The ultimate guide to margin trading

Margin trading is when you pay only a certain percentage, or margin, of your investment cost, while borrowing the rest of the money you need from your broker.

Margin trading allows you to profit from the price fluctuations of assets that otherwise you wouldn’t be able to afford. Note that trading on margin can improve gains, but increases the risk and size of any potential losses.

What does trading on margin mean? In this guide we’ll walk you through what trading on margin is, key techniques and principles such as leverage and margin call, as well as benefits and risks associated with margin trading.

What is margin trading?

But what is the margin in trading? There are two types of margins traders should be aware of. The money you need to open a position is your required margin. It’s defined by the amount of leverage you are using, which is represented in a leverage ratio.

-

2:1 leverage = 50% margin

-

5:1 leverage = 20% margin

-

10:1 leverage = 10% margin

-

20:1 leverage = 5% margin

-

30:1 leverage = 3.3333% margin

-

100:1 leverage = 1% margin

-

200:1 leverage = 0.5% margin

There are also limits on keeping a margin trade running, which is based on your overall maintenance margin – the amount that needs to be covered by equity (overall account value).

Brokers require you to cover your margin by equity to mitigate risk. If you don’t have enough money to cover potential losses, you may be put on a margin call, where brokers would ask you to top up your account or close your loss-making trades. If your trading position continues to worsen you will face a margin closeout.

Margin trading example

Let’s say you have $20 in cash to fund your account and spend it on stock CFD trading. If the leverage you are using is 5:1, you will be able to trade $100 worth of the asset with every dollar of your required margin worth 20% of the total value of your trade. Your broker tops up each $1 to $5 so your $20 becomes $100.

If you were offered 10:1 leverage, or 10% margin, you would be able to trade $200, because every dollar would represent just 10% of the total trade, amounting to $10 with the leverage.

If the leverage were 20:1, or 5% margin, you would be able to trade $400 on your $20 investment. Each asset has a different leverage ratio, or margin percentage.

How does margin trading work?

Margin traders use leverage, hoping that the profits will be greater than the interest payable on the borrowing. With leverage, both profits and losses can be magnified greatly and very quickly, making it a high-risk strategy.

