Brazil real forecast: uncertain outlook for BRL as left winger Lula beats Bolsonaro

We look at the latest Brazil real forecast after the country's election results

The Brazilian real (BRL) has experienced volatility after Luiz Inácio Lula da Silva was elected the next president of Brazil in a tight run-off race against incumbent President Jair Bolsonaro. BRL rose as high as 5.4 against the US dollar (USD) on Monday 31 October, before sliding to 5.18.

The market expectation is that Lula will be pragmatic and take a more centrist approach given the slim margin of victory – Lula’s 50.9% of votes beat Bolsonaro’s 49.1%. In his first speech after the win, Lula vowed to reunify Brazil and return to state-driven economic growth and social policies that helped lift millions out of poverty when he was previously president from 2003 to 2010.

Investors and analysts are now closely watching for any indication of Lula’s future cabinet, while weighing the risk of Bolsonaro questioning the election results, which could fuel political turmoil in Brazil.

The central bank’s most recent Focus survey showed markets have raised their 2022 inflation expectations after 17 weeks of cuts, while growth projections were kept unchanged.

What is the outlook for the Brazilian real following the results of the 2022 election? Can it gain against the US dollar and other major currencies, or will it weaken further?

In this article, we look at the real’s performance and some of the latest analysts’ forecasts.

What drives the BRL?

The Brazilian real has been the national currency of Brazil since July 1994, when it replaced the cruzeiro real.

As with other currencies, the value of the real is driven by the country’s economic activity, including gross domestic product (GDP), international trade balance, government policy on spending and monetary policy such as interest rates.

As Brazil is a major commodity producer and exporter, the BRL is also affected by supply and demand trends in global commodity markets.

Brazil is part of the BRICS group of emerging markets, along with Russia, India, China and South Africa. Overall sentiment on emerging markets can also influence the BRL’s value.

The BRL was partially floated against the US dollar in 1999, in response to the spread of a Russian debt default that prompted investors to withdraw money from emerging markets, including Brazil, triggering a currency crisis that saw the real drop in value from 1.20 to 2.15 against the US dollar.

