Market forces definition: Impact on financial markets

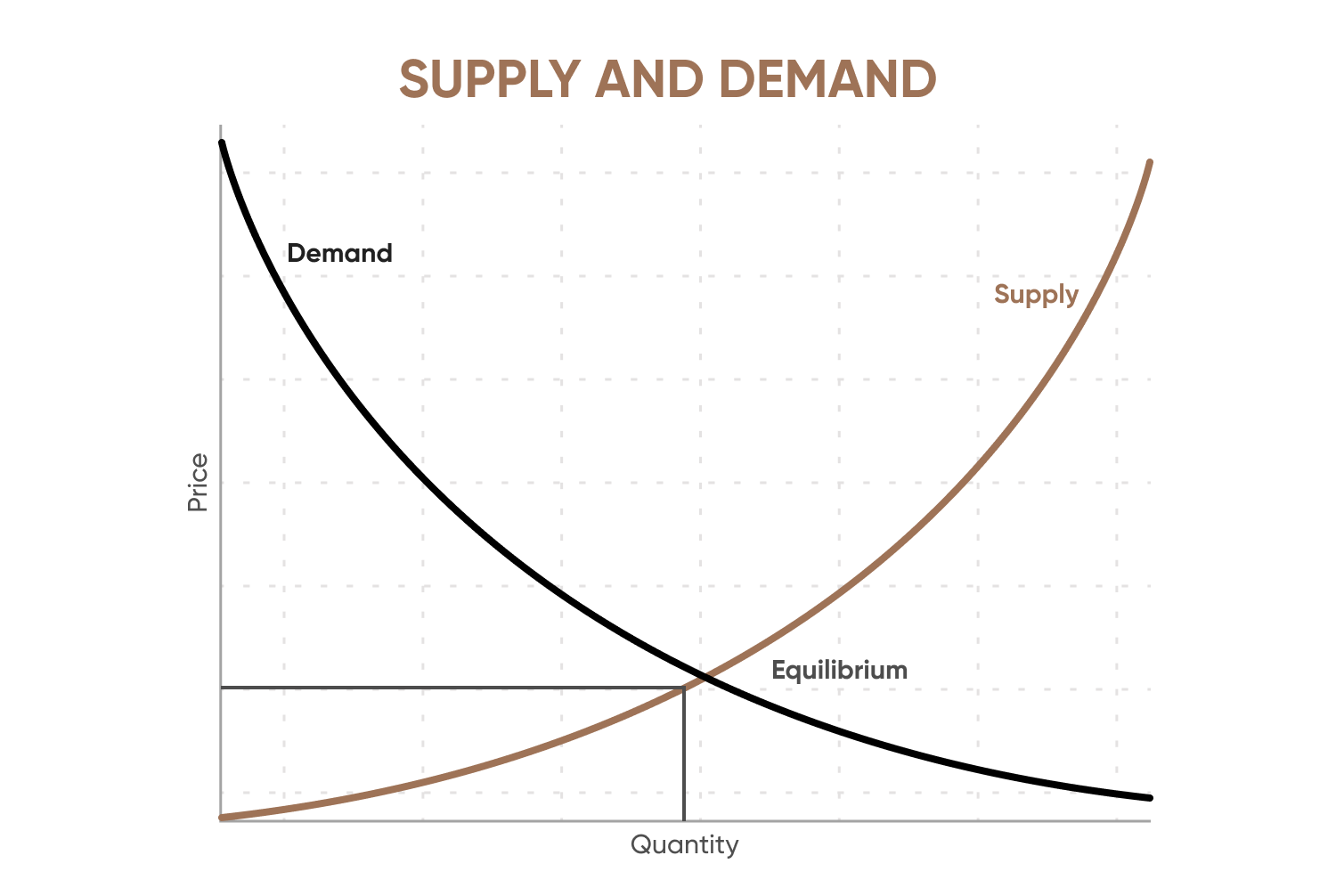

Market forces describe how supply and demand interact to determine prices and the availability of goods and services. When demand for a product rises but supply remains limited, prices tend to increase. Conversely, when supply outpaces demand, prices usually fall. This interaction helps markets find balance, known as equilibrium, where production aligns with consumer needs.

In financial markets, these forces influence how assets are valued and traded. Understanding them can help market participants interpret shifts in price and volume more effectively.

What are market forces?

