What is equity?

In finance, the equity definition is the amount of money the owner of an asset would have after it was sold and any debts associated with it were paid off.

Highlights

-

Equity is the difference between assets and liabilities.

-

The term is used in business, property and branding.

-

Stocks and shares are a form of equity, representing shareholders stake in the company.

-

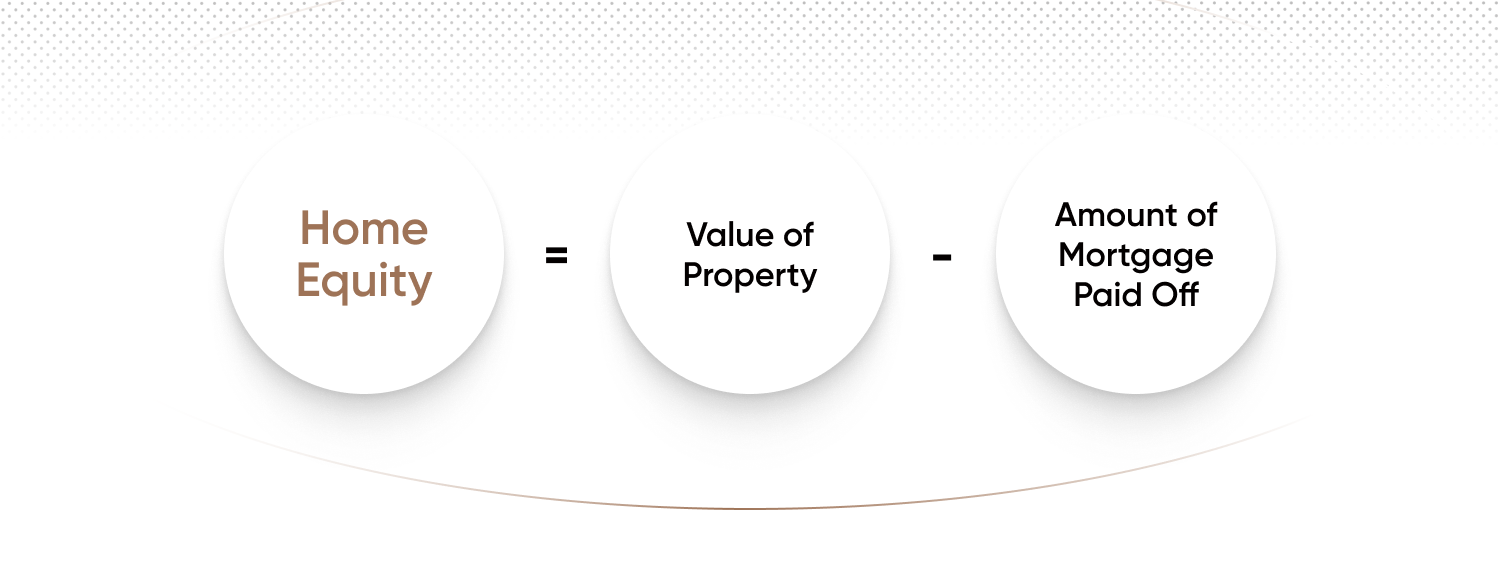

Home equity is the value of a property minus the mortgage.

What is equity?

Equity is the difference between assets and liability. It exists in all parts of the financial realm. For instance, shareholder equity is equity in a company; home equity involves the property market, and brand equity is all about the reputation.

Equity can be used by investors to work out whether something is worth investing in. It can also be used by borrowers to get cheaper and larger loans, and by lenders to decide who can afford to take out a loan.

What is equity used for?

In the world of business, shareholder equity is used as capital, allowing a company to make purchases, pay staff and carry out investments. While a company can raise funds by taking on debt, in other words taking out a loan to fund things, it can also use equity, often in the form of selling shares in the business, to generate some money. Investors will often be attracted to shareholder equity in the form of stocks and shares as it can help generate returns in the form of dividends if the company is doing well and, in some cases, give shareholders a say in how the company is run.

