Projected China interest rate in 5 years: PBoC walking tightrope in attempt to balance yuan and economy risks

Where could China’s interest rate be five years from now?

China’s economy rebounded in Q3 2022 from a slump of 0.4% in the previous quarter amid its persistence to keep harsh Covid-19 restrictions. The optimistic reading followed by Beijing’s move to relax its Covid-19 measures.

The Chinese government has also released more stimulus to address a crisis in its property sector, which has added pressure on growth and hinted at potential rates adjustment.

The property sector crisis combined with slowing economic growth, rising unemployment and poor credit growth has forced the world’s second-largest economy to loosen its monetary policy.

With the latest development, what will be China’s interest rate forecast for the next 5 years?

What is the People’s Bank of China?

The People’s Bank of China (PBOC) is China’s central bank. It was founded in December 1948 from the merger of the Huabei Bank, the Beihai Bank and the Xibei Farmer Bank. The State Council made it a central bank in September 1983.

The PBOC is responsible for regulating financial markets, setting interest rates in China and issuing Chinese yuan (CNY).

The PBOC uses four main tools to conduct monetary policy: the required reserve ratio for banks (RRR), bank deposits and lending rates, the medium-term lending facility rate (MLF), and the seven-day reverse repo rate, according to the International Monetary Fund (IMF).

In 2019, the PBOC implemented the loan prime rate (LPR) system, requiring all loans to reference LPR, effectively making it the benchmark lending rate for Chinese banks. Because the LPR was linked to the MLF rate, the importance of this policy reform increased.

While the PBOC is in charge of interest rates, the State Council makes macroeconomic policy decisions. Key monetary policy decisions are made collectively and frequently in the context of broader policy decisions.

The monetary policy committee of the PBOC serves as a consultative body. It meets quarterly but does not announce the dates in advance. A press release is usually issued a few days after a meeting.

