BurgerCities price prediction: Can BURGER serve up tasty returns for investors?

Volatility on the BurgerCities token has increased. We look at the major drivers and price predictions for the MetaFi project.

The BurgerCities cryptocurrency is trading a long distance away from its all-time highs, like most cryptocurrencies following the collapse of the decentralised finance (DeFi) market.

While the BURGER price spiked in mid-July on news of a partnership to increase liquidity on the BurgerSwap exchange, it has given up some of the gains in its journey up from the May lows.

Are you looking for a BurgerCities price prediction to decide how to trade the crypto token? In this article, we examine the BurgerCities protocol and indications of what would be a realistic BurgerCities crypto price prediction following the recent volatility.

What is BurgerCities?

BurgerSwap launched in September 2020 as a “democratised AMM”, or automated market maker on the Binance Smart Chain to rival SushiSwap on Ethereum. The anonymous community development team has since shifted focus to create a playable metaverse game incorporating DeFi.

DeFi for the metaverse is becoming known as MetaFi.

BurgerSwap’s original decentralised trading functions have been integrated into BurgerCities. Users can become liquidity providers in the BurgerCities game, choosing any token pool.

BurgerCities launched its aggregation protocol with an upgrade to BurgerSwap in December 2021. The project has now integrated that with non-fungible tokens (NFTs) in a metaverse environment where users can “engage in daily activities such as socialising, gaming, and so on in this realm, Simultaneously, [they can] experience DeFi and NFT functions such as Swap, Staking, and viewing NFT exhibitions through their visual metaverse image,” according to the project’s blog.

“BurgerCities has included a game that allows players to explore the metaverse with BurgerCities NFT heroes that can combat monsters, PK, land management, PVP, and more in order to improve usability and playability.”

There was some controversy surrounding the project in June, as the developers issued new tokens beyond the original 21 million put into circulation, as a way to provide incentives as the project updates its brand and functionality, “to quickly seize the MetaFi market and achieve rapid traffic growth.

“However, due to the mismatch between the progress of the product and the timing of token issuance, BurgerCities chose to issue tokens first and then announce it to our community. This approach is not well thought out and does not take into account the feelings of our community. In order to protect the benefits of the existing token holders, BurgerCities has burned all the additional tokens… The total amount of tokens has returned to the original 21 million.”

On 15 July, BurgerCities announced that a vote approved the issuing of an additional 42m BURGER tokens. There were 24.12m tokens in circulation at the time of writing on 9 August, of the new total of 63m. At a price of around $.54, this gave BURGER a market capitalisation of $37.14m, making it the 472nd largest cryptocurrency by value, according to CoinMarketCap.

