Singapore property price crash: Will post-pandemic froth give way to sharp declines amid rising rates?

With soaring interest rates and Singapore dollar slumping against USD, is Singapore property price crash likely?

Singapore’s housing market may finally be in trouble as inflation rises and interest rates approach two-decade highs. But, with a unique, exchange rate-based approach to monetary policy, can the country avoid a Singapore property price crash?

Here we take a look at whether a Singapore property crash is imminent and what factors are shaping the county’s housing prices.

What is a housing crash?

A housing crash is defined by a sudden drop in the average price of housing across a market economy. It is usually marked by an exogenous shock that affects housing and other financial markets.

The most pertinent example of these shocks came from the sub-prime crisis of 2007/08, when swathes of homebuyers with poor credit fell into unaffordability when their initial interest rates expired, creating contagion in mortgage-backed securities and accordingly the whole financial system. For some economies it took years to return to pre-crisis level house prices.

But a housing crash can also be caused by domestic factors. The primary symptom of this is rising interest rates.

Inflation is rising across the world amid jammed supply chains, while Russia’s invasion of Ukraine has driven up the price of key commodities, like oil and natural gas. It means central banks are moving rapidly to raise interest rates at a rate not seen in the modern era.

Higher interest rates set by central banks feed through to the rates set on loans by commercial banks, including mortgages. This increases the cost of borrowing for homeowners, which could increase the supply of homes on the market. At the same time, the rising cost of buying a home shuts out prospective buyers, reducing demand.

These work together to change the supply and demand equation for homes in a market, reducing their price. The level of the drop can vary, based on the size of rate rises and other economic factors.

In the current context, it means consumers are being squeezed from both sides as interest rate increases tend to take time to feed through to prices.

Consumer confidence and spending could be expected to fall, potentially adding to unemployment and lowering incomes.

Because it is typically unexpected, a housing crash has ramifications elsewhere. Homeowners can be pushed into negative equity if prices fall below their purchase price, hammering confidence as well as spending. This can drive a recession if enough people in a market are homeowners who were pushed into negative equity.

House prices in Singapore

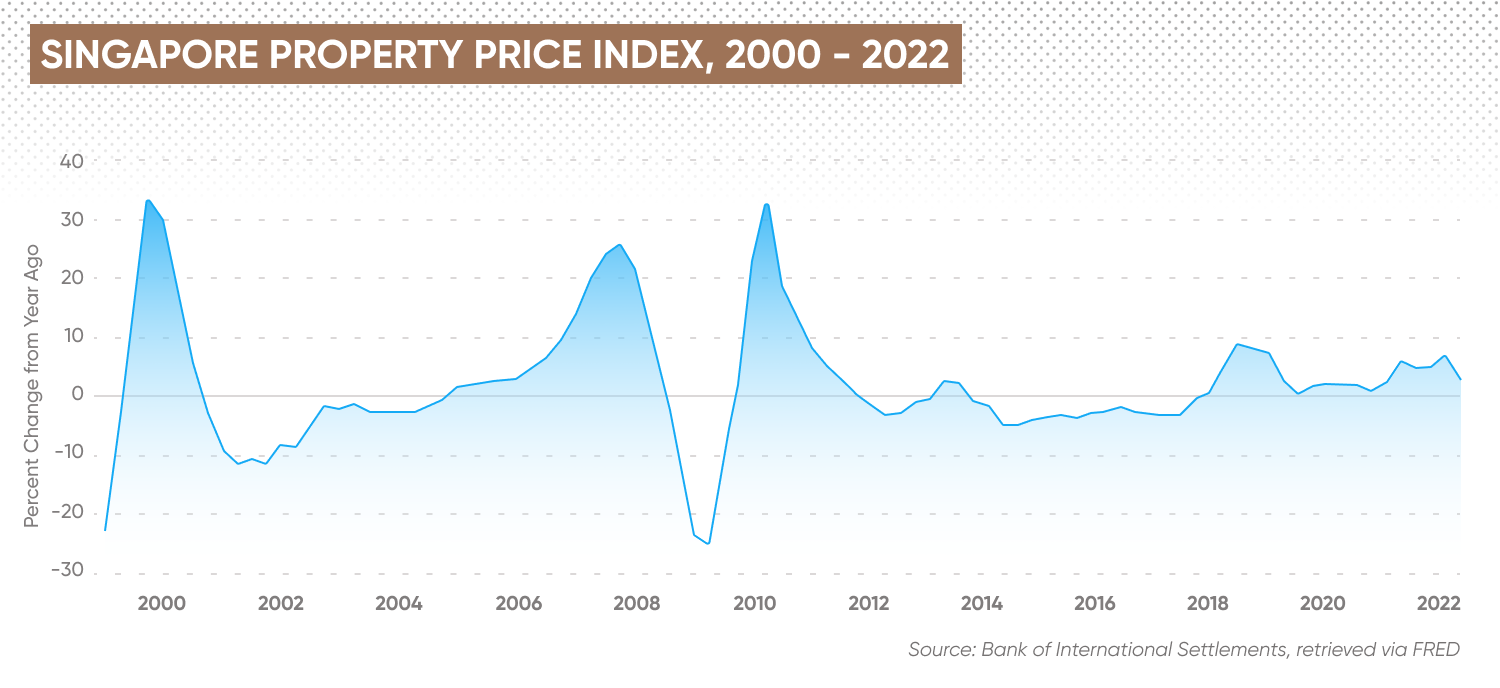

According to data from FRED, Singapore’s average house price has experienced a middling performance over the last decade. This followed a massive Singapore property price crash in 2008/09, where prices contracted by as much as 25% on a year-on-year basis.

