Twitter shareholders: Does Elon Musk own the most TWTR stock?

Elon Musk, Vanguard Group and BlackRock are among the top Twitter shareholders.

Twitter (TWTR) is among the most popular social media platforms in the world alongside Facebook (META), Instagram and Snapchat (SNAP). The micro-blogging site’s wide appeal across various age groups has seen the platform amass about 237.8 million daily active users, according to its Q2 2022 earnings report.

The company has some famous names on its shareholders list from global asset managers like Vanguard Group and Blackrock (BLK) to notable personalities like Elon Musk and Prince Alwaleed bin Talal.

Retail shareholders of Twitter may find it beneficial to follow the actions of the company’s biggest investors as their activity may have a significant impact on the share price. Luckily, parties with shareholding over 5% of a publicly-listed company's total stock issue have to report their ownership to the US Securities and Commission (SEC).

With regards to Twitter, a number of the company’s largest institutional shareholders are publicly-listed companies, which allows retail investors to assess information about their holdings at a deeper level.

Yet who owns the most shares in Twitter? Here we take a look at the Twitter shareholders and how much of the stock they own.

What is Twitter?

Twitter is a micro-blogging platform which was founded in 2006 by Jack Dorsey, Noah Glass, Biz Stone and Evan Williams. The company, based in San Francisco, became listed on New York Stock Exchange (NYSE) in 2013 under the ticker TWTR.

On 29 November 2021, Twitter announced that co-founder Jack Dorsey has decided to step down as CEO. Parag Agrawal, who was serving as CTO, was chosen as Dorsey’s successor.

In April 2022, Agrawal faced a trial by fire as Tesla (TSLA) co-founder and Twitter shareholder Elon Musk disclosed a 9% stake in the company and launched an unsolicited bid to buy Twitter with an all-cash offer of $54.20 a share.

Musk also voiced this intent to take the company private. The parties agreed to a deal on 25 April 2022 upon the closure of which Twitter would be delisted from the NYSE.

However, less than three months later Musk sent a notice to Twitter to terminate the acquisition deal citing alleged breach of information sharing agreement and “materially inaccurate representations”, among others. In response, Twitter has filed a lawsuit against Musk. The trial is being scheduled for October 2022, according to the company.

Twitter shareholders: Top five

According to Twitter’s latest 10-K form filed on 10 February 2022, its total common stock outstanding stood at 800.64 million.

