US Russell 2000 forecast: Will the index recover in 2023?

Hopes that a recession would prompt the Fed to alter its monetary policy may help US Russell 2000 to recover.

The Russell 2000 index (RTY) has gained in 2023 amid wider optimism and the slowing of the US Federal Reserve’s (Fed) rate hiking cycle.

The small-cap RTY index, which is viewed as a proxy for the strength of the US domestic economy, rose over 10% year-to-date (YTD) as of 9 February. Russell 2000 performance widely mimicked the wider market with the US benchmark S&P 500 (US500) also gaining 9% this year.

Russell 2000 Index (RTY) live chart

Will the index maintain the momentum and how will small-cap stocks perform in 2023? Here we take a look at the latest US Russell 2000 forecast.

What is the US Russell 2000 index?

The Russell 2000 Index (RTY), also known as the Russell 2K, was launched in January 1984.

The index tracks the performance of 2,000 small-cap stocks that make up Russell 3000, a larger index that accounts for 98% of the US stock market. Russell 2000 makes up 10% of the total Russell 3000 market capitalisation.

Russell 2000 is a market-cap weighted index, which means that the weight of each holding is proportional to its market capitalisation compared to other stocks.

The index is widely regarded as a bellwether of the US economy due to its emphasis on smaller companies with a focus on the US market.

As of 31 January 2023, industrials, financials and healthcare had the largest weighting in the Russell 2000, followed by consumer discretionary and technology. The index’ top constituents, according to FTSE Russel’s website included:

-

Iridium Communications (IRDM)

-

Matador Resources (MTDR)

-

Crocs (CROX)

-

Saia (SAIA)

-

Inspire Medical Systems

-

Emcor Group (EME)

-

Rbc Bearings (ROLL)

-

Halozyme Therapeutics (HALO)

-

Texas Roadhouse (TXRH)

-

Shockwave Medical (SWAV)

The index composition is subject to change in line with the market capitalisation of the index stocks, or any adjustment resulting from index reshuffle.

