USD/BDT forecast: Taka plumbs new depths against the dollar as the Bangladesh forex reserves crisis deepens

What lies in store for the Bangladeshi taka? Will it continue falling against the US dollar?

The Bangladeshi taka (BDT) has fallen 10% over the past year. It sank to a record low this month as foreign exchange reserves tumbled and the trade deficit widened to a record level.

In this article we look in more detail at what has been driving the Bangladeshi taka lower as well as the latest US dollar to Bangladesh taka forecasts.

How has the Bangladeshi taka performed?

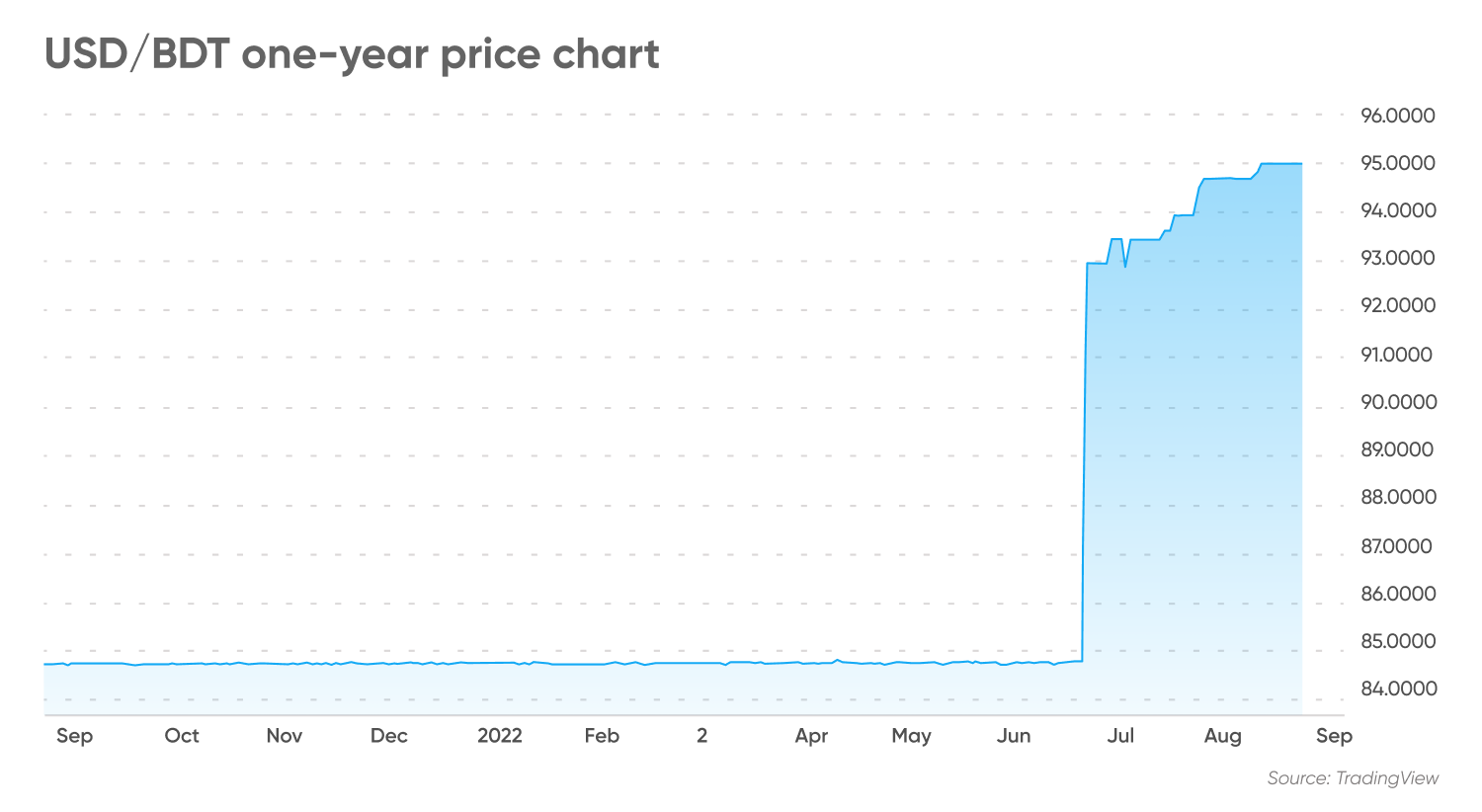

The USD/BDT rate started the year at 84.74 before the weakening taka brought it to 86.00 on 22 March. The exchange rate rose further on 17 May to 87.00 and 89.00 by the start of June. From there, it dropped to 91.38 on 3 June and further on 23 June to 92.95. At the time of writing (24 August), the Bangladeshi taka has reached an all-time low of 95.00.

