Taiwan dollar forecast: TWD declines against USD, stable elsewhere after central bank intervention

We look at the performance of the Taiwanese dollar against other currencies in our latest Taiwan dollar forecast round-up.

The Taiwan dollar (TWD) has fallen against the US dollar (USD) as the greenback has soared in value against Asian currencies, but has fluctuated against other currencies such as the euro (EUR) and the British pound (GBP).

Chinese military drills around Taiwan have affected the country’s trade and weakened the TWD, as have concerns about a global economic slowdown on the country’s technology exports.

In this article, we look at the currency’s recent performance and some of the latest Taiwan dollar predictions from analysts.

What drives the value of the Taiwanese dollar?

The New Taiwan dollar (NTD) has been issued by the Central Bank of the Republic of China (Taiwan), also known as the CBC, since 2000.

The NTD was introduced in 1949 to replace the old Taiwan currency at an exchange rate of 40,000 to one new dollar following a period of hyperinflation during the Chinese Civil War.

The TWD was previously issued by the Bank of Taiwan. The Taiwanese dollar is a restricted currency. It can only be traded in a limited capacity and transfers in TWD outside of Taiwan are not permitted.

Taiwan is a major exporter of semiconductors and other electronics products, so its trade balance is a key influence on the value of the TWD, along with other economic factors such as its gross domestic product (GDP), employment, foreign currency reserves and interest rates.

The TWD has fallen against the dollar in 2022 as the differential in interest rates between the US and Taiwan has widened. The US Federal Reserve (Fed) has hiked interest rates five times so far this year, from 0.00 to 3.25%, while the CBC has raised its key discount rate three times to 1.625%.

High interest rates increase a country’s attractiveness as an investment destination. The rise in US rates has seen overseas institutional investors sell Taiwanese stocks to withdraw their funds from Taiwan, weighing on the value of the TWD.

On 22 September, the CBC raised the policy rate by 0.125 basis points (bps) and reserve requirement ratios by 0.25 bps.

“Given the recent international commodity price decline, the domestic inflation rate is expected to come down gradually in the second half of the year, while registering above 2% for the year as a whole before dropping below 2% next year. Moreover, with a slowing global economy compounded by greater downside risk in the second half of the year through to next year, it is expected that the domestic economic growth momentum would weaken next year,” the bank’s Monetary Policy Committee stated.

The statement added:

