Argentine peso forecast: ARS seeking new bottom amid longstanding and persistent economic woes

Inflation in Argentina is rampant. The Argentine peso has been trading at record lows against the US dollar. What does the future hold for USD/ARS?

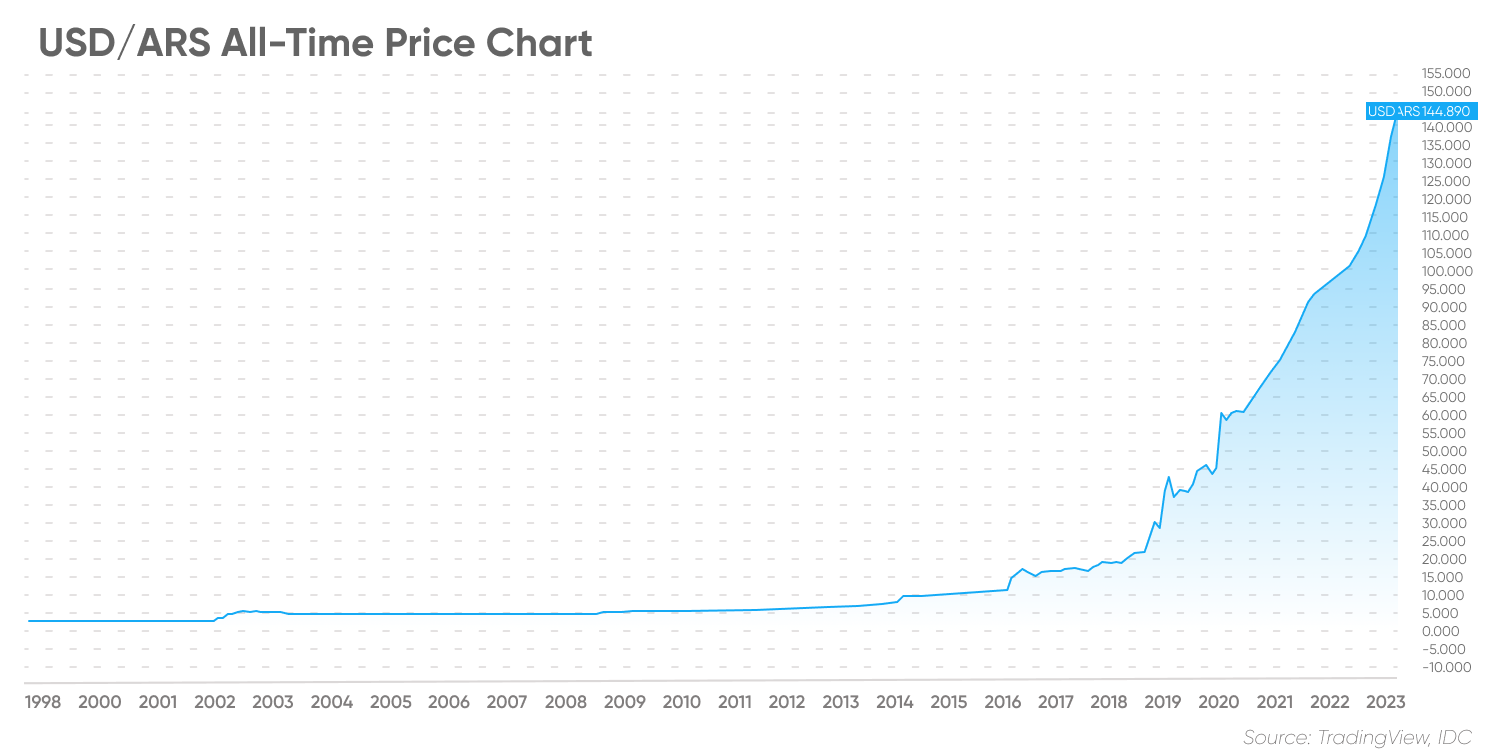

The Argentine peso (ARS) has fallen by 16% year-to-date against the US dollar (USD) in 2023 and in 2022 it tumbled 44% across the year as inflation soared to over 70%.