What is the Bangladeshi taka (BDT)?

The Bangladeshi taka is the official currency of the People’s Republic of Bangladesh. The Central Bank of Bangladesh controls the currency and its issuance.

The USD/BDT exchange rate is set by several dealer banks, which buy and sell currency, and the rate fluctuates depending on supply and demand. The Bangladeshi central bank says that it undertakes US dollar purchases only as needed to maintain orderly market conditions and that it is not in the market on a daily basis.

What drives the value of the taka?

Several factors can influence the Bangladeshi exchange rate. These include:

Interest rates

Higher interest rates often attract foreign investment, which helps boost demand for that currency, lifting its value. On the other hand, when a central bank cuts interest rates, investors will often pull money from the country and look to invest elsewhere, which can lower the currency’s value.

Whether a central bank hikes or cuts interest rates depends on the rate of economic growth, inflation level and the labour market.

Economic growth and inflation levels

When economic growth is strong and inflation rises, a central bank will often look to raise interest rates, lifting the currency's value. When economic growth slows and inflation dips, a central bank will look to cut interest rates to stimulate the economy.

The Bangladesh economy has seen impressive growth and development in its short history. According to the World Bank, it has been among the world’s fastest growing economies over the past 10 years and made a robust economic recovery from the pandemic.

Real gross domestic product (GDP) growth rose to 6.9% in full year 2021 thanks to a rebound in manufacturing and services after Covid-19 restrictions eased, along with export and consumer-led growth.

However, following the Russian invasion of Ukraine, Bangladesh’s economy has struggled, particularly as energy prices have surged.

Foreign currency reserves

Currency reserves are an important factor affecting a country’s exchange rate. The central bank can use reserves to help maintain a steady rate. Reserves buffer against headwinds that could impact the economy or exchange rate.

Trade deficit

A trade deficit is when imports exceed outports, and typically means that international demand for that currency is weaker. As a result, the value of the currency can fall.

USD/BDT historical performance

Since 2010 the Bangladeshi taka has lost just shy of 40% in value. At the start of 2010, the USD/BDT was trading at 68.78, rising in value to a high of 84.37 at the beginning of 2012.

The taka strengthened, pulling the pair down to 77.00 in August 2014. However this was short lived. The pair resumed its climb, reaching 80.00 in March 2017 and a record high of 95.00 in August 2022.

The latest Bangladeshi taka news

The BDT has fallen 10% over the past year. Pressure on the currency has increased following the start of the Russia-Ukraine war, which has taken its toll on the economy while sending the USD to two-decade highs.

Following the start of the Russia-Ukraine war, energy, commodity, and food prices have soared, lifting inflation across the globe.

Safe haven flows to the USD picked up, and the US Federal Reserve (FED) adopted a hawkish stance to tame 40-year high inflation in the US. The dollar rose against its major peers and the taka.

Furthermore, tighter US monetary policy means that USD liquidity is leaving the market and US dollars are becoming scarcer.

