Cotton price forecast: Downside pressures and a strengthened US dollar

The price of cotton has slumped over 20% since the beginning of 2022. Will it continue to struggle through 2023?

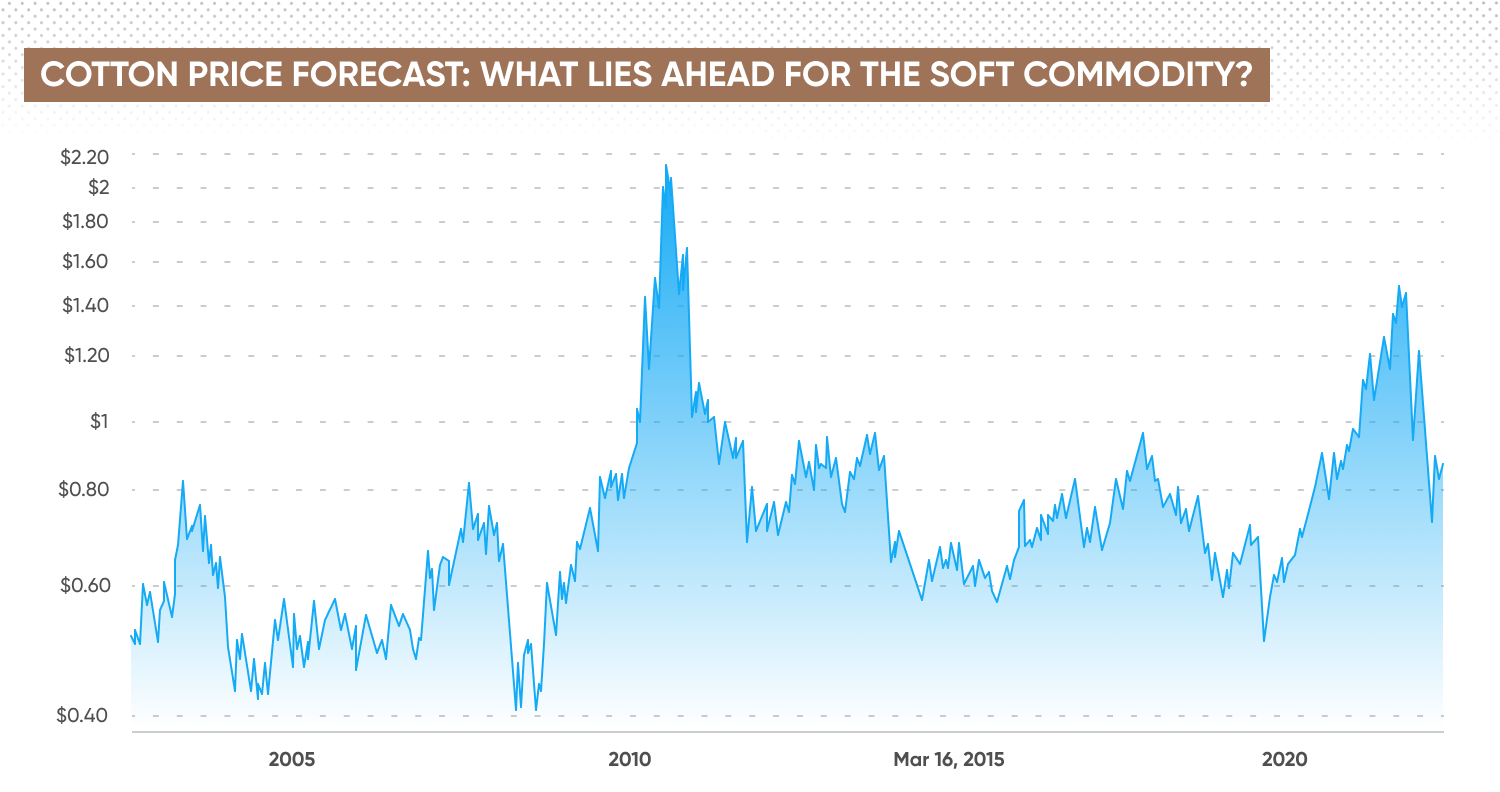

The price of cotton has slumped over 20% since the beginning of this year, despite reaching a multi-decade high of $1.55 in May.

Downside pressures saw cotton trading at two-year lows in October, marking a period of extreme volatility for the commodity.

Initial price drivers included low crop yields in India, global supply chain hurdles and soaring energy prices, which – coupled with the post-pandemic rise in demand – boosted the price of the soft commodity.

