USD/LKR forecast: Will the Sri Lankan rupee keep falling?

With the economic and political crisis deepening, could USD/LKR rise to a new record high in 2023 and beyond?

As of October, the Sri Lankan rupee (LKR) has been one of the worst-performing currencies of 2022. As economic and political turmoil grip the country, could LKR fall further in 2023?

Here we look at the latest USD/LKR news and analysts’ predictions for the US dollar to Sri Lankan rupee pair.

How has USD/LKR performed so far this year?

The USD/LKR pair started 2023 around the 363 mark, but has been down 12% year-to-date.According to Asian Development Bank (ADB) data, Sri Lanka is estimated to see a contraction in its economic growth in 2023.

In 2022, Sri Lanka's economy contracted by 11% and is further expected to shrink by 3% in 2023 as it continues to grapple with the challenge of debt restructuring and balance of payments difficulties,

Why has the Sri Lankan rupee been falling?

The weak economic picture in Sri Lanka has been dragging on the value of the rupee. The country has recently been facing its worst financial crisis in over 70 years, culminating in the default of its debt payments.

The government has cited the pandemic as the cause of the collapse of the economy. However, some economists believe that serious political mismanagement and the racking up of debts with China have also played their part. With foreign reserves running low, the country has struggled to finance the import of essentials, such as food and fuel, since last year.

Fuel reserves have fallen to unprecedented lows, resulting in a sales ban being applied and public transport grinding to a halt. Food shortages are rife and long periods of blackout have become common.