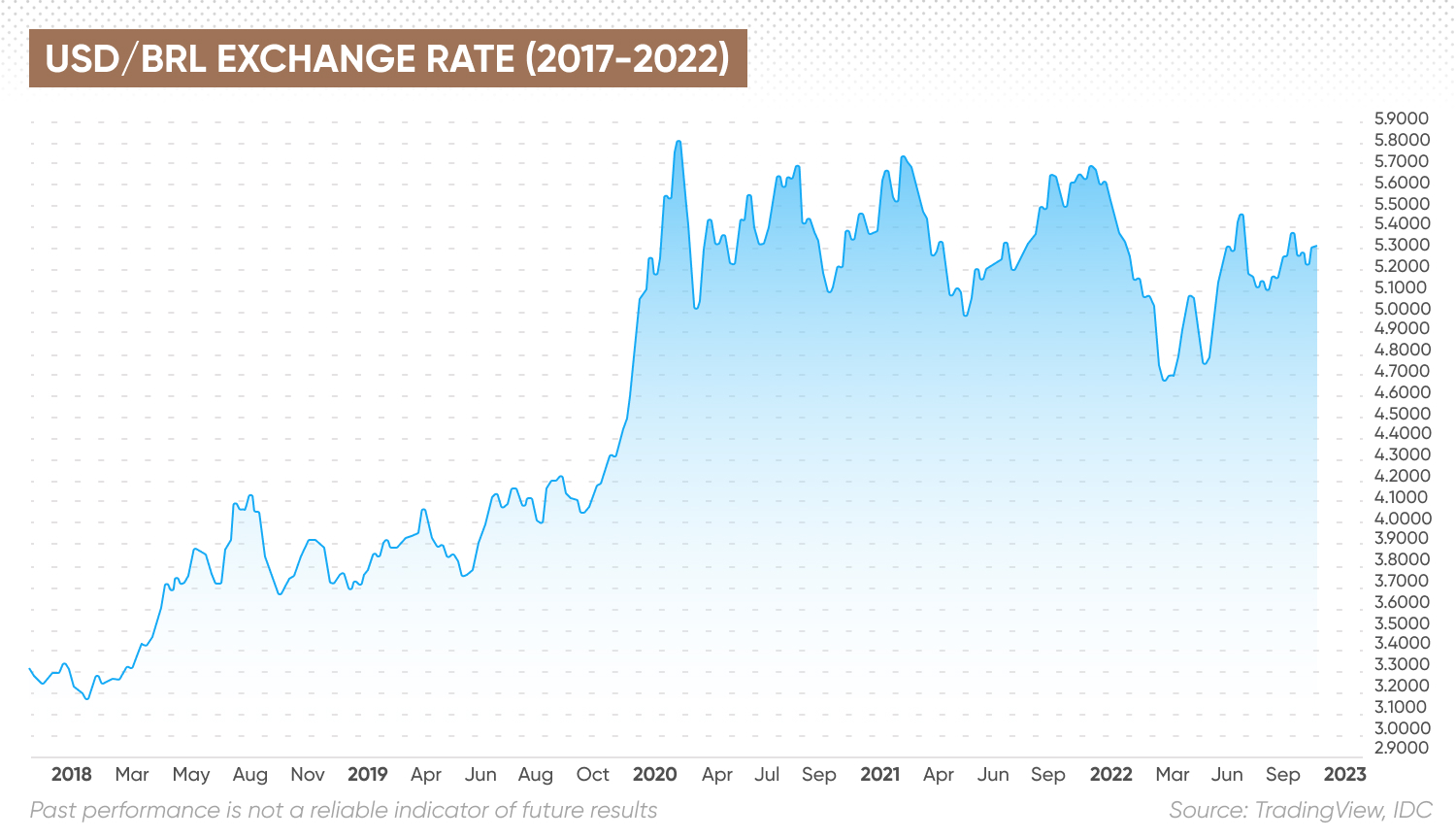

The real began a long-term downward trend against the US dollar during the global financial crisis, with the exchange rate soaring from 1.76 at the start of 2008 to over 5.00 at the start of 2020.

How has the real performed so far in 2022?

The Brazil real started off the year as one of the best-performing currencies, driven higher by rising commodity markets, renewed interest from investors pulling funds from Russian assets and a sharp rise in Brazil’s key interest rate from 2% to 11.75% in just a year. The Banco Central do Brasil (BCB) has since raised the rate further to 13.75%.

The USD/BRL exchange rate fell from 5.6825 at the start of this year to 4.5938 on 4 April as the real climbed in value. The pair spiked to 5.1609 on 9 May, then dropped to 4.7316 on 27 May before the real weakened, with the pair climbing to 5.4977 on 22 July.

The real weakened amid “concerns over fiscal risks in a higher interest rate environment, commodity prices losing steam, and political uncertainty hurting its performance in the early summer”, noted analyst Eduardo Suarez at Canada’s Scotiabank.

The BCB raised the key interest rate by 50 basis points to 13.75% on 3 August, and the real came back into foreign exchange (forex) traders’ favour late in the month, with the exchange rate moving to 5.0292 on 29 August.

Scotiabank’s Suarez further explained:

The real had a volatile Monday morning following Lula’s election victory on Sunday 30 October – the currency traded as high as 5.4 against the USD before dropping to 5.18.

Ricardo Campos, director at Reach Capital, said a calm post-election environment brought relief to the country – and the economy.

“There will be no transition problem, even if Bolsonaro reacts badly, most of his allies have already recognized Lula’s victory,” he told Reuters. Analysts at Citi, meanwhile, pointed to Lula’s cabinet as potential markers of what was to come, saying: “The most important focus for the market will be on Lula’s nominations to Minister of Finance and Budget Planning.”

What is the outlook for the real following the results of the presidential election and Lula’s win?

Below, we look at BRL forecast commentary from forex analysts.

Brazil real forecast: How will the real fare with October’s elections?

Analysts at Sweden’s SEB Group see the Brazilian economy slowing heading into 2023, which could weigh on the real.

They noted: “Brazil’s economy has been boosted by rising commodity prices in the aftermath of the pandemic and during the Ukraine war, but a slowdown in global demand will probably gradually lower commodity prices ahead. Combined with fiscal tightening after Brazil’s October elections, this will lead to a clear slowdown in 2023.”