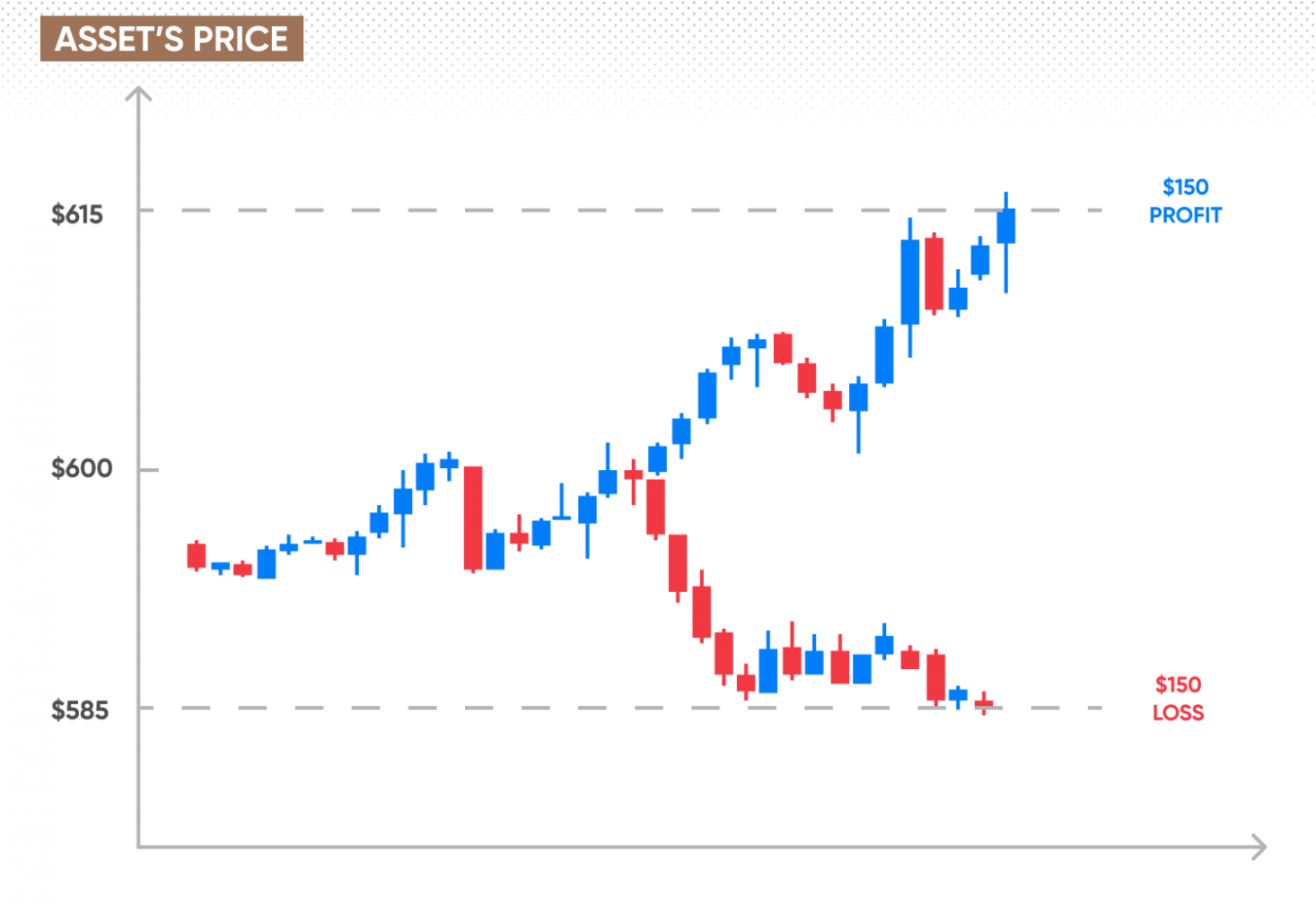

Let’s say you want to trade Tesla (TSLA) stock at $600 a share. To buy 10 shares you would need a deposit of $6,000, which you may not have. In a margin trade with 5:1 leverage you would only need $1,200 as a required margin to open a position, and the rest will be lent by your broker.

If the stock price moves to $615 you will gain $150. This is 10 shares multiplied by the difference between the new price and the $600 at which you bought the shares. The Tesla stock has moved up just 2.5% but trading on margin has boosted your return on investment (ROI) to 12.5%.

The big ‘but’ is that if the price of Tesla went down by $15 to $585 a share, you would lose $150, which would be 12.5% of your deposit, assuming you haven’t placed a stop-loss order.*

*Stop-losses may not be guaranteed.

If you have a number of trades open, or you are trading a highly volatile asset class where large price swings occur quickly, you can suddenly find yourself with several large losses added together.

Minimum equity requirement

The money required to open a trade is interchangeably referred to as margin, initial margin, deposit margin or required margin. At Capital.com, we call it required margin.

Your required margin depends on which assets you choose to invest in. It’s calculated as a percentage of the asset’s price, which is called the margin ratio. Every instrument has its own required margin.

If you have several positions open simultaneously, the combined total of the required margin for each trade is referred to as your used margin. Any money remaining to open new trades is your free margin.

Maintenance margin

In addition to your required margin, which is the amount of available funds you need to open a trade, you would also need money to cover for the maintenance margin in order to keep the trade open.

How much money you need in your overall margin account depends on the value of the trades you are making and whether they are currently in a profitable or loss-making position.

The money you have in your account is your funds or cash balance, while your equity is your funds including all unrealised profits and losses. Margin is your required funds that need to be covered by equity. It’s calculated based on the current closing price of open positions multiplied by the number of contracts and leverage. Your margin level is equity divided by margin.

Therefore, the amount that you need as your overall margin is constantly changing as the value of your trades rises and falls. You should always have at least 100% of your margin covered by equity.

Monitor the position of your trades all the time to ensure you have 100% margin covered. Otherwise, you’d be asked to add more funds to increase equity or close position to lower overall margin requirement.

Credit limit or maintenance margin

In addition to your required margin you would need to have a sufficient overall margin balance in your account. These are the funds in your account that are not being used to trade. They provide cover for the risk of your trade going against you.

How much money you need in your overall margin account depends on the value of the trades you are making and whether they are currently in a profitable or loss-making position.

The money you have in your account is your equity, while the money you potentially owe from loss-making positions is your margin. Your overall margin level, usually displayed as a percentage, is your equity divided by margin.

Therefore the amount that you need as your overall margin is constantly changing as the value of your trades rises and falls. You should always have at least 100% of your potential losses covered by your overall margin.

