South African rand forecast: ZAR faces global headwinds amid lacklustre local growth

We look at the South African rand forecast outlook.

The South African rand (ZAR) was among the worst-performing emerging-market currencies in October, falling to its lowest level against the US dollar (USD) since May 2020. The ZAR lost 1.5% against the dollar.

The rand failed to benefit from a broader pullback in the value of the dollar in October on speculation that the US Federal Reserve (Fed) could slow the pace of its interest rate hikes in its December meeting. The rand also weakened against other currencies such as the euro (EUR) and British pound (GBP), indicating that factors beyond the strength of the greenback are weighing on the currency.

Why is the rand under pressure and what is a realistic ZAR forecast heading towards the end of the year?

Key South African rand drivers

The South African rand is the official currency of the Southern African Common Monetary Area, issued by the South African Reserve Bank (SARB). The rand is used in South Africa and in Namibia, Lesotho and Eswatini alongside their local currencies, which are pegged to the rand. The rand was introduced in 1961, ahead of South Africa becoming a republic.

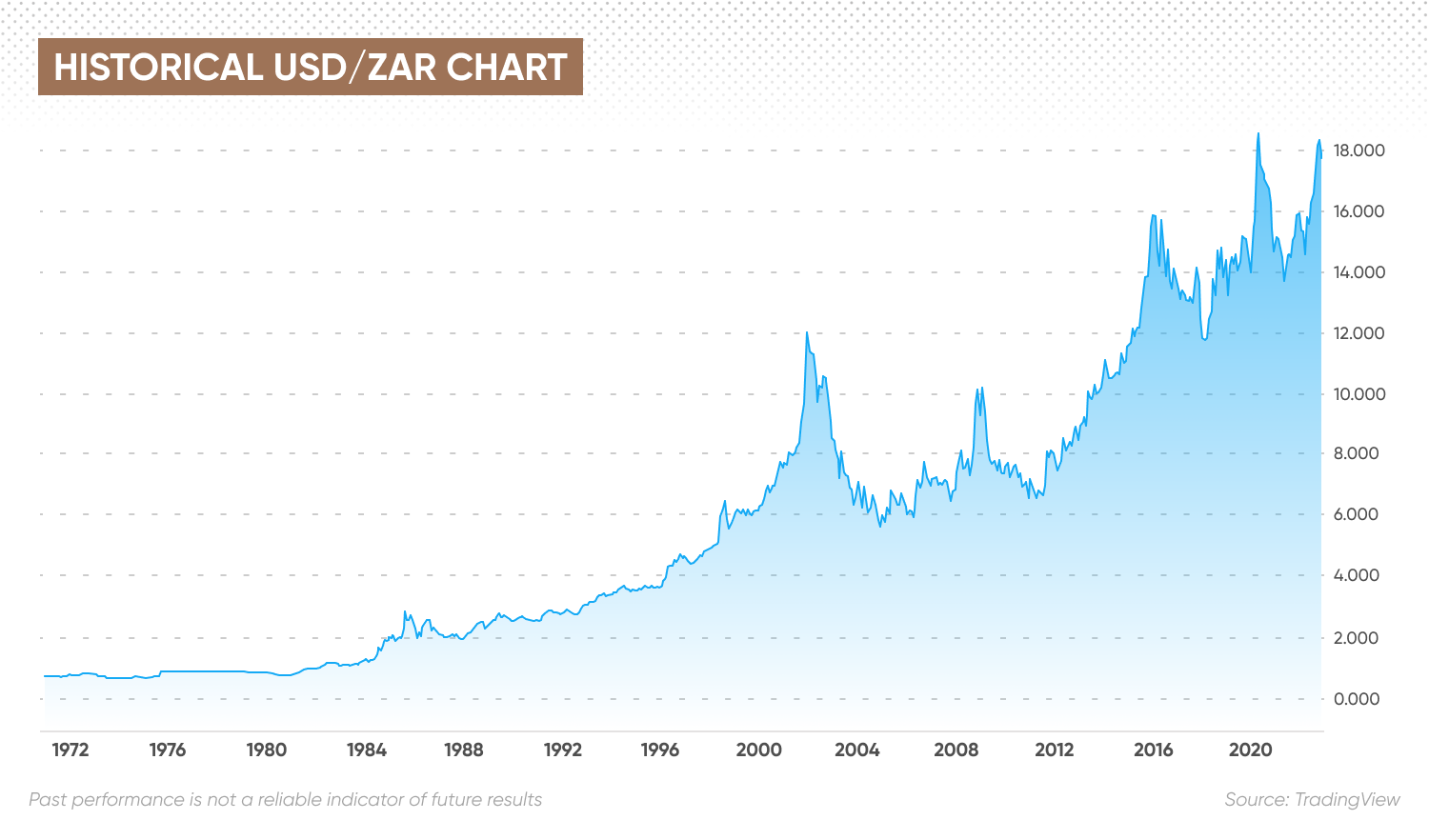

The rand was valued at $1.40 from 1961 until 1971, and then began to fluctuate, with the US dollar becoming stronger than the rand in March 1982. The rand declined from the 1980s as high inflation and international sanctions eroded its value. Political uncertainty, a widening trade deficit and an electricity crisis have driven the rand lower over the recent years.