After reaching a peak of $1.55 a pound in May, cotton was trading at $0.816 per pound as of the time of writing on 14 December 2022. Here we take a closer look at the factors that may affect the cotton price forecast in 2022, 2023 and beyond.

Why did cotton prices surge in 2022?

As is the case with many agricultural commodities, weather is a key factor affecting production and shaping cotton price forecasts.

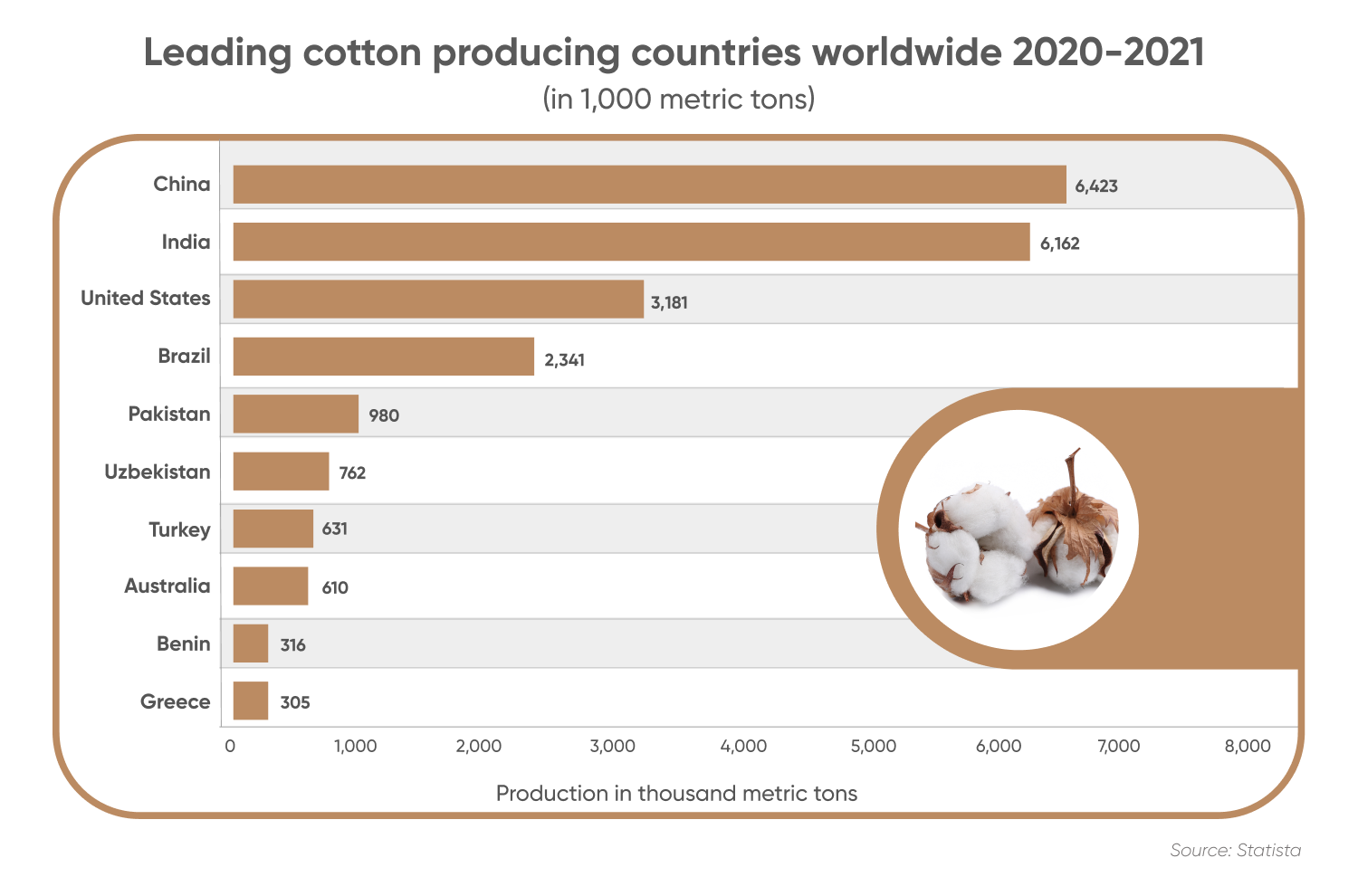

The most recent spike in the cotton price was largely associated with droughts in West Texas, the largest cotton-producing region in the US, which is the world’s third biggest cotton producer. Dry, hot weather affects the production of raw cotton, which in turn restricts supply.

