USD/BRL forecast: How will Brazil’s real perform amid political headwinds?

What’s next for USD/BRL? Read on to learn more about the forex pair and its possible future fluctuations.

The Brazilian real (BRL) has been highly volatile against the US dollar (USD) so far in 2022, shifting from being one of the top performers against the greenback earlier in the year to a sell-off in July that made it one of the biggest underperformers among emerging market currencies. The real gained some value in August, returning to its June levels.

In September, the USD/BRL pair bounced around as currency traders evaluated the dollar’s strength against high Brazilian interest rates and an approaching presidential election in October.

Following the election of Luiz Inácio Lula da Silva as the next president of Brazil in a tight run-off race against incumbent president Jair Bolsonaro, the real has gained value against the dollar, gaining close to 5% over the past week and trading at 5.03 as of 4 November.

The Brazilian central bank left its key interest rate unchanged at 13.75% on 21 September 2022, while the US Federal Reserve (Fed) raised its headline rate by a further 75 basis points (bps) on 3 November, lifting it to the highest level since early 2008.

What has driven the volatility, and what is the outlook for the foreign exchange (forex; FX) pair for the rest of the year?

In this article, we look at the real’s performance against the US dollar and the latest USD/BRL forecast from analysts.

What drives the USD/BRL pair?

The USD/BRL forex pair refers to the exchange rate for the US dollar – the base currency – against the Brazilian real – the quote currency. The exchange rate shows the value of one US dollar in Brazilian reals.

As with other currencies, the value of the Brazilian real is affected by the country’s economic growth, cross-border trade, and monetary policy, such as the adjustment of interest rates, which determine the attractiveness of the currency as an investment. The BRL is also affected by the demand for commodities, of which Brazil is a net exporter.

Brazil was one of the first countries to be considered an emerging market, forming the BRIC group along with Russia, India and China. As such, overall sentiment on emerging market economies and currencies can also affect the value of the Brazilian real.

The US dollar is the global reserve currency and is affected by sentiment on the world economy as well as economic activity within the US, including manufacturing and employment rates. The dollar acts as a safe haven for investors during times of economic and geopolitical uncertainty.

All of these factors have come into play in determining how the USD/BRL pair has performed this year.

Historical USD/BRL performance

The Brazilian real was introduced as Brazil’s official national currency in July 1994, replacing the cruzeiro real. The real immediately strengthened against the US dollar to a rate of 1.20 as the country’s economic growth attracted inflows from foreign investors. Brazil’s central bank then anchored the real to the US dollar to stabilise it.

The real was partially floated against the dollar in 1999, when the effect of Russia’s debt default spread. Investors pulled their funds from emerging markets, including Brazil, setting off a currency crisis that saw the real plummet from 1.20 to 2.15 against the US dollar.

