USD/CHF forecast: Will the franc continue to gain on the dollar?

Are you looking for a USD/CHF forecast? We analyse the recent performance and outlook for the pair

The Swiss franc (CHF) has strengthened to its highest level against the US dollar (USD) since April, on moderating US inflation and a slower pace of interest rate hikes, while the Swiss National Bank (SNB) indicated it will continue to raise rates.

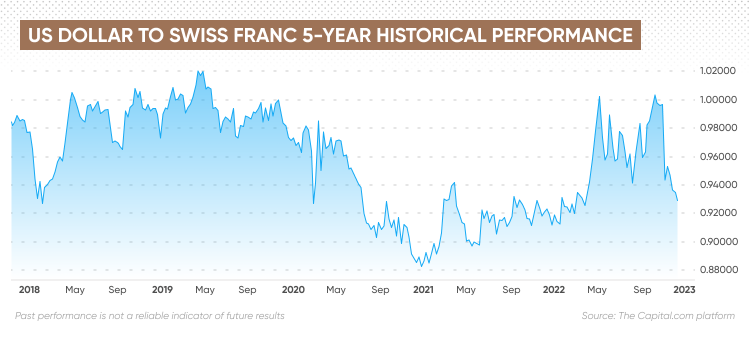

The USD briefly moved above parity with the CHF in early November for the first time since June, but has dropped back to the 0.92 level in December.

USD/CHF live chart

What is driving the fluctuations in the USD/CHF exchange rate? And what is the USD/CHF forecast outlook for 2023 and beyond? We look at the recent movement in the foreign exchange market and the latest forecasts from analysts.

What drives the USD/CHF rate?

In foreign exchange (forex) trading, currencies are traded in pairs that denote their relative value. The USD/CHF pair refers to how many Swiss francs – the quote currency – are needed to buy one US dollar – the base currency.

The USD/CHF is among the 10 most actively traded pairs on the forex markets. The US dollar is the world’s reserve currency. It’s used as a proxy for traders to take a position on the health of the global economy, as well as a safe haven for investors to store their wealth during times of economic or geopolitical uncertainty.

The Swiss franc is also considered to be a safe haven investment, as it is less volatile than the dollar. It’s a way to trade European market drivers, owing to the long-term stability of Switzerland’s economy.

The value of the USD and CHF is driven by economic growth, trade flows and industrial activity, as well as fiscal and monetary policy in both countries. The US dollar has climbed to 20-year highs against a basket of currencies known as the Dollar Index (DXY),. Geopolitical tensions and rising interest rates have increased the dollar’s attractiveness for investors looking for stability and fixed income returns.

The Swiss franc is one of the world’s strongest currencies. The Swiss National Bank does not shy away from intervening in the foreign exchange markets to manage the value of the franc as a way to encourage exports and limit inflation from imports.

“Switzerland’s foreign exchange reserves fell to about CHF790bn ($849bn) in November, the lowest level in nearly two years. The data reflect that the Swiss central bank may be aggressively selling foreign exchange to prevent the depreciation of the Swiss franc, thereby fighting Import Inflation,” according to analysis by Hong Kong bank Hang Seng.

USD/CHF tumbles on dollar retreat

The USD/CHF exchange rate declined in 2020. The attraction of the franc as a safe haven outweighed that of the US dollar as the US weighed the impact of the Covid-19 pandemic on its economy. The pair fell from 0.97 at the start of 2020 to 0.88 by the end of the year. The pair trended higher in 2021 as the US emerged from lockdown restrictions, moving up to 0.91 at the end of the year.

The pair climbed sharply in April and reached parity in May as the US dollar strengthened following the Russian invasion of Ukraine and as the US Federal Reserve (Fed) began raising interest rates.

The central bank started with a 25-basis point (bp) hike in March, which it followed with a 50-point hike in May. The Fed raised rates by 75 bps four times between June and November, and then slowed the pace to 50 points for its 14 December hike to 4.25% to 4.50%.