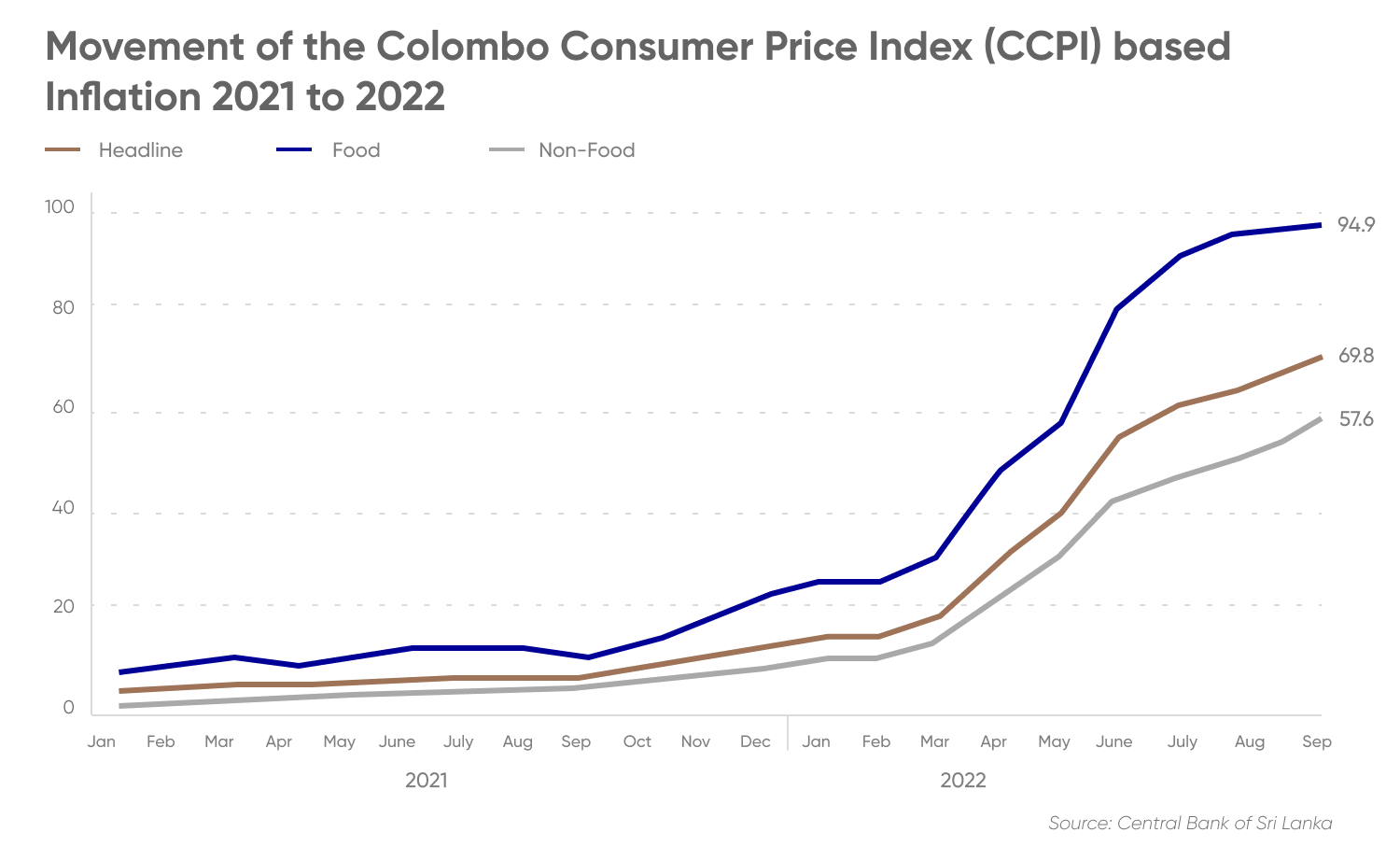

Data from the Central Bank of Sri Lanka announced in February that headline inflation, as measured by the year-on-year (Y-o-Y) change in the Colombo Consumer Price Index (CCPI, 2021=100) decreased to 50.6% in February 2023 from 51.7% in January 2023. The decline in the headline inflation is broadly in line with the disinflation path envisaged by the Central Bank of Sri Lanka (CBSL) in January 2023.

The Central Bank of Sri Lanka said in a statement:

Inflation has risen to a record high of 69.8% year-over-year (YOY) as of October.

The Monetary Board of the Central Bank of Sri Lanka, at its meeting held on 04 April 2023, decided to maintain the Standing Deposit Facility Rate (SDFR) and the Standing Lending Facility Rate (SLFR) of the Central Bank at their current levels of 15.50 per cent and 16.50 per cent, respectively.

The CBSL said.

Central bank Governor Nandalal Weerasinghe said a favourable base effect would start from May, while reductions in fuel prices would help achieve a faster pace of disinflation going ahead.

Governor Nandalal Weerasinghe said:

CBSL raised rates by 100 basis points in early March. This was the first increase in seven months and was part of the country's efforts to finalise a four-year IMF programme to help the island emerge from its worst financial crisis in more than seven decades.

In its most recent policy report, the bank said: “Having considered the recent and expected economic developments, and macroeconomic projections on domestic and global fronts, the Board viewed that the maintenance of the prevailing tight monetary policy stance is necessary to ensure that monetary conditions remain sufficiently tight to facilitate the continuation of the ongoing disinflation process amidst the improvements in market sentiments following the finalisation of the Extended Fund Facility (EFF) from the International Monetary Fund (IMF) and the downward shift in elevated market interest rates reflecting the falling risk premia."

“Inflation is projected to follow a faster disinflation path, thereby further anchoring inflation expectations”

In January, President Ranil Wickremesinghe said the country's economy could contract by -3.5% or 4.0% in January.

Wickremesinghe said:"From 2024, we will take this economy to positive growth. We are creating a strong country that does not bow down to anyone and is debt-free. The growth rate of the economy in 2022 was -11% and could be -3.5 or -4.0% this year."

The government is ready to implement prudent economic management after successful debt restructuring.

With contractionary monetary and fiscal policies already in place, alongside the measures to curtail non-urgent import expenditure, analysts expect this to result in a notable contraction in credit to the private sector and possible upside risks to unemployment in the near term.

On 20 March, the IMF Board approved a 48-month extended arrangement under the Extended Fund Facility (EFF) of SDR 2.286 billion (about US$3 billion) to support Sri Lanka’s economic policies and reforms.

