What are lots in forex, and how do I calculate lot size?

Discover how lots work in forex trading, how to calculate them and why they’re important for currency traders to understand.

What are lots in forex?

In forex trading, a lot represents a fixed quantity of a currency pair. Since forex markets operate with large trade volumes, lots serve to standardise position sizes.

When trading forex CFDs, you don’t buy physical currency. Instead, you speculate on price movements using lot sizes, which define the scale of your trade.

The standard lot size is 100,000 units, but sometimes you’ll see terms like mini lot and micro lot which refer to smaller sizes.

Your profit and loss are determined by how much the currency moves (measured in pips) and the lot size you trade.

Lots and Capital.com

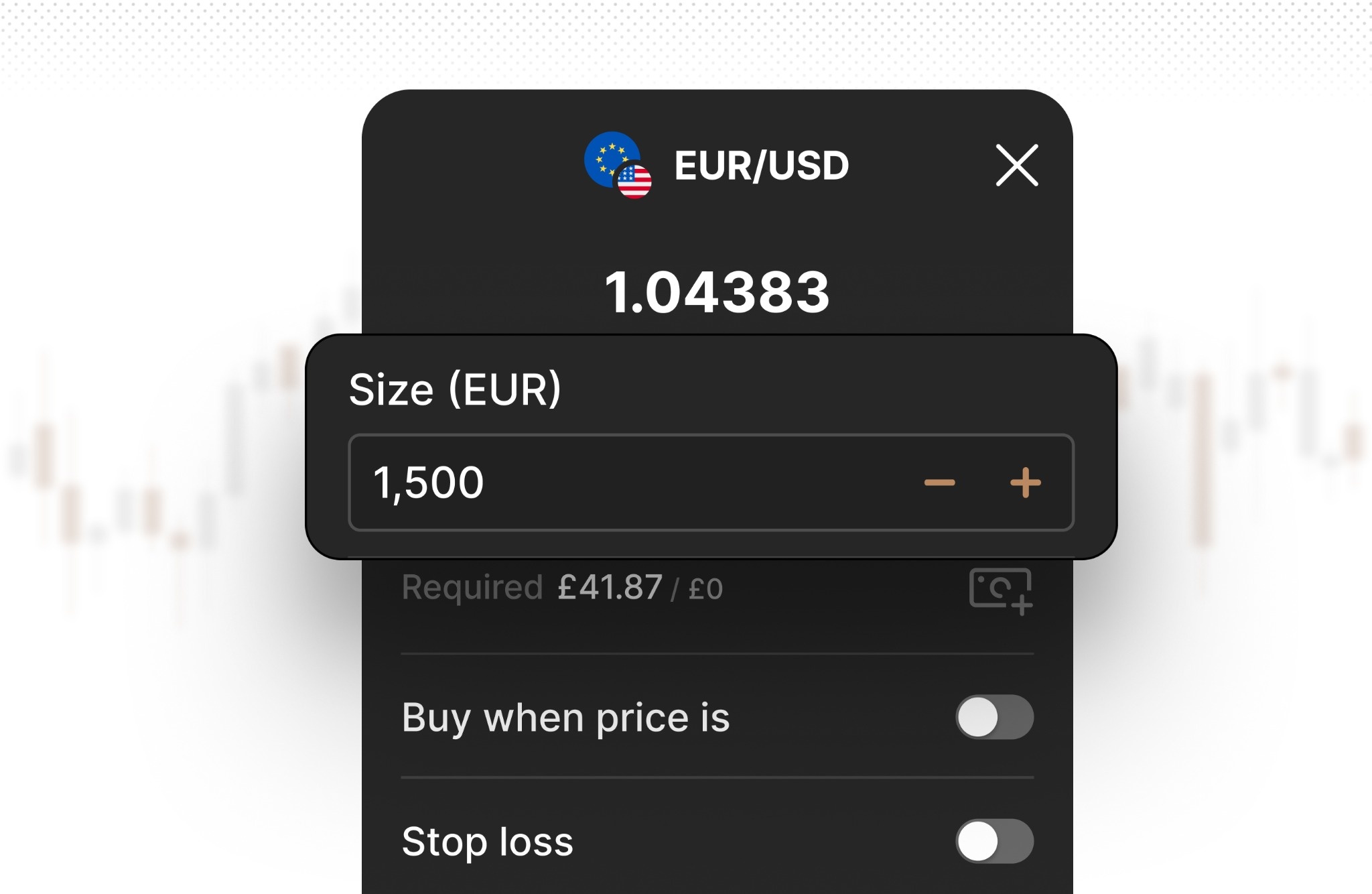

When you trade with us, you’ll have full flexibility over your forex position sizing – we don’t use designated lots. That means you can trade in sizes ranging from just 100 units to increments of 100 units thereafter, with no maximum trade size.

For example, the deal ticket below shows how you can buy 1,500 EUR for 1565 USD (1500 x the price of 1.04383) if you choose, meaning you aren’t restricted to a lot size of 1,000.

Trading forex with lots

When trading forex CFDs, you can buy (go long) or sell (go short) based on price expectations. Since CFD trading allows leverage (also known as margin trading), you can control a large lot size with a smaller margin deposit.