In recent years, the country has had better fortunes, with Singapore home prices rising by 7.3% in 2018 and by 5.5% in 2021, sandwiching two years of slower expansion in 2019 and 2020.

This year, it appears Singapore property prices have continued to grow. Singapore’s Urban Redevelopment Authority’s (URA) latest official house price data for the second quarter of 2022 showed prices rose by 3.5%

A flash estimate by the URA for the third quarter of 2022 found that the private residential property index increased by 6.2 points, from 180.9 points in the second quarter of 2022 to 187.1 points in the third quarter, a 3.5% rise from a year ago and 3.4% increase quarter-on-quarter.

Like most of the world, Singapore is faced with rising prices. Data from the Monetary Authority of Singapore (MAS) showed that core inflation, the bank’s preferred measure which strips out fuel and food prices, hit 5.1% in August. That’s not far off the US’s figure of 6.3%, where the consumer price index was 8.3% in August.

But unlike many other economies, Singapore operates its monetary policy with a focus on exchange rates rather than interest rate manipulation. As a small, open economy, with a large financial hub, the MAS argued that the exchange rate is “relatively controllable through direct interventions in the foreign exchange markets and bears a stable and predictable relationship with the price stability as the final target of policy over the medium-term.”

While it could mean that interest rate rises are less aggressive in the country, there is evidence that rates are rising on the open market The benchmark rate jumped to 2.34% in August, up from 2.04% a month earlier and seeing it exceed the UK’s base rate of 2.25% in the process.

Commercial banks in Singapore are beginning to feel the heat. Local publications began reporting a jump in fixed deposit rates by banks, including UOB, DBS and OCBC, at the start of October. The rates are now approaching 24-year highs as banks scramble to maintain their competitiveness.

Fixed home loan rates, meanwhile, have jumped to 3.85%, potentially increasing repayment costs by hundreds of dollars per month and putting more pressure on the country’s supply-demand dynamic.

A weakening Singapore dollar (SDG), which has fallen steadily against the US dollar this year, could also raise house prices through increasing import costs, as well as via changes in prices for other items, lowering discretionary income for all buyers.

USD/SDG exchange rate

“You can see a massive gap opening up between demand and supply,” Hari Krishnan of PropertyGuru told CNBC’s Squawk Box Asia in June.

Krishnan told the programme that a lack of manpower massively constrained the country’s construction sector for two years until 2021, while supply chain constraints were proving to be a new problem. “Demand has been on a tear and supply has been constrained,” he added.

Uncertainty over the direction of the Singapore housing market is occurring under the cloud of a weakening outlook in the country for economic growth. The Ministry for Trade and Industry (MTI) lowered its gross domestic product (GDP) forecast for 2022 from between 4% and 5% to between 3% and 4%.

Higher than expected inflationary pressures, as well as China’s continued struggles to contain the spread of Covid-19, had conspired to dampen the outlook for growth this year, the ministry said.

However, the ministry did point out that the real estate sector had experienced 11.7% GDP growth year-on-year in August, suggesting the Singapore property market is on a more comfortable footing than other parts of the economy

Singapore property price predictions for 2023 and beyond

Analysts look relatively confident that Singapore’s property market will make it through this challenging period.

The country’s intention since December has been to cool the housing market to reduce the opportunity of a Singapore real estate bubble, mainly by reducing liquidity in the system. Accordingly, it predicted a slowing in the market. Finance Ministry, National Development Ministry and the MAS said in a joint statement:

According to a forecast by Mordor Intelligence, house prices in the country were expected to register average annual growth of 3.2%, avoiding a Singapore property price crash. The institute said:

In an August assessment, property firm Knight Frank said Singapore would benefit from a scarcity of available homes to purchase, propping up prices even as demand-side pressure linger.

And according to Trading Economics’ forecasting service, as of 6 October, Singapore’s house price index was projected to hit 193 points in 2023 and 197 in 2024. That would represent 3.2% growth between Q2 2022 and the end of 2023, and 2.1% growth between 2023 and 2024.

Remember, analysts’ predictions can be wrong and shouldn’t be used as a substitute for your own research. Always conduct your own due diligence before trading A.nd never trade money you cannot afford to lose.

FAQs

Will Singapore property prices drop?

Analysts did not expect Singapore property prices to drop, thanks to prudential strategies by Singapore policymakers and a low level of supply in the country. Note that their predictions can be wrong.

Is now a good time to buy property in Singapore?

While the housing market was expected to be stable, rising inflation could still hurt the supply and demand equation on home buying, meaning prospective buyers should check their appetite for risk and room for affordability. Keep in mind that past performance is no guarantee of future returns. And never invest money you cannot afford to lose.

Is Singapore property overpriced?

According to analysts mentioned in this article, Singapore properties did not appear to be overpriced currently, and were expected to grow over the coming years. Remember, analyst price predictions can be wrong and shouldn’t be used as a substitute to your own research.