Ghana cedi forecast: GHS is the world’s weakest currency as globe’s 2nd largest cocoa producer seeks IMF help

Is a rebound in store for the Ghanian cedi or will it keep falling?

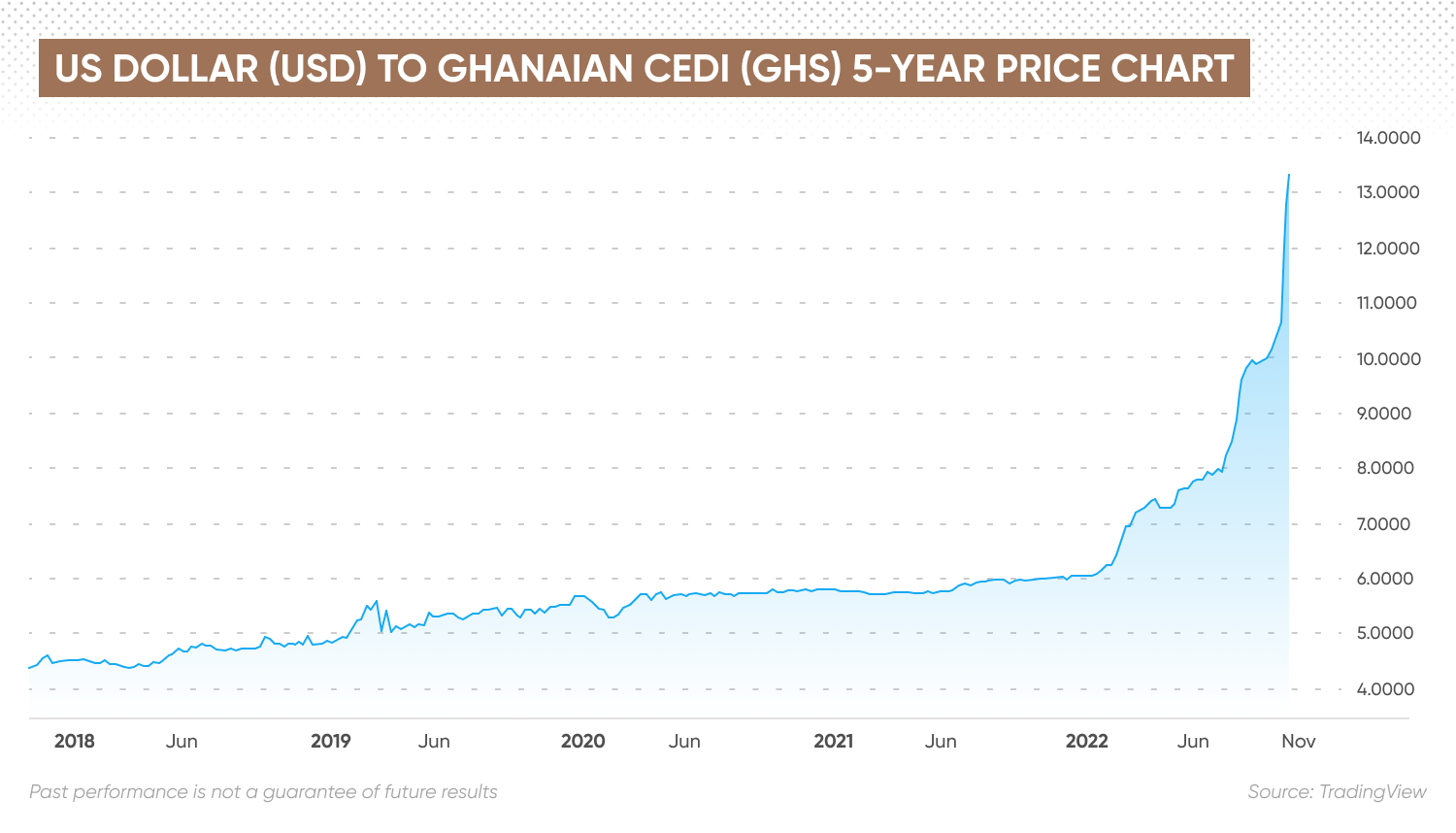

The value of the Ghanaian cedi (GHS) has fallen 56% this year against the US dollar (USD) to become the world’s worst performing currency. Over 25% of that loss has come in October alone as the decline in the cedi has accelerated at its sharpest rate since it was re-denominated 15 years ago.

The Ghanaian government has been forced to seek assistance from the International Monetary Fund (IMF) as it faces soaring inflation, high debt, rapidly rising interest rates abroad and falling prices for cocoa – one of its major exports. Rising fuel prices sparked protests on 19 October, led by the Ghana Union of Traders Association (GUTA).

What is the outlook for the currency of the world’s second largest cocoa producer? We look at the drivers for the cedi’s value and forecasts for its future performance.

What drives the value of the Ghanaian cedi?

The Ghanaian cedi is the official currency of the Republic of Ghana. The cedi was introduced after the country left the British pound (GBP) system in 1965.

The new cedi was introduced after a coup in 1967 and re-denominated in 2007 after decades of high inflation had devalued the currency. The Ghana cedi was introduced at a rate of 1:10,000, becoming the highest-denominated currency in Africa. Over the past 15 years it has lost more than 90% of its value.

Like other emerging market currencies, the cedi’s value is driven by the country’s trade balance, foreign currency reserves, gross domestic product (GDP) growth and monetary policy, as well as foreign investment flows and commodity prices. In addition to being the world’s second largest cocoa producer, Ghana also exports crude oil and gold.

