Projected Canada interest rate in 5 years: Where next Bank of Canada rate settles after current cycle peaks?

As inflation is expected to ease long-term, when will the Bank of Canada start cutting rates?

The Bank of Canada (BoC) surprised the market with a 100 basis points rate hike in July aimed at fighting inflation. As the central bank is heading for its next rate policy meeting on 7 September, the country’s economic indicators are sending mixed signals.

Inflation cooled in July to below the bank’s expectations. Canada’s economy expanded for the fourth consecutive quarter. The labour market remained tight with a record-low unemployment rate.

Will the Bank of Canada maintain its hawkish rate hike, and what do analysts expect from the Canada interest rate in 5 years? Here we take a look at the factors that could shape the central bank’s monetary policy in the long term.

What is BoC?

Founded in 1934, Bank of Canada (BoC) is Canada’s central bank. Similarly to other central banks, the BoC’s primary duty is to maintain inflation at the 2% target using monetary policy tools such as interest rates.

The key interest rate is typically set by the Governing Council eight times a year on fixed announcement dates. As opposed to some other central banks, which use individual votes to determine the rate, the Council makes policy decisions by consensus.

Additionally, the BoC oversees designing, printing, and distributing of Canadian banknotes. As the fiscal agent of the Government of Canada it also oversees the public debt programs and foreign exchange reserves.