Taiwan dollar sheds value against soaring USD

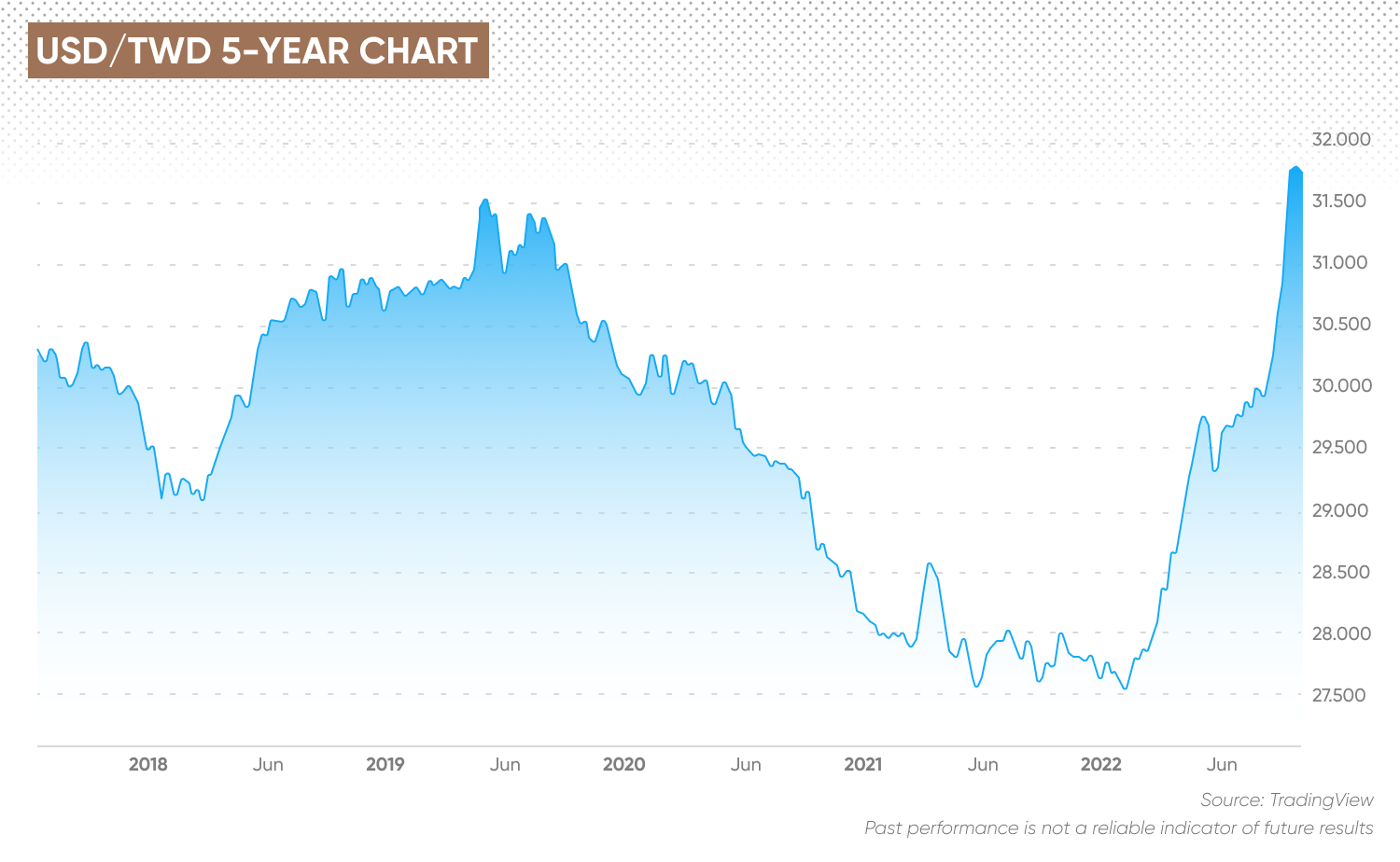

The Taiwanese dollar traded at 33.45 to the US dollar at the start of 2016, its highest level since 2009 and the peak of a five-year upward trend. The USD/TWD exchange rate then declined to 29.14 in early 2008 before moving back above 31 in mid-2019.

The dollar gained against most currencies in March 2020 on a broad sell-off in financial assets at the start of Covid-19 lockdowns, but the Taiwanese currency held up, with the USD/TWD pair falling towards 30. The exchange rate continued to trend lower, reaching 27.88 in February 2021. A brief rally in March 2021 took the rate up to 28.60 but the pair pulled back to 27.55 by May last year. The pair stabilised in a 27-28 range for the rest of the year, starting 2022 at 27.62.

It then began to rally as the US dollar strengthened, first as investors sought a safe haven in February amid the Russian invasion of Ukraine and subsequently as the Fed began raising interest rates in March. The pair reached 29.79 in May and after a brief dip to 29.30 later in the month, and resumed its climb to reach 30 in mid-August.

Mainland China conducted military drills around Taiwan, affecting Taiwan’s international trade as flights and shipments were deferred. Analysts at the Dutch bank ING noted that tension between the US and Mainland China over Taiwan is negative for the country’s economy and weighs on the currency.

The USD continued to strengthen in September and reached 31.94 against the TWD on 3 October, its highest level since June 2016.

With the rise in the pair reflecting strength in the US dollar rather than weakness in the Taiwanese currency, the TWD has gained value against other currencies. The EUR/TWD pair declined from just under the 35 mark in August 2020 to a low of 30.18 in July and August. The pair moved up off the lows in September to reach 31.34 and was trading around 31.16 on 3 October.

The TWD has been volatile against the GBP, with the pair climbing to 39 in August 2020 from 35.25 in March 2020, retreating to 37 in October 2020. The pair traded around 39 in the first half of 2021 but then moved down to 36.62 in November last year. After a rebound to 38 in April this year, the pair fell to a low of 34.51 in September as the value of the pound fell. GBP/TWD was trading around 35.70 on 3 October.

What does the Taiwan dollar forecast look like now (4 October)? Will the currency continue to weaken against the strong dollar? How will it perform against other currencies that do not have the dollar’s momentum?

Taiwan dollar forecast: How will the TWD trade in future?

Analysts at French bank Societe Generale expect the CBC to avoid aggressively hiking interest rates to support the currency, stating: “It seems that the CBC is cautious about the souring export outlook for Taiwan, and with inflation moderating, more aggressive tightening has become less compelling. We now expect only one more hike of 12.5bp from the CBC at the December meeting; after that, the central bank may take a pause.

