Faraday Future stock forecast: FFIE shares hit by production funding shortfall but can EV maker get back on track?

What is a realistic Faraday Future stock forecast? We look at the potential for the EV firm’s share price.

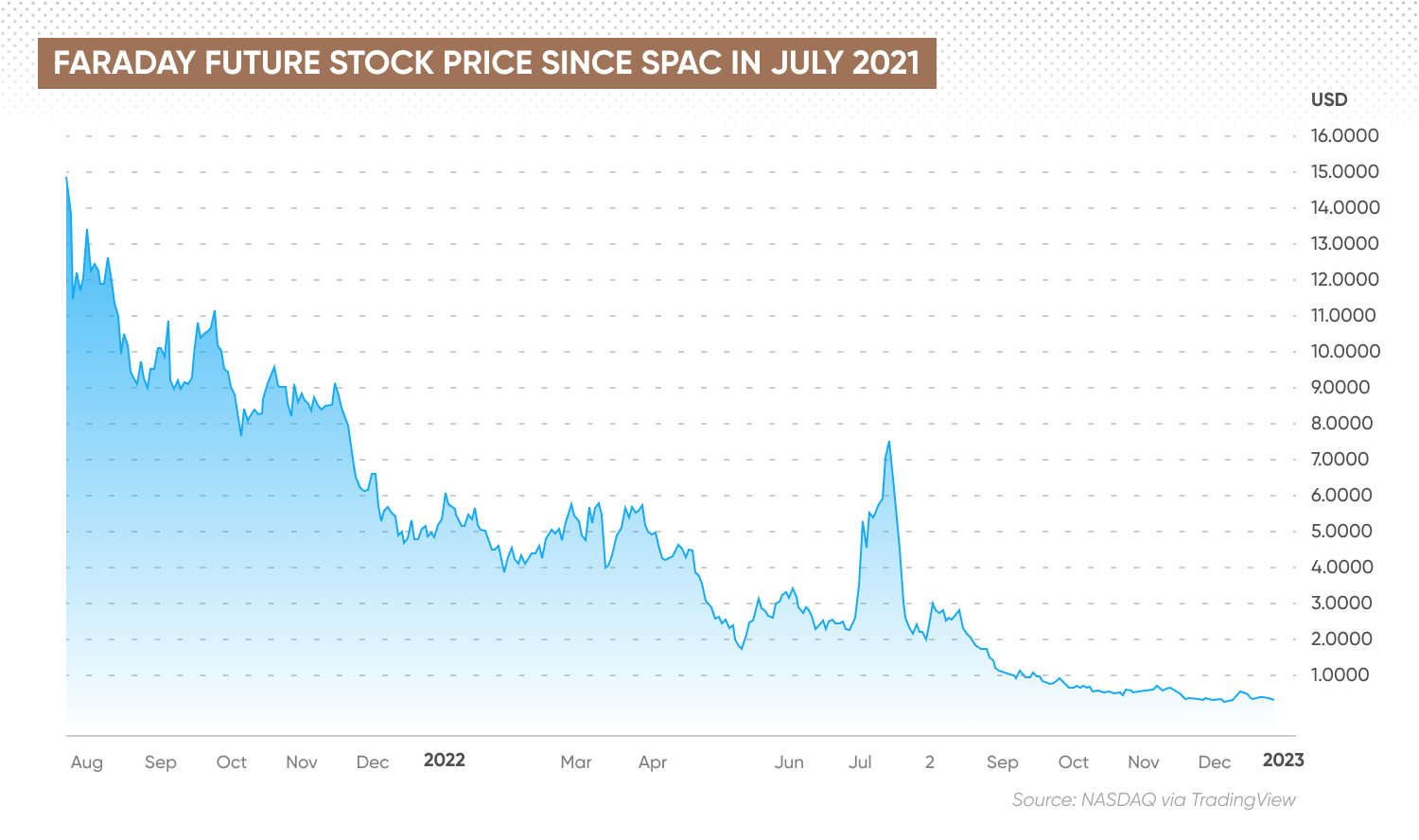

The share price for US-China electric vehicle (EV) developer Faraday Future Intelligent Electric (FFIE) has fallen 95% year to date, as of 28 December. The company has struggled to secure sufficient funding to start production and reshuffled its management team.