For example, with 30:1 leverage, a standard lot trade on USD/JPY ($100,000) requires only $3,330, or currency equivalent, in margin (3.33%). However, leverage also amplifies potential losses, making proper lot size selection critical.

Learn more about forex trading and how it works.

Create an account Open a demo account

Lot size and pip value

A pip is the smallest price movement in forex, typically the fourth decimal place (or second in JPY pairs). The pip value represents how much one pip movement affects your profit or loss and depends on the currency pair being traded.

For pairs where USD is the quote currency (eg, EUR/USD, GBP/USD), the pip value remains fixed:

| Standard lot | $10 per pip |

| Mini lot | $1 per pip |

| Micro lot | $0.10 per pip |

| Nano lot | $0.01 per pip |

That means if you trade a standard lot and the pair moves 10 pips in your favour, you’ll profit $100 (minus any fees). If it moves against you, you’ll lose $100.

For pairs where USD is the base currency (eg, USD/JPY) or cross-currency pairs (eg, GBP/JPY), the pip value must be converted into USD based on the exchange rate.

For example, for USD/JPY at a price of 145.00:

- The pip size for JPY pairs is 0.01.

- Since a standard lot is 100,000 units of the base currency (USD), a one-pip movement (0.01 JPY) is worth: 0.01 × 100,000 = 1,000 JPY per pip.

- To convert this into USD, divide by the exchange rate: 1,000 JPY/145.00 = 6.90 USD per pip.

You should always align your lot size with a comprehensive risk management strategy and use stop-loss orders to control downside risk.