The weather in India, however, was cooler and wetter. Favourable conditions in the region may counter the lower production in the US, according to the Price Group’s report on cotton.

Soaring energy prices and a commodity boom amid Russia’s invasion of Ukraine, coupled with growing post-pandemic demand and supply chain constraints, were contributing factors to the price spike in 2022.

“Global cotton prices peaked as demand started to weaken amid the global economy slowing down due to rising risks, while higher volume of plantings, and better weather for the next cotton production season are expected to increase production,” according to a Fitch Solutions Country Risk & Industry Research report.

China’s slowing imports weigh on cotton demand

Despite the surge in the price of cotton driven by supply and demand dynamics earlier this year, the soft commodity’s price has taken a hit in the near term. This is due to a string of headwinds that are expected to take a toll on the demand for the commodity, and hence affect the cotton price forecast.

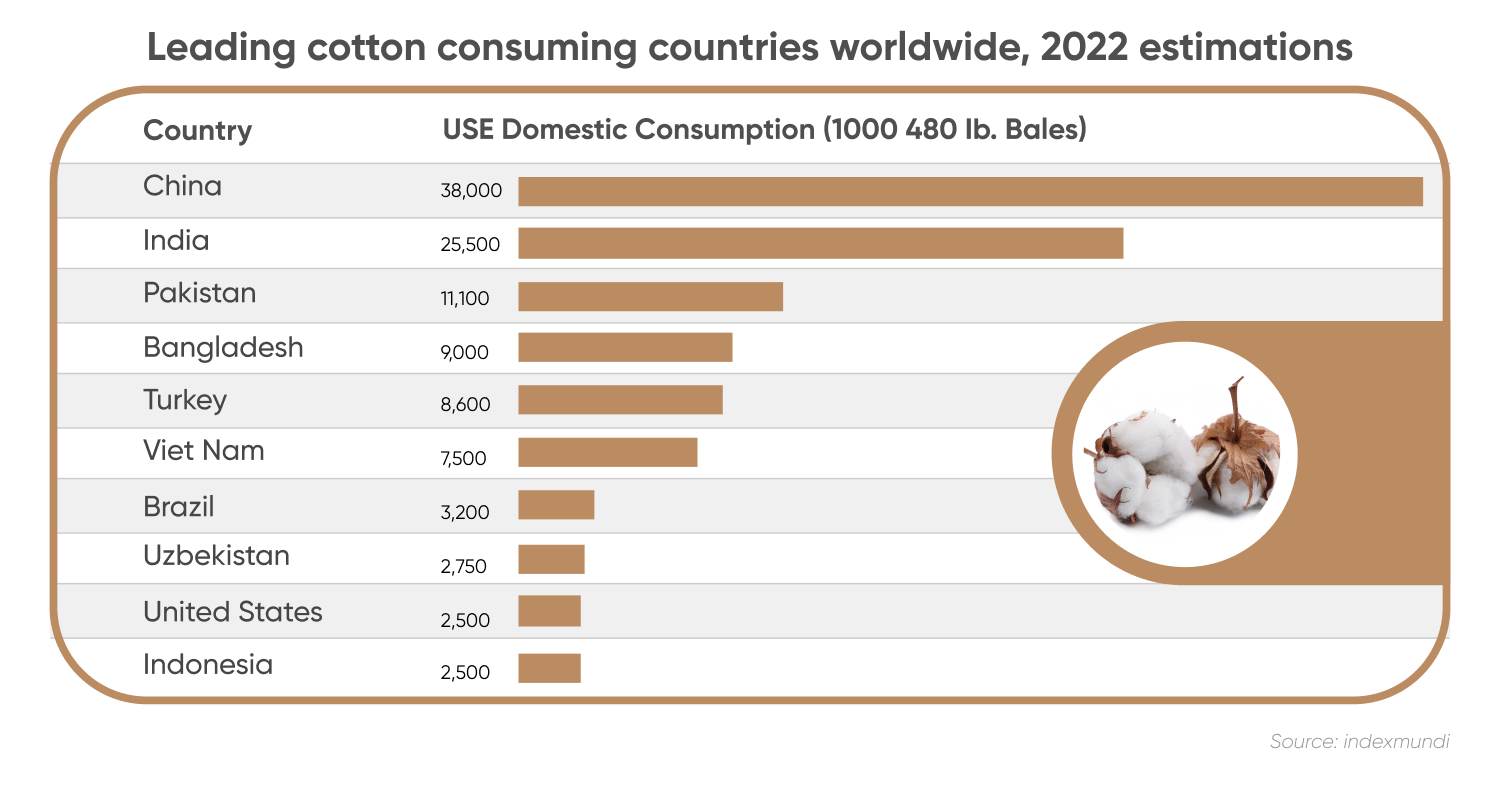

According to a report by the United States Department of Agriculture (USDA), global cotton consumption is projected down 3.3 million bales this month to 111.7 million.

