Your guide to trading the GBP/CAD Forex pair

Why is the GBP/CAD an important market?

GBP/CAD comprises the fourth (British pound) and sixth (Canadian dollar) most traded currencies in the foreign exchange market. Learn about the GBP/CAD currency pair and what it means to investors and forex CFD traders.

Trade [120]+ forex CFDs with Capital.com.

GBP/CAD trading hours

The forex market operates continuously from Monday to Friday, providing access to GBP/CAD trading 24 hours a day, five days per week.

UK trading activity has historically heightened from 8am to 4pm UK time, while Canadian market activity peaks during the Toronto session, from 8am to 5pm local time (1pm to 10pm UK time).

Trading volumes for GBP/CAD are often elevated when these sessions overlap – particularly from 1pm to 4pm UK time – and during major economic data releases or central bank announcements from either country.

History of GBP/CAD

The pound sterling dates back to the 8th century – with decimalisation in 1971 marking a major milestone. Today, GBP ranks as the fourth most-traded currency in the foreign exchange market, and the fifth strongest currency in the world.

Back in the 19th century, Canada began its departure from the colonial pound and transitioned to a decimalised Canadian dollar, a process which was formalised in 1858. The Canadian dollar was pegged to the USD at various times, floated between 1950 and 1962, re-pegged, and has been a free-floating currency since 1970,

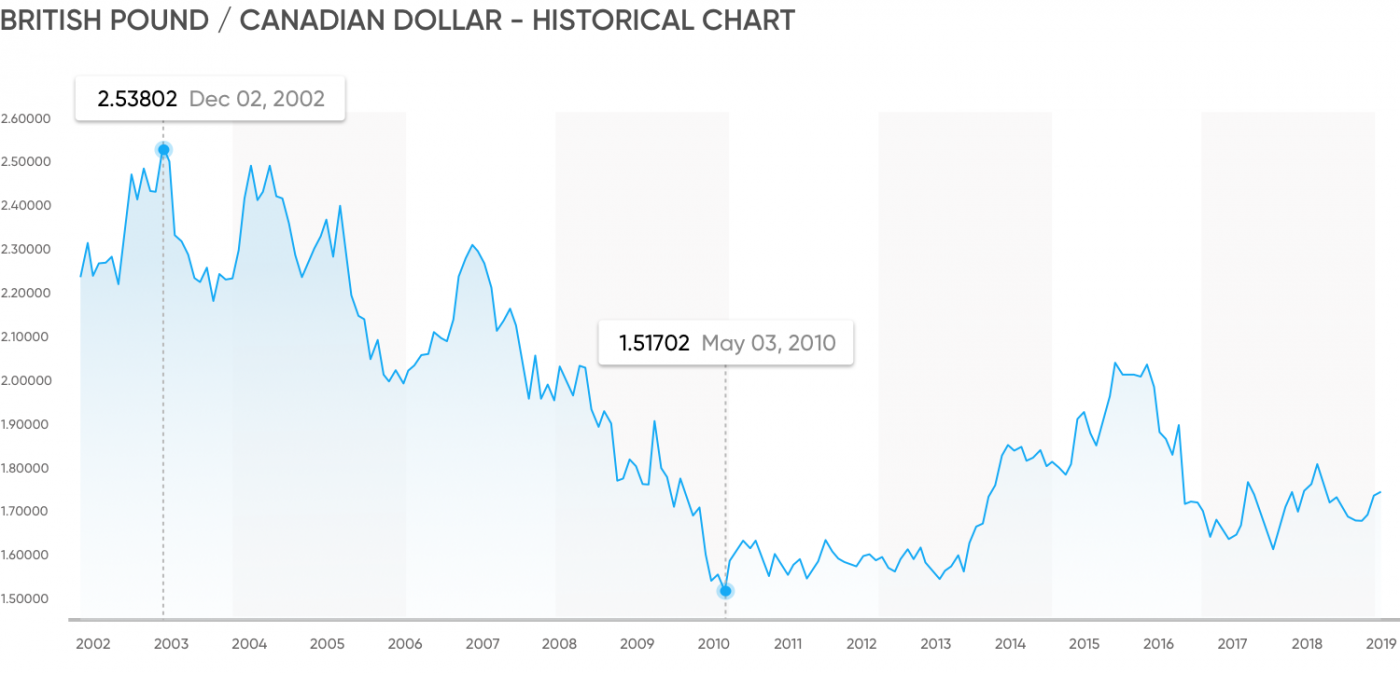

British pound to Canadian dollar forex rate:

Past performance is not a reliable indicator of future results.