Faraday Future Intelligent Electric (FFIE) live stock price

Faraday Future’s shareholders voted in November to approve a reverse stock split, which would reduce the company’s share count and increase the price so that it remains compliant with the Nasdaq’s listing rule that a stock price should remain above $1 a share. The FFIE share price has been trading below $1 since September.

What is the outlook for the company, and will the FFIE stock price rebound or continue to shed value? We look at the company’s performance and analysts’ views on a Faraday Future stock forecast.

Faraday Future aims to integrate EVs with AI

Founded in May 2014, Faraday Future is headquartered in California. It has offices in Beijing, Shanghai, and Chengdu in China. The company is developing products and service offerings that integrate electric vehicles, AI, Internet and sharing models.

Its flagship vehicle model is the FF 91, which is autonomous-ready and Internet connected. The first FF 91 pre-production model was manufactured in August 2018.

Faraday Future plans to manufacture vehicles at its plant in California, and has a contract manufacturing partner in South Korea to meet its additional needs for future production capacity for its FF 81 model. The company has additional engineering, sales, and operational facilities in China, where it plans to develop manufacturing capability through a joint venture arrangement.

The company was listed on the Nasdaq Stock Exchange on 22 July 2021 via a merger with special purpose acquisition company (SPAC) Property Solutions Acquisition Corp. (PSAC). The listing raised $1bn, which was intended to finance the production of the FF 91 and FF 81 models.

Faraday Future raised $7bn from seven funding rounds before going public. It has struggled to bring its EVs to mass production. The company’s co-founder, Jia Yueting, was removed from his role as chief executive officer in September 2019. He was replaced by former BMW (BMW) executive Carsten Breitfeld.

Jia filed for personal bankruptcy to settle $3.6bn in China and placed nearly all of his controlling stake in the company into a trust, reducing his control of the company.

In April 2022, Faraday Future announced in a filing with the US Securities and Exchange Commission (SEC) that, on the recommendation of a special committee of independent directors following an “independent investigation into allegations of inaccurate Company disclosures”, the board had approved remedial actions, including removing Jia as an executive officer, although he would continue in his position as Chief Product & User Ecosystem Officer.

FFIE share price plunges amid challenges

The FFIE stock price closed its first day of trading at $13.98 a share, and has been in decline ever since. The share price ended 2021 at $5.32 and has fallen further in 2022. The stock jumped from $2.48 on 24 June to $7.52 on 15 July, as the FF 91 had been expected to enter production in July. The share price dropped back to $2.21 on 29 July after the company delayed production again.

The share price moved up to $2.72 on 5 August, but fell again, even after the company announced on 15 August an additional $52m in committed funding with a framework facility for up to $600m. The investors received warrants with an exercise price of $5 a share.

What’s driving the FFIE share price?

On 29 August, the company announced that it expected to receive equipment to complete its factory installation by the end of the year, and that “challenges with supply chain issues” had affected its FF 91 production timeline.

The share price subsequently fell further, dropping below the $1 mark to $0.97 on 16 September.

In late September, the firm reported an additional $100m in financing and stated that it was in “ongoing discussions with potential financing sources for additional capital required to fund operations through the end of 2022 and beyond. As part of ongoing efforts to conserve cash and reduce expenses, the Company recently implemented headcount reductions and other expense reduction and payment delay measures.”

Faraday Future also resolved a governance dispute with FF Top, its largest shareholder, with two board members stepping down.

In October, Faraday Future announced a management transition, including the replacement of its chief financial officer. On 14 November, the company said it had received an equity line of credit for an initial commitment of $200m, which can be increased up to $350m.

In late November the board removed Breitfeld as Global CEO and appointed former Ford and Jaguar Land Rover executive Chen Xuefeng, “following a comprehensive evaluation of the Company’s performance since it went public in July 2021.”

The stock traded down to an all-time low of $0.24 on 7 December, spiked to $0.53 on 13 December before falling back to $0.32 on 27 December.