The report stated: “Declining supplies, lower profit margins for spinning mills, falling yarn orders from fabric and apparel companies, and higher inflation levels are all pressuring consumption. Significant challenges for the three largest consumers – China, India, and Pakistan – are expected to lower global consumption significantly below the previous two years.”

“India’s consumption is projected down 1.0 million bales this month to 23.0 million, falling more than 2.0 million from the previous year and the largest year-over-year decline for all cotton consumers. Significantly lower beginning stocks, falling exports of textiles (yarn and fabric) and cotton products, and less competitive yarn export prices are pressuring consumption prospects. Higher spot prices for cotton relative to other major spinners have eroded India’s stature as a competitive yarn exporter to China,” the USDA said.

Price Group’s futures market analyst Jack Scoville said that the pandemic’s effect in China had taken a toll on the country’s demand for US cotton.

“Chinese demand could become less due to the Covid lockdowns. There are trimming imports due to Covid and has closed a number of cities as the Covid spreads through the nation. The cities and ports are shut down again as Covid returns,” Scoville said.

High inflation takes a toll on consumption

Higher inflation around the world, along with the lower consumption reflected in lower retail sales, may also drag the cotton price forecast downward.

Consumer prices in the US jumped to multi-decade highs this year, although the rate of increase in the consumer price index fell to 7.1% in November, lower than the 7.3% forecast by economists and down from 7.7% in October. Overall CPI rose 0.1% from the previous month, lower than the previously recorded 0.4% from October.

Monetary policy tightening by the US Federal Reserve (Fed) in a bid to tame inflation may have an impact on the spending habits of consumers.

The US central bank is expected to raise its benchmark interest rate by 0.50 percentage points, bringing the benchmark rate to between 4.25% and 4.50%. Given this policy tightening, consumers are less likely to spend ahead, which could affect cotton demand.

Cotton is primarily used in the textile and garment industry. Such price fluctuations affect the prices of the end products.

Cotton price forecast for 2023 and beyond

Fitch Solutions’ cotton price forecast for 2023, published in November, suggested that the soft commodity’s price could trade sideways for the remainder of 2022, at around USc85-90/lb. Prices came under downside pressure throughout Q322, easing by 38.2% since then due to a strengthening US dollar and a weakening global economic outlook.

TradingEconomics’ cotton price predictions were bearish at the time of writing (14 December 2022). The economics data provider suggested the price could average $0.7774 in the fourth quarter (Q4) of 2022. Twelve months from now, the cotton price forecast for December 2023 stood at $0.6897.

Neither TradingEconomics nor Fitch Solutions offered a cotton price forecast for 2025.

When looking for a cotton price forecast, always bear in mind that analysts’ price predictions can be wrong. Past performance of a commodity’s price is no guarantee of future results, which is why it is important to do your own research.

Your decision to buy or sell commodities should depend on your risk attitude, expertise in the market and the size of your portfolio. You should never invest or trade money you cannot afford to lose.

FAQs

Is cotton a good investment?

Whether cotton is a good investment for you will depend on your risk attitude, investing goals, portfolio size, experience in the market and other personal circumstances.

At the time of writing on 14 December 2022, analysts suggested the price could go lower, given the surge in supply combined with lower demand. Note, however, that analysts’ expectations can be wrong. Never invest or trade money you cannot afford to lose.

Will cotton go up?

The price of cotton is expected to trade sideways for the near future, according to a forecast by Fitch Solutions published on 18 November.

Note, however, that such predictions can be wrong. You should always conduct your own due diligence.

Should I invest in cotton?

Whether cotton is a good investment for you will depend on your risk attitude, investing goals, portfolio size, experience in the market and other personal circumstances.

At the time of writing on 14 December 2022, analysts suggested the price could go lower, given the surge in supply combined with lower demand. Note, however, that analysts’ expectations can be wrong. Never invest or trade money you cannot afford to lose.