Market forces are the interactions between supply and demand that determine how a market functions and how resources are allocated. Their main function is to create a balance between what producers are willing to supply and what consumers are willing to buy. This balance is called market equilibrium. Market forces are essential because they indicate to producers what to make and to consumers what to buy. When a market operates efficiently, prices reflect both relative scarcity and consumer preferences. These forces are often described as the ‘invisible hand’ of the market, a term introduced by economist Adam Smith in 1776.

Basic principles of market forces

To identify the three market forces, consider the core drivers in a competitive market.

Supply and demand

Supply is the quantity of a good or service that producers are willing and able to sell. Demand is the quantity that consumers are willing and able to purchase. When demand exceeds supply, producers may increase output or prices; when supply exceeds demand, they may reduce output or prices. This continuous interaction forms the foundation of all financial markets.

Competition

Competition compels producers to innovate and control costs. Firms strive to differentiate their offerings – through quality, features or price – to attract buyers. This pressure limits monopolistic power and promotes efficiency, contributing to market resilience.

Government policies

Government interventions – such as taxes, regulations and subsidies – alter incentives for producers and consumers. A tax on a commodity can reduce demand, while a subsidy can encourage production. Such policies can enhance market stability or, if applied ineffectively, create distortions.

The three forces – supply, demand and competition – form the foundation of market forces in economics. You can observe how market forces influence asset prices in real time using a demo account.

What drives market forces?

What influences market movements? Let’s take a closer look.

Economic indicators

Investor sentiment

Geopolitical events

How market forces affect trading and investment decisions

Traders and investors regularly analyse what market forces are and how they operate to inform their decisions. They look for imbalances between supply and demand to identify potential opportunities.

Real-world examples of market forces are common. When a company launches a new product, expectations of higher future earnings can increase demand for its shares, raising the stock price. In the forex market, a central bank’s decision to raise interest rates can increase expected returns, making the currency more attractive and boosting demand. In commodities, a drought may constrain supply while consumption remains steady, creating scarcity and pushing prices higher.

Traders use fundamental and technical analysis to evaluate these forces and understand how they influence market behaviour.

Government interventions and their influence on market forces

Governments do not always leave markets to operate without intervention. Their actions can represent a significant market force.

Central banks implement monetary policy to influence liquidity in an economy. They conduct open market operations by buying or selling government bonds and adjust interest rates accordingly. Higher interest rates tend to curb borrowing and spending, slowing economic activity and helping to contain inflation. Lower rates encourage borrowing and spending, supporting growth and demand.

Fiscal policy, such as government spending and taxation, also shapes market dynamics. Increased government spending can inject money into the economy, create jobs and bolster demand. Conversely, tax cuts leave individuals and businesses with more disposable income, which can be spent or invested, further sustaining demand.

Both monetary and fiscal policies have a direct impact on supply and demand. They are key instruments used to address economic imbalances and stabilise an economy.

Market equilibrium and competitive market forces

Market forces work to achieve a state of balance, called ‘market equilibrium’, where the quantity supplied equals the quantity demanded. At this point, there is no inherent pressure for prices to change. Competitive dynamics help sustain this balance.

In a competitive market, many sellers vie for customers, preventing any one firm from exercising significant price-setting power. If a seller increases prices, buyers may switch to rivals. Likewise, competition discourages complacency, encouraging firms to innovate and control costs. This supports market efficiency.

However, equilibrium is not fixed. A disruptive innovation can shift supply or demand. For example, the introduction of smartphones reduced demand for digital cameras, prompting manufacturers to cut output and reach a new equilibrium.

See what market forces are in action with a demo account, where you can track live price changes without risk.

FAQs

What are market forces and why are they important?

Market forces are the interactions between supply and demand that govern price formation and resource allocation. They are key influences in a market economy, ensuring production aligns with consumer needs.

How do supply and demand shape the financial markets?

Supply and demand form the basis of financial markets. Increased demand for a share tends to raise its price, while an excess supply in a currency market can reduce its value. This ongoing interaction drives market movements.

What are examples of market forces in action?

An example of market forces can be seen in oil markets, where geopolitical tensions in a major producing country limit supply while consumption remains steady, pushing prices higher. Technological developments – such as advances in artificial intelligence – can also increase demand for related equities, influencing valuations.

How do government policies influence market forces?

Government measures alter market incentives. Taxes can raise production costs or consumer prices, while subsidies can lower them. Changes in interest rates affect borrowing costs and spending power. Such interventions can influence economic activity by either reinforcing or constraining natural market dynamics.