Beyond Meat stock 5 year forecast: Is BYND shares’ mini surge more than a dead cat bounce?

The recent bear market has taken a toll on Beyond Meat’s stock price. But what lies ahead for the company?

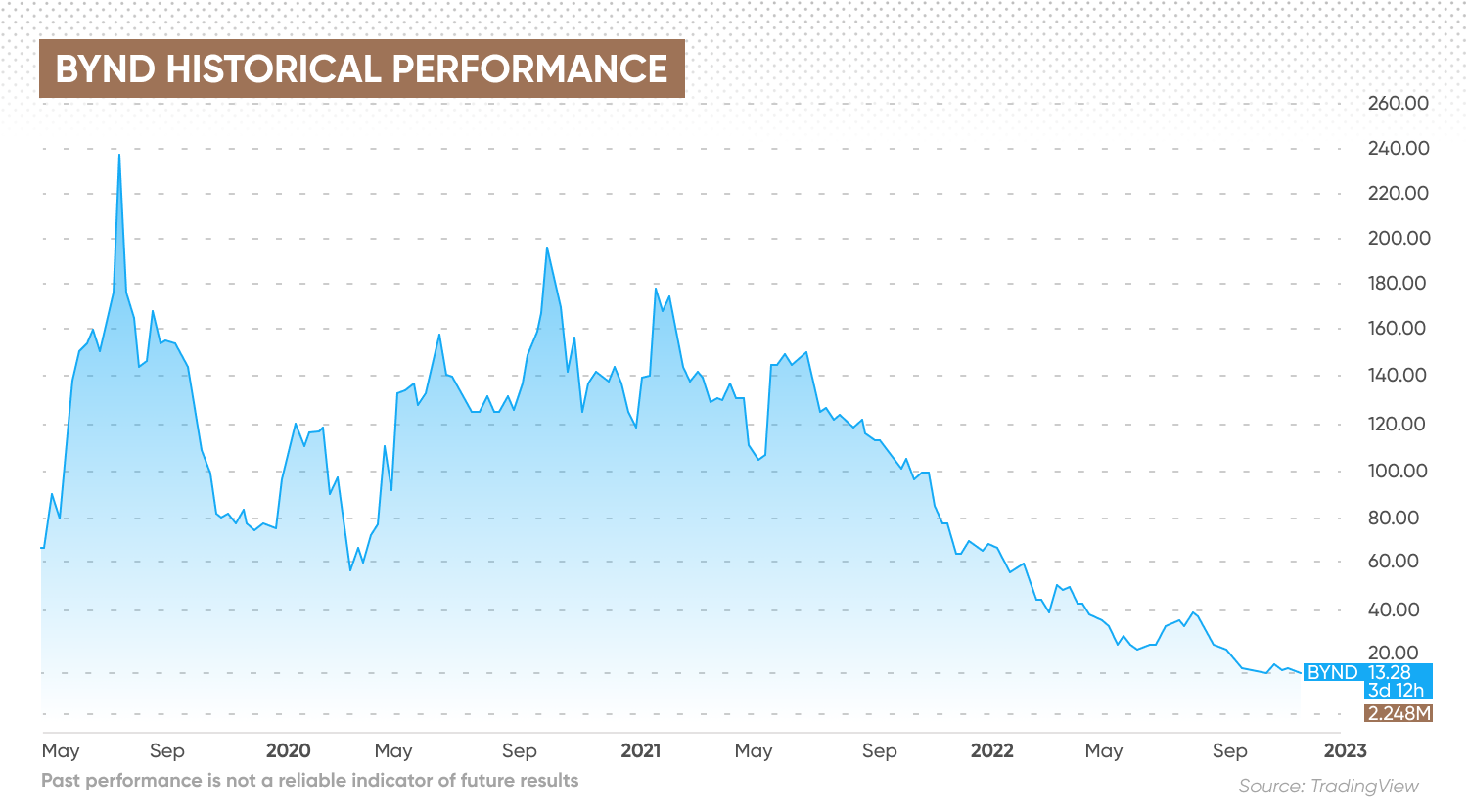

Investors in Beyond Meat (BYND), the plant-based meals company, may have found this year hard to stomach with the stock price having fallen almost 80%.

The US-based company has struggled in the bear market, despite being in an industry that’s predicted to grow substantially over the next decade. As well as making a loss and revealing a fall in revenues, its executives recently warned that record inflation “continues to pose a challenge” for the brand.

However, the stock price has risen 35% in recent weeks after reporting third quarter results and outlining its strategic shift towards sustainable growth.

So, what does this mean for investors? In this Beyond Meat stock 5 year forecast, we examine why the stock price has struggled this year, look at the management’s plans and consider analysts' views.

What is Beyond Meat?

Beyond Meat is a plant-based meat company founded in 2009 by president and CEO Ethan Brown. Its products are designed to have the “same taste and texture as animal-based meat”, while being better for people and the planet.

The company has said its ingredients are simple and made from plants, without genetically modified organisms (GMOs). “Beyond Meat sources proteins, fats, minerals, flavours and colours, and carbohydrates from plant-based sources like peas, beans, potatoes and brown rice,” it explained.

Stock price analysis

Before we consider the Beyond Meat stock projections of analysts, it’s important to chart the company’s stock market journey.

Beyond Meat began trading on the Nasdaq Global Market on 2 May 2019 under the ticker ‘BYND’. Its initial public offering (IPO) was priced at $25. The stock soared more than 160% on its debut.