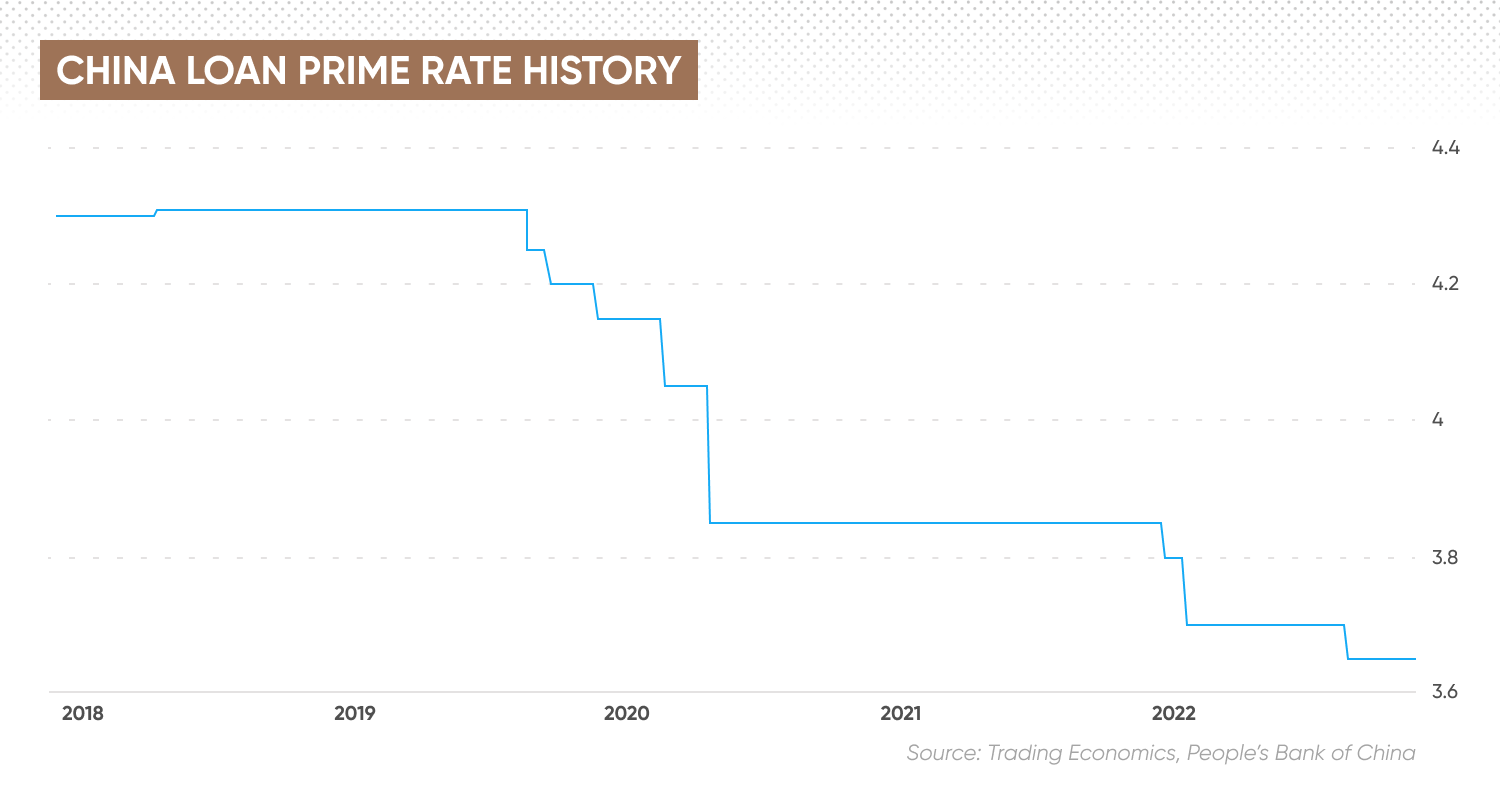

China interest rate history

During the Covid-19 pandemic in 2020, the PBOC made two interest rate cuts, lowering the LPR to 3.85% in April from 4.05% in February. The central bank kept the rate unchanged until December 2021 when it cut LPR by 5 basis points (bps) to 3.8%.

In July 2021, the PBOC reduced the Required Reserve Ratio (RRR) by 50 bps to 8.9%, followed by another 50 bps in December to 8.4%. This lowered the reserves required of banks and increased liquidity in China's financial system. The cut was intended to help corporations affected by a deleveraging campaign and Covid-19 restrictions.

Covid-19 outbreaks in early 2022 forced the PBOC to continue its rate cut policy in 2022. It lowered the LPR to 3.7% in January, cutting it for the second time to 3.65% on 22 August.

Due to Covid-19 outbreaks in Q1 2022, the PBOC was forced to maintain its rate-cut policy throughout 2022. It reduced the LPR twice, in January and August, bringing China’s interest rate down to 3.65% by August. The LPR remained unchanged at 3.65% as of 24 November.

In April 2022, the PBOC made a third RRR cut to 8.1%.

On 5 September, the PBOC announced that the reserve requirement ratio for foreign currency deposits would be reduced from 8% to 6%, effective from 15 September to support the CNY, which had been weakening against other currencies, particularly the US dollar (USD). This followed a 100-bp cut in May.

The PBOC also made two cuts of 10 bps on China’s one-year MLF rate, bringing it to 2.75% in August 2022, from 2.95% in November 2021. Additionally, it lowered its seven-day reverse repo rate in January and August 2022 by 10 bps each, taking the interest rate in China to 2.75% in August, from 2.95% in January.

Latest China interest rate news

Before we dive into the long-term interest rate forecast in China, let’s examine recent news on China’s economy and interest rates.

Q3 GDP rebounds but outlook remain bearish

China’s gross domestic product (GDP) grew by 3.9% in Q3 2022, bouncing back from 0.4% in the previous quarter. In the first nine months of 2022, the world’s second largest economy grew by 3%, according to the National Bureau of Statistics China.

Despite the economy’s recovery and a recent decision to loosen Covid-19 restrictions, analysts are concerned that China's zero-Covid policy will continue to stifle economic growth. China is the last major economy to maintain strict restrictions, which include measures such as snap lockdown and mass testing.

