Orchid (OXT) price prediction 2022–2030: is the coin a buy?

Is now the time to buy or sell the privacy-focused Orchid cryptocurrency?

After a strong performance in March OXT, the coin of the self-styled digital privacy champion, Orchid has hit a bumpy downhill slope in April to lose 37% of its value and sink to $0.218 today (29 April).

It is now below the level it was when its surge in March kicked off. In fact, it is at the same level it was in November 2020.

Orchid sees a growing opportunity for virtual private networks in 2022 as the world's users look to protect their data as well as gain the value from it.

So, with a clear use case and apparently expanding opportunity, what does the future for Orchid’s crypto look like? What is a realistic target price? What will drive that forecast?

In this article, we look at the protocol’s recent developments and news, and review the latest analyst OXT price prediction to assess its outlook in 2022 and beyond.

What is Orchid?

Orchid Labs, which is developing the protocol, was founded in 2017 by Steven Waterhouse, Jay Freeman, Brian J. Fox, Gustav Simonsson and Stephen Bell. The founders brought together experience across open-source software, technology management, blockchain investment, app package management and security – Waterhouse co-founded cryptocurrency-focused venture capital company Pantera Capital; Freeman created Cydia, an alternative to the Apple App Store for jailbroken Apple devices; Fox created the first interactive online banking system at US bank Wells Fargo; and Simonsson was one of the core security developers for the Ethereum network when it launched in 2015.

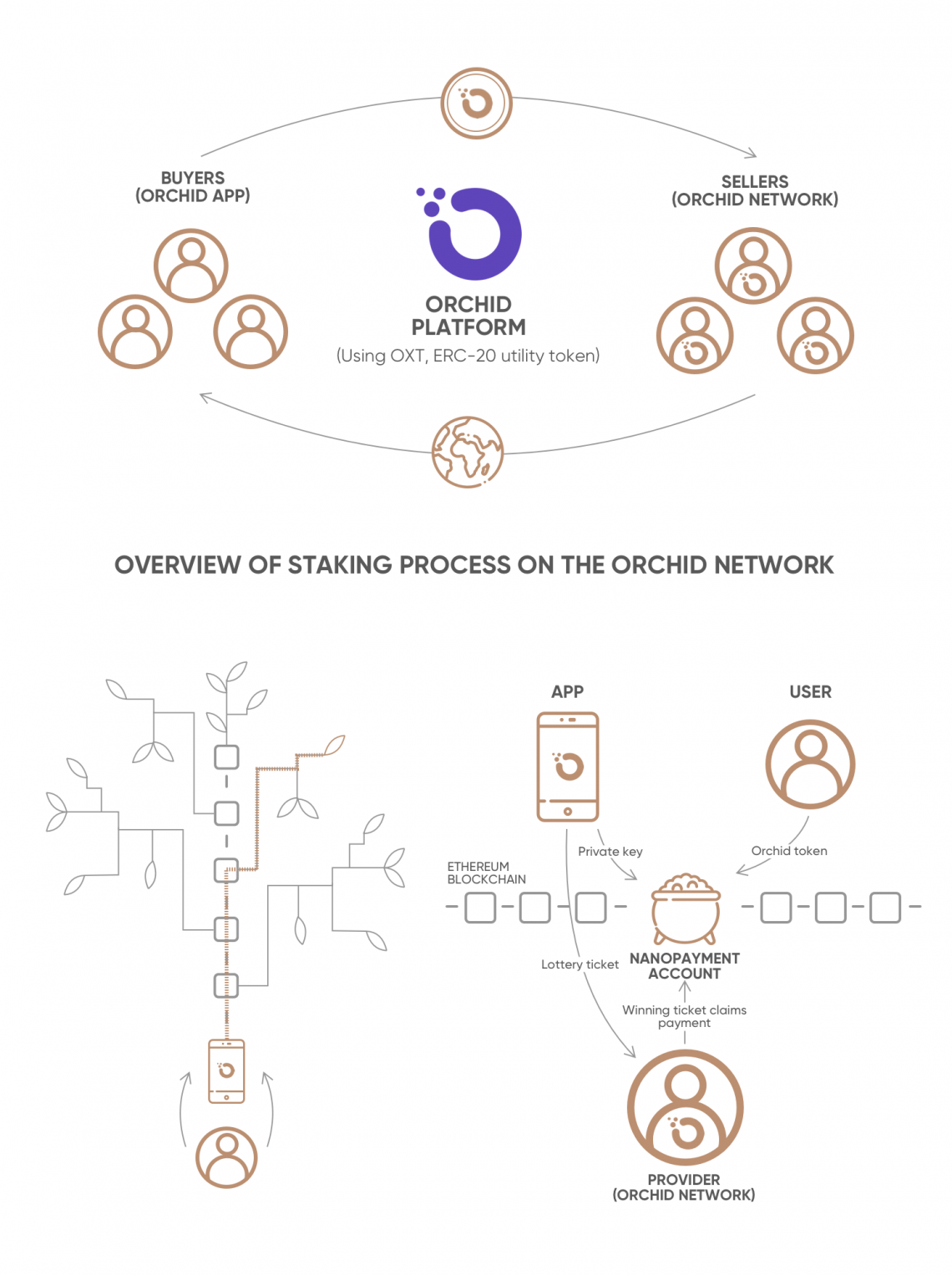

The Orchid network brings cryptocurrency to the cybersecurity space, providing a blockchain-based, peer-to-peer VPN service that connects users with a decentralised pool of providers with surplus bandwidth. It operates what the Orchid website calls a “VPN protocol for token-incentivised bandwidth proxying, and smart-contracts with algorithmic advertising and payment functions”. The decentralised nature of the network allows users to maintain their security and privacy as they browse the Internet.