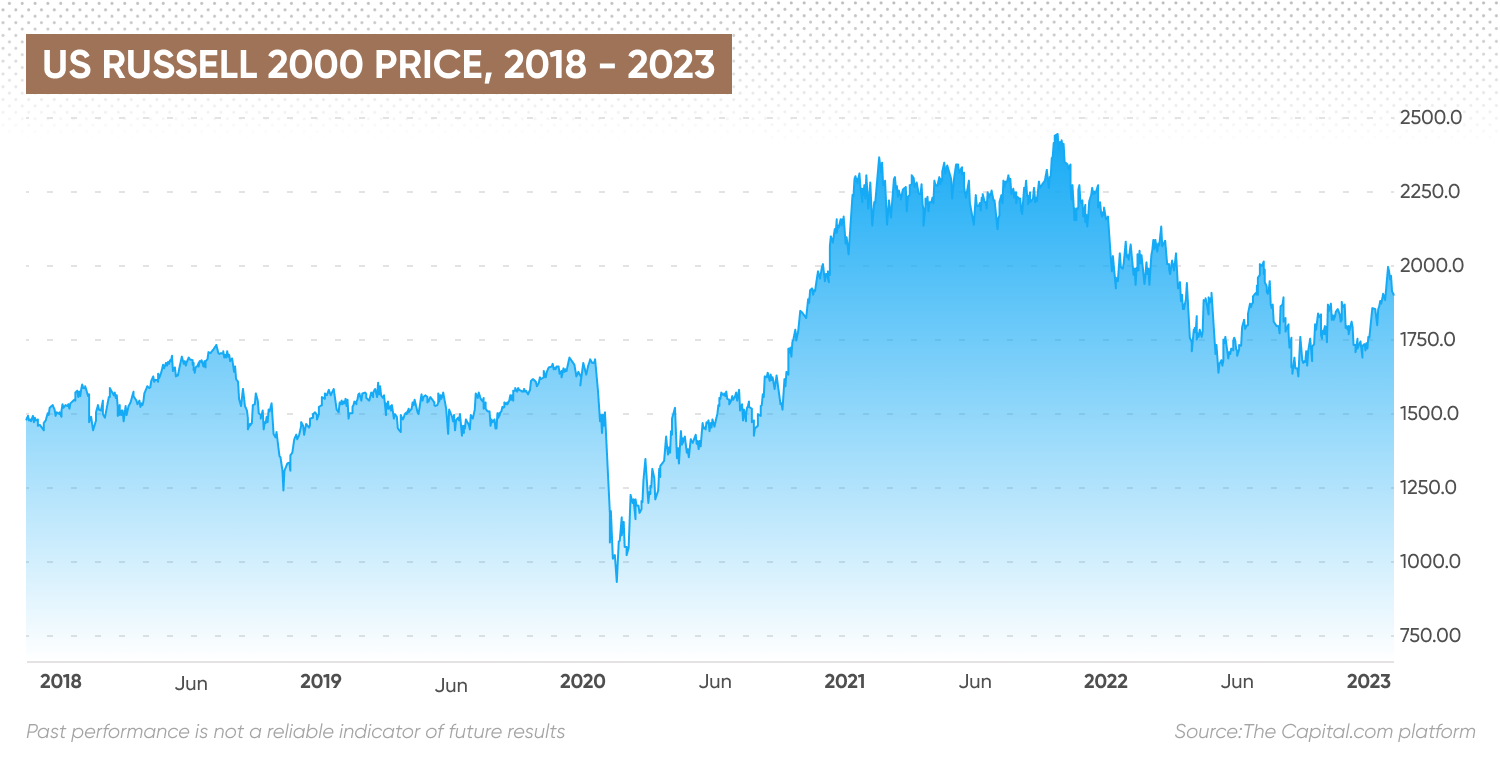

Russell 2000 historical price action

Over the course of 2020, as seen on the Russell 2000 historical chart, the index struggled through a volatile ride amid a global sell-off in equity markets at the start of Covid-19 pandemic in March 2020. The index plunged to 1,013.89 on 16 March.

The index started to climb back as the Fed stepped in with monetary policy loosening and the government launched economic packages to rescue the economy.

The small-cap index surged more than 26% in the fourth quarter of 2020, significantly eclipsing the Russell 1000, as vaccine breakthroughs and steadfast monetary and fiscal support spurred economic recovery for the coming year.

Outperforming healthcare and tech sectors boosted the Russell 2000 performance during the peak of the pandemic in 2020. Pharmaceutical and biotechnology achieved 5.6% return in 2020, while tech software delivered 3.3% gain to the index.

The index continued its stellar performance into 2021 despite the persistent Covid-19 pandemic and mounting worries about the US economic recovery. The Russell 2000 gained 14.8% in 2021.

RTY suffers bear market in 2022

The bull run reversed its course in 2022 as the Fed began its tightening cycle. Russia’s invasion of Ukraine and China’s massive lockdowns to combat new Covid-19 outbreaks have put pressure on the equity markets as concern about global economic slowdown intensified.

The index lost 20.4% in the full year amid wider market slump and investors sentiment shift to risk-off. Its senior peer, the Russell 1000, fared better than the small-cap index “as investors favoured larger, less volatile players across sectors” according to the Russell US Indexes Spotlight report.

Fed’s monetary policy and fears of recession

In 2023, the RTY index managed to recover some losses, rising over 10% year-to-date in line with the wider stock markets, as the Fed slowed interest rate hikes to 25 basis points (bps) in February.

News on macroeconomic headwinds have been the main factor driving equity markets. Small-cap stocks tend to rally when the economy is growing. On the other hand, economic pessimism and fears of recession hurt investor sentiment on small-caps.

When a central bank increases its key interest rate, it typically affects other rates such as mortgage and loan rates. High interest rates would increase borrowing costs for companies, affecting their earnings. Higher borrowing costs could also encourage companies to slow spending for expansion.