Monitor the position of your trades all the time to ensure you have 100% margin covered. Otherwise, you’d be asked to add more funds in a margin call.

Margin calls: How to avoid them?

A margin call is a warning that your trade has gone against you and you no longer have enough funds to cover losses. A margin call happens when the amount of equity you hold in your margin account becomes too low to support your borrowing.

In other words, it means that your broker is about to reach the maximum amount it can lend you, and you must add funds or close positions to stop further losses.

When you receive a margin call, you should not ignore it and do nothing. This could lead to a margin closeout, where your broker closes your trades and you risk losing everything.

You could put in risk-management tools to reduce the risk of receiving a margin call, such as using a stop order*, increasing equity by topping up the account or reducing margin requirements by closing positions. It’s always better to prepare for the worst case scenario, because markets are volatile and extremely hard to predict with any degree of accuracy.

*Not all stop-loss orders are guaranteed.

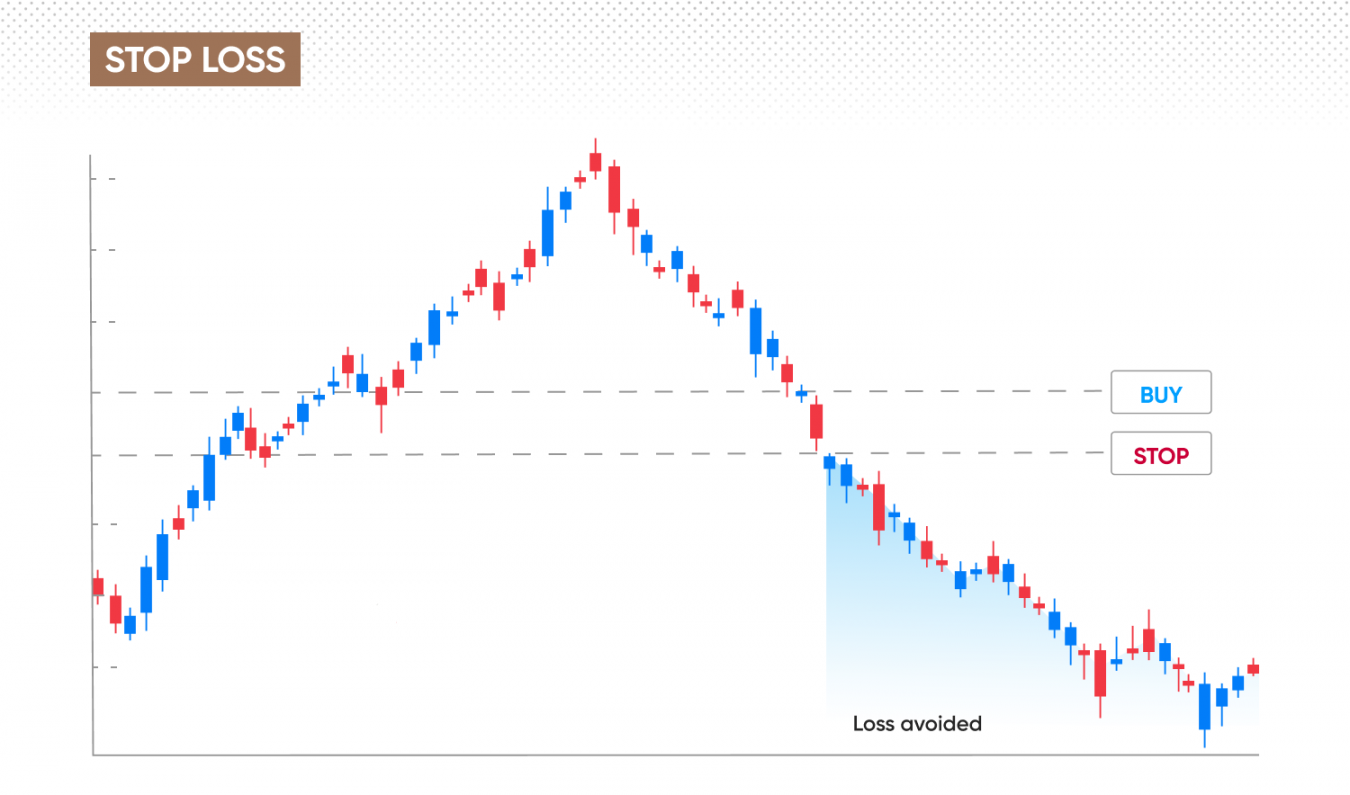

Why are stop orders important?