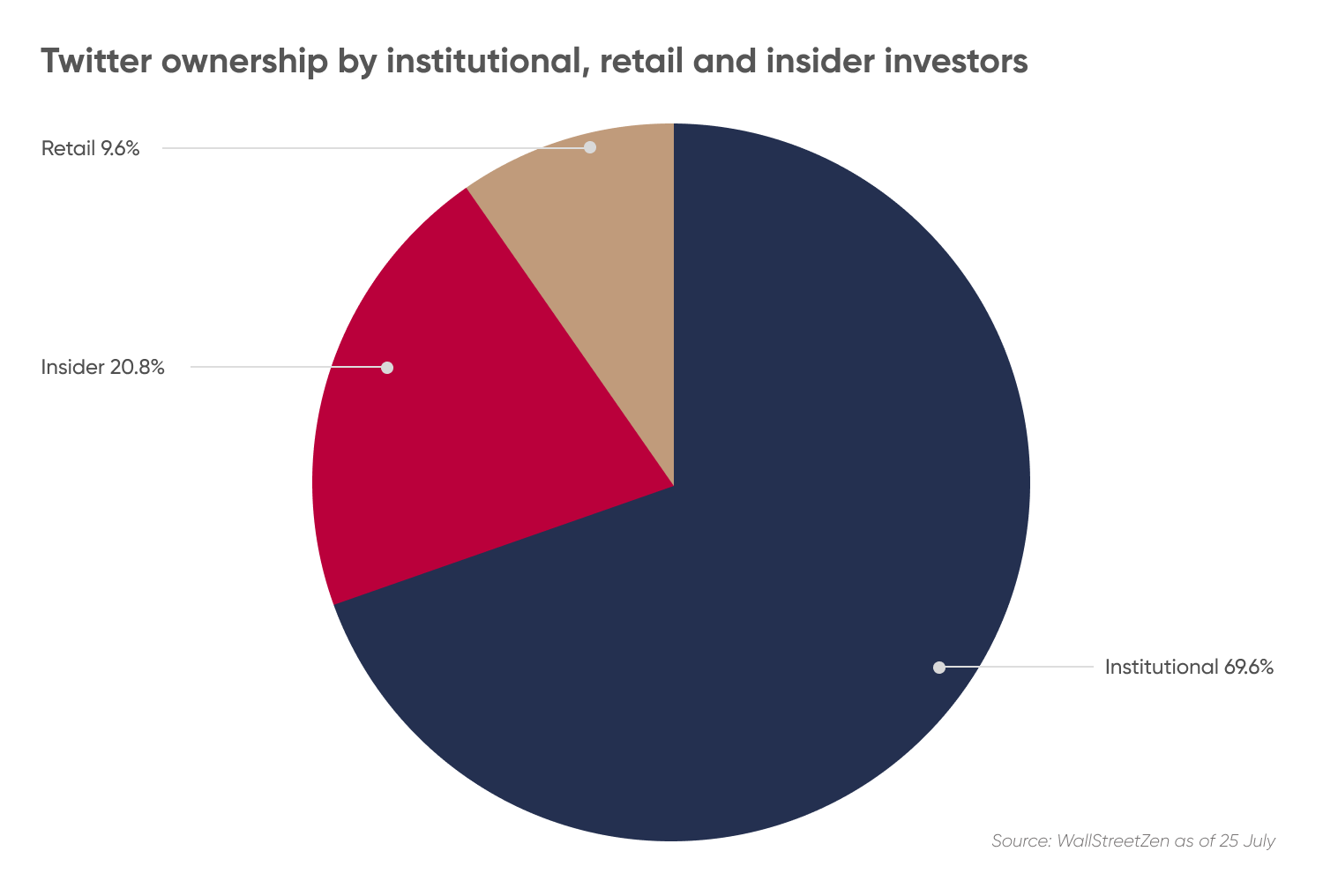

Institutional investors, which included hedge funds, investment banks and mutual funds, dominated stock ownership and accounted for about 70% of the company’s total outstanding shares, according to WallStreetZen data, as of 25 July 2022. Company insiders held about 20% of the stock, while the remaining 10% was held by retail investors.

Among institutional investors, Vanguard Group, Blackrock (BLK) and Morgan Stanley (MS) topped Twitter's major shareholders list with 10.78%, 6.70% and 4.95% stakes, respectively.

According to the SEC filing, as of April 2022, Elon Musk held 9% of the company, making him the biggest individual Twitter shareholder. Among the company insiders, Saudi Arabian investor Prince Alwaleed bin Talal and Twitter founder Jack Dorsey were major Twitter shareholders with 4.57% and 2.67% holdings, respectively.

Vanguard Group and Elon Musk were Twitter’s biggest shareholders controlling about 20% of the company stock together, as of 25 July 2022.

Vanguard Group

Pennsylvania-based investment advisor Vanguard Group was the largest shareholder of Twitter with a shareholding of about 10.3%, according to its form 13G filing dated 31 March 2022. WallStreetZen data, as of 25 July, showed the company owned 10.78% of Twitter.

Vanguard Group was established in 1975. Today Vanguard is the second biggest fund manager in the world with assets under management (AUM) of over $8tn, according to ADV Ratings.

The investment giant is known for its low-cost index-tracking mutual and exchange-traded funds (ETFs). The company also provides a range of investment products, advisory and retirement services to individual investors, institutions, and financial professionals.

Research firm Morningstar reported that Vanguard was the leading long-term mutual fund and ETF provider in the US with a market share of 27%, as of May 2022.

According to Twitter’s last close of $39.84, Vanguard Group’s 82.4 million Twitter shares were worth $3.28bn, as of 24 July 2022.

Elon Musk

On 4 April 2022, a SEC filing revealed that Tesla founder Musk had accumulated over 73.1 million shares in Twitter, representing 9.1% of company stock, to make him Twitter’s largest individual shareholder.

