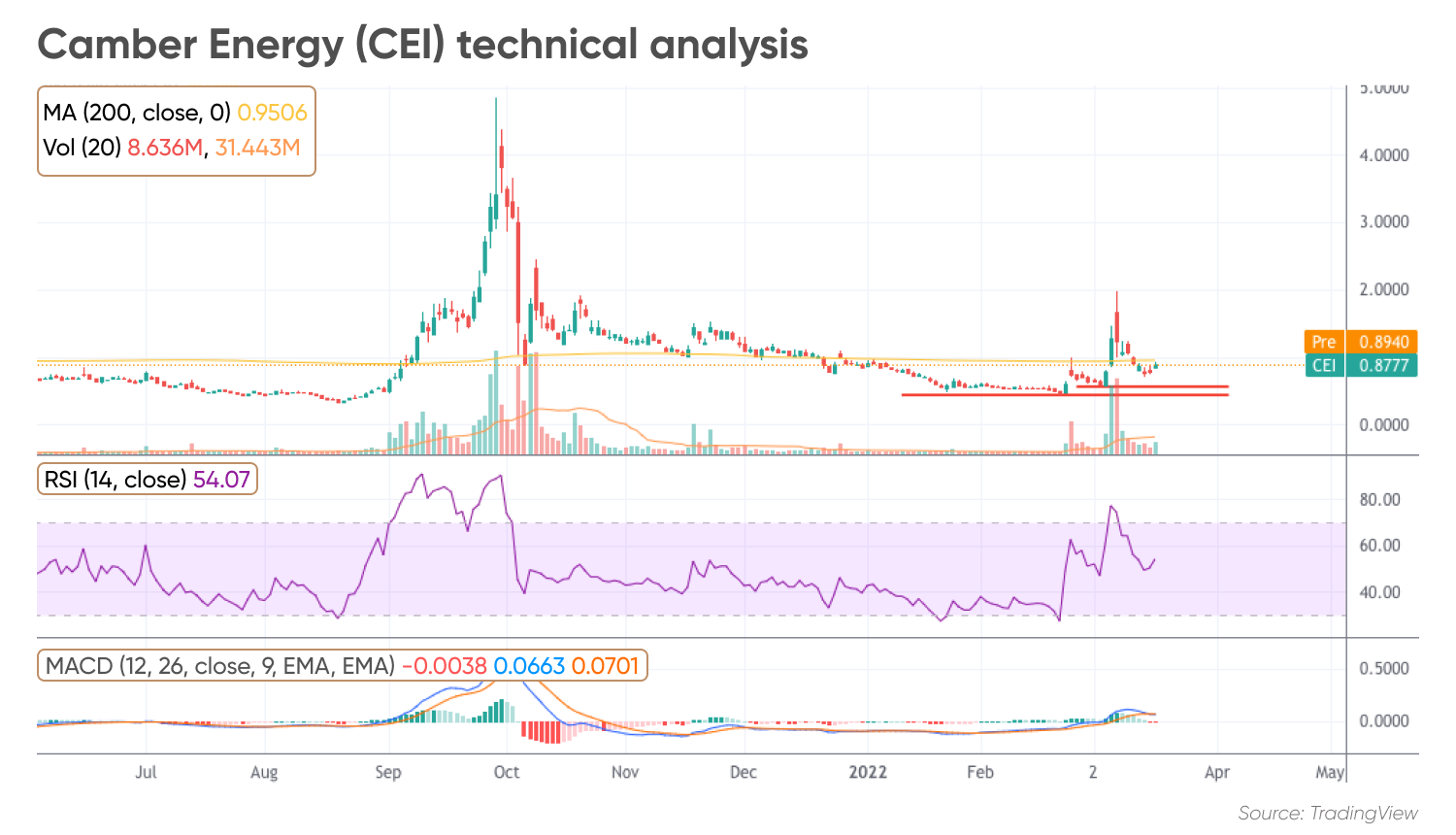

The CEI stock chart above shows how the price has reacted positively to the latest increase in the price of crude oil amid the continuous escalation in the armed conflict between Russia and Ukraine.

The specific reason behind this uptick in oil prices has been a ban imposed on crude imports from Russia as a potential deterrent to stop the invasion. For now, several countries, including the United States, the United Kingdom, Canada and Australia, have shunned Russian oil imports.

For Camber, a company that has several interests in oil and gas fields in Texas, Louisiana and Mississippi, higher crude prices effectively increase the value of these properties and could boost the firm’s top-line performance in the near term.

