What is a take-profit order?

What is a take-profit order?

A take-profit (T/P) order is a pre-specified price level at which a trader sets a position to automatically close when it's profitable. Once the asset's price reaches the take-profit level, the order is converted into a market order or a limit order for execution, depending on a broker.

By using take-profit orders, traders can manage risk and protect their gains from potential market reversals or adverse price fluctuations, providing them with better control over their trading strategy.

Key takeaways

-

A take-profit order is a pre-specified price level set by traders to automatically close a winning position, helping lock in profits and managing risk.

-

When the asset's price reaches the take-profit level, the order converts into a market order or a limit order for execution, depending on a broker’s trading system.

-

Take-profit orders are often used alongside stop-loss and limit orders, each serving different purposes in trading, such as locking in profits, limiting losses, or opening and closing positions at specific prices.

-

Take-profit orders help traders reduce emotional stress, improve risk management, maintain trading discipline, and use their time more efficiently by automating the position closing process.

Take-profit order explained

Take-profit orders can be used in various trading scenarios, such as in trend-following strategies, where traders aim to capture gains during strong price moves, or in range-bound market conditions, where traders seek to capitalise on price fluctuations between support and resistance levels.

Additionally, take-profit orders can be combined with other order types, such as stop-loss and limit orders, to create a risk management system that balances potential gains with downside protection.

How to set a take-profit order

To set a T/P order, a trader first needs to determine the desired price level at which they would like to close a profitable position. This level is typically established based on technical analysis, key support and resistance levels, or predetermined profit targets derived from trading strategies.

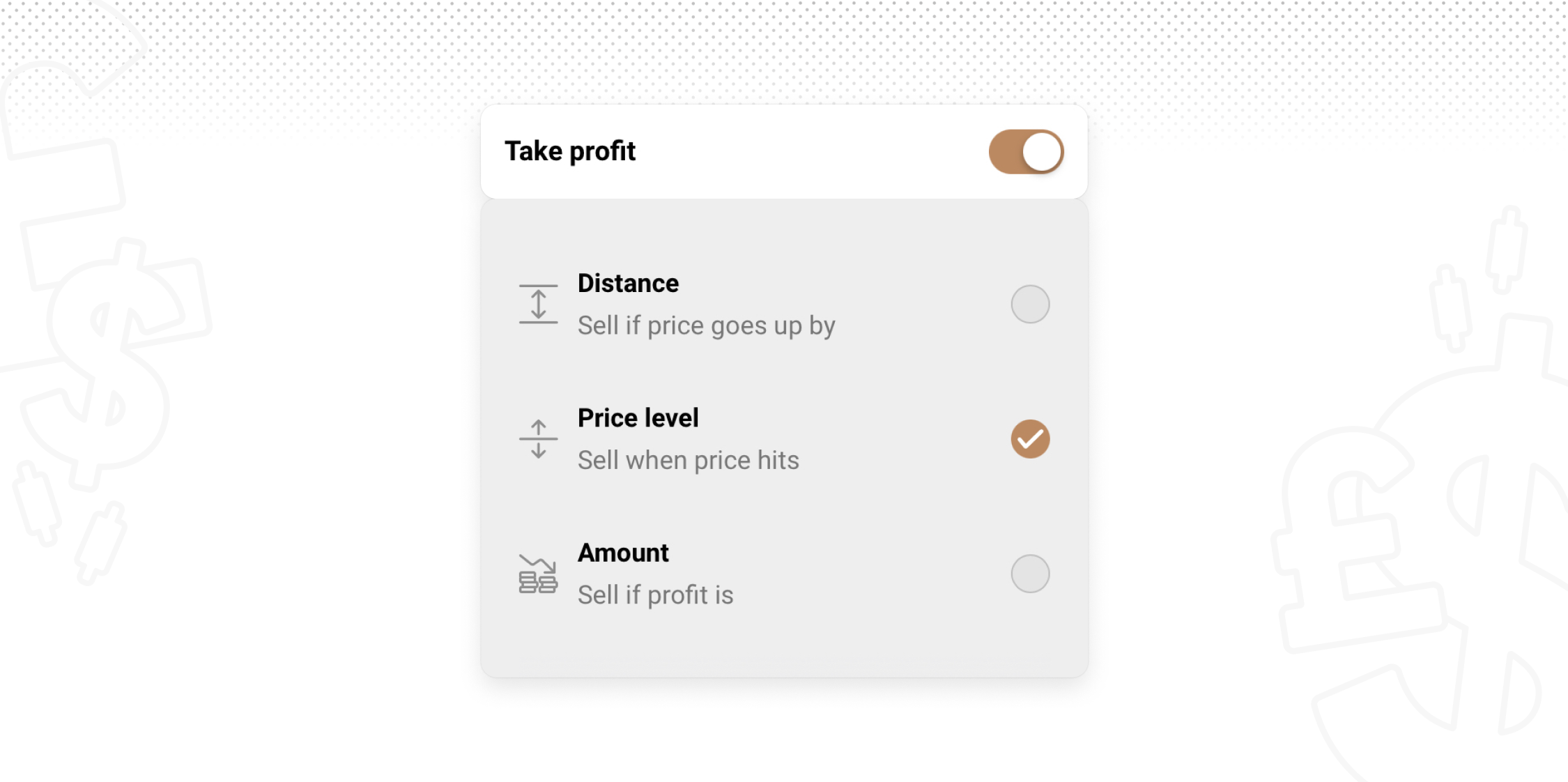

Note that some brokers, including Capital.com, may offer to set a take-profit order based on the desired profit’s amount or price distance from opening, rather than the price level only.