On 11 November, the Chinese government announced the Covid-19 quarantine period for close contacts and inbound travellers would be cut to eight days from the previous 10 days.

But the recent rise in daily cases may prompt Beijing to refrain from fully reopening the economy. On 21 November, Guangzhou imposed a five-day lockdown on Baiyou district, which is home to one of the country’s busiest airports.

ANZ Research chief economist Greater China Raymond Yeung and senior China strategist Zhaopeng Xing wrote on 16 November:

ANZ Research forecast China’s GDP to only grow 3% in 2022, rebounding to 5.2% in 2023 and 4% in 2024.

ING Group forecast China’s economic growth at 3.3% in 2022, rising to 5.3% in 2023. The country was expected to grow by 5.1% in 2024 and 5.5% in 2025. Analysts Robert Carnell, Iris Pang, Nicholas Mappa and Min Joo Kang wrote on 16 November:

Property sector bailout

The Chinese government recently unveiled a rescue package aimed at saving the country’s real estate sector, which has been plagued by a liquidity crisis and a severe downturn.

The package, which aims to promote “stable and healthy development of the property market”, includes measures to address the liquidity crisis such as providing pre-sales funds for developers.

ANZ Research estimated the property crisis has dragged China’s GDP growth by 1 percentage point (ppt). The country’s property sector and related sectors account for 25% of China’s GDP.

They added that even when taking into account the property tax pilot that is due before 2024, new demand will still be weak due to structural barriers in the real estate sector.

Possible RRR cut to support liquidity

China’s Cabinet, the State Council, indicated a possible reduction in the reserve requirement ratio to boost financial support for the economy. RRR is the amount of money that banks are required to keep as a buffer against the country’s economic headwinds.

In a statement as cited by state media Xinhua on 23 November, the State Council said:

The news on the potential monetary stimulus helped the USD/CNY exchange rate steady at around 7.15.

USD/CNY live chart

The US dollar to Chinese Yuan currency pair has gained around 12% year-over-year (YOY), reflecting US dollar strength against the currency. The yuan has been depreciating against the US dollar as the US Federal Reserves continued its aggressive rate hike and China’s harsh Covid-19 policy hurt its economy.

Projected China interest rate in 5 years

China’s interest rate prediction by ING Group saw the seven-day reverse repo rate to average 2% from the final quarter 2022 until Q3 2025 before rising it to 2.60%, as of 16 November.

Scotia Bank expected the PBOC to reduce interest rates in China to hit 3.60% in Q4 2022 and remain unchanged until Q1 2024. The central bank was projected to lower the rate to 3.55% in Q2 2024 and maintain it until Q4 2024.

In its interest rate predictions in China, ANZ Research expected the PBOC to set the seven-day RRR at 2%. It projected that the central bank will still cut rates in 2024 without giving detailed interest rate forecasts to China:

As of 24 November, Trading Economics forecast the seven-day RRR to stand at 1.90% by the end of Q4 2022. For the long term interest rate forecast, the data aggregator expected the rate to trend around the same level in 2023.

Neither the three banks nor Trading Economics offered a China interest rate forecast for the next 5 years.

The bottom line

According to the analysts cited in this article, the PBoC will keep interest rates unchanged in 2023 and may resume rate cuts in 2024. They did not, however, provide projected China interest rates for the next 5 years.

Keep in mind that analysts' China interest rate forecasts for next 5 years can be incorrect. You should always conduct your own research before trading. Previous results do not guarantee future outcomes. Furthermore, never trade with money you cannot afford to lose.

FAQs

Is the interest rate going down in China?

Analysts expected the People’s Bank of China to continue the rate-cutting policy until the end 2022. The central bank may pause cutting its rates 2023 and resume any adjustment on China’s interest rates in 2024.

How low will China interest rates go?

Trading Economics forecast China’s seven-day reverse repo rate at 1.9% by the end of Q4 2022.

Where will interest rates be in 5 years?

No one can be sure. The PBOC will take into account various factors from gross domestic product (GDP), unemployment rate, to inflation and post-Covid-19 measures before making a rate decision. In addition, these factors are complex and uncertain. The farthest projection is 2024.