The Swiss central bank raised its benchmark interest rate by 50 points on 15 December, lifting the rate to 1%. The SNB unexpectedly increased the rate in June for the first time in 15 years, from -0.75% to -0.25%, and then moved the rate into positive territory with a 75-bp hike on 22 September.

For its part, the US central bank indicated it “anticipates that ongoing increases in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time.”

But the committee indicated that it could moderate the pace of rate hikes in 2023:

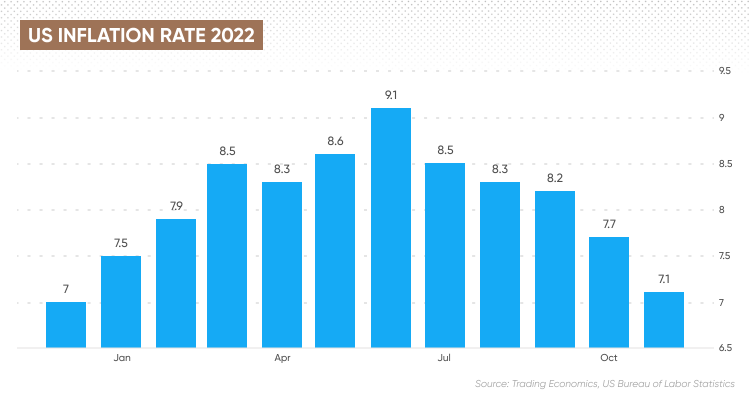

Inflation in Switzerland stabilised at 3% in November, according to data from the Federal Statistical Office. That was down from 3.5% in August, which was the highest level since August 1993. While Swiss inflation remains above the SNB’s 0% to 2% target rate, it is still far lower than the 10% level seen in the neighbouring eurozone and the 7.1% reported in the US.

The US inflation rate rose by 0.1%, less than economists had predicted. The 7.1% rise was the smallest increase in 11 months. That has raised expectations that the Fed will slow the pace of interest rate hikes that have supported the strength in the dollar, while other central banks such as the SNB continue raising rates to shrink their differentials to the US and limit foreign exchange outflows.

The US inflation rate rose by 0.1%, less than economists had predicted. The 7.1% rise was the smallest increase in 11 months. That has raised expectations that the Fed will slow the pace of interest rate hikes that have supported the strength in the dollar, while other central banks such as the SNB continue raising rates to shrink their differentials to the US and limit foreign exchange outflows.

Higher interest rates make a country’s currency more attractive, as investors sell their assets in other markets to buy the currency with the aim of making higher returns.

The USD/CHF pair traded between 0.943 and 1 from May until 3 November, when it reached 1.01, and then dropped sharply to 0.92 on 14 December as the US dollar weakened.

What is the outlook for the US dollar to Swiss franc forecast? We look at the latest analysis below.

USD/CHF forecast: Analysts’ comments and predictions

Analysts at Dutch bank ING “back a stronger dollar into early 2023 and favour the defensive Japanese yen and Swiss franc when the dollar does properly turn.”

“On the assumption that inflation differentials between Switzerland and its trading partners do not immediately narrow, we assume that the SNB will want further nominal appreciation in 2023. The big question is through which channels this occurs. The recent sharp fall in USD/CHF has taken the pressure off the EUR/CHF axis to make the adjustment,” according to the analysis.

Analysts at Hong Kong based HSBC also saw the potential for the USD to turn lower in 2023 as US interest rates stabilise, although they do not expect a rate cut until 2024.

“In the end, a slower hiking pace and a recognition that the Fed is in the late stages of the tightening cycle are part of why we expect further USD downside in 2023. The forces that supported our USD bullish view in 2022 have now lost their momentum, exposing the USD’s stretched rich valuation. The USD’s swift decline in the last two months means that overvaluation is now less stretched. However, if slowing US inflation allows the Fed to pare back its hawkishness further and global growth avoids an onerous slowdown, the ‘safe haven’ USD will likely weaken further from here.”