A stop order, or a stop-loss, is a mechanism that closes an open position when it reaches a certain price that’s been set by you. This means that when a trade goes against you, it can automatically be closed before any losses grow too large and lead to the possibility of a margin call.

A stop-loss order limits the risk. If you were to buy an asset at $100 a share CFD, a stop-loss order could automatically trigger a sell when the price falls to the limit you set, for example below $95.

If you are taking a short position, you would set the stop-loss order at a higher price, for instance at $105, in case the trade goes against you and the asset’s price starts to rise.

You should, however, note that a stop-loss order only gets triggered at the pre-set level, but is executed at the next price level available. For example, if the market is gapping, the trade gets stopped out with the position closed at a less favourable level than that pre-set. This is also known as a slippage. To avoid this, guaranteed stop-loss orders can be used.

Guaranteed stops work like basic stops, but can’t suffer slippage as they will always close the position at the pre-set price. Keep in mind that guaranteed stop-loss orders require a small premium.

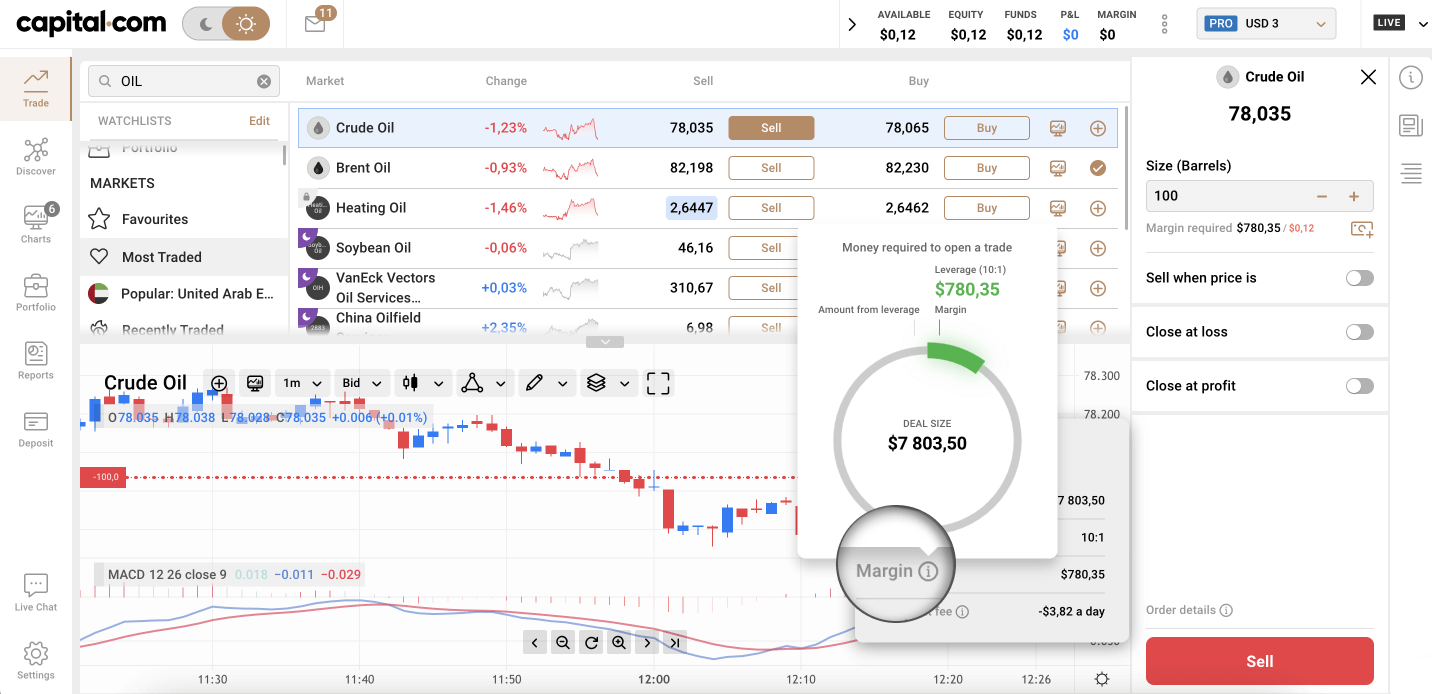

How to trade on margin?

