What is non-operating income?

Non-operating income is a part of a company’s income that is not derived directly from its major business activity. It can include profits or losses from investments, sale of assets and property, currency exchange, asset write-downs or dividend income.

Key takeaways

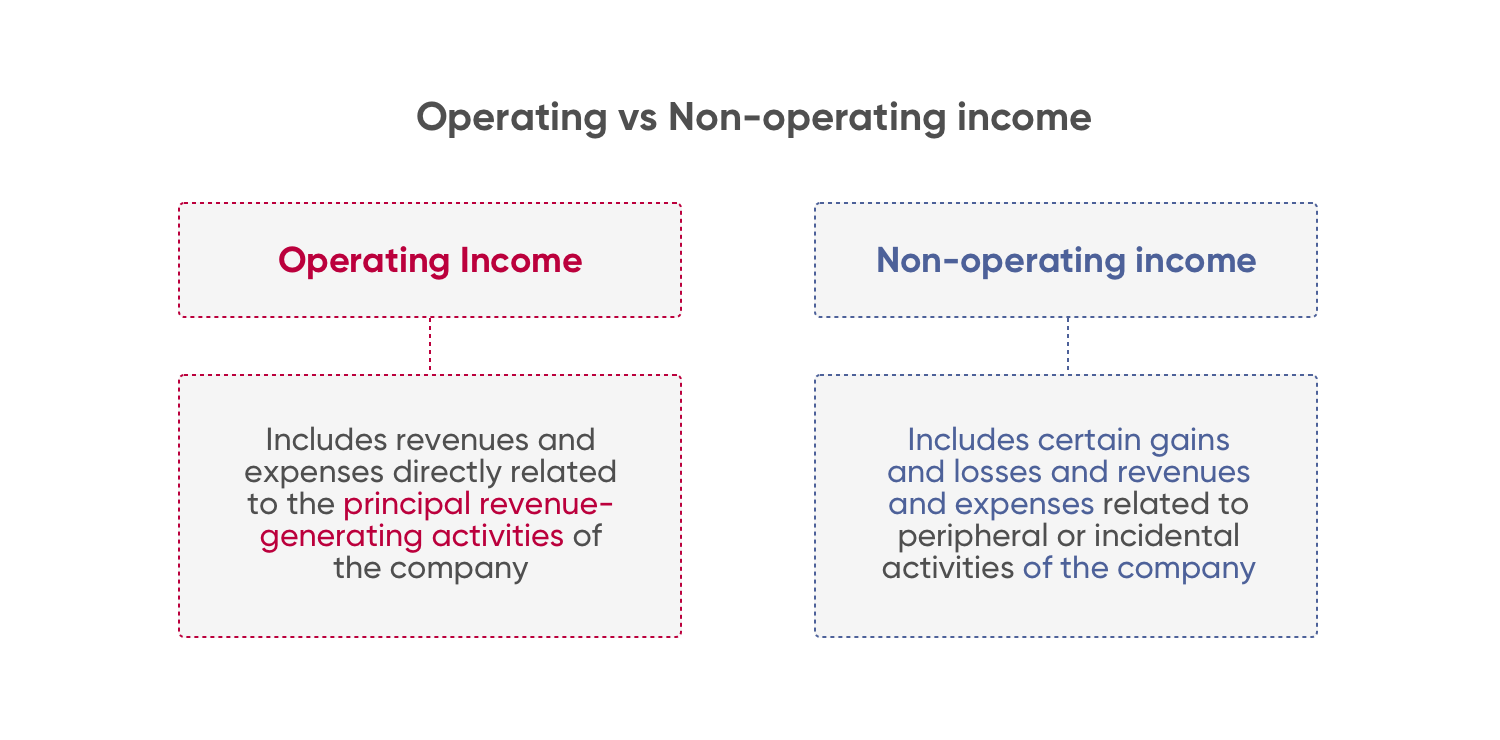

Non-operating income is income not derived from core business activities, including investment profits, asset sales, currency exchange, asset write-downs, and dividends—typically non-recurring and peripheral to operations.

Separating non-operating from operating income is crucial because it can significantly affect earnings and obscure the real picture of company performance, enabling clearer assessment of efficiency at turning revenue into profit.

Operating income equals total revenue minus cost of goods sold and operating expenses, while earnings before tax equals operating income plus non-operating income when gains exceed losses.

Investors should exclude non-recurring income like asset sales from performance analysis; for example, a $500m division sale that increased a company's $1bn earnings by 50% cannot be repeated.

This type of income is also referred to as peripheral or incidental. It is usually not recurring and is separated from evaluating the company’s performance for a certain period of time.

Distinguishing non-operating income from operating income enables investors and analysts to build a clear vision of the company’s efficiency at turning revenue into profit.

Non-operating income explained

Earnings are among the most important metrics in a company’s financial statements, as they represent the business’ profitability compared with analyst valuations.

Sometimes the company’s profit for an accounting period comes from operations not related to its core business. The company can earn a significant portion of income from investments or sale of property or equipment.

This type of income can significantly affect the company’s earnings, making it difficult for investors to see the real picture of the company’s performance during the reported period.

That is why it is very important to separate operating and non-operating income.

Non-operating income formula

The company’s operating and non-operating income could be defined in a multi-step income statement. To calculate the operating income, you need to subtract the cost of goods sold and all the operating expenses from the total revenue of the company. Operating expenses include SG&A, R&D and depreciation expenses.

If you add the non-operating income to the operating income, you can calculate the company’s earnings before tax. In case non-operating gains are bigger than non-operating losses, the company reports a positive non-operating income.

Non-operating income examples

For example, a small e-commerce business invests $20,000 in the stock market, gets 5 per cent of capital gain or $1,000 (20,000 x 0.05). This will be considered non-operating income and not regarded as continuous income over an extended period.

Let’s take another case, assuming that a technology company sells one of its divisions for $500m. The gains from this deal are considered non-operating income. If a year later the company earns $1bn in income, we will know that the extra $500m has increased the company’s earnings by 50 per cent.

A sudden surge in earnings may draw investors’ attention, making it an attractive investment. However, you should remember that the additional money inflow, coming from the sale of its division, cannot be repeated and should not be included in performance analysis.