The International Monetary Fund (IMF) has been in and out of talks with the country to arrange a bailout package, amid hopes that Sri Lanka’s political problems can be solved. In a recent press briefing, the IMF said:

Following the Executive Board discussion on Sri Lanka, Ms. Kristalina Georgieva, Managing Director, issued the following statement:

What is driving the US dollar?

The US dollar has seen an impressive surge in 2022. The US dollar index (DXY), which values the USD against a basket of major currencies, rose to a 20-year high at the end of last month at 114.78.

However, the index has since corrected slightly but remains in an ascending channel at 113.43 at the time of writing on 21 October.

The annual inflation rate in the US slowed only slightly to 6.4% in January of 2023 from 6.5% in December, less than market forecasts of 6.2%. Still, it is the lowest reading since October 2021. This was caused by supply chain issues, the war in Ukraine, which upended global trade and sent fuel prices surging. The US was propped up by government handouts and savings, consumers managed to bounce back from pandemic shutdowns only to find a short supply of everything from used cars to housing, which has triggered a cost of living crisis.

High inflation levels have encouraged the Fed to adopt a more aggressive approach to raising interest rates. The Federal Reserve delivered its nineth straight interest rate increase in March and the Board of Governors of the Federal Reserve System voted unanimously to approve a 1/4 percentage point increase in the primary credit rate to 5 percent, effective 23 March 2023.

The Fed also forecast raising interest rates to 5.1 percent by the end of 2023, before coming down to 4.3 percent by the end of 2024.

Hawkish Federal Reserve bets have been rising for some time. However, fears are also growing that the Fed could tip the US economy into recession by hiking too aggressively. The fears have also driven a safe play in the greenback.