Cedi plunges on economic pressures

In 2020, the cedi was the best performing currency against the dollar at the start of the year, gaining 7.3% by mid-February. This followed a 13% decline in 2019. The cedi retreated slightly from the gains in March 2020, remained relatively stable between 5.00 to 6.00 to the dollar until this year’s underperformance.

The USD/GHS exchange rate started 2022 at 6.15 and moved above 7.00 in March, following the Russian invasion of Ukraine and as the US Federal Reserve (Fed) began raising interest rates. Emerging markets have seen a jump in capital outflows since the start of the war in Ukraine as investors have become more risk averse and sought safe haven in assets such as the USD.

The USD/GHS pair moved above 8.00 in July. In August 2022, global ratings agencies S&P Global and Fitch Ratings downgraded their outlook for the Ghanaian economy, which further weighed on investor sentiment and exerted additional downward pressure on the exchange rate.

USD/GHS reached 10.00 at the end of August and 10.41 at the end of September.

The Bank of Ghana, the country’s central bank, noted in its latest monetary policy committee (MPC) statement on 6 October that up to September, the cedi had declined 37.5% against the dollar in 2022, 24.1% against the British pound sterling and 27.5% against the euro.

The MPC raised interest rates by 250 basis points (bps) to a record high of 24.5% in an attempt to tackle soaring inflation. Ghana’s inflation rate accelerated to 33.9% in August, up from 31.7% in July and 29.8% in June.

The country’s trade surplus at the end of August was $1.7bn, up from $892.4m in August 2021. Total exports increased by 19.5% year-on-year (YOY) to $11.8bn. The value of crude oil exports climbed by 56.5% to $3.8bn on higher prices and gold exports rose by 23.9% to $4.2bn on higher production in response to a tax cut. However, lower sales and prices reduced cocoa exports by 22.8% to $1.7bn. And oil and gas imports almost doubled to $3.1bn from $1.7bn a year earlier.

However, the value of the cedi has continued to fall, shedding over 9.9% on 21 October, its sharpest decline in 22 years, to trade at 13.13 to the dollar at the time of writing (26 October). That was up from 10.95 on 17 October. USD/GHS reached a new high above 14.01 on 25 October.

Inflation climbed further in September, reaching 37.2%. The Ministry of Finance said in late September that it had started discussions with the IMF for a financing programme, which would “require a comprehensive Debt Sustainability Analysis (DSA)”. This has raised concerns among investors that the government will need to restructure its debt to qualify for assistance of up to $3bn and created additional uncertainty for domestic bondholders.

The Ministry of Finance issued an update on 21 October stating: “A clear path towards the final details of a Programme has been agreed upon by both parties, with the goal of reaching a Staff-Level Agreement by the end of the year.”

What is the Ghana cedi forecast outlook for the rest of 2022 and beyond? We round up some predictions from analysts and forecasters below.

Ghana cedi forecast: Will it remain the world’s worst performer?

Back in August, analysts at Fitch Solutions were positive in their GHS forecast, suggesting the Bank of Ghana could raise interest rates by to 27% by the end of 2023, lifting real interest rates into positive territory, having been negative since March this year. Fitch noted:

USD/GHS forecast

As of 26 October, the Ghana cedi forecast from TradingEconomics projected it could strengthen to 13.69653 against the US dollar by the end of the year, but then weaken to a fresh low of 15.12885 in one year, based on global macro model projections and analysts’ expectations.

The US dollar to Ghana cedi forecast for 2022 from algorithm-based forecaster Wallet Investor also predicted that the rate could pull back to 13.235 by the end of the year. But the dollar could then resume its rise against the cedi, with the Ghana cedi forecast for 2025 reaching 15.363, from 13.914 at the end of 2023 and 14.638 at the end of 2024.

The USD/GHS forecast from Gov Capital projected that the pair could trade at 13.928 at the end of 2022 but then rise to 19.315 at the end of 2023, based on its deep learning technical analysis.

EUR/GHS forecast

The cedi could also lose further value against the euro over the long term, according forecasts.

The euro to Ghana cedi forecast from Trading Economics showed that the exchange rate could end the quarter and the year at 13.30396, from 13.51 on 25 October, then rise to a fresh high of 14.05690 in one year.

Wallet Investor’s EUR/GHS forecast estimated the pair could end 2022 at 13.265, then move up to 14.114 at the end of 2023 and 15.909 at the end of 2025.

Gov Capital’s GHS prediction showed the EUR/GHS pair trading up from 14.061 at the end of this year and climb to 20.028 by the end of 2023.

Given the volatility of foreign exchange markets, analysts and forecasters have yet to issue a Ghana cedi forecast for 2030.

If you are looking for a Ghana cedi forecast to inform your foreign exchange trading, it’s important to remember that currency markets are highly volatile, making it difficult for analysts and algorithm-based forecasters to come up with accurate long-term predictions.

We recommend that you always do your own research. Look at the latest market trends, news, technical and fundamental analysis, and expert opinion before making any investment decision. Keep in mind that past performance is no guarantee of future returns. And never invest money you cannot afford to lose.

FAQs

Will the Ghana cedi get stronger in 2022?

No one can say for sure. The direction of the GHS could depend on any deal the Ghanaian government reaches with the IMF, as well as commodity prices, the Bank of Ghana’s monetary policy and the continued influence of US interest rates.

Will the Ghana cedi rise?

Whether the cedi rises from its record low could depend on the macroeconomic and geopolitical factors that have weighed on the currency in 2022.

Is it a good time to buy Ghana cedi?

You should do your own research to determine whether the GHS is a suitable investment for your portfolio based on your risk tolerance and how much you intend to invest. Remember to never invest or trade with more money than you can afford to lose.