What is a stop order?

What is a stop loss?

A stop-loss order in trading is a directive you give to your broker to close a losing position when the price falls (in case of a long position) or rises (in case of a short position) to a certain predetermined price level. This way, traders can manage their potential losses if the market doesn't move in their favour

Key takeaways

-

A stop-loss order is a risk management tool that allows traders to limit potential losses in case of adverse market moves.

-

Setting up a stop-loss order depends on a trader's risk tolerance and the chosen trading strategy; the stop loss will automatically close a losing position at the predefined price level or worse.

-

Guaranteed stop-loss orders ensure closure at the exact predetermined price level, providing full protection against slippage, although they come at an additional cost.

-

Trailing stop-loss orders, adjusting to favourable price movements, can help lock in profits when the market trends in the trader's favour, providing a dynamic approach to managing positions.

How does a stop loss work?

A stop loss can be used in a variety of strategies, and is generally a risk-management tool that lets a trader manage their losses. Traders typically set a stop loss when they open a position, yet they can also apply a stop loss to a trade that’s already running.

How to set a stop loss

To set up a stop-loss, a trader first needs to decide the price level at which they would like to stop a potential loss. This level would depend on a trader’s risk tolerance and the trading strategy they are employing.

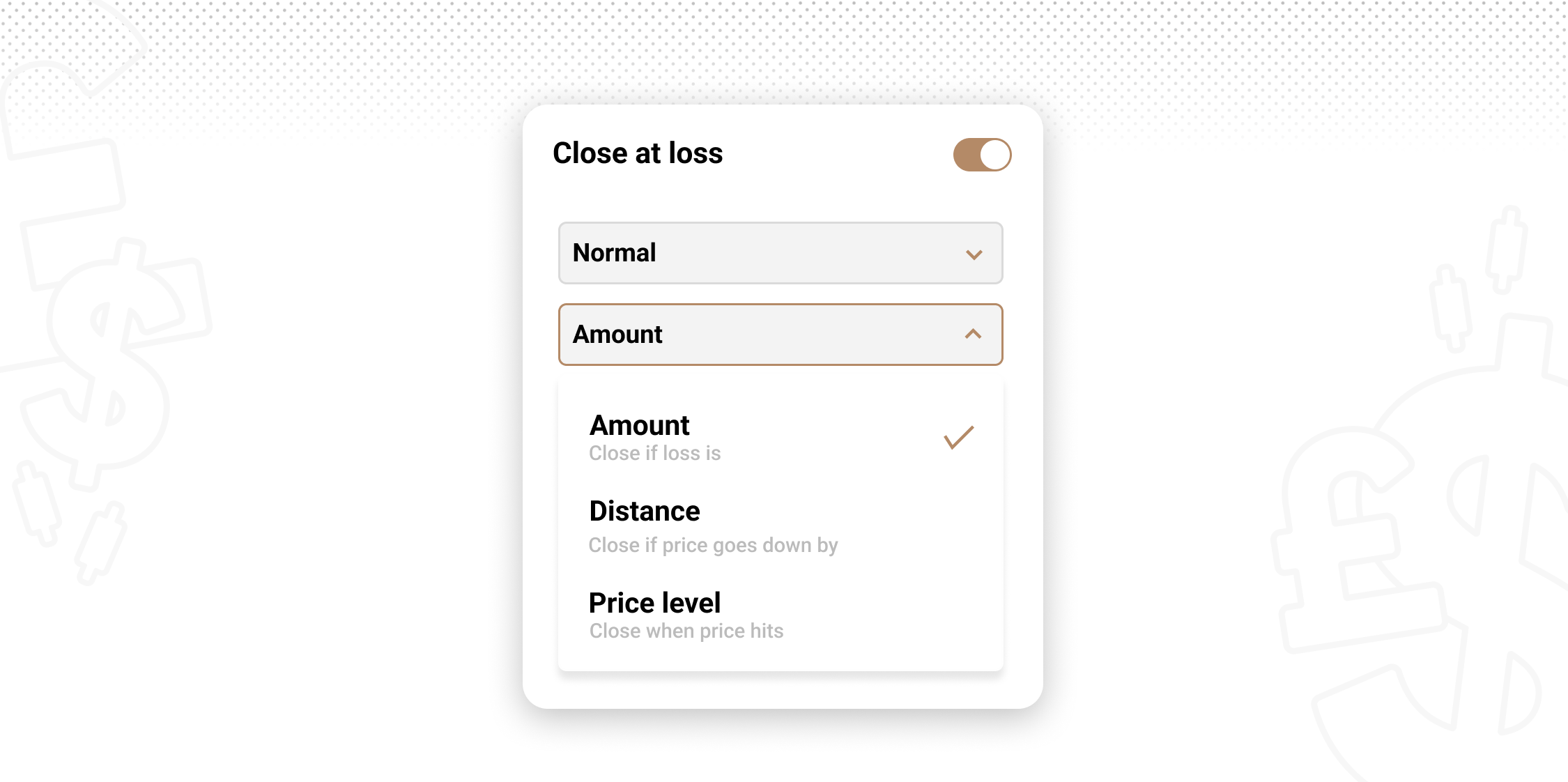

Note that some brokers, including Capital.com, may offer to set a stop-loss order based on the desired profit’s amount or price distance from opening, rather than the price level only.