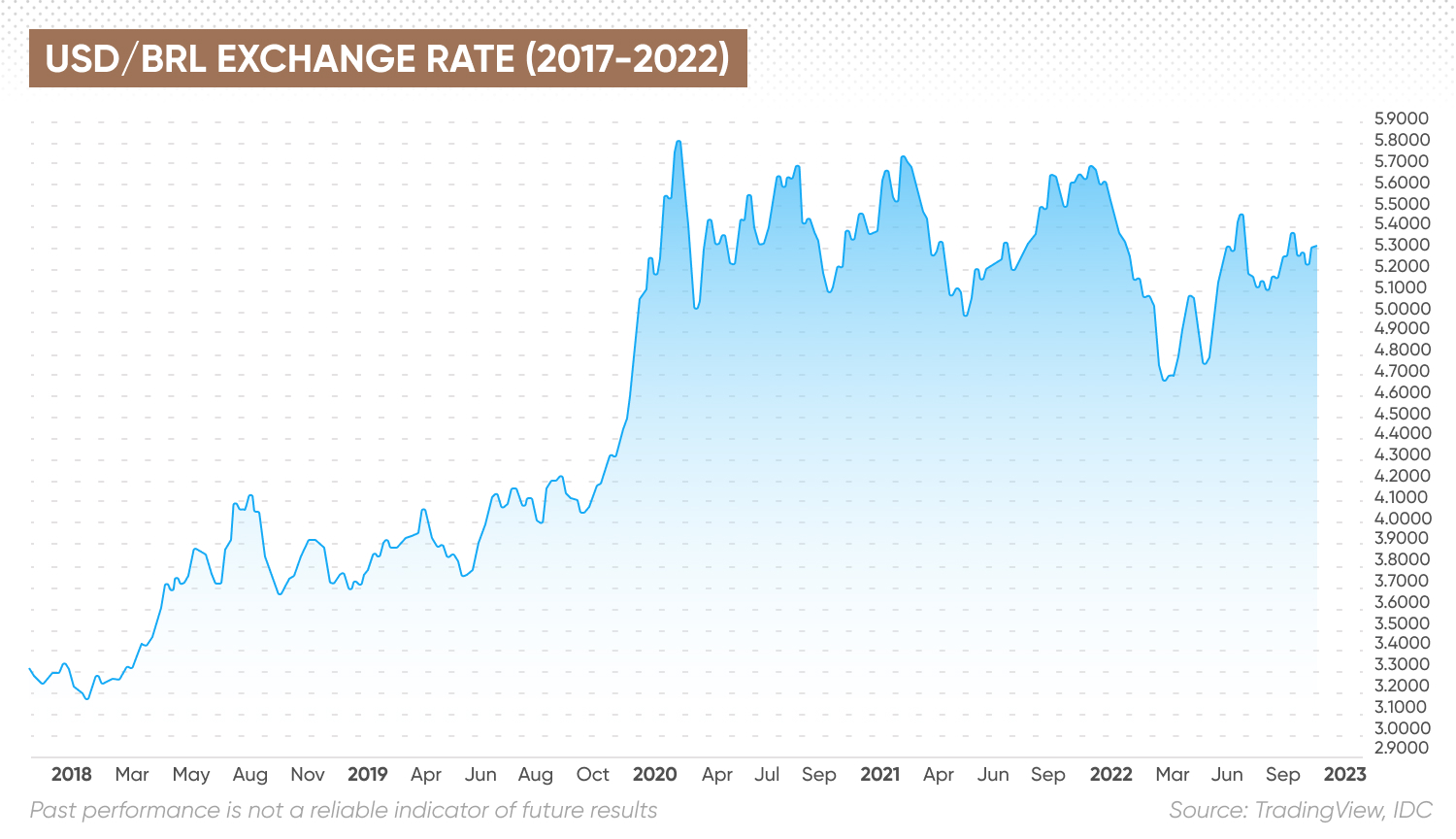

The USD/BRL exchange rate was around 1.76 at the start of 2008, but with the global financial crisis the real entered a long-term downward trend against the dollar. The USD/BRL rate surpassed 5.00 at the start of 2020, with each real worth as little as $0.18 as the Covid-19 pandemic drove investors to seek a safe haven in the US dollar.

The BRL has halted the downward trend, trading largely within the 4.70-5.70 range, and has been gaining value against the USD following the conclusion of Brazil’s recent election.

How has USD/BRL performed so far in 2022?

The real started off 2022 as one of the top-performing currencies, surprising market analysts by gaining as much as 21% against the dollar in the first quarter.

Analysts at French bank BNP Paribas noted in April that the real benefited from at least three factors: rising commodity prices; a rebalancing among investors away from US technology stocks and Russian assets towards other markets such as Brazil; and relatively high interest rates after nine hikes took the key policy rate from 2% to 11.75% in a year.

However, after reaching a peak in early April, the real has retreated against the US dollar, which at the same time has reached a 20-year high against a basket of currencies. From its 21% year-to-date gain against the dollar to 4.59, from 5.68 on 4 April, the real retreated to 5.50 on 22 July. It has since gained some strength, with the rate falling to 5.03 on 29 August. In September, the USD/BRL pair ranged between 5.09 and 5.25.

The US dollar has rallied on growing concerns that the Fed’s hawkish turn on interest rates since March could see the world’s largest economy enter a recession. Concerns about the impact of Covid-19 restrictions in China on manufacturing activity have also weighed on sentiment in recent months.

The real has begun underperforming against Latin American currencies, with the Mexican peso, for example, climbing in response to strong remittances, rising interest rates and a potential increase in manufacturing activity from US companies relocating production from China. While the Mexican central bank is eyeing at least six more rate increases, the Central Bank of Brazil is tapering its rate hikes.

Following Lula’s victory over former president Bolsonaro, the BRL has dropped from 5.38 against the USD on 26 October to 5.03 as of 4 November.

The market expectation is that Lula will be pragmatic and take a more centrist approach given the slim margin of victory – Lula’s 50.9% of votes beat Bolsonaro’s 49.1%. In his first speech after the win, Lula vowed to reunify Brazil and return to state-driven economic growth and social policies that helped lift millions out of poverty when he was previously president from 2003 to 2010.

Investors and analysts are now closely watching for any indication of Lula’s future cabinet, while weighing the risk of Bolsonaro questioning the election results, which could fuel political turmoil in Brazil.