The US Fed hiked rates seven times in 2022 to combate multi-decade high inflation, bringing the federal funds rate to 4.25% to 4.50% by the end of the year. Although the central bank has slowed the hiking speed lately, raising the rate by 25bps in the February 2023 meeting, the damage has been done.

Over 40% of Russell 2000 companies were already unprofitable in 2022, according to a Morgan Stanley report. The key risk on the downside is that higher borrowing costs and weaker demand may continue to hurt small businesses included in the RTY index

When will the Fed pivot its key rate remains the billion-dollar question. As of 8 February, analysts at ING expected the rate to go as high as 5% in the first half of 2023, before falling back to 3% in 2024.

Meanwhile, the forecasts for the US economy were equally pessimistic. The Dutch bank saw it contracting by -0.5% in the third quarter and by -0.9% in the final quarter of 2023, which would mean a technical recession and tough times for small-caps. Overall, the economy was expected to grow by 0.1% in the full-year of 2023, speeding up to 1.5% in 2024 and 2%

Small-caps enjoy discounted valuations

Yet despite small-caps being particularly affected by economic uncertainty, their valuations look compelling according to the analysts at Alliace Bernstein. They said in December 2022:

Meanwhile, global chief investment officer at Voya, Matt Toms, pointed out in December that small-caps trade at a “40% price-to-earnings discount to their large-cap counterparts - the biggest gap since 2003.”

US Russell 2000 forecast: Price targets from 2023 to 2025

So where is the small-cap index heading to in 2023 and what’s the latest US Russell 2000 outlook?

Capita.com’s senior analyst Justin McQueen said that downside risks are likely to persist, with the Fed remaining hawkish and the US inflation report in focus. He said:

Justin added that the risk remains that the next consumer price index (CPI) reading - the US gauge of inflation rate - comes above analyst expectations:

In its RTY forecast as of 9 February, economic data provider Trading Economics expected the index to trade at 1,920.41 by the end of this quarter and at 1,737.57 in one year.

Trading Economics did not provide a US Russell 2000 forecast for a longer term. However, algorithm-based price forecasting services, such as WalletInvestor, offer up to five-year projections using US Russell 2000 futures historical price.

The service was bullish on the index futures, suggesting US Russell 2000 was a good long-term investment as of 10 February. In its US Russell 2000 forecast for 2023, it estimated that the small-cap index futures could trade at 2,066.504 by December 2023.

Its US Russell 2000 forecast for 2025 projected the index futures to rise to 2,327.451 by December 2025, and to 2,515.386 in July 2027. The service did not provide the US Russell 2000 forecast for 2030.

Note that analysts and algorithm-based RTY predictions can be wrong. Forecasts shouldn’t be used as a substitute for your own research. Always conduct your own due diligence. And never invest or trade money you cannot afford to lose.

FAQs

Is Russell 2000 a good investment?

Whether the RTY index is a good investment will depend on your risk tolerance, investing goals and portfolio composition. You should always conduct your own due diligence before investing. And never invest or trade money you cannot afford to lose.

Will Russell 2000 go up or down?

In its RTY forecast as of 9 February, economic data provider Trading Economics expected the index to trade at 1,920.41 by the end of this quarter and at 1,737.57 in one year. Note that their predictions can be wrong.

What companies are in the Russell 2000 index?

The Russell 2000 Index tracks price performance of 2,000 small-cap US companies from 10 sectors: basic materials, consumer discretionary, consumer staples, energy, financials, health care, industrials, real estate, technology, telecommunications and utilities.

What are the largest companies in the Russell 2000?

As of 31 January 2023, the index’ largest companies included Iridium Communications (IRDM), Matador Resources (MTDR) and Crocs (CROX). Note that the index top constituents are subject to change.

Should I invest in Russell 2000?

Whether you should invest in RTY index depends on your risk tolerance, investing goals and portfolio composition. Always conduct your own research. Remember that past performance does not guarantee future returns, and never invest or trade money that you cannot afford to lose.