Projected Poland interest rate in 5 years: Unexpected NBP hike pause tempers expectations

The Polish central has hiked interest rates to highest in nearly two decades

Interest rates in Poland surged from record lows to their highest in nearly two decades in 2022. The Polish central bank emerged as one of the most aggressive policymakers, having conducted 11 interest-rate hikes since October 2021.

On 7 December 2022, the central bank held interest rates steady at 6.75% for the third month in a row amid a fall in monthly inflation and quarterly GDP growth numbers.

Will we see more rate hikes in the future? What does this mean for the Poland interest rate forecast?

What is Narodowy Bank Polski?

The Narodowy Bank Polski (NBP) is the central bank of the Republic of Poland. The NBP is responsible for setting interest rates, issuing national currency and the management of foreign currency reserves, among others.

The NBP pursues an inflation-targeting strategy with the objective of keeping annual inflation at a target of 2.5% with a symmetric band for deviations of +/-1% in the medium term.

According to the NBP, interest rates constitute its key instrument of monetary policy. NBP’s other monetary instruments include open market operations, required reserve systems and standing facilities.

It should be noted that Poland is a European Union (EU) member state, but does not use the euro. The Polish zloty (PLN) is the country’s legal tender, which is issued by the NBP. Monetary policy in Poland is conducted by the NBP. Poland is expected to adopt the euro at some point in the future.

“All EU countries except Denmark, which has an opt-out, are expected to join the monetary union and to introduce the euro as soon as they fulfil the convergence criteria,” said the European Central Bank (ECB).

“In the future, when the euro becomes legal tender in Poland, the European Central Bank will be the issuer of notes while NBP will remain the issuer of coins,” the NBP added.