According to data from the Instituto Nacional de Estadística y Censos (INDEC), Argentinian inflation skyrocketed in February 2023 by 102.5% year-on-year after soaring 98.8% in the previous month. It remained at the highest levels since 1991 when the country came out of hyperinflation.

The government is on its third minister of the economy in as many months, and Argentina currently owes over $40bn to the International Monetary Fund (IMF). Is it so surprising that the peso is crumbling?

The IMF reviewed Argentina's economic situation on 3 April and lowered the country's net reserves target. Meeting this target is crucial for the Argentinian President Alberto Fernandez and with an election coming in October, it appears Fernandez will have a lot to contend with over the coming months.

There was some good news in March 2023, however, as Argentina’s consumer confidence indicator rose by 2 points to 38.2 in March of 2023. According to data from the Universidad Torcuato di Tella, the improved sentiment was noted across all sectors of the survey, notably for households’ personal situation (40.6 vs 39.3 in February), Argentina’s macroeconomic situation (40.4 vs 41.4), and consumers’ willingness to purchase durable goods and residential property (29.6 vs 27.9).

But with rising inflation, an election on the horizon and the country's current debt - is Argentina heading into a recession?

Felipe Camargo, senior economist for Latin America at Oxford Economics told Capital.com:

"According to EMAE data (the monthly GDP indicator) Argentina has already been in a recession since September last year. They have had four consecutive monthly GDP contractions since, with a small hiccup to the upside in January (which won’t last)."

Camargo goes on to say that all economic policy options are very limited. The central bank could try depreciating the ARS to push exports up, but that would push inflation and external debt up further. The real policy rate is already -20% in real terms. Fiscal expansions would compromise the IMF target and future debt sustainability.

Here we look in more depth at the latest news and moves in the currency, as well as the latest Argentine peso forecasts.

What is the Argentine peso and what drives its value?

The Argentine peso (ARS) is the national currency of Argentina. Its value against other currencies, such as the US dollar (USD), is determined by a floating market-determined exchange rate. This replaced the fixed exchange rate of 1 USD to 1 ARS, which expired in 2001.

Inflation and the ongoing economic crisis are among the key drivers of the Argentine peso. Over the space of less than 100 years, Argentina has gone from being one of the world’s wealthiest southern hemisphere countries to suffering a prolonged economic downturn, with mounting debts, multiple recessions, devaluations and hyperinflation.

This massive change in the Argentine economy has come as a result of political uncertainty, poor monetary policy and external headwinds.

Historical rate performance

A decade ago, 1 USD was worth 9.5 Argentine pesos. The peso continued to weaken, and by the end of 2017, 1 USD was worth 17.5 pesos.

In 2018, an economic crisis hit the country and the peso halved in value. The president at the time, Mauricio Macri, agreed to a bailout loan from the IMF for $57bn – the largest in the IMF’s history, and the organisation’s 21st loan to Argentina. However, it wasn’t sufficient to stabilise the Argentine economy.

In 2019, Alberto Fernandez won the country’s presidential election, sending government bonds sharply lower. In August 2019, the USD/ARS jumped from 43.4 to 61.99.

Argentina defaulted on its debt in May 2020, thereby closing access to international credit lines.

During the pandemic, USD/ARS kept rising as Fernandez printed money to finance salary and support programmes, paving the way for hyperinflation. USD/ARS ended 2021 at 100, rising by 100% in just two short years.

In January 2022, Fernandez announced that Argentina had secured an outline deal with the IMF to restructure $44.5bn of debt from the 2018 bailout, removing the threat of an immediate clash with the institution.

How has the Argentine peso performed so far this year?

The Argentine peso has fallen by 16% YTD against the USD so far in 2023. The USD/ARS steadily climbed to 178.00 at the start of January and now sits at 210.00, as of 4 April.