The SEC filing also showed that Musk had bought over 73.1 million shares in Twitter at a price of over $2.64bn in the span of nine weeks between 31 January and 1 April 2022.

On 13 April 2022, Musk offered to acquire all outstanding common stock not owned by him for an all-cash consideration of $54.2 a share.

On 25 April 2022, Twitter signed a deal to be acquired by Musk. However, on 8 July 2022, Musk delivered a notice to terminate the deal citing that Twitter misled investors about the percentage of alleged fake accounts on the platform.

Twitter commenced litigation against its second largest shareholder on 12 July 2022. The trial is scheduled for October 2022, according to the company.

Blackrock

Blackrock is the largest asset manager in the world with AUM worth about $9.5bn, as of the company’s latest earnings report.

The global investment firm held over 52 million shares in Twitter, representing 6.5% of the company’s common stock, according to a SEC filing on 8 February 2022. WallStreetZen data as of 25 July showed that the asset manager held 6.7% of Twitter stock.

This makes the asset managers the third biggest Twitter shareholders, and the second biggest institutional investor.

BlackRock was established in 1999. It’s headquartered in New York, US. The company is a provider of investment, advisory and risk management solutions. Products include single and multi-asset portfolios, investing in equities, fixed income, alternative and money market instruments.

The company is listed on the New York Stock Exchange (NYSE) under the ticker BLK.

According to Twitter’s last close of $39.84, BlackRock’s over 5.2 million Twitter shares were worth over $2.07bn, as of 25 July 2022.

Morgan Stanley

Investment bank Morgan Stanley (MS) was Twitter’s third largest institutional Twitter shareholder and fourth biggest investor of Twitter overall.

According to the company’s SEC filing on 10 February 2022, Morgan Stanley held over 67 million shares in Twitter amounting to 8.4% of the company’s common shares.However, the WallStreetZen data as of 25 July showed that the company held 4.97% of the total Twitter stock.

Morgan Stanley is a global financial service company based in New York. The firm offers various financial services including wealth management, investment banking, trading, advisory and underwriting.

The company has been handling initial public offering (IPO) and private placements since its establishment in 1935. Morgan Stanley went public in 1986 and is listed on the NYSE under the ticker MS.

State Street Corp

Institutional investment services provider State Street Corporation is another of the major Twitter shareholders. It held over 36.4 million shares at the end of the first quarter of 2022, representing about 4.5% of the company’s total outstanding shares. The WallStreetZen data as of 25 July showed that the company held 4.78% of the total Twitter stock.

State Street Corp is a global provider of financial services to institutional investors with offerings such as investment servicing, investment management, investment research and trading. As of 30 June 2022, the company’s AUM stood at $3.5tn and assets under custody and/or administration of around $38.2tn.

The company is headquartered in Boston. It has offices in over 100 geographical markets. State Street Corp is listed on the NYSE under the ticker STT.

The bottom line

Knowing who owns the most of Twitter’s stock can help in understanding the company's objectives. Big investors typically have substantial influence over the future potential of the company.

For the near term, the actions of Musk, the second largest Twitter shareholder, will be the top topic of discussion until the saga of his attempted acquisition of the company is concluded.

However, Twitter shareholders should not be the key reason for your decision to buy a stock. Whether Twitter is a good investment should depend on your investment goals, risk tolerance and the size of your portfolio. It is important to do your own research before making any investment or trading decision. And never invest or trade money that you cannot afford to lose.

How many shares of Twitter are there?

According to Twitter’s latest form 10-K filed on 10 February 2022, its total common stock outstanding stood at 800.64 million.

How many shareholders does Twitter have?

As of 25 July 2022, Twitter had 1573 institutional shareholders that have filed 13D/G or 13F forms with the SEC, according to data compiled by Fintel. The total number of retail shareholders is difficult to estimate as shares change hands on a daily basis on trading days.

Who owns Twitter?

70% of Twitter stock is owned by institutional investors, 20% by company insiders and about 10% by retail investors, as of 25 July 2022, according to WallStreetZen.

How many shares of Twitter does Jack Dorsey own?

As of 25 July 2022, Jack Dorsey held 2.67% of Twitter’s total outstanding shares, amounting to over 20.3 million shares, according to WallStreetZen.