BurgerCities price analysis: Token breaks out of downward trend

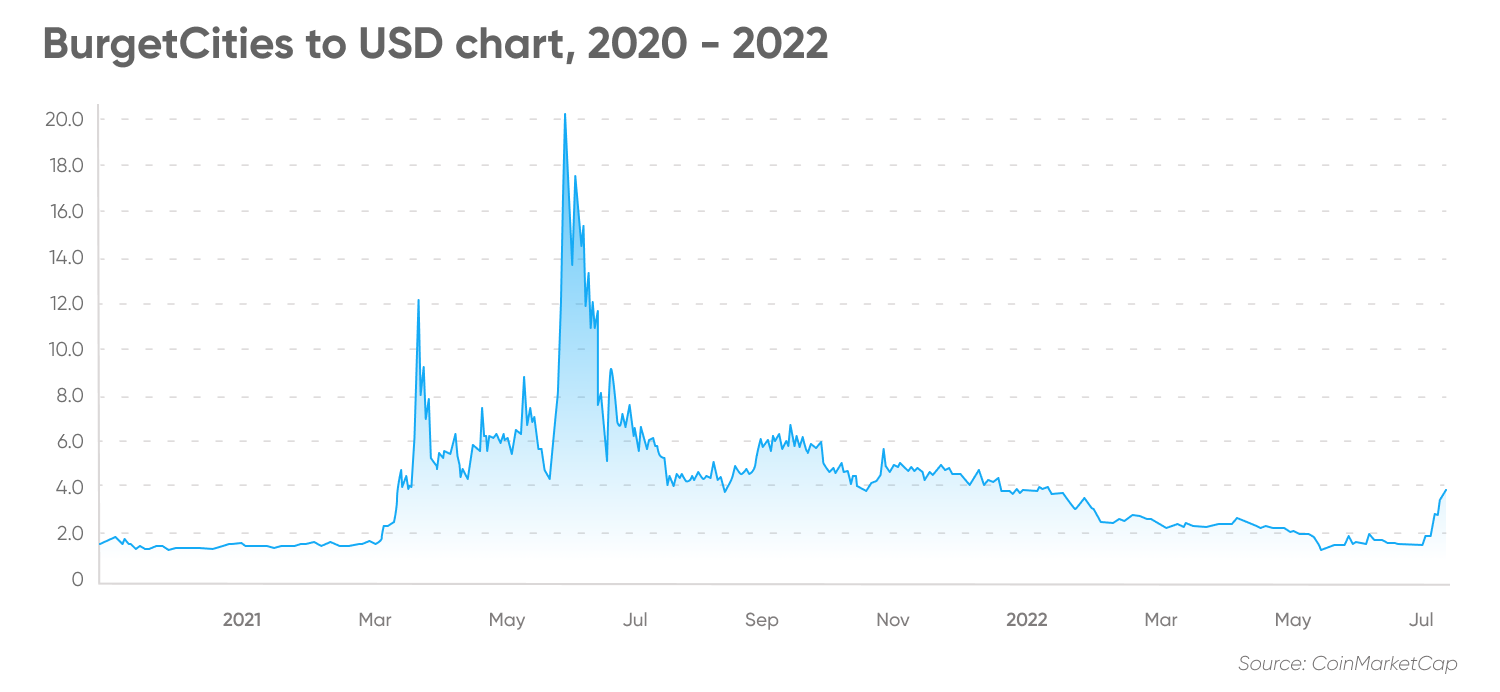

The BurgerCities token traded at less than $1 from its launch in September 2020 until January 2021, when cryptocurrencies began to rally strongly with the growth of decentralised finance and the emergence of NFTs.

The BURGER price soared to $15.78 on 19 February 2021, a gain of more than 1,600% from where it closed on its first day of trading at $0.88. The price dropped in March 2021, sliding to $3.53 mid-month before rebounding to $8.98 in mid-April. The token retreated again to $3.33 on 23 April, before it took off to its all-time high of $28.01 on 3 May as cryptocurrencies rallied to new highs.

But after the price dropped to $3.07 on 21 July when the crypto markets sold off, it did not follow other tokens to new highs in October and November. The token traded up to $6.30 on 22 August but has since been in a downward trend.

The token ended 2021 at $3 and continued to trend lower in the first half of 2022, reaching $0.2899 on 12 May, when cryptocurrency markets crashed. The price briefly spiked above $1 in May and again in June, then started July at $0.5898.

The price doubled from $1.01 to $2.02 on 6 July and continued to climb to reach a high of $3.52 on 11 July.

The price retreated to $2.41 on 12 July before rebounding to $3.46 on 13 July after BurgerCities announced a partnership with NFT and metaverse Web3 platform StarryNift. The BURGER price fell to $1.49 on 23 July. BURGER spiked above $2 on 24 July, but retreated to $1.56 by 26 July. The token has traded around $1.60 so far in August.

BurgerCities rallies on iZUMi integration

BurgerCities announced a strategic partnership on 17 June with iZUMi Finance, which is a cross-blockchain DeFi protocol that provides one-stop liquidity-as-a-service (LaaS). On 7 July, the developers explained how the integration of iZUMi with the BurgerCities aggregation protocol works, with the liquidity from iZUMi enabling BurgerCities users to swap tokens immediately at more competitive prices.

