USD/ILS forecast: Will the US dollar continue to rise against the Israeli shekel in 2023?

The US dollar enjoyed strength as a safe haven. As inflation eases will it maintain the momentum against the Israeli shekel?

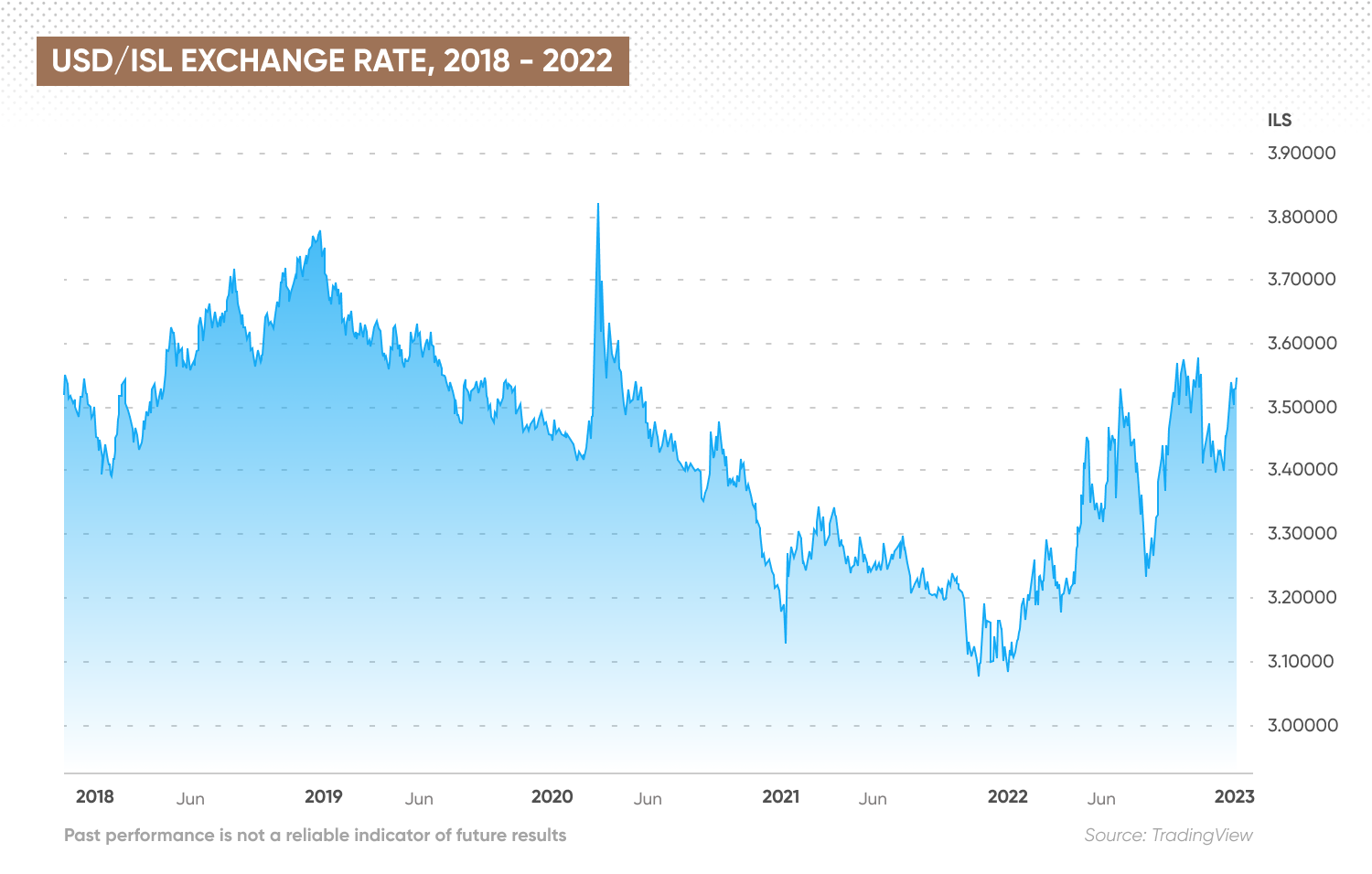

The US dollar to Israeli shekel (USD/ILS) exchange rates rose over 13% in 2022 after an aggressive interest rate hike cycle by the US Federal Reserve (Fed) supported US dollar appreciation against other world currencies.

USD/ILS live exchange rate

Looking forward to 2023, there is uncertainty in the market as to how long this support will continue as the Fed balances between taming inflation and supporting economic growth.

Furthermore, the health of Israel’s tech services-exporting economy will be one to watch amid the threat of a global recession.

How will the USD/ILS rate fare in 2023? Here we take a look at the USD/ILS forecasts for 2023 and beyond.

What drives USD/ILS?

USD/ILS is the exchange rate of one US dollar to the Israeli new shekel. As of 5 January 2023, USD/ILS exchange rate stood at 3.5264.

The US dollar (USD) is the most dominant reserve currency in the world which global central banks hold in large quantities. The US dollar is also considered a safe-haven currency that investors flock to in times of economic turmoil.

According to the Congressional Research Service, the US dollar is involved in nearly 90% of all transactions in foreign exchange markets.

The Israeli New Shekel (ILS) is the official currency of Israel. The ILS replaced the old Israeli Shekel in 1986. The nation’s banknotes are printed in Switzerland. Over the decades, the ILS has been strengthened, supported by Israel’s resilient economy and growing trade surplus.

The monetary policy of central banks was the dominant force in the foreign currency market in 2022 and is expected to continue to exert market influence in 2023. Policymakers typically hike rates to combat high inflation or cut them to encourage economic growth – lower rates stimulate consumer spending. Interest rate differentials – the difference in interest rates between two or more economies – are major drivers of forex exchange rates.

