Uniswap price prediction 2025-2050: Third-party UNI insights

Uniswap (UNI) traded at $6.29 at 9:24am (UTC) on 29 October 2025, with session prices ranging between $6.29 and $6.63, according to Capital.com’s data. The token is holding near the session low, trading at the lower end of its intraday range.

Uniswap price moves as of 29 October 2025 come amid broader cryptocurrency momentum following the US Federal Reserve’s 25-basis-point rate cut on 27 October, widely reported to have supported risk assets and digital currencies. Trading activity on leading decentralised exchanges, including Uniswap, has also been shaped by institutional participation, currency volatility and renewed retail activity across major DeFi platforms (AInvest, 27 October 2025)

Uniswap price prediction 2025-2030: Analyst price target view

CoinCodex (technical model)

CoinCodex sets a short-term Uniswap (UNI) target of $7.64 for October 2025 and $10.81 by year-end, citing neutral sentiment and stabilisation near key support levels following steady trading volumes and a normalising Fear & Greed Index (CoinCodex, 29 October 2025).

Cryptopolitan (consensus forecast)

Cryptopolitan notes that analysts expect Uniswap to average $8.21 in October 2025, with potential highs around $10.35, as on-chain flows and DEX liquidity remain steady after recent macro risk events (Cryptopolitan, 27 October 2025).

Changelly (quantitative research)

Changelly projects UNI to trade between $6.50 and $6.65 through October 2025, reflecting a consolidating trend across DeFi assets as technical indicators point to low volatility (Changelly, 28 October 2025).

Traders Union (market aggregation)

Traders Union forecasts UNI to average $4.44 in November 2025, potentially reaching $10.63 by January 2026, supported by protocol upgrades and wider adoption across retail and institutional traders (Traders Union, 29 October 2025).

Analyst forecasts are based on historical data and may not account for unforeseen events. Past performance and simulated outcomes are not reliable indicators of future results.

UNI price: Technical overview

Uniswap (UNI) trades near $6.29 (9:24am UTC, 29 October 2025), hovering close to the session low. The main daily moving-average cluster sits around $6.3 / $7.7 / $8.9 / $7.8 (20-, 50-, 100- and 200-day SMAs), all above the current price, forming a technical ceiling. The EMAs, positioned mostly above the SMAs, reinforce resistance across short- and long-term timeframes.

Momentum remains subdued, with RSI(14) at 41.5 (neutral) and ADX(14) at 23.8, showing no established trend. The first resistance level is the R1 Classic pivot at $9.58; a daily close above it could shift focus to R2 at $11.51. Initial support lies near the Classic pivot at $8.43, followed by the 100-day SMA (~$8.9). A break below this area may expose the S1 pivot at $6.50 (TradingView, 29 October 2025).

This technical analysis is for informational purposes only and does not constitute financial advice or a recommendation to buy or sell any instrument.

Uniswap price history

Uniswap coin has seen notable price swings over the past two years. It rallied above $18 in December 2024, after closing 2023 at around $7.35, driven by strong DeFi trading volumes and renewed market optimism.

By early 2025, a wider digital-asset correction saw UNI slide below $10 by February, trending lower through mid-year. On 29 October 2025, UNI closed at $6.29, down 33% year to date and nearly two-thirds below its December 2024 high, though still above late-2023 levels. The period highlights continued volatility and changing sentiment across both DeFi and the wider crypto market.

Past performance is not a reliable indicator of future results.

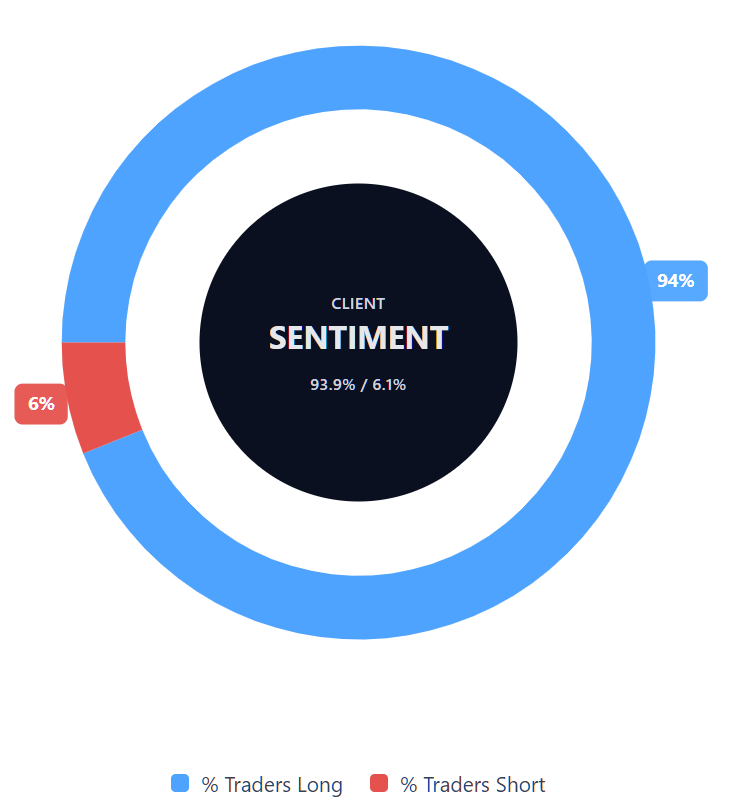

Capital.com’s client sentiment for Uniswap CFDs

As of 29 October 2025, Capital.com client sentiment in Uniswap CFDs shows 93.9% long positions versus 6.1% short, a difference of 87.8 percentage points. This suggests a strong long bias among traders, though positioning may shift rapidly with market movements.

FAQ

How many Uniswap coins are there?

Uniswap (UNI) has a maximum supply of 1 billion tokens, with allocations to the community, team members, investors and a governance treasury. The circulating supply stands at around 630.3 million UNI as of 29 October 2025.

Could Uniswap’s price go up or down?

Yes. Like other cryptocurrencies, Uniswap’s price can fluctuate with market sentiment, trading volumes, regulation and demand for decentralised exchange services. Price changes are driven by broader market conditions and on-chain activity within the Uniswap ecosystem. Past performance is not a reliable indicator of future results.

Should I invest in Uniswap?

Capital.com does not provide investment advice. Whether UNI is suitable for you depends on your financial situation, experience and risk tolerance. Cryptocurrency prices are highly volatile, and past performance is not a reliable indicator of future results. Learn more about Uniswap CFDs and trading risks in our cryptocurrency trading guide. CFDs are traded on margin – leverage amplifies both profits and losses.