When the price is reached, the stop-loss will automatically close the position at the predefined level or worse. Hence, with ordinary stop losses there is always the risk of a slight variation in the final execution price due to market volatility, slippage and liquidity issues. A guaranteed stop-loss, on the other hand, protects from slippage but comes at a fee.

Types of stop losses

There is more than one type of a stop loss. As mentioned above, the guaranteed stop loss will always close the position at the predefined level, protecting from slippage.

Meanwhile, a trailing stop loss will act as an ordinary stop loss in the way that it won’t protect from slippage, but it will adjust when the market is trending in the trader’s favour. The trailing stop loss, therefore, can help in booking profits if the position’s entry level and the trailing stop loss break even.

Note that ordinary and guaranteed stop losses can too be adjusted when the price moves in the trader’s favour, yet it would have to be done manually.

| Ordinary stop loss | Guaranteed stop loss | Trailing stop loss | |

| Triggered at | The predetermined price level or worse | The predetermined price level | The predetermined price level or worse |

| Adjusts to favourable price movements | No | No | Yes |

| Additional cost | No | Yes | No |

Stop order example in trading CFDs

Stop losses can be employed across a wide array of markets and with any financial asset. This includes the use of stop-loss orders in stock market trading and with derivatives, such as contracts for difference (CFDs).

Suppose you open a long position on a stock CFD from a technology company XYZ, purchasing it at a price of $115 per contract, with the expectation that the price will rise. However, you also want to limit your potential losses if the market doesn't perform as expected. Thus, you decide to place a stop loss order at $110.

Over the next few days, the price of XYZ fluctuates, but it remains above your stop loss level. Then, due to an unexpected market event, the price suddenly drops to $110. Your stop loss order is immediately triggered, and your CFD position is automatically closed at the next available price.

This action effectively limits your loss to $5 per contract (plus trading costs). Without a stop loss, if the price had continued to drop, say to $105 or $100, your losses would have been far greater. A stop loss order, in this case, protected your trading capital from further downward price movement.

Why use a stop loss?

-

Risk management: Stop loss orders are a simple yet effective risk management tool. You're able to set the maximum loss you're prepared to accept, giving you better control over your financial exposure.

-

Emotion check: Trading can be an emotional roller coaster. A stop loss helps keep emotions in check, as it can prevent panic selling during market downturns.

-

Trading discipline: Implementing stop losses can promote discipline in your trading strategy. It can ensure you stick to your trading plan, regardless of market fluctuations.

-

Time efficiency: Once a stop loss is set, you don't have to constantly monitor your trades. This leaves more time to focus on analysing the markets.

Final thoughts

In a nutshell, stop-loss orders serve as valuable risk-management tools for traders, providing a safety net against potentially significant losses. Whether it's an ordinary stop-loss, guaranteed or trailing, each has its unique perks and considerations.

An ordinary stop-loss offers cost-efficiency and basic protection. In contrast, a guaranteed stop-loss provides certainty of the exit price at an extra cost, and a trailing stop-loss delivers a dynamic solution that adjusts to favourable market movements.

Remember, stop-loss use doesn't guarantee profitability, as each trade's outcome still largely depends on a host of factors, including market volatility, strategy effectiveness, and the trader's skill. As always, conduct thorough due diligence and never trade more money than you can afford to lose.

FAQs

What is a stop-loss?

A stop-loss is a trading order used to limit potential losses. It instructs a broker to close a position when a certain price is reached.

How does a stop order work?

A stop-loss order is an instruction to your broker to close a losing trade when the price reaches a specified level. For a long position, a stop-loss order gets triggered when the price falls to the set level. Conversely, for a short position, the stop-loss gets activated when the price rises to the specified level. The key purpose of a stop-loss order is to limit potential losses on a trade, helping to manage risk.

Where should I place my stop-loss order?

The placement of your stop-loss depends on your risk tolerance and trading strategy. It's usually set at a price point that, if reached, would indicate that the initial trade idea was incorrect.

What is an example of a stop order?

If you buy a stock CFD at $100 and set a stop loss at $90, if the price drops to $90 or below, the stop loss order would trigger and sell the CFD to limit further loss.

What's the difference between stop loss and limit order?

A stop-loss order is triggered when the price reaches a predetermined level and aims to limit potential losses. A limit order is executed at a specific price or better, aiming to achieve a specific target price or better.

What is a good stop-loss percentage?

A good stop-loss percentage depends on individual trading strategy and risk tolerance. It varies based on factors like volatility and trader's risk profile. Always conduct thorough due diligence before trading.