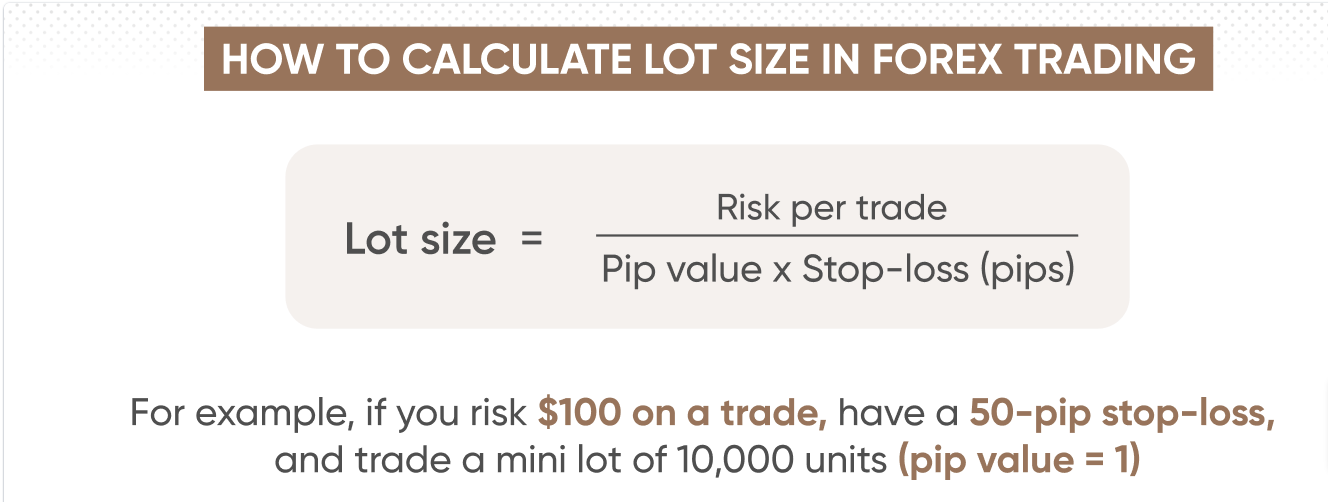

How to calculate lot size

To calculate the lot size that fits your trade:

- Determine your riskDecide how much of your capital you’re willing to risk per trade (eg, 1% of your account).

- Set a stop-lossDefine how many pips you are willing to risk on the trade.

- Use a lot size formula

Forex lot trading example

Let’s say you want to trade the EUR/USD currency pair using a standard lot (100,000 units of EUR). The current price of EUR/USD is 1.04248, meaning 1 EUR = 1.04248 USD.

Trade details

- Currency pair: EUR/USD

- Lot size: 1 standard lot (100,000 EUR)

- Entry price: 1.04248

- Leverage: 30:1

- Margin required: 3.33%

Step 1: Open the trade

- Log into your trading platform and search for EUR/USD in the market list.

- Click ‘Buy’ (if you expect the price to rise) or ‘Sell’ (if you expect it to fall).

- Enter 100,000 in the ‘Size’ section of the deal ticket. This represents one standard lot.

- Review margin details – since leverage is 30:1, your required margin is 3.33% of the total trade value.

Margin calculation:

Since you’re trading 100,000 EUR, the margin required in EUR is: 100,000 × 0.0333 = 3,330 EUR

Converted to USD at the entry price of 1.04248:

3,330 × 1.04248 = $3,471.46 (or equivalent in your account currency).

That’s how much you need to put down to open this position.

Step 2: Understand pip value

A pip is the smallest price movement in forex (0.0001 for most pairs). As mentioned above, the pip value for EUR/USD when trading a standard lot (100,000 EUR) is $10 per pip.

Step 3: Profit & loss calculation

Let’s assume you buy at 1.04248 and close the trade at 1.04748 (a 50-pip increase). Your profit will be 50×10 = $500, or currency equivalent.

If the trade moved against you and you exited at 1.03748 (a 50-pip loss), the loss would be 50×10= $-500, or currency equivalent.

Learn more about trading

For more on trading across different markets, don’t miss our trading essentials page where you can get to grips with the key concepts central to markets. Also, find out more about technical analysis and get up to speed with how historical prices can influence your decisions.

Browse our trading strategy guides for a comprehensive look at the most popular approaches undertaken by our clients.

If you want to master forex trading try our step-by-step forex course and explore potential profits and losses on your forex CFD trades with our free forex profit calculator.

FAQs

What is a lot and how does it work?

A lot in forex is a standardised trade size that determines how much of a currency pair you’re buying or selling. A standard lot is 100,000 units, but traders can also use mini (10,000), micro (1,000), or nano (100) lots for more flexibility. The larger the lot, the bigger the pip value – meaning higher potential profits or losses. Choosing the right lot size is key to managing risk and aligning with your strategy.

How many lots can I trade with $100?

With $100 and a 3.33% margin requirement (30:1 leverage), you can trade 0.03 lots (3,000 units) in forex. At Capital.com we don’t use designated lot sizes, so trade sizes are flexible. You can check the platform for exact margin requirements per market.

How much is one lot in forex?

One standard lot in forex equals 100,000 units of the base currency. For EUR/USD, that’s €100,000, with each pip move typically worth $10. Smaller lots reduce exposure, with mini lots worth $1 per pip and micro lots $0.10 per pip. If USD is the base currency, like in USD/JPY, the pip value varies with the exchange rate.

What is a lot size calculator?

A lot size calculator can help you find the right position size based on their account balance, risk percentage, and stop-loss. Just enter your details, and it tells you how much to trade – helping you stay within your risk limits and avoid overexposure.