Your guide to trading the EUR/CAD Forex pair

Why is the EUR/CAD an important market?

EUR/CAD is an actively traded currency pair in the forex market, with wide availability in CFD markets. Learn what the euro to Canadian dollar means to traders and investors.

Trade [120]+ forex CFDs with Capital.com.

EUR/CAD trading hours

The foreign exchange market is open 24 hours a day, five days a week. EUR/CAD trading has historically experienced more activity during the London session (8am to 4pm UK time) and North American session (8am to 5pm local time – 1pm to 10pm UK time). Heightened liquidity may be found during the overlaps of these sessions – 12pm to 3pm UTC.

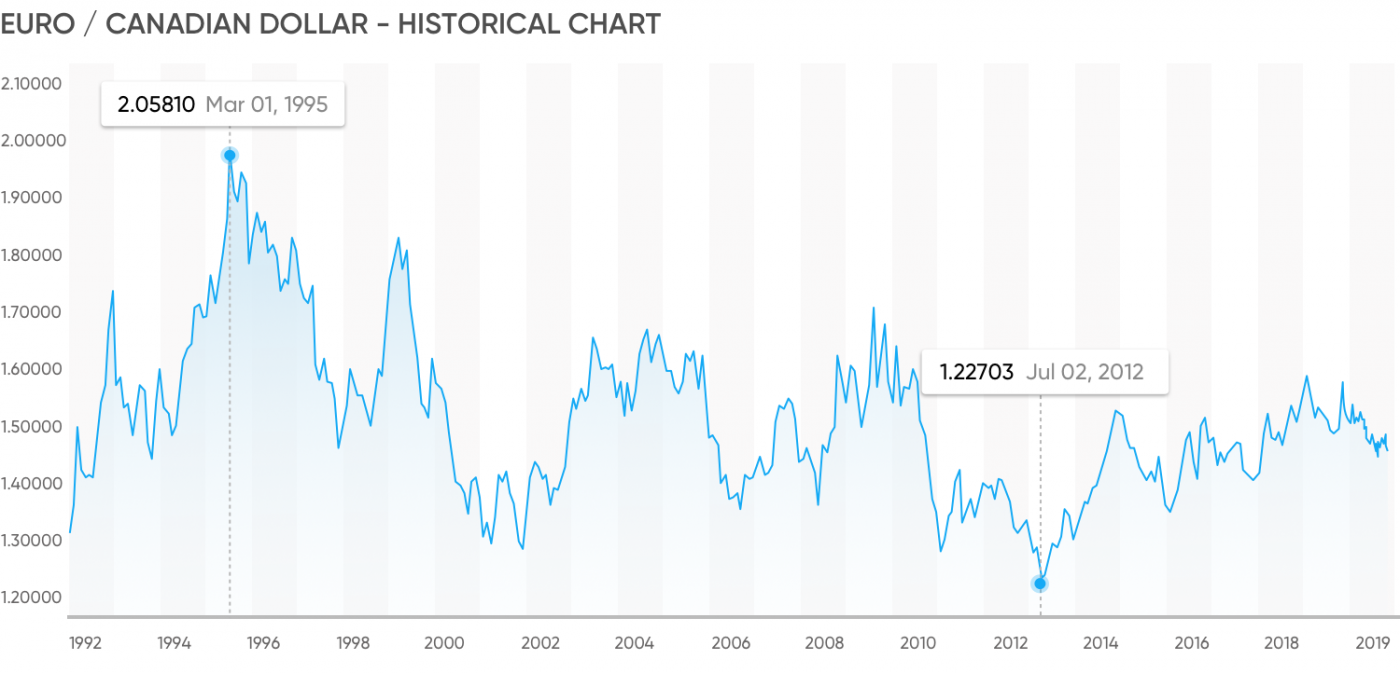

History of EUR/CAD

Conceived in the latter half of the 20th century, the euro was first introduced as a digital currency in 1999, with physical notes and coins not released until 2002. Now the euro is the currency for 20 European Union member states. Political and economic events since its launch, including the Eurozone debt crisis (2009–2012), have contributed to euro volatility.