“The partnership comes after BurgerCities launched its Aggregation Protocol last year. In addition to iZUMi, the list of DEXs it cooperated with includes PancakeSwap, MDEX, Biswap, Apeswap, BakerySwap, Babyswap, WOOFiSwap, Julswap, and so on

“The protocol sources liquidity from various exchanges and is able to reroute its users’ trades between them to try and ensure that they’re getting the best prices… BurgerCities’ Aggregation Protocol finds the most efficient way to ensure the best price by using all the different exchanges and liquidity protocols.”

The BurgerCities partnership with StarryNift, which integrates gamified NFTs, NFT art collections and metaverse creation, brings StarryNift’s NFTs into the BurgerCities game app.

On 2 August, BurgerCities said that it would introduce new game content and reward early users and investors with airdrops.

At the same time, the large increase in BURGER’s circulating supply from 21m coins to 63m could limit upside potential in the price.

BurgerCities price prediction: Where will the token trade next?

According to technical analysis by CoinCodex, as of 9 August, sentiment for the coin was bearish. ConCodex’s BURGER price prediction projected that the token could move up by 0.88% to reach $1.57 by 14 August but then drop to $1.03 in a month.

Wallet Investor was optimistic in its BurgerCities price prediction for 2022, anticipating that the coin could climb to $4.73 by the end of the year. The website’s algorithm predicted that the price could rise further to $12.693 by the end of 2023 and reach $28.591 by the end of 2025.

DigitalCoin projected a much slower upward trajectory in its long-term outlook. The website’s BurgerCities price prediction for 2025 saw the token averaging $2.99, up from $2.02 in 2022, and rising to $7.05 by 2030, based on historical data.

The BurgerCities price prediction for 2030 from Price Prediction put the token price at an average of $18.27, up from $2.93 in 2025 and $1 in 2022, based on its artificial intelligence-assisted technical analysis.

Gov Capital was bullish in its BurgerCities price prediction, estimating that the price could reach $4.839 by the end of 2022 and $12.242 by the end of 2023, climbing to $31.32 in December.

When considering a BurgerCities coin price prediction, it’s important to keep in mind that cryptocurrency markets remain extremely volatile, making it difficult to accurately predict what a coin or token’s price will be in a few hours, and even harder to give long-term estimates. As such, analysts and algorithm-based forecasters can and do get their predictions wrong.

If you are considering investing in cryptocurrency tokens, we recommend that you always do your own research. Look at the latest market trends, news, technical and fundamental analysis, and expert opinion before making any investment decision. Keep in mind that past performance is no guarantee of future returns. And neve invest money that you cannot afford to lose.

FAQs

Is BurgerCities a good investment?

In volatile cryptocurrency markets, it is important to do your own research on a coin or token to determine if it is a good fit for your investment portfolio. Whether the BURGER token is a suitable investment for you depends on your risk tolerance and how much you intend to invest, among other factors. Keep in mind that past performance is no guarantee of future returns. And neve invest money that you cannot afford to lose.

Will BurgerCities go up or down?

The direction of the BURGER price could depend on the development of the BurgerCities project and the trends on the broader cryptocurrency markets, which the price tends to follow. At the time of writing, cryptocurrency forecast sites like WalletInvestor, DigitalCoin and PricePrediction projected that the price could go up in the future. However, analysts and algorithm-based forecasters can and do get their predictions wrong. Keep in mind that past performance is no guarantee of future returns. Always do your own research. And never invest what you cannot afford to lose.

Should I invest in BurgerCities?

It’s important to stay on top of the latest BurgerCities project news and cryptocurrency market developments to decide whether you should invest in the token. Keep in mind that past performance is no guarantee of future returns. And never invest what you cannot afford to lose.