In the world of traditional investing, buying on margin means borrowing money from a broker to purchase a stock. But you can also use margin to trade derivatives, such as contracts for difference (CFDs). CFDs enable you to trade on the price movement of stocks, commodities, forex, indices and crypto.

You can follow the following steps to trade on margin:

Step 1: Open a margin account

To trade on margin, you need to have a special type of account called a margin account.

It’s an account with your broker, who has agreed to lend you money to increase the value of your trades and apply leverage. Using margin accounts means you can increase the size of potential profits, but simultaneously increase any potential losses.

Step 2: Deposit funds in line with the broker’s requirements

At Capital.com, the minimum initial deposit is $20.

Step 3: Choose an asset you want to trade on margin

You could choose to trade 3,000+ markets with CFDs on Capital.com, including cryptocurrencies, shares, commodities, indices and forex pairs.

Step 4: Meet a maintenance requirement

At all times, you should have enough funds in your margin account to cover all your trading positions. In other words, your equity needs to always cover 100% of the margin.

Using margin for different asset classes

With Capital.com, you can use margin to trade asset classes ranging from shares to commodities and more.

Stocks and shares

If the shares you want to buy are in a big company, the broker could ask for a 50% margin. This means, for example, that you would pay $50,000 and your broker would buy you $100,000 worth of shares.

A 20% rise in the share price would get you $20,000 in profit, actually, a little less after paying the interest and transaction fees.

The problem is that if the shares fall 20%, you’ve made a $20,000 loss, plus interest on the $50,000 borrowed and the transaction fees. That’s the danger with margin – you can reap huge rewards but face equally large losses.

Contracts for difference (CFD)

Trading directly in shares on margin is for experienced investors who have been vetted by their broker and have a strong credit history. But the principle of margin trading on derivatives like CFDs also works for retail investors.

An investor who owns shares might trade CFDs as a hedge against the shares they own falling in price.

The investor could take a short position using a CFD. Short selling shares means borrowing shares you don’t own and selling them at the current price, leaving you short, in the belief that the price will fall.

You then buy what you owe once the share price has dropped and return the borrowed shares, keeping the money you’ve made.

CFDs enable an investor to short cheaply because they do not have to borrow or own the underlying asset.

How hedging with CFDs works

An investor holding 1,000 shares in company ABC, fearing the price is going to fall could make a CFD short trade in the same company.

If the price falls, the investor would lose money on the shares but recover it on the CFD trade (less any interest on the borrowed money and transaction fees).

But investors do not just hedge against share price movements. You can use margin to speculate that one currency will do well against another. You can speculate that a market index will rise or fall. You can speculate that the price of a commodity will go up or down.

Margin is not limited to a single asset class.

Margin trading for retail traders

Simplified margin trading, using automated margin trading systems online and on mobile apps, are now available to retail investors, often based on CFDs.

You might only need a small amount of money to begin trading, usually with trades closing at the end of the trading day. CFDs are considered suitable for short-term investments and day trades, due to overnight funding adjustments.

The systems are carefully regulated, often with a maximum leverage ratio set by regulators.

The best case scenario is when you use margin to benefit from the significant gains margin trading can bring, while avoiding potentially magnified losses.

You can trade cautiously, using limit orders rather than market orders, or with stop-loss orders in place to curb individual losses. You can monitor your trades and close loss-making orders quickly to avoid a margin call and margin closeout.

If a market suddenly moves against you while you have a trade open, you could potentially lose everything you have in your margin account and still owe more.

Even if your broker works hard to close out all your positions, it might not be possible to close them fast enough to stop the losses.

Some retail trading platforms, like Capital.com, offer guarantees that in the event of the broker’s close out failing to limit losses in your maintenance margin, they will write off any extra debt.

In that case, you would only lose the money you had deposited with the broker.

What is margin closeout?

Margin closeout is a safety net to protect you from spiralling losses. Margin closeout happens when your loss-making positions grow to the point where you only have enough equity to cover 50% of your losses.

If your broker offers a guarantee to limit your losses to the amount you have deposited, the margin closeout also protects the broker from further losses. If your broker doesn't offer this guarantee, you will still owe your broker money after closeout. However, it’s very important to keep in mind that the 50% closeout can never be guaranteed. The closeouts are done by closing the open positions based on the current market prices and liquidity. Should the market be gapping at the moment when your equity drops 50% below the required margin level, the closeout can be done at an even lower level.