What is the USD/BRL forecast for the real against the dollar for the remainder of the year and beyond? How will the election affect the value of the Brazilian real/US dollar pair?

USD/BRL forecast: How will the pair perform?

Dutch bank ING was “bearish on the BRL given the risk that Bolsonaro challenges any Lula win (rigged electronic voting etc) – uncertainty reigns,” according to analyst Chris Turner in the bank’s monthly FX analysis. Turner added on 14 September:

ING’s longer-term USD/BRL forecast indicated that the pair could end the year at 5.70 and move to 6.00 by the end of 2023.

In their September USD/BRL prediction, analysts at UK-based foreign exchange company Monex wrote that “in terms of rates, although the BCB has been ahead of the curve in raising interest rates to fight inflation, the hiking cycle has come to an end.”

They added: “The Selic rate now sits at 13.75% and money markets expect them to decline as early as next year as growth conditions deteriorate, fuelled in part by the lagged impact of aggressive monetary tightening. Taking those factors and adding in a hefty dose of political risk that stems from the country’s October presidential election into account, there is a recipe for a stronger USD/BRL rate in the near-term, especially if the Fed continues to talk up the US terminal rate. Over the medium term, once political risk dissipates and global economic conditions stabilise, the Brazilian real could re-emerge as the market’s sweetheart.”

Monex’s latest USD/BRL forecast, issued on 1 October 2022, put the rate at 5.00 in three months, 4.80 in six months, and 5.00 in 12 months.

Analysts at Canada’s CIBC wrote in their monthly BRL outlook on 6 October:

In a more recent piece on 25 October, ING’s Chris Turner attributed the gains in the real to the actions of the country’s central bank, which “hiked early and aggressively”.

Turner said analysts at ING were taking a more “negative” view of the currency, and cautioned of potential risk following the election:

Forex analysts at State Street were bullish on the near-term outlook for the USD, but bearish over the long term, noting: “The USD is historically expensive and near-term overbought. Over the next 3-5 years, we will continue to see ample downside to the USD (15-20%) as we eventually move to acceptable levels of inflation, lower monetary policy rates, and enter the next global recovery cycle. However, these conditions are distant and higher rates and rising recession are likely to support the USD over the coming months.”

Jankiel Santos, an analyst at Spanish bank Santander, observed that Brazilian “exporters may be finally repatriating resources hoarded abroad between late 2020 and early 2021.

Santos added: “On the other hand, we expect less favourable international conditions and lingering uncertainties about the future of domestic economic policy from 2023 onwards to limit the room for a substantial and perennial strengthening of the BRL.”

Algorithm-based forecasting service WalletInvestor indicated in its USD/BRL forecast for 2022 that the real could trade at 5.728 to the dollar by the end of the year and weaken to surpass 6.00 in December 2024. Its USD/BRL forecast for 2025 indicated the pair could trade at 6.449 by the end of the year.

Analysts have yet to issue a USD/BRL forecast for 2030.

When consulting forecasts for the US dollar/Brazilian real pair or any other asset, remember that analysts can and do get their predictions wrong. We recommend you always do your own research and consider the latest market trends and news, technical and fundamental analysis, and expert opinion before making any investment decisions. Keep in mind that past performance is no guarantee of future returns. And never invest money you cannot afford to lose.

FAQs

Why has USD/BRL been dropping?

The Brazilian real made strong gains against the US dollar in the first quarter of 2022, and appears to be regaining strength following Lula’s victory over former president Jair Bolsonaro at the end of October.

Keep in mind that markets remain volatile, and that past performance is no guarantee of future returns.

Will USD/BRL go up or down?

The direction of the USD/BRL pair could depend on monetary policy in both countries, macroeconomic sentiment, and new president Lula’s economic policies and cabinet appointments, among other factors.

When is the best time to trade USD/BRL?

Technically, you can trade currency pairs, including USD/BRL, around the clock. However, there are certain time slots when forex trading is most busy. This usually occurs between 08:00-12:00 ET, when US economic data is typically released. Whenever significant macroeconomic data is released or new central bank policies are unveiled, the USD/BRL pair’s volatility often tends to increase.

However, you should make trading decisions only after performing your own research, and remember that high volatility increases risks of losses.

Keep in mind that past performance is no guarantee of future returns, and never invest money you cannot afford to lose.

Is USD/BRL a buy, sell or hold?

Whether you should buy, sell, or hold the USD/BRL currency pair is a personal decision that depends on your trading strategy, risk tolerance and investing goals. You should do your own research into the economic data, government policies and other factors that drive the exchange rate to make an informed decision.

Keep in mind that past performance is no guarantee of future returns, and never invest money you cannot afford to lose.