Poland’s interest rate timeline

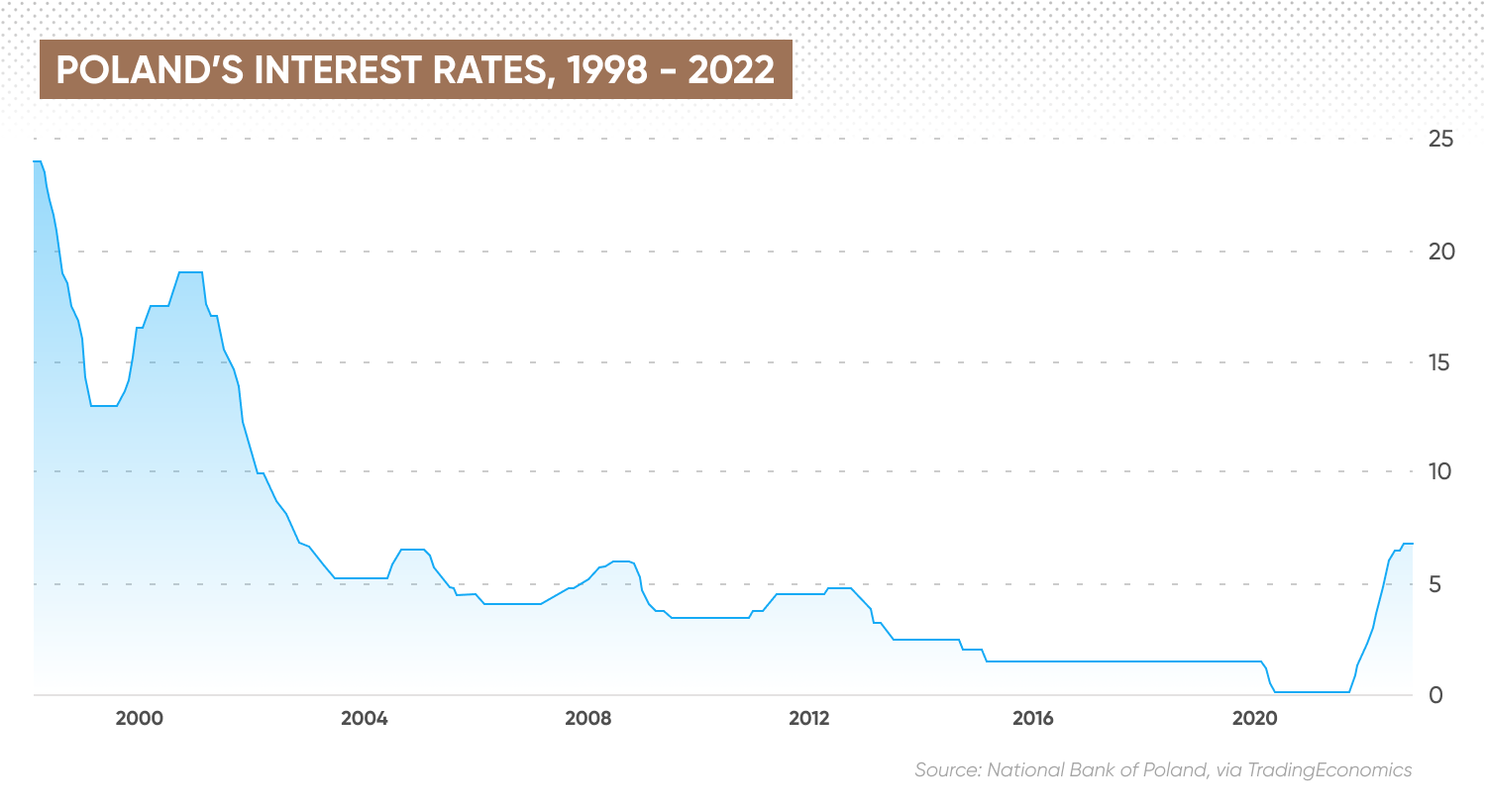

Historical data on Poland interest rates compiled by Trading Economics showed that the benchmark reference rate trended above 15% at the start of the millennium. Data shows Poland interest rates reached an all-time high of 24% in March 1998 and a record low of 0.10% in May of 2020.

The NBP cut the rate to 5% by 2004 following which there were multiple periods of rate hikes and cuts, notably during the financial crisis of 2008.

In May 2020, the NBP cut interest rates to a record low of 0.1% to support economic growth during the Covid-19 pandemic. At the time, ECB interest rates fell to -0.5%.

The NBP held Poland interest rates at 0.1% for the next 17 months until October 2022. Rising inflation prompted the Polish central bank to embark on a rate-hike cycle.

The NBP conducted 11 consecutive rate hikes between October 2021 and September 2022, taking interest rates from a record low of 0.1% to 6.75%, its highest in nearly two decades.

The central bank stopped short of making its 12 consecutive Poland interest-rate hikes as it kept the reference rate unchanged at 6.75% at its latest monetary policy council meeting held on 5 October 2022.

“Further decisions of the council will depend on incoming information regarding perspectives for inflation and economic activity, including the impact of the Russian military aggression against Ukraine on the Polish economy,” said the NBP.

On 7 December 2022, the NBP held reference rate at 6.75% for the third month in a row, noting a “strong decline in the growth of consumption and investment” in the country.

Poland interest rate forecast for next 5 years: Key drivers

Let’s take a look at the key factors that could influence Poland’s long-term interest rate forecast.

Inflation

Inflation is the key reason why central banks across the world have started interest-rate-hike cycles in 2022.

Any Poland interest rate prediction could be heavily influenced by economic data, especially on inflation. The current Polish rate hike cycle, which started in October 2021, came after annual inflation was reported consistently above 5% in the second half of 2021, compared with the NBP’s inflation target of 2.5%.

Inflation in 2022 has come in higher following Russia’s invasion of Ukraine, which has tightened the supply of energy and commodities. Curbs to Russian energy supplies into Europe have particularly hit European nations due to their dependence on Russian energy imports.

The latest flash CPI estimate for November 2022 showed annual inflation rates fell for the first time in 10 months to 17.4%, compared with 17.9% in October 2022.

Policymakers will take November’s inflation data as a positive but are not expected to lose sight of their inflation-fighting policy, as headline inflation still remained way above the central bank’s target of 2.5%.

“The decrease in CPI in year-on-year terms compared to October was driven by lower growth in prices of energy carriers and fuels. Inflation remains at a high level, which – to a great extent – stems from a gradual pass-through of high commodity prices to consumer prices,” said the NBP on 7 December.

Economic growth

Economic growth is a key consideration for central banks when implementing rate hikes or rate cuts. Therefore the NBP’s outlook for economic growth will be influential in interest rate predictions in Poland.

We can look at the rate cuts conducted in 2020 as an example of how central banks look to kickstart or sustain economic growth by reducing interest rates. Back in 2020, the world was under strict lockdowns to curb the spread of the Covid-19 virus. Policymakers cut rates to record lows in order to support economies against corporate bankruptcies, job losses and recession.

Today the policymaker’s priority has changed from economic resilience to inflation control. Many central banks are willing to risk economies from falling into recession in order to get inflation expectations under control and to prevent a price-wage spiral.