During the quarter ended on 30 September 2020, the last one reported by the company, Camber produced 28.1 barrels of oil equivalent per day and reported producing reserves of 133,442 barrels of oil equivalent.

By the end of that period, the company had no employees and relied on independent contractors that are hired on an as-needed basis.

The most recent uptick in the CEI stock value pushed the performance of the shares to positive territory in 2022, gaining 3.3% thus far since the year started.

Momentum indicators have moved higher amid this recent jump with the Relative Strength Index (RSI) making multiple higher highs and currently standing above the 50 mark (bullish). Meanwhile, the Moving Average Convergence Divergence (MACD) remains in positive territory although it just crossed below the signal line.

Camber Energy shares are also trading 82% below their 52-week high of $4.85 per share and almost 8% below their 200-day Simple Moving Average.

Moving forward, there are two relevant areas of support to watch. These are the $0.55 and $0.45 levels. A break below these marks could favour a bearish CEI stock projection. Meanwhile, the $2 level remains the most relevant resistance in the near term for Camber Energy.

Camber Energy fundamental analysis: Latest earnings

The latest quarterly earnings report published by Camber Energy covered the third quarter ended on 30 September 2021.

According to this report, the company produced total oil and gas revenues of $57.46m resulting in a 38% decline compared to the same period a year ago amid sizable declines in the price of crude oil, natural gas and NGL (natural gas liquids).

The firm’s output during that period experienced a 32% drop as well at 26 barrels of oil equivalent commercialised per day.

Operating losses for the period stood at $827,642. This figure was 26.1% lower than the one reported during the third quarter of 2020. However, net losses ended at $22.31m as the company reported heavy losses coming from the reassessment of some derivatives and equity instruments.

During the six months ended on 30 September, Camber Energy reported negative operating free cash flows of $1.34m – nearly half the amount it burned the previous year.

Meanwhile, by the end of these three months, the company had $38m in outstanding preferred Series C shares, which have now been fully redeemed, along with total assets of $11.80m including $1.11m in cash.

Camber Energy does not pay a dividend at the moment while the current market capitalisation of the company stands at $0.33bn (as of 22 March).