OXT is the native Orchid token used to exchange value on the network, which operates a pay-per-use model. The token was launched in December 2019.

The service runs on the Orchid bandwidth marketplace app, which is similar to a typical VPN client. The Orchid protocol runs on top of WebRTC, a common web standard used to transmit audio and video in browsers. Bandwidth users and providers need to hold OXT in a secure Web3 cryptocurrency wallet to be able to use the service. Web3 refers to the next-generation, decentralised Internet, which introduces a governance layer that enables individuals to take control of their personal data and privacy.

The app offers a multiple-hop interface that supports connecting OpenVPN and WireGuard configurations in onion routing, or layered encryption, through different VPN providers.

Users can keep costs low by only paying for the bandwidth they consume, and they can quickly switch between providers to customise the experience. The network uses what it calls a “probabilistic nanopayment system” that spreads fees across multiple transactions and parties. Unlike bitcoin and other cryptocurrencies, OXT tokens are not mined. Bandwidth providers can stake tokens to share their surplus bandwidth and act as network nodes in exchange for rewards. The list of nodes is kept in an Ethereum smart contract.

Orchid runs on the Ethereum blockchain, which has seen its processing costs, known as gas prices, spike as transactions have increased. As the OXT cryptocurrency is an ERC-20 coin, payments on the network need ether to cover the gas costs, exposing OXT users to high fees. Orchid Labs responded by adding support for other blockchains that are compatible with the Ethereum Virtual Machine (EVM) to avoid the fees. Users can buy and sell bandwidth using xDAI and digital assets from other EVM-compatible blockchains.

Use of the Orchid crypto has been increasing. On 29 September, US regional bank Vast selected OXT as one of eight cryptocurrencies that customers can buy, sell and store in its recently launched Crypto Banking service. US authorities recently approved Vast as the first federally chartered bank to offer access to cryptocurrencies through a current account. OXT was also listed on the LATOKEN exchange on 7 October.

On 5 November, Orchid Labs released an updated version of the app, giving users more control by making it easier to configure and adding new capabilities for multiple-hop circuits for enhanced privacy. Users can now pay for circuits with prepaid xDAI accounts as well as OXT.

On 7 December OXT was listed on the crypto exchange, Crypto.com which has, said Orchid, more than 10 million users around the world.

On 14 January OXT was listed on Vauld, a Singapore-based digital asset platform that offers crypto lending, borrowing, and trading solutions.

On 20 January the VPN service from Orchid, the self-styled digital privacy champion, was expanded to support payments on eight blockchains.

Of the update, Orchid said users who self-custody any of the eight native tokens on their respective Ethereum virtual machine compatible blockchains including Avalanche, Binance, Matic and Ethereum, "can now move their funds into Orchid accounts using the Orchid dapp V2 and pay for VPN service with nanopayments on that chain".

What has been happening to the OXT coin?

The OXT price climbed to $0.76 on 2 November 2021, its highest level since mid-May, when cryptocurrency markets sold-off their highs. It had previously spiked as high as $0.86 on 17 April. The price briefly slipped to a small year-to-date loss in June, trading below the $0.20 level, having started the year at $0.22. OXT then moved up to $0.52 on 25 August during the summer rally, and bottomed at $0.29 in late September as the markets dipped.

Following the spike at the start of November, the cryptocurrency is now (29 April) trading around $0.22.

What is the outlook for the price in 2022 and beyond? Will it return to the previous highs or shed more value?

Orchid (OXT) price prediction 2022–2030: where next for the privacy coin?

At the time of writing (29 April), cryptocurrency data tracker CoinCodex remained bearish on the price outlook for OXT in the short-term, with four technical analysis indicators giving bullish signals and 26 bearish. Its short term OXT crypto price prediction expected the price to fall 4% to $0.21 by 4 May.

CoinArbitrageBot listed OXT as a sell based on technical analysis. In its Orchid price prediction it said that the OXT price could be $0.4 at the end of 2022 and $0.65 at the end of 2023. For three years' time its price estimate was $1.7.

The Orchid coin price prediction 2021–2025 from algorithm-based forecasting site Wallet Investor projected that the coin could be at $0.051 this time next year and fall to $0.034 by 2027.

The OXT coin price prediction from forecasting site DigitalCoin estimated that the coin could average $0.28 in 2022, rising to $0.42 in 2025, based on historical data. For the longer term, the site projected that the price could average $1 in 2030.

When reviewing these Orchid predictions it’s important to keep in mind that cryptocurrency markets remain extremely volatile, making it difficult to accurately predict what a coin’s price will be in a few hours, and even harder to give long-term estimates. As such, analysts and algorithm-based forecasters can and do get their predictions wrong.

We recommend that you always do your own research, and consider the latest market trends, OXT news, technical and fundamental analysis, and expert opinion before making any investment decision. Keep in mind that past performance is no guarantee of future returns, and never invest more than you can afford to lose.

Follow Capital.com to stay on top of the market’s latest news.

FAQs

Is Orchid crypto a good investment?

Cryptocurrencies are highly volatile assets, making them riskier than other forms of investment. Whether OXT is a suitable investment for you depends on your risk tolerance and the balance of your portfolio. You should do your own research to determine whether it is a good fit for your investing goals. Keep in mind that past performance is not an indicator of future returns.

Will the Orchid (OXT) price go up or down?

The direction of the price will depend, among other factors, on the adoption of the Orchid Protocol and sentiment on the broader cryptocurrency markets. Some forecasting sites predicted that the OXT price could rise. Whether you believe those OXT predictions is a decision only you can make.

How high can OXT go?

Some forecasting sites predicted that the OXT price could approach $1 in the next few years. However, you should keep in mind that analysts and online forecasting sites can and do get their predictions wrong.