BoC interest rates policy over the years

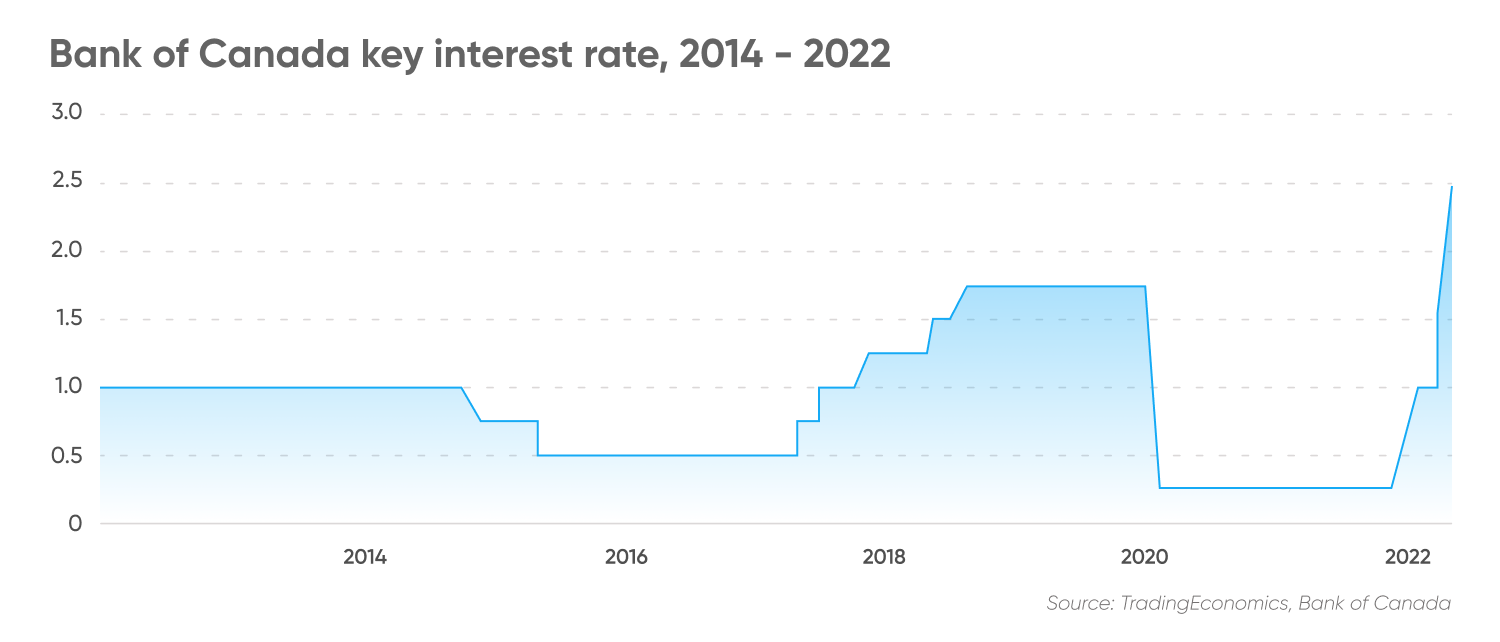

In 2019, Bank of Canada interest rate stayed steady at 1.75% amid concerns about slowing economic growth and the intensifying trade war between the US and China weighing on global demand and commodity prices.

The BoC reduced its overnight rate three times at the start of the Covid-19 pandemic, reducing the rate from 1.75% to 0.25%. At that time, Canada's economy shrank by 5.5%, and inflation fell below the 2% target in 2020. The bank kept its key rate at 0.25% until the first quarter of 2022.

In March 2022, the BoC began raising interest rates by 25bp to 0.50%, as inflation soared to 5.1%. It was the first BoC’s first rate increase since October 2018.

As of 6 September, the BoC hiked rates four times in 2022, following in the footsteps of other central banks such as the US Federal Reserve (Fed) and the Bank of England (BoE). With the fourth rate hike in July, at the time of writing (6 September) the overnight rate stood at 2.50%.

Inflation forecast to cool in 2022 and 2024

Inflation is the key factor shaping central banks’ decisions, as high inflation typically encourages banks to start a tightening cycle. If inflation is set to slow for a prolonged period, interest rates are likely to follow the suit.