In the case of shares, equity can be used to represent how much is invested in a business, with individual investors represented by the percentage of shares that they hold. Equity can be viewed in either positive or negative terms. If it is positive, then the company has more assets than liabilities; if it is negative then it has more liabilities than assets. Negative equity is something that could lead an investor to decide that a business is not worth putting money in, as it could be seen as a far too risky investment.

Equity can also be used by potential investors to work out whether or not a share price is expensive or a relative bargain.

However, the state of a company’s equity is not the only thing that an investor should assess before deciding whether or not to invest. They may want to take a more holistic view, examining such things as the state of the market and the latest news about the business, conducting fundamental and technical analysis before coming to a conclusion.

Types of equity

There are a few different types of equity. Let’s have a look at some of them.

Shareholder equity. Shareholder equity can be used to give an indicator of a company’s financial health. For instance, if a company had £1m assets and £500,000 liabilities, its shareholder equity would be £500,000. However, if the company had £500,000 worth of assets and £1m worth of liabilities, then it would have a negative shareholder equity, which would mean that the company was in a pretty poor financial shape.

Home equity. Home equity is the difference between the value of a property and the amount of mortgage that is paid off. Home equity can be a significant source of collateral for a homeowner, potentially allowing them to gain access to larger and cheaper loans than might otherwise be the case. They can also gain access to a home equity loan, also known as a second mortgage, based on their property’s equity, meaning that it has several uses. In this case, if a property is worth £200,000, and the homeowner has £100,000 left to pay on their mortgage, then they will have home equity worth £100,000.

Brand equity. Equity can also be referred to in a more intangible sense when talking about a company’s brand reputation. Equity in this example is often referred to as brand equity – for example, a supermarket may stock both tins of Heinz beans costing 80p and their own brand of beans costing 40p. In this example, Heinz would have a brand equity of 40p.

Though uncommon, brand equity can also be negative – an example of this would be a customer opting for a generic store product over a big-name brand as a result of bad publicity surrounding the brand. A specific example of this would be a customer deliberately snubbing a clothing label that is known to use real fur in their designs, preferring instead to buy from another brand that they know uses ethical production techniques.

Margin equity. Equity can come into play when it comes to margin trading, or using leverage, basically borrowing money in order to invest or trade with it. If someone trades on margin, then their equity is the value of the securities in the trader’s margin account minus what has been borrowed from their broker. In this case, if a trader has £100,000 in their margin account but has borrowed £50,000 to use as leverage, then their margin equity will be £50,000.

Formula and calculation

If you want to find out what a company’s equity is, you will need to do the following:

-

Get the company’s balance sheet

-

Find the business’s total assets

-

Find its liabilities

-

Subtract the liabilities from the assets

-

Remember that liabilities plus equity should always equal assets

Therefore the formula is as follows:

Shareholder’s Equity = Total Assets − Total Liabilities

In terms of home equity, the formula is as follows:

Equity example

Let’s look at an example of home equity. Imagine a homeowner has a property estimated to be worth £100,000 and an outstanding mortgage of £40,000. In this scenario, the amount of equity they hold is £60,000 (£100,000 current market value less £40,000 debt obligations) or 60% (£60,000/£100,000).

These figures would change slightly if the homeowner was to take out an equity loan.

Conclusion

Equity, the difference between assets and liabilities, is an important concept in the world of finance. It could be one of the factors to consider when deciding whether or not it might be worth investing in a company; could help people get larger and cheaper loans; give lenders an idea who can take out loans safely, and could show brands how much their reputation is worth.

However, the concept of equity is just one of the many assessments investors and traders have to make. Regardless of something’s equity status, they will still need to do their own research.

FAQs

What is equity in simple terms?

Equity is the total of assets minus liabilities. It can exist in a positive form, where the amount of assets is greater than the liabilities, or in a negative form, when the number of liabilities is larger than assets.

What are the types of equity?

In the world of finance, the types of equity include shareholder, home and brand equity.

Is equity an asset or income?

Equity is neither an asset nor is it income. However, equity is made up of assets, with the sum of liability subtracted from their overall value.