Factors influencing the GBP/CAD

Role of GBP

Factors influencing the GBP’s forex value include domestic economic performance. The UK’s Office for National Statistics (ONS) periodically releases three estimates of gross domestic product (GDP): the preliminary estimate, the second estimate, and the final estimate, also known as the Quarterly National Accounts. These data releases are closely monitored by both investors and forex CFD traders.

The UK’s central bank, the Bank of England (BoE), is responsible for setting monetary policy and interest rates in the country – which can impact British pound forex pairs, including GBP/CAD.

Role of CAD

Similarly, central bank policy decisions made by the Bank of Canada can influence the Canadian dollar, although it hasn’t directly intervened in the currency since 1998.

Canada is a major exporter of materials and commodities, including wood, grain, minerals, and petroleum. Movements in these sectors can contribute to changes in the value of the Canadian dollar. Its close proximity to the US has strengthened Canada’s import/export industry.

How to trade the GBP/CAD CFDs

You can trade GBP/CAD either through spot forex trading or by using a contract for difference (CFD) on the currency pair to speculate on price movements.

A CFD is a financial contract between a provider and a client, where the parties agree to exchange the difference in value of an underlying asset between the opening and closing of the contract. This lets you speculate on price movements without ownership or physical delivery of the actual currency pair.

For example, you might open a long position (buy) if you expect the price of GBP/CAD to rise, or a short position (sell) if you anticipate the pair will fall in value.

|

CFDs are complex instruments and carry a high risk of losing money rapidly due to leverage. You should ensure you fully understand how CFDs work and carefully consider whether you can afford the risk of losing your money. |

Past performance is not a reliable indicator of future results.

Why trade GBP/CAD CFDs with Capital.com

Advanced technology – our news feed delivers curated content based on your interests; SmartFeed offers analysis and educational material to inform your decisions – recommending videos, articles, and news to help enhance your trading strategy.

Trade on margin – CFDs are traded on margin with leverage of up to 20:1 for retail clients on non-major forex pairs such as GBP/CAD (subject to jurisdiction and regulatory status). Leverage beyond 1:1 magnifies both potential gains and potential losses. Professional accounts may access higher leverage, depending on regulatory classification.

Contracts for difference (CFDs) – by trading GBP/CAD CFDs, you speculate on whether its price will rise or fall. You can go short or long, set stop-loss and take-profit orders to manage risk, and apply trading scenarios that align with your objectives.*

Sharpen your analysis – stay informed about the latest moves with [100]+ technical indicators – including chart-drawing tools and more.

We prioritise your safety – Capital.com places strong emphasis on security. The platform operates through entities authorised and regulated by the FCA, MENA, ASIC, SCB, and CySEC.

Rapid withdrawals – withdrawal requests can be submitted 24/7, and are processed within one business day. Actual receipt of funds may depend on your payment provider or bank. Client funds are held in segregated accounts in accordance with local regulations.

*Stop-loss orders aren’t guaranteed. Guaranteed stop-loss orders (GSLOs) incur a fee when activated.

Need more support? Try our step-by-step forex course to guide you through the basics to the advanced concepts and explore potential profits and losses on your forex CFD trades with our free forex profit calculator.

FAQ

How is Forex different to other markets?

Forex operates without a central exchange. Trading is decentralised and conducted over the counter, involving a wide range of participants worldwide. This structure tends to result in high trading volumes and can offer competitive bid-ask spreads, potentially lowering trading costs compared to some other markets.

I keep seeing the word 'pip,' what does that mean?

‘Pip’ stands for ‘percentage in point’. It represents the smallest standard unit of price movement in the forex market. For most major currency pairs, including GBP/CAD, a pip is typically equal to 0.0001.

What is bought and sold in forex CFD trading?

In forex CFD trading, you are speculating on the relative value between two currencies, rather than buying or selling physical currency. For example, when trading GBP/CAD, you are effectively taking a position on whether the British pound will strengthen or weaken against the Canadian dollar.