HSBC’s technical analysis on 14 December showed that there was support for USD/CHF at 0.9163 and 0.9037, with resistance at 0.9481 and 0.9673. Canada’s Scotiabank saw first support on 15 December at 0.9227 with resistance at 0.9315. The moving average convergence divergence as well as the nine-day and 21-day moving averages showed sell signals but at 34, the relative strength index (RSI) was close to oversold territory.

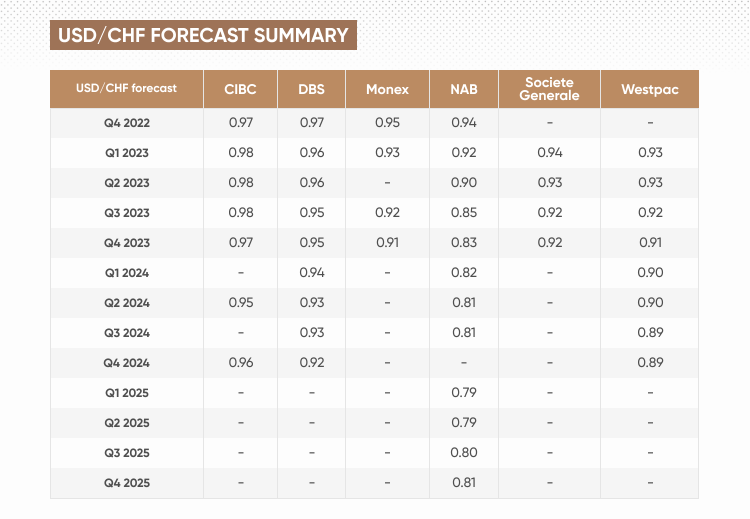

The long-term USD/CHF forecast view from analysts indicates that the pair could move further away from parity over the coming years as the dollar weakens. But they did not quite agree on the level the forex pair could reach. Predictions ranged from 0.94 to 0.97 for the end of 2022 and from 0.83 to 0.97 for the end of 2023.

The long-term USD/CHF forecast view from analysts indicates that the pair could move further away from parity over the coming years as the dollar weakens. But they did not quite agree on the level the forex pair could reach. Predictions ranged from 0.94 to 0.97 for the end of 2022 and from 0.83 to 0.97 for the end of 2023.

The USD/CHF forecast for 2023 from the National Australia Bank (NAB) is at the low end of the range, with Canada’s CIBC predicting a stable exchange rate. NAB’s USD/CHF forecast 2025 indicates that the pair could fall to 0.79 in the first half of the year and end it at 0.81, down from 0.94 at the end of 2022. The USD/CHF prediction from Australia’s Westpac also estimates that the rate could fall below 90, albeit in the third quarter of 2024, rather than NAB’s forecast of the third quarter of 2023.

Given the volatility of exchange fluctuations, analysts have yet to issue a USD/CHF forecast for 2030.

When using any USD/CHF forecast to inform your trading decisions, we recommend that you always do your own research. Look at the latest market trends, news, technical and fundamental analysis, and expert opinion before making any investment decision. Keep in mind that past performance is no guarantee of future returns. And never invest money you cannot afford to lose.

Stay up to date with the major forex pairs using our currency strength meter.

FAQs

Why has USD/CHF been dropping?

The USD/CHF pair has fallen from above parity since early November as the US dollar has weakened while the Swiss National Bank has intervened in the foreign currency markets to maintain a strong franc to limit import inflation.

Will USD/CHF go up or down?

The direction of the USD/CHF exchange rate will depend on monetary policy in the US and Switzerland as well as trading activity and economic growth.

When is the best time to trade USD/CHF?

The best time to trade on forex markets is around the release of major economic announcements, such as trade data, inflation and interest rates.

Is USD/CHF a buy, hold or sell?

How you trade the USD/CHF pair is a personal decision you should make based on your personal circumstances and risk tolerance, among other factors. You should do your own research to take an informed view of the market. Remember, past performance does not guarantee future returns. And never trade with money you cannot afford to lose.