The rand reached a record low against the US dollar in 2020, with the USD/ZAR exchange rate climbing to a record high of 19.05 in April of that year on concerns about the impact of the Covid-29 pandemic on the country’s economy, particularly its mining industry.

Mining accounts for around 5% of South Africa’s gross domestic product (GDP). The country has the world’s largest reserves of platinum group metals (PGMs) as well as manganese, chromite and gold. It also exports various industrial metals and coal. As a result, global commodity prices and demand have an influence on the value of the rand.

Inflation and interest rates in South Africa and internationally, as well as investor interest in emerging markets, are also important drivers.

Rand remains under pressure from deficits

The rand started 2022 at 15.40 against the US dollar, and strengthened to 14.61 at the start of March. But the gains were short-lived, and the rand began to trend lower, reaching 15.81 on 1 April. It climbed above 16.00 in May. The USD/ZAR pair passed the 17.00 mark in July and reached 18.40 on 24 October, its highest level since April 2020. The pair has pulled back slightly, trading around 17.73 on 7 November.

The SARB last raised its key interest rate, the repurchase rate, by 75 basis points to 6.25% on 22 September, returning it to a pre-Covid-19 level. That followed a 75-basis point rise to 5.5% on 21 July, a 50-point rise on 19 May and a 25-point rise on 24 March. The central bank’s monetary policy committee (MPC) meets every two months and is expected to raise rates further at its November meeting.

South Africa’s headline annual consumer price index (CPI) increase was 7.5% in September, down from 7.6% in August and 7.8% in July, according to data from Statistics South Africa. The SARB’s inflation target is 3-6%, and it expects CPI to return to that range in 2024.

Economists had expected September CPI to remain at 7.6% and had predicted a 50-basis point interest rate rise in November, but forward agreements are pricing in another 75-point rise later this month, according to Bloomberg.

Canadian bank CIBC wrote:

What does that mean for the value of the rand against other currencies?

South African rand forecast: Will the rand remain under pressure or rebound?