The Argentine government announced in March that it will allow investors the chance to exchange holdings of local debt into new bonds in a bid to ease fears of a default on the government's $35bn of local debt, which is due in the second quarter of the year.

Economists, however, are not optimistic about the currency's future performance.

Wells Fargo expect the Argentine Peso to suffer a substantial depreciation in 2023.

The picture was also bleak for 2022, with the Argentine peso starting the year at just over 100 pesos per 1 USD. The USD/ARS steadily climbed higher across the year, rising to 125.00 by the end of June 2022 and 176.00 by December.

What has driven the Argentine peso lower?

The Argentina peso has tumbled in value as inflation in the country surges. Political infighting and the inability to agree on a long-term plan for the economy are adding to the currency’s woes.

Analysts at Oxford Economics said in February:

Inflation

Inflation in Argentina rose to a 20-year high of over 70% year on year in September. It stepped up again in February 2023 by 102.5% year-on-year after soaring 98.8% in the previous month. It remained at the highest levels since 1991 when the country came out of hyperinflation.

In an attempt to rein in surging prices, the Argentine central bank hiked its interest rates by 300 basis points to 78% in March, after annual inflation hit 100% for the first time in over three decades.

This sharp hike was the first since September, when the bank raised its 28-day Leliq rate by 550 basis points. The Argentine Government had hoped it would cut rates in 2023, forecasting that inflation would cool - however, that has not been the case.

Inflation has risen again in 2023, despite the government's attempts to reduce retail prices, which have increased due to the country's drought that has hammered grain and wheat supplies.

IMF

The IMF and Argentina have renegotiated a new deal, following the agreement in 2018, pushing out payments from the earlier program as long as Argentina complies with certain conditions, such as introducing positive real interest rates and making progress in its quarterly reviews.

These reviews consider Argentina’s progress in accumulating foreign reserves and reducing its fiscal deficit. The risk is that if Argentina doesn’t pass the review, the country could default on the loan, potentially cutting off any remaining international financing sources.

On 1 April 2023, the Executive Board of the International Monetary Fund completed its fourth review of Argentina’s 30-month Extended Fund Facility (EFF) arrangement, allowing for an immediate disbursement of about $5.4bn.

The IMF stated that all quantitative performance criteria through end-December 2022 were met with some margin, supported by firmer macroeconomic policy implementation in the second half of 2022. The IMF added that against the backdrop of an increasingly severe drought, rising inflation, weak reserve coverage, a stronger policy package is needed to safeguard stability, address setbacks, and secure program objectives.

Gita Gopinath, First Deputy Managing Director and Acting Chair, at the IMF said in a statement:

Oxford Economics analyst, Camargo said the IMF is anticipating that the economy will likely fall short to meet some (probably all) of its short term targets due to the recent drought. Considering past experiences amid natural disasters of the sort, it is likely that these targets may be stretched for some quarters and some slippage will be allowed by the IMF without hurting the current deal

Reserves

On 3 April, the IMF lowered Argentina’s net reserves accumulation target for the end of 2023 to $8bn, in response to the government’s beleaguered finances. The IMF’s previous reserves target was $9.8bn.

The IMF hope that the central bank will have at least $10.3bn of net reserves by the end of December.

Net cash reserves have also depleted and fallen to around $2.1bn, as of mid-August. Total reserves are about 50% of what they were three years ago, raising the likelihood of the peso devaluing.

Camargo said:

Fears of another devaluation mean Argentines regularly buy dollars on the so-called “blue market”, potentially making the situation worse.

Argentina’s unofficial exchange rate, known locally as the “dólar blue”, offers customers higher peso rates on the street rather than at official currency exchange facilities. The so-called “blue market” got its name from the blue strip on the newer one hundred dollar bills.