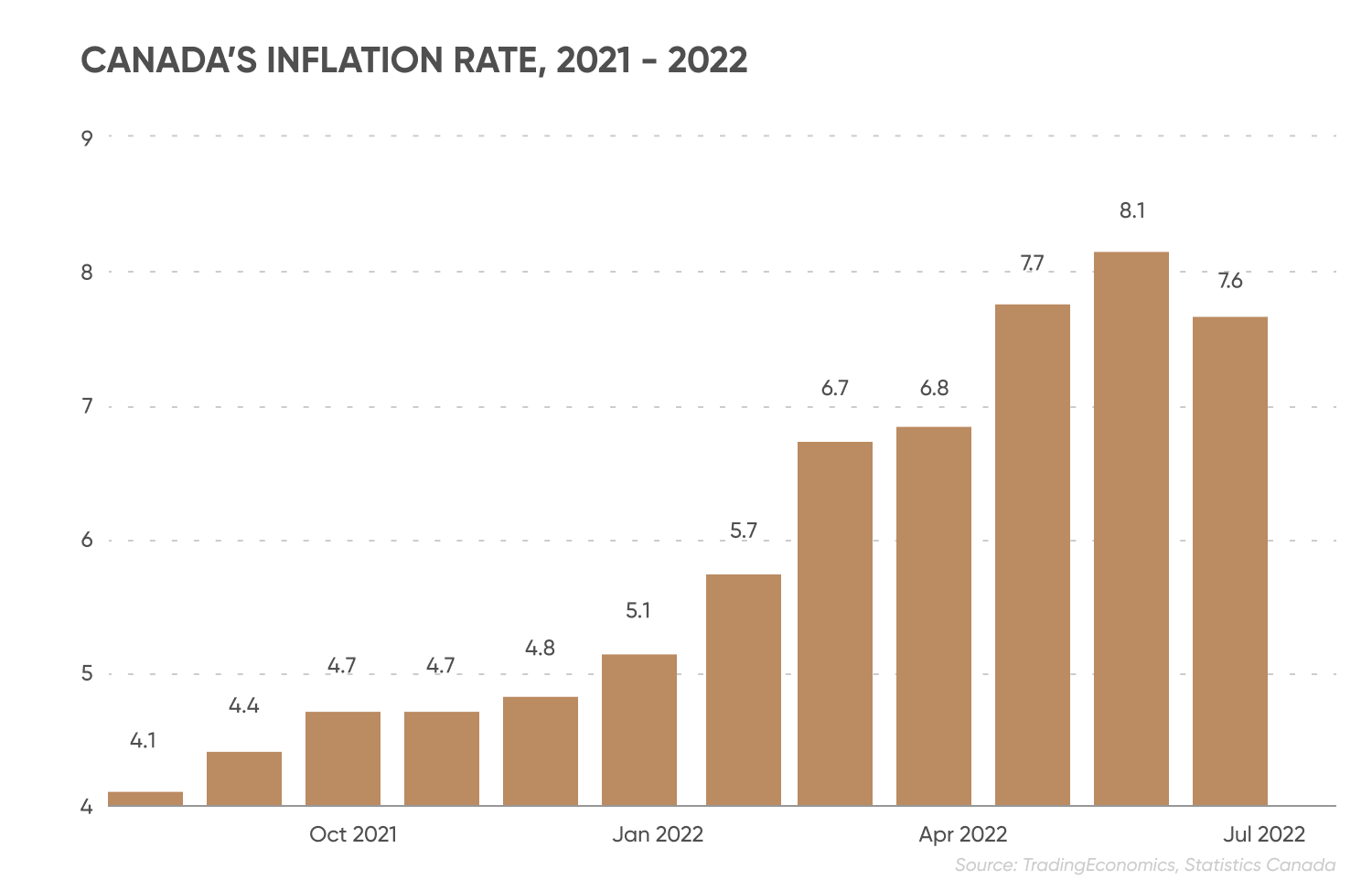

Canada’s annual inflation eased in July, with the Consumer Price Index (CPI) at 7.6%, dropping from 8.1% in June, Statistics Canada revealed in August. The deceleration was caused by slower annual growth of gasoline prices.

Gasoline prices rose 35.6% year-on-year in July, slowing from a 54.6% increase in June. Yet compared with June, consumers paid 9.2% less for the commodity – the largest monthly decline since April 2020.

July’s inflation reading was lower than the BoC’s predicted 8% rate for the third quarter of 2022. The central bank forecast that inflation would drop to 7.5% in the fourth quarter of 2022, cooling to 3.2% in the same period of 2023.

The bank expected inflation to return to its 2% target in the fourth quarter of 2024 as domestic demand and global price pressures ease.

In July, Scotiabank forecast Canada’s CPI to average at 7.3% in 2022, before dropping to the BoC’s target of 2% in 2023.

Dutch lender ING Group estimated Canada’s annual inflation to average 7% in 2022, falling to 3.1% in 2023 and 1.8% in 2024, in its latest forecast on 5 September.

TD Economics projected Canada’s CPI to average 6.7% in 2022 and ease to 3.5% in 2023, according to their latest forecast in June. Inflation was expected to fall to 2.1% in 2024 and return to the BoC’s 2% target in 2025, remaining steady at that level until 2027.

Economic growth seen to slow below 2% before recovering

Combating inflation without causing a recession is a tough balancing act central bankers are aiming to succeed in. This is why gross domestic product (GDP) readings are crucial data points in determining how high central bankers are willing to hike interest rates.

Canada’s economy climbed by 0.1% in June after a flat reading in May, with real GDP growing by 0.8% in the second quarter, Statistics Canada reported on 31 August.

The country's GDP increased at an annual rate of 3.3% in the second quarter, marking the fourth straight quarter of growth. It was below the BoC target of 4%. It was also below analysts’ expectations.

Scotiabank’s median forecast of Canada’s GDP for the second quarter stood at 4.4%, with a low forecast of 4.2% and a high estimate of 4.8%. The bank expected Canada’s GDP to grow at the average 3.5% in 2022, slowing to 1.6% in 2023.