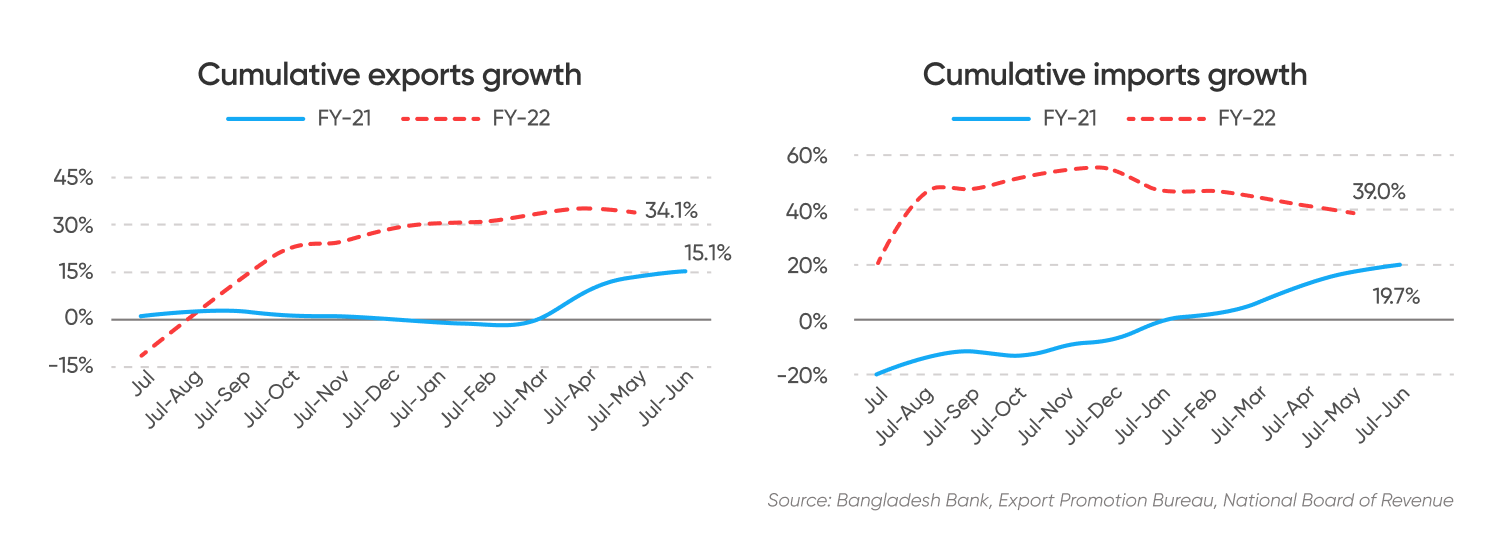

The trade deficit in Bangladesh widened to $33.3bn in FY 2021 to 2022, which ended in June. The cost of fuel, food and other essential items saw record level increases. Rising prices globally have meant import growth outpaced exports substantially, widening the trade deficit and depleting foreign exchange reserves.

Bangladesh’s reserves have steadily declined across the year. According to the Bangladesh Bank, total foreign exchange reserves fell to $39.59bn as of 27 July. This was down from $45.8bn a year earlier. This is sufficient to cover around four months of imports, above the International Monetary Fund’s (IMF) recommended three months.

The Bangladesh bank highlighted this in its FY 2022 to 2023 monetary policy statement:

In addition to high import prices hurting foreign exchange reserves, the Bangladesh central bank intervened in the local foreign exchange market by selling significant foreign reserves to support exchange rate stability.

Recently, Bangladesh authorities announced a series of austerity measures to help preserve dollars. Such measures include limits on the import of luxury goods, fruits and processed foods, and even the suspension of the 5G telecom plan, given that around 80% of the equipment needs to be imported.

Economic growth in Bangladesh, the world’s second largest garment exporter, is slowing. The economy is being threatened by slowing global demand as the cost of living crisis ramps up in Europe and the US, garment orders have slowed.

Surging energy prices maen costs in this key industry have risen sharply. The IMF forecast GDP growth of 6.4% in FY 2022, and inflation is expected to be elevated at 6%.

The Bangladesh Bank has raised interest rates to rein in inflation. The central bank hiked rates to 5% on May 29, 2022, and has since lifted them again by 0.5% to the current level of 5.5%.

Bangladesh has approached the IMF for a loan to help support the economy, which is being hit by inflation and dwindling foreign reserves. Negotiations are taking place to design a suitable programme.

The latest BDT forecasts for 2022 and beyond

As of 24 August, according to analysts at TradingEconomics, the taka was expected to continue weakening. It forecast that USD/BDT could be at 95.71 by the end of the quarter and 98.05 in 12 months’ time.

The USD/BDT forecast from algorithm-based forecaster Wallet Investor also predicted the Bangladeshi taka could weaken in the near term, with USD/DBT ending 2022 at 96.66. In the longer term, its USD/DBT forecast for 2025 saw the rate rising to 100.03 by the end of the year.

Wallet Investor’s USD/BDT prediction for 2027 saw the pair rising to 102.43. Continuing with this trend, the USD/DBT forecast for 2030 could be higher still. However, at the time of writing, no services offered a forecast so far into the future.

It is important to remember that analysts’ and algorithm-based USD/BDT forecasts can be wrong. Always conduct your own due diligence before trading, looking at the latest news, technical and fundamental analysis, and analyst commentary. Past performance does not guarantee future returns. And never trade money that you cannot afford to lose.

FAQs

Why has USD/BDT been rising?

USD/BDT has been rising on a combination of a stronger USD and a weaker BDT.

The USD has risen on safe-haven flows and expectations that the US Federal Reserve could continue to act aggressively by raising interest rates. Meanwhile, the BDT has fallen as the trade deficit widened and foreign exchange reserves fell.

Will USD/BDT go up or down?

Where USD/BDT goes from here could depend on the economic conditions in

both countries. Given the US Federal Reserve is expected to continue hiking interest rates for the foreseeable future, the Bangladesh Bank could struggle to support the taka.

When is the best time to trade USD/BDT?

The best time to trade USD/BT is 8:00 to 12:00 ET. This is when US economic data is mainly released.

Is USD/BDT a buy, sell or hold?

Only you can decide what the right choice is for you concerning USD/DBT. Remember to do your research, considering each country's economic outlook, GDP, imports, exports, inflation data and foreign exchange reserves. Never invest money you cannot afford to lose.