In the future, if inflation rates in Poland fall under the NBP’s target range, the central bank may be prompted to stop its rate hike cycle and even begin cutting rates in order to reinvigorate economic growth.

On 7 December 2022, the NBP noted that tightened monetary conditions in Poland have affected economic activity in the nation. The central bank said Poland’s annual gross domestic product (GDP) growth slowed to 3.6% in the third quarter of 2022 from 5.8% in the second quarter.

The bank also highlighted a fall in Polish labour force survey total employment in the third quarter of 2022.

Currency rates

The Polish central bank’s objective of financial stability comes with the responsibility of protecting the Polish zloty against foreign exchange depreciation.

Interest rates are key drivers of supply and demand of currencies in foreign exchange markets. More importantly, interest rate differentials between economies are influential in determining foreign exchange rates.

For example, when interest rates in Poland increase relative to interest rates in other countries. Polish assets such as government bonds become attractive to foreign and domestic investors. As a result more Polish assets are bought, capital inflows into Poland increase and demand for the Polish national currency rises.

It should be noted that the interest rate is one of the many factors that will affect the foreign exchange rates of the Polish zloty.

In 2022, the Polish zloty has lost nearly 10% year-to-date against the US dollar as of 8 December, despite the NBP coming out as one of the most aggressive central banks in the world.

The increasing demand for safe-haven currencies like the USD and the poor outlook for European economies has put the onus on the Polish central bank to double down on its efforts to protect the zloty from deteriorating further.

The NBP has stated that it could intervene in the foreign exchange market to protect the Polish zloty. On 7 December, the NBP noted the role the zloty could play in lowering inflation rates in Poland :

USD/PLN exchange rate

Poland interest rate forecast for 2022 - 2024

As we have learnt, the Poland interest rate forecast for next 5 years could be dependent on factors such as inflation, economic growth, the strength of the zloty and the outlook of the Russia-Ukraine war.

A look into the Polish inflation forecast from the NBP suggested that interest rates could remain elevated in the near term.

NBP's November 2022 inflation report raised its inflation forecast to 13.1% for 2023 from 12.3% previously stated in July 2022.

Polish inflation was expected to remain above the central bank’s 2.5% target in 2024, with CPI forecast at 5.9% for the year.

In terms of economic growth, the NBP expected the Polish GDP to grow at 4.6% in 2022, a slight decrease from 4.7% previously forecast in July 2022.

The Polish economy was seen growing at 0.7% in 2023 and 2% in 2024.

NBP’s Poland interest rate prediction indicated that no interest rate cuts are expected in 2023. The central bank saw three-month WIBOR interest rates at 6.95% in 2023 and 2024.

According to economic data provider Trading Economics’ interest rate predictions in Poland, the rates were expected at 6.75% by the end of 2022. Trading Economics’ Poland interest rate forecast projected the rates to trend at 6% in 2023. Yet the firm’s global macro models and analysts' expectations stopped short of giving Poland interest rate forecast for next 5 years.

The bottom line

Forecasting inflation rates and interest rates is a challenging task due to the uncertainties of the future. This was best displayed in 2022, when the start of the war in Ukraine threw a spanner in the works of the “transitory inflation” narrative that central banks across the world were hoping to realise.

Policymakers globally are scurrying to clamp down on runaway inflation with larger-than-expected rate hikes, which were not anticipated a year ago.

It is important to note that projected Poland interest rates in 5 years and short-term Poland interest rates outlook from analysts and experts can be wrong.

Forecasts shouldn’t be used as a substitute for your own research. Always conduct your own due diligence, looking at the latest news, technical and fundamental analysis.

Remember that your decision to trade or invest should depend on your risk tolerance, expertise in the market, portfolio size and overall strategy. And never trade money that you cannot afford to lose.

FAQs

Is the interest rate going up in Poland?

The Polish central bank has conducted 11 consecutive interest rate rises between October 2021 and September 2022, taking rates from 0.1% to 6.75%.

How high will Poland interest rates go?

According to economic data provider Trading Economics’ interest rate predictions in Poland, the rates could rise to 6.75% by the end of 2022. Trading Economics’ Poland interest rate forecast projected the rates to trend at 6% in 2023.

Where will interest rates be in 5 years?

NBP saw 3-month WIBOR interest rates at 6.95% in 2023 and 6.95% in 2024. The Polish central bank did not give an interest rate forecast for 2027.