The firm announced several management changes on 13 December, with executive and board member Matthias Aydt appointed Global Senior Vice President, Product Execution, replacing Bob Kruse who had recently left the company. Xiaoyang Ningtaking took on business development responsibilities previously held by Aydt, and Ma Xiao became acting head of Production Definition and Eco Mobile Systems.

According to an update on 15 December, Faraday Future has delayed the anticipated start of FF 91 production to the end of March 2023, with “deliveries to users anticipated to begin April 2023, subject to timely receipt of additional financing and stockholder approval.”

The company is “engaged in discussions with both potential new investors and existing FF investors to provide the estimated $150-170M of additional capital needed to produce the FF 91.” The company has received a draft $30m binding letter of intent from a current investor, and it expects other investors to provide capital to support production.

“No assurance can be provided that the Company’s ongoing financing discussions with existing and potential new FF investors will result in binding commitments in a timely manner or at all,” the company stated. “The Company’s plans with respect to additional funding assume stockholder approval of an authorised share increase by the end of January 2023.”

Latest earnings report

In reporting its third quarter results on 17 November, Faraday Future had said that it had just 369 preorders for the FF 91, down from 399 at the end of the second quarter, and an accumulated deficit of approximately $3.3bn as of 30 September.

The company reported an operating loss of $81m for the quarter, down from $186m in the third quarter of 2021. Net loss was $103m, down from $304m a year earlier.

Spending during the quarter was focused on completing the California manufacturing plant. The company stated:

In an SEC filing alongside its quarterly report, the company stated that “there is substantial doubt about its ability to continue as a going concern for a period of one year… The timing of first deliveries of FF 91 vehicles is uncertain and is not expected to occur in 2022 and remains subject to various conditions, many of which are outside of FF’s control, including the timing, size, and availability of additional financing as well as the implementation and effectiveness of FF’s headcount reductions and other expense reduction and payment delay measures.”

The company added that it is also dependent on suppliers meeting their commitments on delivering parts. Faraday Future had just $31,766 of cash on hand as of 30 September.

Faraday Future stock forecast for 2023 and beyond

What do the latest Faraday Future stock predictions indicate about the outlook for the share price?

According to data compiled by MarketBeat as of 28 December, few Wall Street analysts have issued a 12-month Faraday Future share price forecast. Analysts at Wedbush Securities downgraded the stock from buy to hold on 16 August, but without setting a price target.

Algorithm-based forecasters were bearish on the outlook for the stock at the time of writing (28 December), with the Faraday Future stock forecast for 2023 from Wallet Investor and the Faraday Future stock forecast from Gov Capital projecting that the share price could drop to zero in January. That would indicate a Faraday Future stock forecast for 2025 of zero, with the company possibly unable to operate as a going concern.

The Faraday Future stock forecast from Stock Invest showed that the share price “lies in the middle of a very wide and falling trend in the short term and further fall within the trend is signalled. Given the current short-term trend, the stock is expected to fall -43.20% during the next 3 months and, with a 90% probability hold a price between $0.0984 and $0.272 at the end of this 3-month period.”

If you are looking for a FFIE stock forecast to decide whether to trade the stock, you should proceed with caution, given the concerns about the company’s operations. Remember, that analysts and algorithm-based forecasts can be wrong.

As with any investment, we recommend that you always do your own research. Look at the latest market trends, news, technical and fundamental analysis, and expert opinion before trading. Keep in mind that past performance is no guarantee of future returns. And never invest money you cannot afford to lose.

FAQs

Is Faraday Future a good stock to buy?

There are concerns about Faraday Future and whether it will be able to bring its electric vehicle to production. We recommend that you do your own research into the company before making a trade or investment.

As with any investment, we recommend that you always do your own research. Look at the latest market trends, news, technical and fundamental analysis, and expert opinion before trading. Keep in mind that past performance is no guarantee of future returns. And never invest money you cannot afford to lose.

Will Faraday Future stock go up or down?

A FFIE stock forecast could depend on whether the company can receive sufficient funding and bring its electric vehicle into production. Remember, all trading contains risk.

Should I invest in Faraday Future stock?

Whether you should invest in FFIE is a personal decision you should make depending on your risk tolerance and investing strategy. You should do your own research to take an informed view of the stock. And never invest money you cannot afford to lose.