Every margin trader has a margin closeout level. Understanding these levels can help to protect you from losses. Look for and monitor margin levels on your trading platform. The closeout level changes as your trades and asset prices fluctuate.

How is margin closeout calculated?

The margin closeout level is calculated using the account’s balance and unrealised profit or loss from any open positions, determined using the current midpoint rates. If your trades are in different currencies they are all converted into the currency of the account.

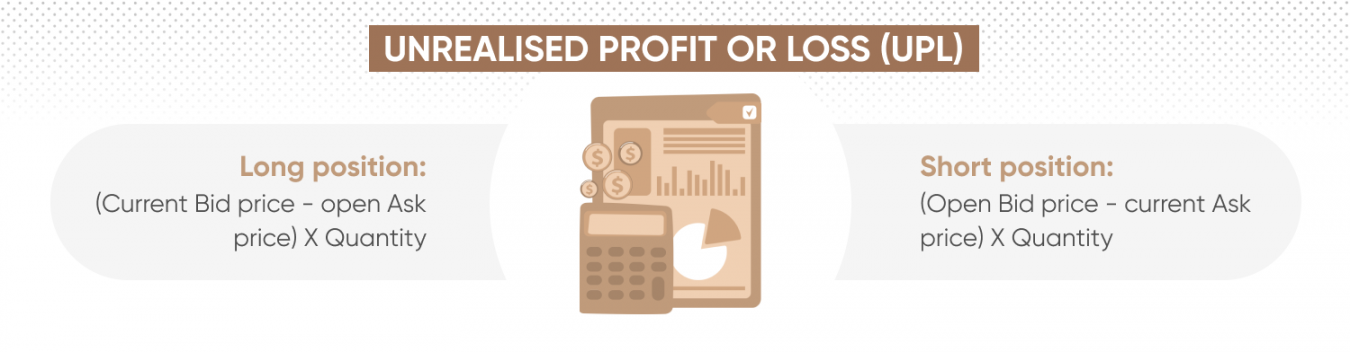

Your unrealised profit or loss (UPL) is calculated using the formula below.

Profitable and loss-making positions offset each other. But if the sum of your trades puts you in a loss-making position, that total must be higher than what is covered by the money in your account. In other words, your margin level needs to be 100% (i.e. your equity covers at least 100% of the margin required).

You can see your margin percentage in the Capital.com mobile app and on the web trading platform. When you sign up, you should commit to actively monitoring your equity and keeping it above 100%.

Margin closeout happens when you no longer have sufficient funds deposited to maintain your trading positions. At Capital.com, we close out your positions to protect you from unlimited losses, and to protect ourselves from unlimited liability.

Consider these guiding levels:

-

Good cover (more than 100%): If the margin level is more than 100% then you have sufficient cover to keep all your positions open and there is no need to add further funds.

-

Not so good (75% – 100%): When your margin level dips under 100% you will get a margin call asking you to take action, either to close positions or top up funds in your account.

-

Automatic closure and warning (50% and below): This occurs when your margin level gets near to the 50% threshold. It is the range where you can expect to be closed out.

-

Close out without warning: A sudden market movement affecting your open positions means your maintenance margin slumps to 50%. Your account is closed out without a warning because there is no time to send you one.

In volatile markets there can be sharp price movements. For that reason, you may receive multiple margin calls and margin closeout emails within a very short period.

How margin closeout works

If you fail to respond to a margin call or, despite topping up your overall margin, your positions continue to worsen and your overall margin reaches 50%, your broker will begin a closeout.

This is why it is better to be prepared for sudden market volatility. You can’t control price movements but you can add stop limits to prevent the possibility of close outs.

If a closeout happens, your broker will begin to gradually close your margin positions. The closeout will happen automatically, in the following order:

-

All pending orders are closed

-

If the margin level is still below 50%, then all losing open trades on open markets are closed*

-

If the margin level is still below 50%, then all profitable open trades on open markets are closed*

-

If the margin level is still below 50%, then all other positions are closed as soon as the respective markets open

*Note that not all markets are open at the same time. Hence, a profitable trade may be closed before a losing one.

Your broker will try to close your open position as fast as possible using whatever prices are available at that time in the market. You will miss the opportunity for your trades to bounce back. They will be closed with a loss.

How to recover from margin closeout

A margin closeout is never a pleasant experience. Remember, you are not alone. Among Capital.com trading platform’s clients, half have experienced a margin closeout at some point. This is to ensure client protection.