The Bank of Canada predicted that the country's economy would grow by 3.5% in 2022, then slowing to 1.75% in 2023 and 2.50% in 2024, owing to policy tightening to lower inflation.

In its September’s forecast, ING Group estimated Canadian economic growth to ease to 2.8% in the fourth quarter 2022, from 3.9% in the third quarter. For 2022, ING projected 3.6% growth on average. Canada’s economy was expected to slow to 1.5% in 2023, recovering to 1.9% in 2024.

TD Economics analysts expected Canada’s economy to slow to 1.6% in the final quarter of 2022, down from 3% in the previous quarter. In terms of annual growth, the analysts expected the economy to grow, on average, 3.7% in 2022, slowing to 1.7% in 2023.

For a long-term GDP forecast, TD Economics expected the country’s economy to ease to 1.4% in 2024, rising to 1.6% in 2025. Canada’s GDP was expected to continue recovery to 1.7% in 2026 and remain at that level in 2027.

Record low unemployment rate

Unemployment is another important gauge of economic health. According to Statistics Canada, the unemployment rate in Canada remained stable in July at 4.9%, matching the historic low reached in June. The agency will release the August unemployment rate on 9 September.

In its July forecast, Scotiabank expected the country’s unemployment rate to rise to 5.6% in 2023, from an estimated 5.3% in 2022.

TD Economics expected Canada’s unemployment rate to climb to average 5.8% in 2024, from 5.3% in 2022 and to peak at 6.1% in 2024. The rate was forecast to fall to 6% in 2025 and steady at 5.9% in 2026 and 2027, according to its forecast.

Canada interest rate forecast 2022-2027

As inflation forecasts show signs of cooling, what are the projected interest rates in 5 years in Canada?

There are a limited number of analysts providing long term-forecasts. TD Economics predicted the Canadian central bank to lower the policy rate to 2.90% in 2024, 2.05% in 2025, 2% in 2026 and 2% in 2027.

In its short to medium-term Canada interest rate predictions, TD Economics projected the BoC to hike the interest rates to 3.25% in the fourth quarter and maintain the level until the end of 2023.

Scotiabank expected the Bank of Canada to raise its policy rate to 3.5% in the fourth quarter of 2022, maintaining the rate throughout 2023.

ING forecast BoC to have a further 75bp of hikes, bringing the overnight rate to 4% in the fourth quarter of 2022, dropping to 3.75% in the third quarter and 3.25% in the fourth quarter.

The BoC was forecast to continue lowering the policy rate to 2.75% in the first quarter of 2024 and to 2.5% in the fourth quarter.

Looking at a Bank of Canada interest rate forecast for 2022, ING Group’s economist James Knightly and FX strategist Francesco Pesole expected the BoC to opt for 75 basis point (bp) interest rate hike on 7 September, taking the overnight rate to 3.25%.

The BoC’s main focus will remain to bring back inflation to its 2% target, Knightly and Pesole said in a note published on 2 September:

The bottom line

Analysts mentioned in this article expected the Bank of Canada to start cutting the rate in 2023 as inflation and a high interest-rate environment may start hurting the country’s economic health.

TD Economics projected that the rate will be cut to 2% by 2027.

Keep in mind that analysts’ views on Canada projected interest rates in 5 years can be wrong. You should conduct your own research before trading. Remember, past performance does not guarantee future results. And never trade money that you can't afford to lose.

FAQs

What is the interest rate in Canada?

As of 6 September, the overnight rate in Canada stood at 2.5%. However, BoC’s Governing Council is set to hold an interest rate meeting on 7 September.

Who controls interest rates in Canada?

The Bank of Canada’s Governing Council is responsible for adjusting the interest rates in Canada.

How often are interest rates adjusted?

The BoC’s Governing Council meets eight times a year to discuss and adjust the overnight rate.

What is the future of interest rates in Canada?

TD Economics projected the rate would drop to 2% in 2027, from an estimated 3.25% in the third quarter of 2022. However, remember that analysts’ interest rate predictions in Canada can be wrong.