When the market price reaches the specified take-profit level, the order is automatically triggered and converts into a market order or a limit order for execution.

This conversion ensures the position is closed immediately, albeit with the possibility of a slight variation in the final execution price due to market volatility, slippage and liquidity issues.

At Capital.com, for example, a take-profit order is converted into a limit order when the price target is reached, which means the order would be executed at the pre-defined level or better.

Take-profit vs other order types

As mentioned above, T/P orders are often used alongside stop-loss and limit orders. While some of their features overlap, there are some key differences traders should be aware of.

| Take-profit order | Stop-loss order | Limit order | |

| Purpose | Lock-in profits | Limit potential losses | Open or close positions at a specified price or better |

| Execution | Converts to a market order when target is reached | Converts to a market order or limit order when target is reached | Executes only at a specific price or better |

| Price target | Profit target | Loss limit target | Specific price or better |

| Position management | Closing positions | Closing positions | Opening and closing positions |

Note that ordinary stop-losses may not protect from slippage. For this, traders may choose to use paid-for guaranteed stop losses which ensure the specified closing price even during extreme market volatility.

Benefits of using a take-profit order

-

Locking in profits: Take-profit orders allow traders to automatically close their positions once a specific price target is reached, ensuring that profits are secured and not lost due to sudden market reversals.

-

Reducing emotional stress: By setting a predetermined take-profit level, traders can avoid the emotional turmoil associated with constantly monitoring their positions and making impulsive decisions based on short-term price movements.

-

Improved risk management: Take-profit orders can be used in conjunction with stop-loss orders to help traders manage their risks more effectively and achieve consistent results.

-

Greater discipline in trading: Take-profit orders encourage traders to establish clear profit targets and adhere to their trading plan, fostering greater discipline and reducing the likelihood of overtrading or deviating from their strategy.

-

Time efficiency: With take-profit orders in place, traders can focus on other aspects of their trading activities or manage multiple positions simultaneously, without constantly monitoring each trade for potential exits. This can lead to more efficient use of time and resources.

Example of a take-profit order in trading

Suppose a trader using the Capital.com trading platform believes that the price of a stock index is going to increase in the short term. The current price of the index is 13,227 points, and based on their strategy the trader decided to open a long position on the stock’s contracts for difference (CFDs), anticipating that the price will rise to 13,400 points.

To lock in profits and automatically close the position if the desired price target is reached, the trader sets a take-profit order at 13,400 points.

If the stock index price begins to rise, and if it reaches 13,400 points, the take-profit order will be triggered, and provided the market conditions are not extreme, the CFD position will automatically close at 13,400. This mechanism ensures that the trader locks in the anticipated gain without having to monitor markets constantly.

Note that this example is of illustrative purpose only, and should not be used for real-life trading. Always conduct your own thorough research on the asset’s price and its direction before trading.

Conclusion

Take-profit orders can play an important role in the trading strategies as they provide an effective mechanism to lock in profits and protect gains from potential market reversals or adverse price fluctuations. By setting a predetermined take-profit level, traders can mitigate emotional stress and maintain better control.

Take-profit orders are often used alongside other order types, such as stop-loss and limit orders, to create a balanced risk-management system. The benefits of using take-profit orders include locking in profits, reducing emotional stress, improving risk management, fostering greater trading discipline, and enabling more efficient use of time and resources.

With a clear understanding of the purpose and execution of take-profit orders, as well as their advantages and role in conjunction with other order types, traders can make more informed decisions and enhance their overall trading experience.

Whether trading stocks, commodities, forex, or other financial instruments, understanding take-profit orders and incorporating them into a well-structured trading plan can help to achieve consistent results and navigate the unpredictable world of financial markets more confidently.

Always remember to conduct your own due diligence before trading, and test your strategy using a demo account.

FAQs

What's the difference between stop-loss vs take-profit order?

Stop-loss and take-profit (T/P) orders differ in purpose. A stop-loss order is set to limit potential losses by closing a position when a specific price level is reached. Meanwhile, a take-profit order locks in profits by closing a profitable position when a predetermined price target is met.

What's the difference between limit order vs take-profit order?

A limit order is used to open or close positions at a specific price or better, while a take-profit order is set to automatically close a profitable position once a profit target is reached. A take-profit order then converts into a market order or a limit order when the price target is reached, depending on how a trading platform is operated.

Can I change or cancel my take-profit order?

You can change or cancel your take-profit order if it hasn’t been triggered or executed yet. To do so, simply modify or remove the take-profit order on your trading platform or via your broker.

Can I place a take-profit order and a stop-loss order at the same time?

You can place both a take-profit order and a stop-loss order at the same time. This combination can help you manage risk by automating the desired profit targets and limiting potential losses for each trade.