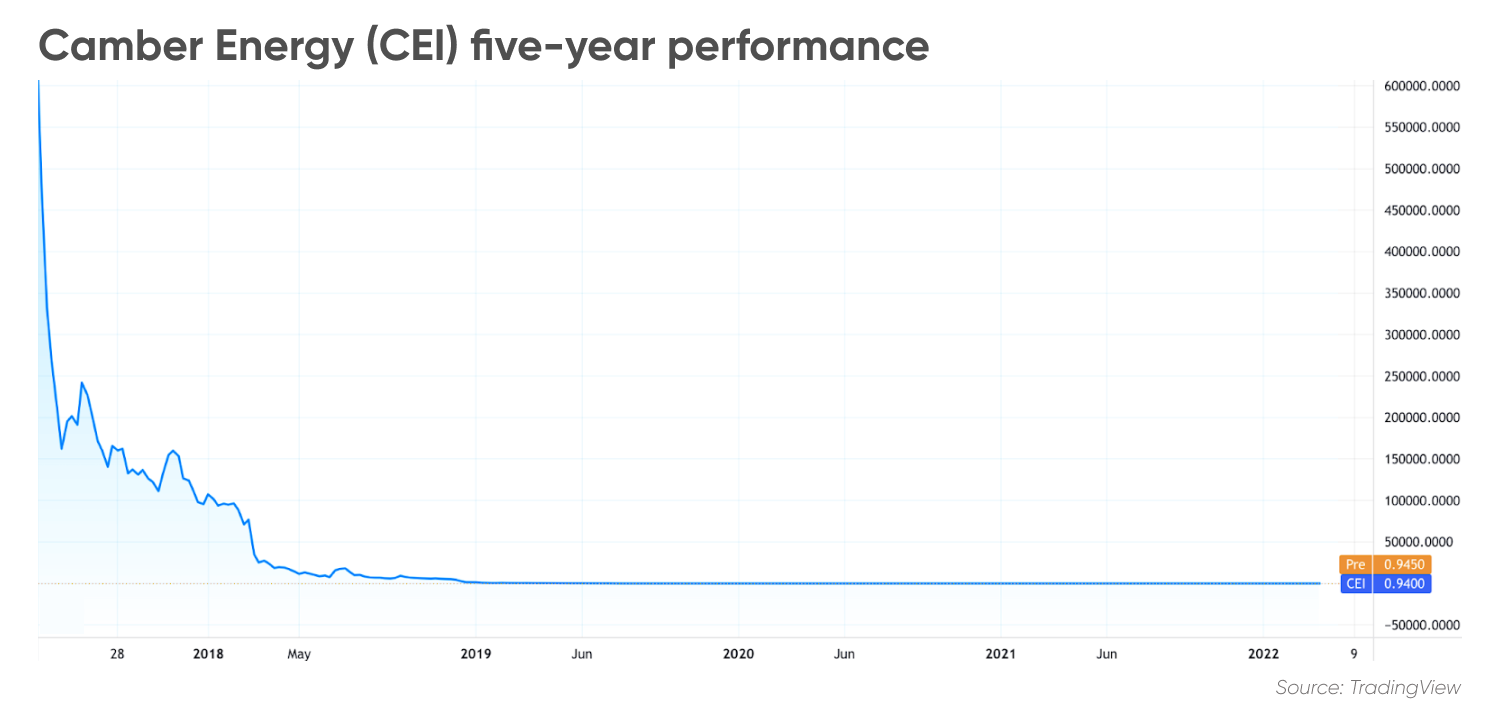

Will the penny stock rebound? Does the recent spike in oil prices help to boost the CEI stock potential? For now, its five-year historical price chart looks flat.

CEI stock prediction: Analyst sentiment

Is Camber Energy stock a ‘buy’, ‘sell’, or ‘hold’? Camber Energy’s relatively small market capitalisation makes it qualify as a micro-cap stock. Due to its low valuation, the stock is not covered by any financial services firm for the purpose of issuing a rating on the instrument.

Therefore, there are no analysts’ consensus ratings available that can give us a sense of the market’s CEI stock potential price.

Commenting on the CEI stock future price, Mikhail Karkhalev, analyst at Capital.com, said:

“The CEI chart, which is reminiscent of the VIX (volatility index), is no longer ambiguous about that. Accordingly, there is nothing but speculation and rising volatility in Camber Energy shares. The company has not issued financial statements for a long time, so there are no options to assess its real performance either.”

Camber Energy (CEI) stock forecast: Targets for 2022 and beyond

The current technical setup of Camber Energy stock (as of 22 March) is pointing to a neutral outlook as the price action has not yet tagged or moved above or below any of the support and resistance areas mentioned above. Moreover, there are no relevant technical patterns in play and trading volumes have subsided in the past few days.

Meanwhile, several algorithm-based forecasting services provided mixed Camber Energy stock price prediction as of 22 March:

Wallet Investor had a bullish short-term CEI stock prediction based on an assessment of multiple technical indicators. For the next 14 days, the algorithm estimated that the price could average at $1.14 per share by 4 April 2022.

Meanwhile, Wallet Investor predicted that the price of CEI stock could decline to zero by the end of December 2022. Based on the estimate, the algorithm suggested that the company could go bankrupt.

Gov.Capital also gave a bearish Camber Energy stock forecast as the algorithm expected that the price could go down to zero within the next 12 months. However, in the next 15 days, the stock is expected to climb to around $1.2 per share, according to its short-term outlook.

The negative price targets for the end of 2022 do not leave space for longer term Camber Energy stock predictions for 2025 and 2030. Whether the company will manage to show resilient financial results and stay listed on the NYSE is yet to be seen.

When looking for the CEI stock predictions, it’s important to bear in mind that analysts’ forecasts can be wrong. They have been drafted based on an analysis of the Camber Energy historical stock price, and past performance never guarantees future results.

It’s important to do your own research and always remember that your decision to trade depends on your attitude to risk, your expertise in the market, the spread of your investment portfolio and how comfortable you feel about losing money. You should never invest more than you can afford to lose.

FAQs

Is Camber Energy stock a good buy?

Camber Energy is a micro-cap stock with weak fundamentals and no earnings or cash-flow generation capacity. The company has failed to file its financial reports for the past quarters and that increases delisting risk.

Will Camber Energy stock go up or down?

Based on the two forecasting services Wallet Investor and Gov.Capital, the price of Camber Energy is expected to go down to zero in the next one to three years.

How high will Camber Energy stock go?

Based on the algorithm-based CEI price prediction from Wallet Investor as of 22 March, the price of Camber Energy in the near term could rise to $1.14 per share by 4 April 2022. However, the service predicted that the stock could end the year at $0.

Why has the Camber Energy stock been rising?

The price of Camber Energy rose in early March amid a sustained uptick in crude prices. The armed conflict between Russia and Ukraine has prompted many countries to ban oil imports from the country ruled by President Vladimir Putin and that has led to a jump in the price of this commodity.

Camber Energy is an oil and gas company primarily and that makes it a direct beneficiary of an increase in the price of crude.