If you get a margin closeout, remember that it’s not the end of the world. Look back on your trading history and analyse what you can change to prevent a closeout in the future.

Maybe you didn’t use sufficient risk-management tools, or didn’t have a comprehensive trading strategy, or didn’t stick to the plan due to emotional factors? Learning from mistakes is vital and will help you to recover.

Monitoring your account and keeping an eye on any open positions is very important. Using an efficient, fast-loading app to track your trades could save you a lot of frustration. When you get a margin call, you must be able to react as fast and decide if you want to add more funds in order to keep your trades open.

Understanding what a margin closeout is and how it works is the first step to avoiding it.

Benefits and risks of margin trading

Is margin trading a good idea?

The benefits of trading on margin vs non margin trade is in leveraging your trading power. Your trading capacity is dramatically increased for comparatively little initial cost – magnifying and intensifying performance.

It goes both ways, margin supercharges both gains and losses. Margin trading gives traders greater exposure to price changes, increasing risk and potential returns.

By definition, leverage trading means small or modest market movements can result in significant profits and losses. You should keep a close eye on your account at all times. In particularly volatile markets the price can move sharply.

Margin trading best practices

When used responsibly and supported by careful research and risk-management strategies, margin trading can augment profits. But it can also cause heavy losses. In the worst scenario, margin trading can wipe out funds in your trading account.

-

Monitor your open positions at all times

You need to keep an eye on trades and close them if they move against you or put in place automatic stop orders to end positions early.

-

Keep your maintenance margin at 100% or more

Bear in mind that many traders start out with too little in their margin accounts, which can, in some circumstances, exaggerate their losses. Holding the bare minimum in your account increases the chances of a margin call. Hold a little bit more in reserve so your account can sustain small market swings.

You do not want to be in a position where your broker has to sell your holdings quickly at a highly disadvantaged price with no chance for the price to recover. No one wants to see their positions closed automatically, and therefore you should ensure your account is sufficiently funded.

-

Have a trading strategy in place

Having a well-researched and crafted trading strategy can help to minimise emotion from your trading decisions. Always conduct due diligence before trading, looking at technical and fundamental analysis, latest news and analysts’ commentary.

-

Use stop-loss orders

Using stop-losses automates your trading and reduces the emotional factor from your decision making. Stop orders can limit losses in the time of a market sell-off and protect you from a margin call or a margin closeout.

Start your margin trading journey with Capital.com

Trading on margin allows you to leverage gains when the price of an asset moves the way you hoped – or lose more than your initial deposit if a trade goes against you. Capital.com offers negative balance protection to protect you from this.

With CFD trading you can go long (buy), if you think the price will rise, or short (sell), if you believe it will fall.

Learn more about how CFD trading works and consider what assets you’d like to trade. Choose from a wide range of stocks, indices, commodities and forex pairs available for margin trading.

If you’re new to margin trading, at Capital.com you can start with a demo account to practice without risking your funds. Once you feel confident enough, open a live trading account and put your first margin position.

If you’re already trading on margin, don’t forget to use risk-management tools to protect your account from margin calls and margin closeouts.

FAQs

What is margin trading?

Margin trading means you trade with borrowed money using leverage. You can start a position with just a fraction of the trade’s value, while the rest is lent out by your broker. Note that leverage could magnify both your profits and your losses.

What is the difference between margin and leverage?

Margin is money you need to open a position. Leverage is the multiple of the account’s equity exposure to a trade. For example, using 2:1 leverage you pay only half the asset’s value and you borrow the other half from your broker. Margin and leverage are connected, which is reflected in the leverage ratio, or a percentage of margin.

What is the margin in trading with example?

Margin is the amount of money required to open a position. For example, Capital.com offers a 10% margin on silver CFDs. If you want to place a trade for $1,000 of silver CFDs, you will need only $100 to open the trade.

Is margin trading a good idea?

Margin trading has its benefits and risks. It allows you to open larger positions and trade assets you otherwise could not afford. It also increases the risk of making higher losses. Whether margin trading is a suitable option for you will depend on your risk tolerance and trading goals.

Can margin trading make you rich?

Margin trading can potentially bring you more money with lower initial investment, if an asset’s price goes in line with your position. However, markets are volatile, and if it goes in the opposite direction, you can suffer bigger losses.

What is a margin call?

Margin call is a warning from a broker, which occurs when the value of your margin account falls below the maintenance margin requirement.