Canada adopted the Canadian dollar in 1858, introduced to replace the Canadian pound as part of a transition to a decimal-based monetary system, influenced in part by the US model. Today, its economy is generally ranked among the world’s top ten economies.

Past performance is not a reliable indicator of future results.

Factors influencing the EUR/CAD

Role of EUR

The European Central Bank (ECB) releases regular reports and statements, with key monetary policy meetings held eight times per year, concerning rates and policy direction, which are used as indicators about possible future policy direction. Furthermore, many individual countries within the eurozone publish their own data, with Germany’s economy acting as a particularly influential indicator due to its size and role within the region.

Another factor that is considered is employment numbers, which are readily available to view. Consolidated employment figures for the region, along with other key indicators – such as inflation, GDP, and economic sentiment – can impact the pairing.

Role of CAD

Similarly, central bank policy decisions made by the Bank of Canada can influence the Canadian dollar, although it has not directly intervened in the currency since 1998.

Canada is a major exporter of materials and commodities, including wood, grain, minerals, and petroleum. Commodity price fluctuations are frequently considered when assessing movements in the Canadian dollar. Its close proximity to the US has strengthened Canada’s import/export industry and helps CAD maintain its position as a major currency in global forex markets.

How to trade EUR/CAD CFDs

You can trade EUR/CAD either through spot forex trading, which involves direct transactions in the currency market, or by using a contract for difference (CFD) on the currency pair to speculate on price movements via a CFD broker, such as Capital.com.

A CFD is a financial contract between a broker and a trader, where the parties agree to settle the difference in price of an underlying asset between the opening and closing of the contract. This lets you speculate on price movements without ownership or physical delivery of the actual currency pair.

You may open a long position (buy) if you expect the price of EUR/CAD to rise, or a short position (sell) if you anticipate the pair will fall in value.

|

CFDs are complex instruments and carry a high risk of losing money rapidly due to leverage. You should ensure you fully understand how CFDs work and carefully consider whether you can afford the risk of losing your money. |

Past performance is not a reliable indicator of future results.

Trade euro/Canadian dollar CFDs.

Need more support? Try our step-by-step forex course to guide you through the basics to the advanced concepts and explore potential profits and losses on your forex CFD trades with our free forex profit calculator.

Why trade EUR/CAD CFDs with Capital.com

Advanced technology – our news feed aims to deliver curated content relevant to your trading activity; SmartFeed offers analysis and educational material to inform your decisions – recommending videos, articles, and news to help enhance your trading strategy.

Trade on margin – CFDs are traded on margin, with leverage of up to 20:1 for retail clients on non-major forex pairs such as EUR/CAD, which may vary depending on jurisdiction and regulatory status. Leverage beyond 1:1 magnifies both potential gains and potential losses.

Contracts for difference (CFDs) – by trading EUR/CAD CFDs, you speculate on whether its price will rise or fall. You can go short or long, set stop-loss and take-profit orders to help manage risk, and apply trading scenarios that align with your objectives.*

Sharpen your analysis – stay informed about the latest moves with [100]+ technical indicators – including chart-drawing tools and more.

We prioritise your safety – our trading platform and mobile apps are authorised and regulated by the FCA, MENA, ASIC, SCB, and CySEC.

Rapid withdrawals – withdrawal requests can be submitted 24/7, and are typically processed within one business day. Client funds are held in segregated accounts in accordance with local regulations.

*Stop-loss orders aren’t guaranteed. Guaranteed stop-loss orders (GSLOs) incur a fee once activated.

FAQ

How is Forex different to other markets?

Forex operates without a central exchange. Trading is decentralised and conducted over the counter, involving a wide range of participants worldwide. This structure may result in high trading volumes and competitive bid-ask spreads, potentially lowering trading costs compared to some other markets.

I keep seeing the word 'pip,' what does that mean?

‘Pip’ stands for ‘percentage in point’. It represents the smallest standard unit of price movement in the forex market. For most major currency pairs, including EUR/CAD, a pip is typically equal to 0.0001.

Does Capital.com take commission from my Forex trades?

The simple answer is 'no' – at Capital.com, you do not pay a commission on forex CFD trades – you only pay the spread, which is the difference between the bid and ask prices – along with any applicable overnight funding charges. This differs from some brokers, who may charge a separate commission on each trade.