This enthusiasm continued, with the all-time high stock closing price of $234.90,achieved on 26 July 2019. However, life has since been more challenging for investors. Over the past year, the stock has fallen 83% from $77.53 to $13.45 at market close on 18 November 2022.

According to Morningstar, the company’s three year trailing returns are -44.74%, compared to the 6.61% generated by the packaged foods industry.

Aim for sustainable growth

In mid-October 2022, the company announced a “strategic shift” in pursuit of a more sustainable growth model that emphasises the achievement of cash flow positive operations. This consists of reducing operating expenses and rationalising manufacturing networks while maximising cash from inventory and focusing brand investment on the highest potential prospects.

In a statement, Ethan Brown outlined his belief that the current headwinds, including record inflation, were transient but acknowledged the challenges:

Brown explained its decision to reduce personnel and expenses throughout the business, reflected “an appropriate right-sizing” of the organisation, given current economic conditions:

Latest results

In early November 2022, Beyond Meat announced net revenues of $82.5m for the third quarter –

22.5% down year-over-year (YOY). Net loss was $101.7m, with an earnings before interest, tax, depreciation and amortisation (EBITDA) loss of $73.8m.

In a statement, the company said all markets and channels were impacted by weaker than expected demand, as well as customer and distributor changes such as reduced inventory levels.

The decrease in net revenue was blamed on factors such as price reductions in the US and EU, along with increased trade discounts and unfavourable foreign exchange rates. The company said its operating environment continued to be affected by near-term uncertainty related to macroeconomic issues, including inflation and rising interest rates.

It also flagged up “increasing concerns about the likelihood of a recession”, as well as Covid-19 and its potential impact on consumer behaviour, and supply chain disruptions. As a result, 2022 net revenues are expected to be in the range around $400m to $425m, representing a decrease of approximately 14% to 9% compared to 2021.

Ethan Brown emphasised the company’s planned move to a sustainable growth model and the focus on achieving cash flow positive operations within the second half of 2023.

What factors are likely to determine the share price long-term?

Any Beyond Meat 5 year forecast must consider the sector in which it operates and whether it’s likely to grow by 2027. In particular, enthusiasm for plant-based foods will play an influential role in the future of Beyond Meat and whether it proves to be a successful investment.

Back in August 2021, a report from Bloomberg Intelligence highlighted the potential of plant-based foods:

The report credited Beyond Meat, as well as Impossible Foods and Oatly for driving an increase in plant-based options as they partnered with restaurants and major chains.

“As consumers become familiarised with plant-based products and initiatives, BI foresees an evolution in consumer habits over the next decade.”

Ethan Brown has previously emphasised his belief that this is a market with tremendous longer-term growth potential.

Beyond Meat stock 5 year forecast: What is the outlook?

Where do analysts see Beyond Meat stock in 5 years? As of 22 November, according to 11 Wall Street analysts compiled by TipRanks, the stock was a ‘moderate sell’ considering the Beyond Meat projected growth.

Eight of the analysts had ‘hold’ recommendations in place, while three saw the stock as a ‘sell’. The consensus view was that BYND could fall 16.36% to $11.25. The highest prediction was for it to reach $14, while the lowest forecast came in at just $6.

However, the 13 analyst views compiled by MarketBeat provide more encouraging news with the consensus view being that the stock has a 51.49% potential upside to $20.38. The highest stock prediction was $62, while the lowest came in at just $8.

It’s difficult to give an accurate Beyond Meat long term stock forecast due to the variables at play, not least of which is the challenging global economic environment. Beyond Meat was classed as a “bad long-term (one year) investment” by the algorithmic forecasts of Wallet Investor.

The site predicted that the stock price could slump to 0.000001 over the next 12 months. So, what about the Beyond Meat stock 5 year forecast? The view from Wallet Investor was heavily bearish, as it predicted BYND stock could still be at the 0.000001 level in November 2027.

Rebecca Scheuneman, senior equity analyst at Morningstar, had a fair value estimate of $24.50 on the stock. However, she didn’t believe Beyond Meat could become cash flow-positive by the second half of 2023.

“We maintain our view that this milestone likely won’t be reached until 2026,” she said. “We may revisit this projection in February, when more specifics will be given.”

Scheuneman also believed the management will need to tap banks or capital markets in 2025, at which point she anticipates it will need to raise about $200m.

When looking at Beyond Meat stock predictions keep in mind that analysts’ predictions can be wrong. Forecasts shouldn’t be used as a substitute for your own research. Always conduct your own due diligence before trading. And never invest or trade money you cannot afford to lose.

FAQs

Where will BYND stock be in 5 years?

According to the algorithmic forecasting of Wallet Investor, the Beyond Meat stock price is expected to slump to 0.000001 over the coming year – and still be there in November 2027. However, it’s important to remember that this may be inaccurate. You should do your own research. Remember that past performance is no guarantee of future success. And never invest money you cannot afford to lose.

Will Beyond Meat stock go up or down?

No one can say for sure. As of 22 November, analysts are divided. The consensus views compiled by TipRanks suggested the stock could fall 16.36% to $11.25 over the coming year. However, analysts collated by MarketBeat expected it to rise 51.49% to $20.38.

Is Beyond Meat a good long term investment?

Whether Beyond Meat is a suitable investment for you over the long-term will depend on your views on the company, your investment aims and objectives, and the growth of the plant-based food market. That’s why it’s important to carry out your own research. And never invest money you can’t afford to lose.