“Against the backdrop of aggressive tightening by central banks, there are concerns over capital outflows and whether the central bank should tighten to limit the yield differential. However, the CBC does not find the argument compelling. It argues that equities are the major source of foreign inflows, while further foreign investment of Taiwan lifers would be limited due to regulatory requirements.

Societe Generale’s USD/TWD forecast shows the pair ending 2022 at 31.50 and holding at that level in the first quarter of 2023, before sliding to 31.00 in the second quarter and 30.50 in the third quarter. The bank’s Taiwan dollar forecast for 2025 showed the US dollar pulling back to 27.00 and remaining around that level in 2026.

Analysts at ING expected consumer demand in Mainland China to result in weaker demand for electronic devices in the second half of this year, weighing on the semiconductor sector that has driven Taiwan’s export growth. But over the longer term, the Taiwanese currency could rebound.

In September, ING’s Taiwan dollar forecast for 2022 showed the USD/TWD pair weakening from 31.30 at the end of the third quarter to 30.10 at the end of the year. The pair could continue to trend lower in 2023, dropping to 29.60 at the end of the first quarter, 28.90 at the end of the fourth quarter and 28.20 by the end of 2024.

| ING | Maybank | Societe Generale | UOB | Westpac | |

| Q4 2022 | 30.10 | 29.80 | 31.50 | 31.20 | 30.60 |

| Q1 2023 | 29.60 | 29.60 | 31.50 | 31.40 | 30.30 |

| Q2 2023 | 29.00 | 29.50 | 31.00 | 31.50 | 30.00 |

| Q3 2023 | 29.30 | - | 30.50 | - | 29.70 |

| Q4 2023 | 28.90 | - | - | - | 29.50 |

| Q1 2024 | 28.70 | - | - | - | 29.40 |

| Q2 2024 | - | - | - | - | 29.50 |

| Q4 2024 | 28.20 | - | - | - | - |

| 2022 | - | - | 29.30 | - | - |

| 2023 | - | - | 30.46 | - | - |

| 2024 | - | - | 27.04 | - | - |

| 2025 | - | - | 27.00 | - | - |

| 2026 | - | - | 27.00 | - | - |

Will the TWD continue to rise against EUR, GBP?

The long-term Taiwan dollar forecast from Trading Economics at the time of writing (4 October) showed the EUR/TWD pair trading at 30.9742 by the end of this quarter and at 30.3534 in one year, based on global macro models and analysts’ expectations. The GBP/TWD pair could decline from 35.2005 at the end of this quarter to 34.2873 in one year, the analysis showed.

The TWD forecast from algorithm-based forecasting service Wallet Investor also expected the Taiwanese currency to strengthen against the euro and pound, with the EUR/TWD pair declining from 30.52 at the end of 2022 to 29.43 at the end of 2023, 27.23 at the end of 2025 and 25.773 in five years’ time. The GBP/TWD pair could fall from 34.74 at the end of this year to 33.93 at the end of 2023, 32.28 at the end of 2025 and 31.361 in five years’ time. Analysts have yet to issue a Taiwan dollar forecast for 2030.

Are you looking for a Taiwan dollar forecast to inform your forex trading? It’s important to remember that currency markets are highly volatile, making it difficult for analysts and algorithm-based forecasters to come up with accurate long-term predictions.

We recommend that you always do your own research. Look at the latest market trends, news, technical and fundamental analysis, and expert opinion before making any investment decision. Keep in mind that past performance is no guarantee of future returns. And never invest money you cannot afford to lose.

FAQs

Is the Taiwan dollar a good investment?

It is important to do your own research to determine if the Taiwanese dollar is a good fit for your investment portfolio. Whether it is a suitable investment for you depends on your personal circumstances, risk tolerance and how much you intend to invest.

Will the Taiwan dollar go up or down?

The direction of the TWD could depend on whether the strength in the US dollar persists, interest rate policy in the US and Taiwan, Taiwan’s trade flows, and the relative performance of other currencies such as the euro.

Should I invest in the Taiwan dollar?

Whether you invest in the TWD is a personal decision depending on your risk tolerance and investing strategy. You should do your own research to take an informed view of the market. Keep in mind that past performance is no guarantee of future returns. And never invest money you cannot afford to lose.