This mechanism is run by money dealers on the streets, who give better rates for foreign currency. In other words, you get more local currency for your dollar than if you change money in a bank or use an ATM.

Furthermore, analysts believe that Argentina's only hope at keeping its promise to the IMF is to look at its forex reserves.

In relation to the ARS forecast, Camargo added:

What’s next?

Controlling rampant inflation will be a crucial focus for Sergio Massa, Argentina’s latest minister of the economy. He replaced Martin Guzman, who abruptly resigned in July after two and a half years in office. Guzman was succeeded by Silvana Batakis, who lasted just a few short weeks in the position.

Sergio Massa supports conventional approaches to taming inflation, such as higher interest rates and not calling on the central bank to print more money to fund soaring government spending. It is hoped that Sergio Massa will have more of an economic plan for the country than Fernandez, who made abundantly clear in interviews that he didn’t believe in financial plans, instead preferring a haphazard, piecemeal approach.

However, Massa has a big job on his hands, which shouldn’t be underestimated, particularly given that the government has subsidised recent surges in energy prices.

Economists believe that while the ARS didn’t depreciate as much, capital controls have contained profit and dividend outflows from multinational companies in Argentina, which helps keep the current account on a more sustainable position.

Camargo said:

Argentine peso forecast for 2023 and beyond

Camargo said:

Looking further ahead, the REM report gave their ARS prediction and said the USD/ARS forecast is that the currency pair will rise to 298.83 next year.

Analysts at TradingEconomics considered that the Argentine peso could weaken against the US dollar by the end of the year. Its US dollar to Argentine peso forecast predicted the pair could trade at 144.06 by the end of September and carry on rising to 145.71 in 12 months’ time.

Algorithm-based forecast website Wallet Investor predicted that the Argentine peso could weaken, but by a more significant margin. The service’s Argentine peso forecast had the USD/ARS pair ending 2022 at 147.22. The service considers that the peso will weaken more significantly in 2023, ending at 171.70. Meanwhile, its Argentine peso forecast for 2025 saw the pair rising to 221.10 by the end of the year. There were no services that offered an Argentine peso forecast for 2030.

Wallet Investor gave their EUR/ARS forecast for 2023 and beyond and said based on its forecasts, a long-term increase is expected. The Forex rate prognosis for 2028 is 399.953.

Analysts’ views

Analysts at BBVA Research forecast that the USD/ARS will rise to 154 in 2022 and 222.00 in 2023.

Fiona Cincotta, senior market analyst at City Index, believes that the Argentine peso will weaken further. She wrote in a note to Capital.com:

It is important to remember that analysts’ and algorithm-based Argentine peso forecasts can be wrong. Always conduct your due diligence before trading by looking at the latest news, technical and fundamental analysis, and analyst commentary. Past performance does not guarantee future returns. And never trade money that you cannot afford to lose.

Interested in comparing the major forex pairs? Try our currency strength meter.

FAQs

Will the Argentine peso get stronger in 2022?

Given the deteriorating economic picture and surging inflation in the country, combined with the hawkish outlook from the Fed, along with a number of other factors, the Argentine peso might not strengthen against the USD in the coming year, according to projections made by market analysts and a range of AI indicators.

Remember that analysts and algorithm-based platforms can and do get their projections wrong. Always do your own research to understand the latest market trends, news, and analysis.

Will the Argentine peso rise?

The Argentine peso has been steadily losing value across the year. Whether it starts rising could depend on monetary policy in Argentina, the macroeconomic picture and the country’s ability to rein in spiralling inflation, among other factors. Remember to always do your own research and keep in mind that past performance is no guarantee of future results.

Is it a good time to buy the Argentine peso?

Whether you consider it to be a good time to buy the Argentine peso is a personal decision. You should carry out your own research to understand the latest market trends, news and analysis, basing any decision on your risk tolerance, investing strategy and portfolio composition. Keep in mind that past performance is no guarantee of future returns. And never invest money you cannot afford to lose.