USD/ZAR forecast

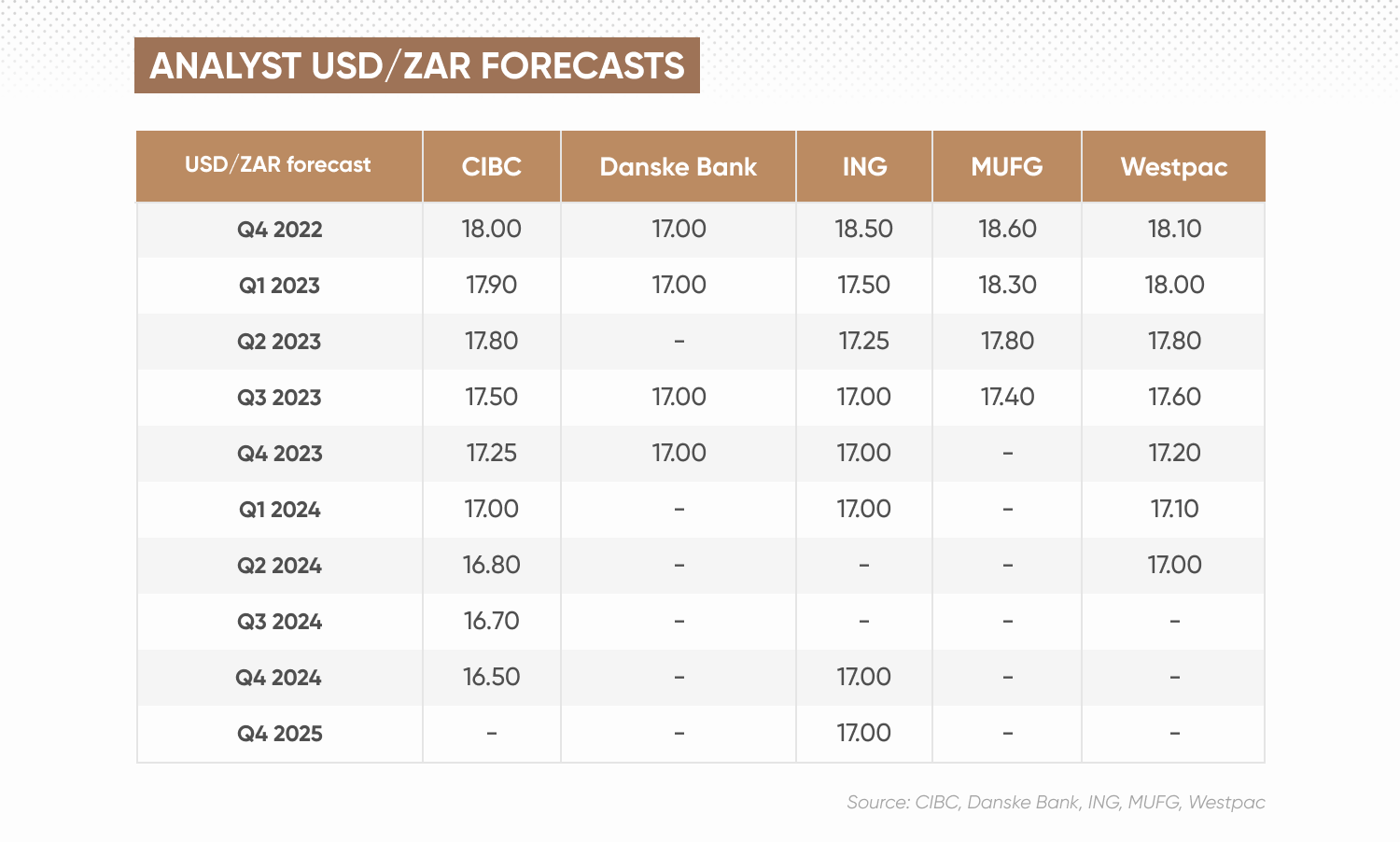

In their latest South African rand forecast, CIBC’s analysts were cautious, expecting the currency to move back to 18 against the US dollar by the end of 2022, noting:

“The presumption of significant additional tightening continues to weigh on growth assumptions and drag on broad investor sentiment. A prolonged period of above average inflation and slow growth, additionally the current account is expected to slip back into deficit territory into 2023, underlines why speculative ZAR holdings have fallen back to levels last seen in March while international investors have been net sellers of foreign bonds over the last month.

Over the longer term, CIBC’s USD/ZAR forecast shows the USD/ZAR pair falling to 17.25 by the end of 2023 and 16.50 by the end of 2024.

The latest ZAR forecast from Japanese bank MUFG was bearish on the short-term outlook for the rand, predicting that the USD/ZAR rate could rise to 18.60 by the end of the year. The pair could then trend lower in 2023 to 17.40.

“The rand’s failure to even stage a relief rebound highlights that the bearish trend remains firmly in place. Heightened fears over a hard landing for the global economy have been weighing more heavily on commodity prices in recent months resulting in the CRB raw industrials price index extending its decline to almost 20% from the April peak. Lower commodity prices have triggered a deterioration in South Africa’s terms of trade that is consistent with a weaker rand,” according to MUFG’s monthly report.

French investment bank BNP Paribas was positive in its 12-month ZAR prediction, expecting it to trade at 16 against the dollar from 18.00 in three months’ time.

Over the long term, according to the South African rand forecast for 2030 from AI Pickup, the USD/ZAR pair could retreat to 16.28 by the end of the decade.

EUR/ZAR forecast

At the time of writing (8 November), analysts saw the potential for the rand to strengthen against the euro over the long term, following potential short-term weakness.

MUFG’s South African rand forecast for 2023 showed the EUR/ZAR pair rising to 18.12 in the first quarter, from 17.67 at the end of 2022, but then retreating to 17.75 by the third quarter.

The EUR/ZAR forecast from Denmark’s Danske Bank indicated that the pair could decline from the current spot rate around 17.77 to 16.50 in one month, 16.30 in three months, 16.20 in six months and 15.80 in 12 months.

GBP/ZAR forecast

Similarly, Danske’s GBP/ZAR forecast estimated that the rand could gradually strengthen over the next year, with the pair falling from 20.45 at the time of writing (8 November) to 18.74 in one month, 18.34 in three months, 18.56 in six months and 18.38 in 12 months.

But for the longer term, the British pound to South African rand forecast for 2025 from algorithm-based forecasting service Wallet Investor showed the pair rising to 20.714, from 20.231 at the end of 2023 and 19.976 at the end of 2022.

The bottom line

Are you looking for a South African rand forecast to inform your foreign exchange trading strategy? It’s important to remember that the volatility of currency markets makes it difficult for analysts and algorithm-based forecasters to come up with accurate long-term predictions.

We recommend that you look at the latest market trends, news, technical and fundamental analysis, and expert opinion before making any investment decision. Keep in mind that past performance is no guarantee of future returns. And never invest money you cannot afford to lose.

FAQs

Is the South African rand going up or down?

The rand has been falling in value against a strong US dollar amid high inflation and slowing growth in South Africa.

Will the South African rand strengthen in 2023?

The direction of the ZAR against other currencies could depend, among other factors, on US interest rates as well as South Africa’s monetary policy on inflation and interest rates, commodity prices and the country’s account deficits.

Is it a good time to buy South African rand?

Whether it is a good time for you to buy or sell the ZAR is a personal decision that will depend on your risk tolerance and investing strategy. You should do your own research to take an informed view of the market.

We recommend that you look at the latest market trends, news, technical and fundamental analysis, and expert opinion before making any investment decision. Keep in mind that past performance is no guarantee of future returns. And never invest money you cannot afford to lose.