USD TRY forecast: Third-party outlook

US dollar/Turkish lira (USD/TRY) was trading at 41.2837 at 15:00 UTC on 15 September 2025, within an intraday range of 41.0993-41.3709.

The pair remains close to record highs as the Turkish lira has lost 21.32% over the past 12 months and is still below September’s peak near 41.36 (Trading Economics, 15 September 2025).

The lira faces pressure after Turkey’s central bank delivered a larger-than-expected 250-basis-point rate cut to 40.5% in September. Political uncertainty also weighs on sentiment ahead of a key court ruling on opposition leadership. Meanwhile, broader US dollar weakness – with the DXY down 3.3% year-to-date and Federal Reserve rate cut expectations at around 92% for September’s meeting – adds mixed signals. Turkish inflation remains elevated at 32.95% despite its 15th consecutive monthly decline (ING Think, 11 September 2025).

USD/TRY forecast for 2025-2030

Goldman Sachs (equity research)

Goldman Sachs expects USD/TRY to reach 42 by October 2025, 44 by January 2026, and 48 by July 2026. The bank expects further rate cuts of around 350 basis points and highlights carry trade unwinding amid depreciation pressure (Investing.com, 20 July 2025)

JPMorgan (emerging markets research)

JPMorgan projects USD/TRY at 45.50 by end-2025, with inflation falling to 26% if policies remain unchanged. Analysts raised their March inflation outlook from 2.3% to 3.2% following political uncertainty and slower disinflation (PA Turkey, 30 January 2025).

Morgan Stanley (global strategy)

Morgan Stanley forecasts USD/TRY at 41 by Q4 2025 and 44 by Q4 2026. It places the lira among the stronger CEEMEA currencies as of February 2025. The bank maintains inflation expectations at 30% by end-2025 and sees policy rates easing to 37% (Türkiye Today, 20 February 2025).

Trading Economics (consensus model)

Trading Economics expects USD/TRY at 41.40 by Q4 2025 and 36.28 within 12 months as of September 2025. Its models incorporate exchange rate volatility and central bank easing (Trading Economics, 10 September 2025).

Long Forecast (quantitative analysis)

Long Forecast projects USD/TRY at 43.44 by December 2025 and 51.99 by December 2026, with monthly volatility of 2-6%. It anticipates gradual lira depreciation averaging 1.9% monthly through year-end (Long Forecast, 12 September 2025).

Forecasts are subject to change and often prove inaccurate, as unforeseen events can shift markets. Past performance is not a reliable guide to future outcomes.

USD/TRY: Technical overview

USD/TRY holds at 41.2837 as of 15:00 UTC (TradingView, 15 September 2025), trading above its 20, 50, 100 and 200-day moving averages at roughly 41.0, 40.6, 39.8 and 38.1. The alignment remains constructive, with clustering across shorter averages. Momentum indicators show the 14-day RSI at 85.3, signalling stretched conditions. The ADX(14) at 7.4 highlights a lack of strong trend momentum.

On the upside, R1 resistance at 41.35 is the first pivot; a daily close above could target R2 at 41.68, approaching August highs. On pullbacks, support lies at the pivot near 40.81, with the 100-DMA around 39.8 as a key level. Below that, the 200-DMA at 38.1 becomes critical.

This analysis is for informational purposes only and does not constitute financial advice.

Past performance isn’t a reliable indicator of future results.

Follow the Turkish lira’s performance with our USD/TRY chart.

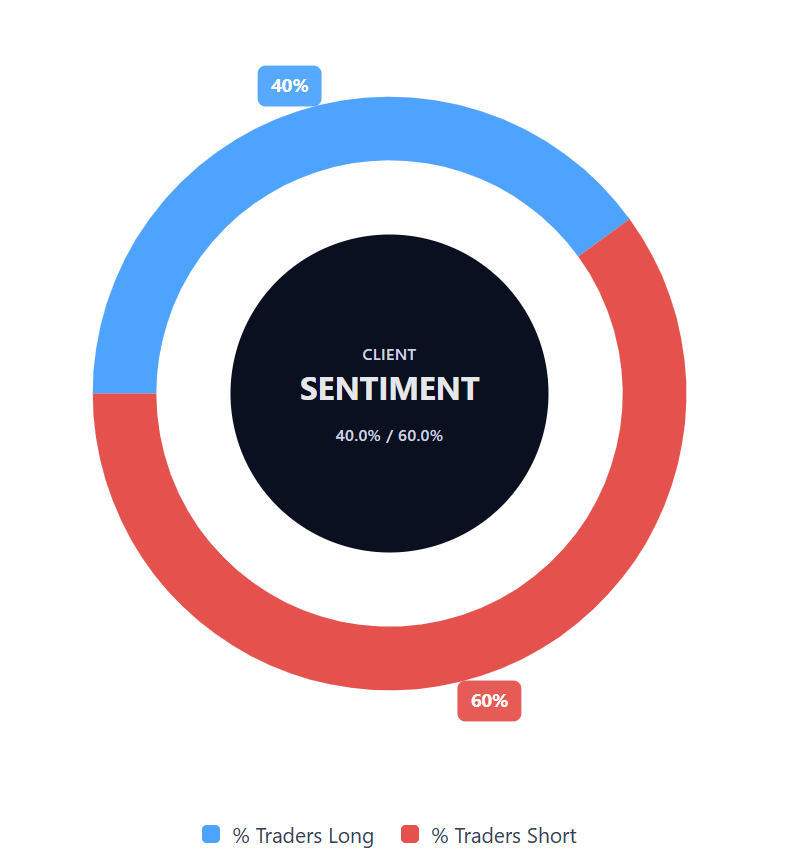

Capital.com’s client sentiment for USD/TRY

As of 15 September 2025, Capital.com clients trading USD/TRY CFDs were 40% long and 60% short. This reflects a majority-sell bias, but not at extreme levels. Positioning data is a snapshot and may change over time.

FAQ

What is the 5 year forecast for USD TRY?

Long-term projections vary, with analysts generally expecting further lira weakness linked to monetary policy and inflation. However, forecasts differ widely due to political and economic uncertainty.

Is USD TRY a good buy?

Suitability depends on trading goals and risk tolerance. The pair is influenced by policy decisions, inflation, politics, central bank interest rates, and global dollar trends. Traders should align any decision with their risk management approach.

Could USD TRY go up or down?

The pair can move in either direction, reacting to policy shifts, inflation, political events and the dollar trend. Volatility is common, making it important to monitor data and news.

Should I invest in USD TRY?

Contract for difference (CFD) trading allows short-term exposure to USD/TRY without owning the currencies. Please note that CFDs (including USD/TRY) involve margin, and leverage above 1:1 amplifies both your profits and your losses. Longer-term investing in lira-linked assets carries higher risks tied to economic stability, policy, and geopolitics. Any decision should reflect your chosen trading strategy, experience, and risk appetite.