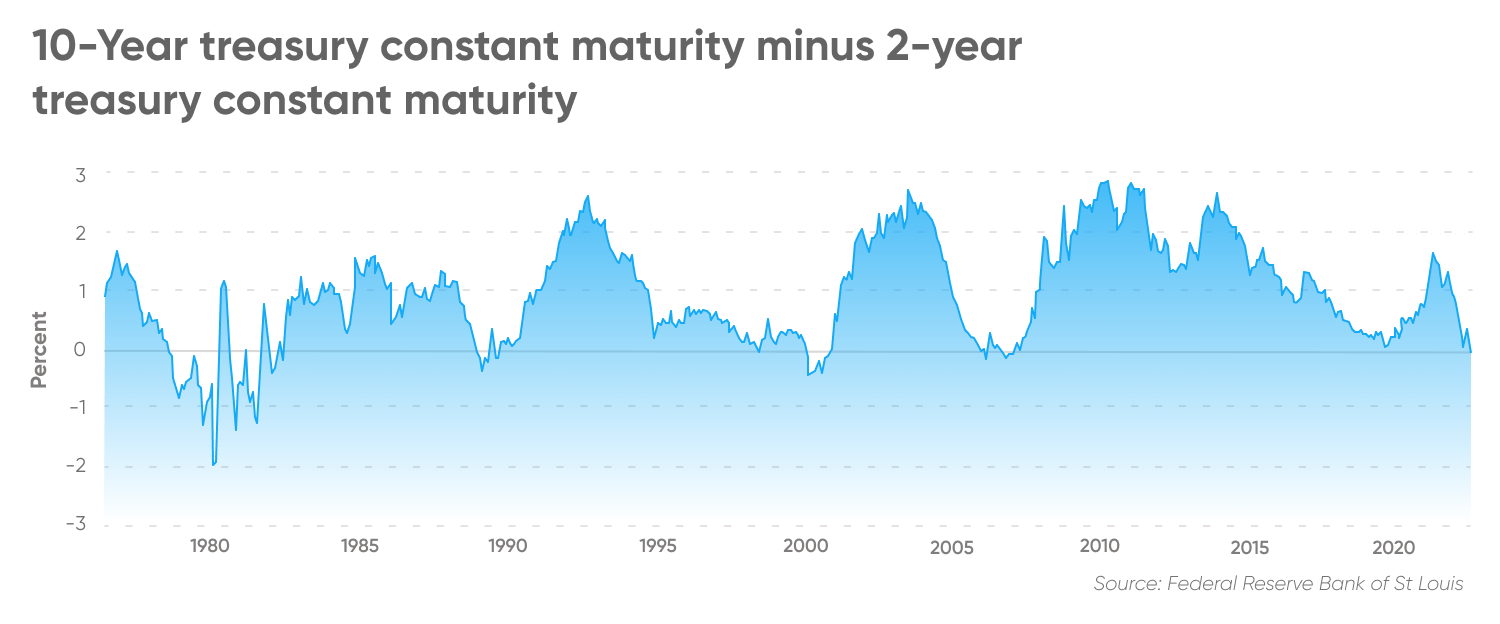

Whether the US economy falls into a recession or not remains to be seen. However, there are some signs in the market that a recession could be coming. For example, the two-year and 10-year US Treasury yields have inverted. This is traditionally considered a warning signal for a recession in the US.

USD/LKR forecast for 2022 and beyond

So, where could the US dollar to Sri Lanka rupee forecast go from here? Given that there are a rupee weakness and a dollar strength story in play, let’s see what the analysts think.

Sri Lanka’s rupee, which became the world’s best performing currency in 2022 amid hopes of an International Monetary Fund bailout, may resume declines and lose a fifth of its value against the dollar by end-2023, according to Fitch Solutions.

Seah Wang Ting, country risk analyst at Fitch Solutions said:

Fitch maintained its forecast for the rupee to weaken to a record low of 390 per dollar by year-end.

Sri Lanka has increased taxes, cut energy subsidies and loosened its grip on the currency to secure the IMF loan. The central bank recently lifted borrowing costs further to ensure that inflation which has slowed from nearly 70% doesn’t flare up.

Fitch said in a report:

The Sri Lankan rupee may also be pressured by tightening global monetary conditions, according to Fitch. Federal Reserve Chair Jerome Powell told the Senate Banking Committee in March that the ultimate level of interest rates is likely to be higher than previously anticipated.

Analysts at ING were relatively bullish in their USD outlook, saying:

The USD/LKR forecast 2023 from Trading Economics, predicts that The Sri Lankan Rupee is expected to trade at 325.05 by the end of this quarter. Looking forward, we estimate it to trade at 357.15 in 12 months time.

The USD/LKR forecast from algorithm-based forecaster Wallet Investor predicted in the longer term, its USD/LKR forecast for 2025 saw the rate rising to 501.558 by the end of the year.

Wallet Investor’s predictions for 2027 saw the pair rising further to 582.878 by October of that year. Continuing with this trend, the USD/LKR forecast for 2030 could be higher still. However, at the time of writing, no services offered a USD/LKR prediction that far into the future.

When looking at USD/LKR forecasts, remember that analysts can and do get their predictions wrong. We recommend you always research and consider the latest market trends and news, technical and fundamental analysis and expert opinion before making any investment decisions, and never invest money you cannot afford to lose.

Interested in comparing the major forex pairs? Try our currency strength meter.

FAQs

Why has USD/LKR been rising?

The USD/LKR has been rising due to a combination of USD strength and LKR weakness.

LKR has dropped as Sri Lanka suffers its worst economic crisis in seven decades, with foreign exchange reserves depleted and debt unsustainably high.

Will USD/LKR go up or down?

Where USD/LKR goes from here depends on whether the economic and political picture in Sri Lanka improves.

Given the extent of the crisis and the fact that few are prepared to invest in the country, the outlook is bleak for now.

When is the best time to trade USD/LKR?

The best time to trade USD/LKR is 08:00 to 12:00 ET (UTC -5). This is when US economic data is usually released.

Is USD/LKR a buy, sell or hold?

Only you can know what the right choice is for you concerning USD/LKR. You should do your own research and take into account the economic outlook of each country, GDP, imports, exports, inflation data and foreign exchange reserves.

Remember never to invest money you cannot afford to lose.