Fear of recession is another key factor in currency rates. During a time of economic turmoil, market participants tend to turn to safe haven currencies like the USD and JPY. If a global recession becomes increasingly possible, USD/ILS rates could rise due to increased inflows to the US dollar.

Furthermore, export-oriented economies like Israel could be affected by lower spending by their trade partners during a recession. Lower Israeli tech exports could lead to a decrease in demand for the Israeli New Shekel.

USD/ILS price action analysis

A study of the historical USD/ILS exchange rate showed the Israeli Shekel gradually strengthening against the US dollar over the last 20 years.

In June 2002, USD/ILS exchange rate was trading at an all-time high of 5.0051. By the end of the first decade of the new millennium, the exchange rate dropped to 3.5399.

Much of the outperformance by the Israeli Shekel was due to strong economic growth, highly skilled labour and an entrepreneurial wave in the Middle East nation.

A technology sector mushroomed in Israel, which thrived over the next decades as more venture capital and tech experts flowed into the country.

“Israel is an entrepreneurial powerhouse and a hotbed for pioneering technologies, profitable business opportunities, and high investment returns,” said Deliotte.

The USD/ISL fall continued into the 2010s amid periodic USD outperformance during 2011-2012 and 2014-2015. By November 2021, USD/ISL rates fell to an all-time low of 3.04.

Since then the US dollar has made a comeback supported by a rate hike cycle started by the US Fed.

USD/ISL posted big monthly gains in April and June 2022, rising about 4.8% each and following it with a 6.9% surge in September. The USD/ISL rose to 3.615 by October, its highest since April 2020.

In parallel, the US dollar index (DXY) which tracks the performance of the US dollar against a basket of developed currencies, rose to a two-decade high in 2022.

The USD fell against the ILS in November as the market priced in slower rate hikes by the US Fed in months to come on the back of easing inflation.

USD demand returned in December as concerns about falling tech expenditure amid a global recession saw investors exchange ILS for USD.

Across 2022, the USD/ILS pair gained about 13.3%. At the time of writing on 4 January 2023, the USD/ILS exchange rate was about 3.525.

Bank of Israel hikes rates

On 2 January 2023, the Bank of Israel hiked rates by 50 basis points to 3.75%, sending borrowing costs to its highest since 2008.

The central bank said Israel’s gross domestic product (GDP) was expected to grow 2.8% in 2023 and 3.5% in 2023, while the unemployment rate among those aged between 25 and 64 was expected to average 4% in both 2023 and 2024. The bank said:

US inflation decelerates

On 13 December 2022, the US Department of Labor reported that the annual US consumer price index (CPI) inflation rate fell for the fifth straight month in November 2022 to 7.1%.

“If current inflation is a guide of how much further the Fed has to hike, recent data points to an imminent end to this hiking cycle. But if the job market is a guide of how long it would take before it decides to cut rates, there is still a protracted period of restrictive monetary policy ahead,” said ING in a 5 January note.

With the US job market still going strong, the US dollar could still have more room to run on a prolonged rate hike cycle by the Fed.

The minutes of the Fed’s December meeting revealed that the Fed members were not ready to take their foot off the pedal.

“In view of the persistent and unacceptably high level of inflation, several participants commented that historical experience cautioned against prematurely loosening monetary policy,” read the 14 December 2022 minutes.

USD/ILS forecast for 2023 and beyond

In their US dollar to Israeli shekel forecast, the Bank of America (BofA) expected USD/ILS to fall over the course of 2023, with exchange rates seen at 3.4 during the first three months and at 3.2 during the last three months of the year. BofA saw USD/ILS falling further to 3.1 by the end of 2024.

Elsewhere, data firm Trading Economics saw the USD/ILS rate at 3.77 in January 2024 in a USD/ILS prediction based on its global macro models and analysts' expectations.

In a USD/ILS forecast for 2025, GovCapital expected the pair to trade at 8.773 by the end of the year. GovCapital did not give a USD/ILS forecast for 2030.

When reading USD/ILS forecasts, it’s important to remember that analysts’ forecasts can be wrong. We encourage you to always conduct your due diligence by reading the latest news, conducting technical and fundamental analyses, and studying a wide range of economic commentary.

Remember, your decision to trade should depend on your attitude to risk, your expertise in the market, the spread of your portfolio, and how comfortable you feel about losing money. You should never trade more than you can afford to lose

Interested in comparing the major forex pairs? Try our currency strength meter.

FAQs

Why has USD/ILS been rising?

The USD/ILS rate rose in 2022 as a rate hike cycle started by the US Fed supported the US dollar throughout the year. In 2022, USD/ILS gained about 13.3% during the year.

Will USD/ILS go up?

The Bank of America (BofA) expected USD/ILS to fall over the course of 2023, with exchange rates seen at 3.4 during the first three months and at 3.2 during the last three months of the year. However it’s important to remember that analysts’ forecasts can be wrong. We encourage you to always conduct your due diligence by reading the latest news, conducting technical and fundamental analyses, and studying a wide range of economic commentary.

When is the best time to trade USD/ILS?

The best time to trade is after you have completed a thorough research on the asset you want to trade or invest in. Remember, your decision to trade should depend on your attitude to risk, your expertise in the market, the spread of your portfolio, and how comfortable you feel about losing money. You should never trade more than you can afford to lose.

Is USD/ILS a buy, sell or hold?

Financial markets are unpredictable, therefore only you can decide whether USD/ILS is a buy, sell or a hold after thorough research. We encourage you to always conduct your due diligence by reading the latest news, conducting technical and fundamental analyses, and studying a wide range of economic commentary. Never invest money you cannot afford to lose.