What is Staking?

Staking is a response to the growing energy demand from Proof-of-Work (PoW) protocols used by the bitcoin (BTC) blockchain to validate transactions. Staking is when a user locks funds in a cryptocurrency wallet to participate in a blockchain system based on the proof-of-stake protocol.

Staking means buying and setting aside tokens used to validate transactions made through the blockchain. Stakers are incentivised to find a new block or add a transaction to a blockchain, just like they would in a PoW network.

PoS blockchain technology is scalable and offers quick transaction rates. Staking is comparable to proof-of-work in that it helps a network attain consensus while compensating participants.

Numerous blockchains, including ethereum (ETH), have adopted proof-of-stake protocols to run their networks in response to growing environmental issues triggered by the increased adoption of cryptocurrencies.

Each proof-of-stake blockchain has its own set of staking rules. These rules explain the financial and technical requirements, such as a minimum stake amount, procedures for selecting validators and principles of reward distribution.

Rewards are generally determined by the stake size, participation in the consensus process and the overall number of coins at stake.

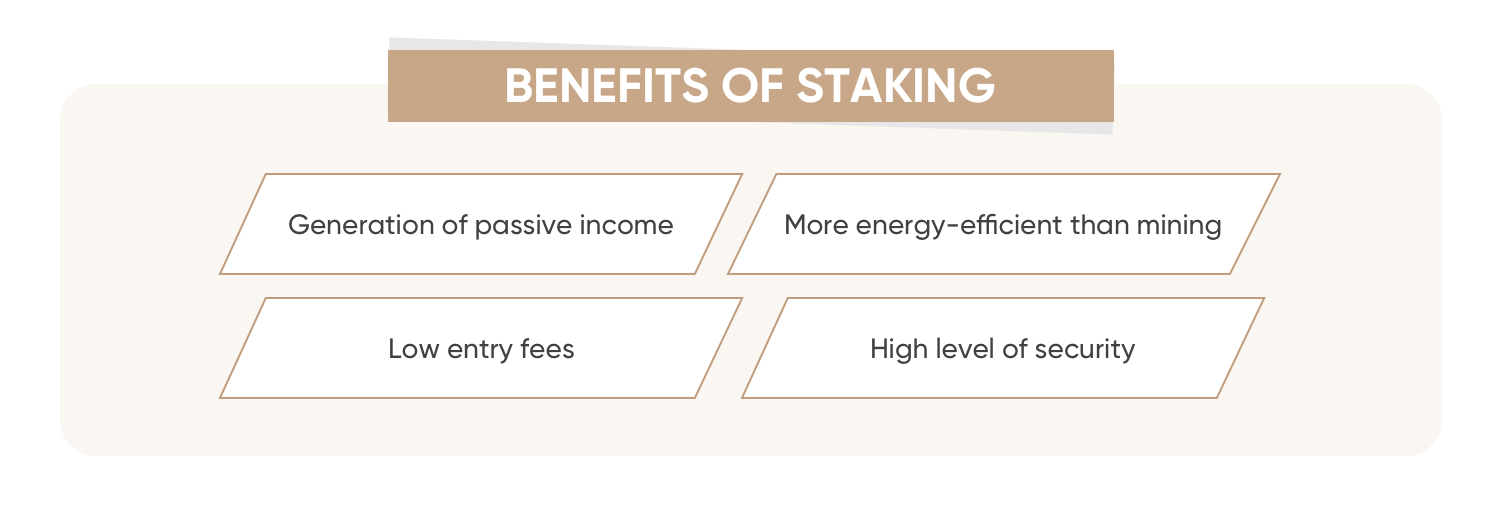

Staking benefits

-

Users of PoW blockchains, such as bitcoin, must purchase sophisticated machines and pay for electricity. PoS needs much less computing power. Staking can be done with a standard laptop or a mobile wallet on your smartphone.

-

PoS cryptocurrencies are more resistant to 51% attacks because the attacker must purchase 51% of the coins to take over the network.

-

Once you've staked your assets, you can collect staking rewards on top of your holdings and compound future rewards to grow them even more. Interest rates vary from the 6% a year offered by well-reputed networks, like ethereum (ETH) and Cardano (ADA), to as much as the 100% offered by smaller networks, such as Kava (KAVA) and PancakeSwap (CAKE).

-

Unlike proof-of-work, proof-of-stake requires no specialist knowledge. Users need to purchase coins on the exchange and delegate them for staking in a cryptocurrency wallet. The system then computes the reward on its own.

Staking drawbacks

The idea of collecting rewards for holding cryptocurrency seems appealing, but stakers should be mindful of the risks:

-

The potential downturn in the price of the crypto asset during the staking period.

-

The possibility of a cybersecurity incident that could result in the loss of tokens held within a certain exchange or online wallet.

-

The inability to utilise coins until the expiration of the staking contract. Funds could become illiquid for the entire duration of the lock-in period.

-

The uptime of the validator node holding staked tokens. Very often a validator is penalised if its ability to process transactions is affected. A staking income could be diminished by any disruption in the uptime.

Investing in cryptocurrencies can be profitable, but the cryptocurrency space as a whole is very volatile, which can lead to huge losses if you don’t have a diversified portfolio. With contracts for difference on Capital.com, you can trade popular PoS cryptocurrencies, such as Cardano (ADA), Algorand (ALGO), and Tezos (XTZ), without actually acquiring the coin.