Similarly, Jankiel Santos, analyst at Spanish bank Santander, noted on 25 August:

USD/BRL forecast

How do analysts expect the US dollar to perform against the real?

“The strength in Brazil’s real… was a bit puzzling,” noted Monex FX analysts Simon Harvey and Jay Zhao-Murray in September 2022. “Although economic indicators near the beginning of August pointed toward strength and helped boost incumbent president Jair Bolsonaro in the polls, most of the dataflow toward the back half of the month painted a picture of fundamental weakness in the Brazilian economy. Furthermore, the commodity export-heavy economy experienced a significant weakening in its terms of trade, which were previously a tailwind for the real… although the BCB has been ahead of the curve in raising interest rates to fight inflation, the hiking cycle has come to an end.”

They added:

Monex’s latest USD/BRL forecast, issued on 1 October, put the rate at 5.00 in three months, 4.80 in six months, and 5.00 in 12 months.

Analysts at Canada’s CIBC wrote in their monthly BRL outlook on 6 October:

In a piece on 25 October, Chris Turner, Global Head of Markets at Dutch financial group ING, attributed the gains in the real to the actions of the country’s central bank, which “hiked early and aggressively”.

Turner said analysts at ING were taking a more “negative” view of the currency, and cautioned of potential risk following the election:

As of 31 October, the BRL prediction from TradingEconomics projected that the pair could trade at 5.45 against the US dollar by the end of this quarter and 5.94 in a year, based on global macro models and analysts’ expectations.

WalletInvestor’s US dollar to Brazil real forecast for 2022 projected the pair could rise to 5.36 at the end of the year from 5.17 at the end of Q3, move up to 5.72 by the end of 2023 and breach 6.10 by the end of 2024.

EUR/BRL forecast

Analysts’ forecasts on the outlook for the value of the euro against the Brazilian real vary, ranging from 5.70 at the end of the year from Dutch bank ING to 5.35 from TradingEconomics and 4.75 from Monex.

In 12 months’ time, ING expected the EUR/BRL pair to trade at 6.31, while Monex forecast a rate of 5.35 and TradingEconomics expected 5.57.

The EUR/BRL forecast from algorithm-based forecaster WalletInvestor estimated that the pair could trade up from 5.19 at the start of October to 5.27 at the end of December, 5.77 by the end of 2023, 6.78 by the end of 2025 and 7.57 in five years’ time.

GBP/BRL forecast

The British pound to Brazil real forecast from TradingEconomics showed the real weakening against sterling, with the pair moving up from 6.21 by the end of this quarter to 6.42 in one year.

WalletInvestor’s GBP/BRL forecast at the time of writing (31 October) showed the pair trading up from 6.13 at the start of October to 6.25 at the end of 2022 and 6.74 by the end of 2023. The algorithm-based service had a brazil real forecast for 2025 estimated at 7.73 by the end of that year.

Analysts have yet to issue a Brazil real forecast for 2030.

The bottom line

If you are interested in trading the Brazilian real, you should keep in mind that currency markets are highly volatile. We recommend that you always do your own research before making any investment decision.

Look at the latest market trends, news, technical and fundamental analysis and expert opinion. Remember that past performance is no guarantee of future returns. And never invest money that you cannot afford to lose.

Stay up to date with the major forex pairs using our currency strength meter.

FAQs

Why has the Brazil real been weakening?

The Brazilian real has weakened after becoming one of the top-performing currencies earlier in the year, as Brazil’s central bank brings its aggressive series of interest rate hikes to an end. October’s presidential election has injected uncertainty into the real’s future.

Will the Brazil real get stronger?

The direction of the Brazilian real will likely depend on the events following the October presidential elections, as well as Brazil’s economic performance and the level of interest rates compared to other countries, among other factors.

Remember to always do your own research before coming to an investment decision. And never trade or invest more than you can afford to lose.

Is it a good time to buy the Brazil real?

Your trading strategy for the real will depend on your personal circumstances, risk tolerance and portfolio composition, among other factors. You should do your own research to develop an informed view of the market. Keep in mind that past performance is no guarantee of future returns. And never invest money you cannot afford to lose.