USD/MXN forecast: Mexican peso has kept time with surging dollar but US slowdown will pose almighty test

What’s next for the Mexican peso? We look at the latest USD/MXN forecast from analysts.

The Mexican peso (MXN) has held up against the surging US dollar (USD) in 2022, reversing dollar gains each time the greenback has pulled ahead.

While most emerging markets currencies have seen the dollar soar to record highs, the peso is up by almost 5% against the USD since the start of the year as the Mexican economy has outperformed expectations.

What has supported the value of the peso, and will it be able to continue holding ground? In this article we look at the key drivers for the USD/MXN foreign exchange (forex) rate and the latest long-term forecasts from analysts.

What drives USD/MXN?

In forex trading, currencies are traded in pairs with a base currency and a quote currency. The USD/MXN pair refers to how many Mexican pesos – the quote currency – are needed to buy one US dollar – the base currency.

The Mexican peso is Mexico’s official currency, issued by the country’s central bank, the Banco de Mexico (Banxico). The peso has historically been one of the most stable currencies in Latin America thanks to Mexico's economic growth and trading relationship with the US. The MXN is accepted for payment in border towns in the US, as well as Guatemala and Belize.

Mexico exports oil, vehicles and metals, such as copper and gold. Oil products account for around 4% of total exports. As a result, commodity prices can have an influence on the value of the peso.

Following the 1970s oil crisis, Mexico defaulted on its external debt and saw significant capital outflows, inflation and currency devaluation. The US dollar skyrocketed from 12.50 against the peso to more than 3,000, prompting the government to introduce the nuevo (new) peso, MXN, in January 1993. One new MXN was equivalent to 1,000 old MXP pesos.

The MXN is now the third most-traded currency in the Americas behind the US and Canadian dollars (CAD). The US dollar is the world’s reserve currency and as such is influenced by the health of the global economy as well as the US economy’s performance.

Investors tend to use the dollar as a safe haven asset to protect wealth during times of economic and geopolitical uncertainty. That dynamic has driven the dollar to 20-year highs against a basket of currencies – as measured by the US Dollar Index (DXY) – this year, and sent it to record highs against some emerging markets currencies.

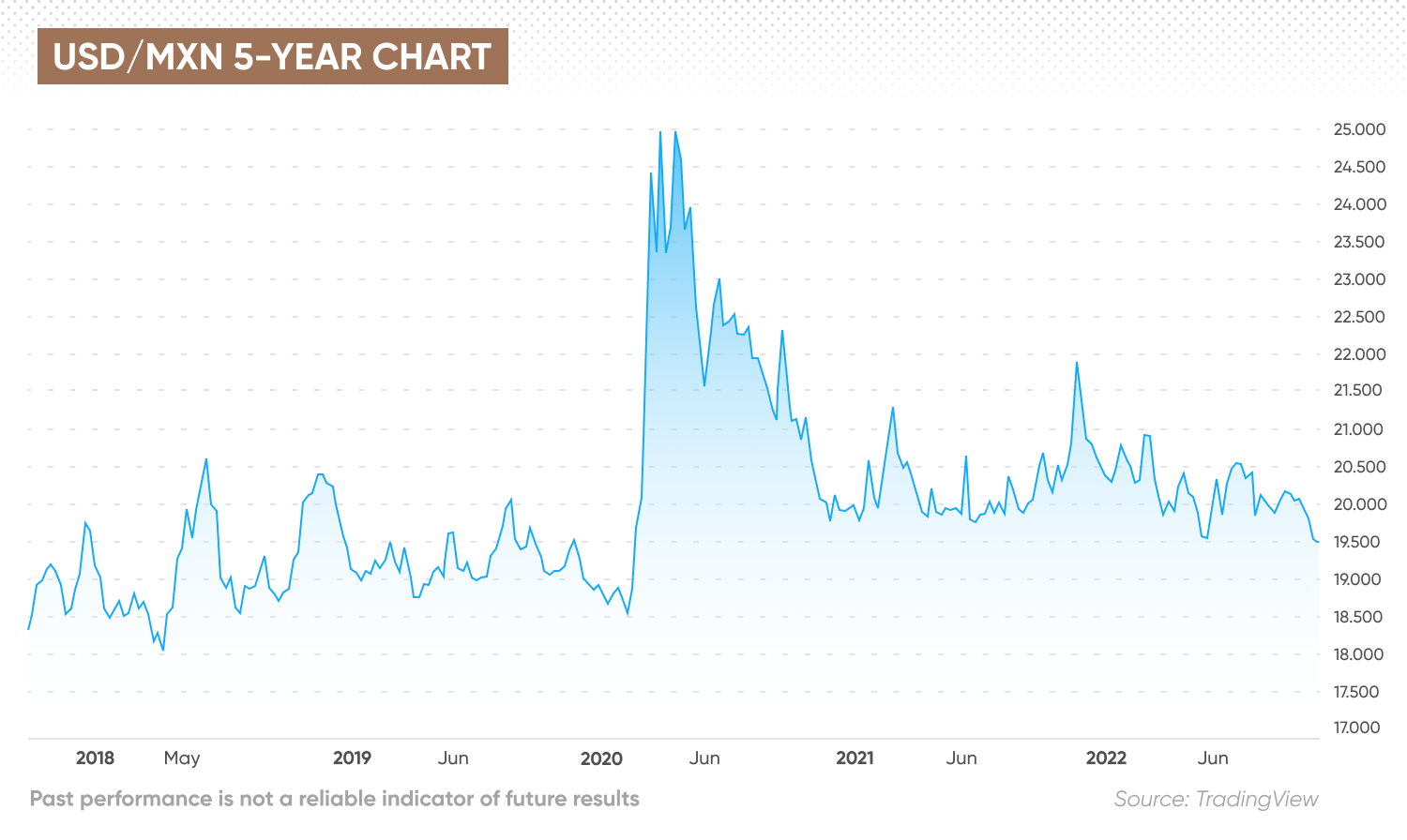

USD/MXN reverses gains

The USD/MXN pair started 2022 at 20.51 and climbed to 21.38 in early March as the dollar rallied in response to the Russian invasion of Ukraine. But the peso had recovered by the end of the month and strengthened to 19.79 by mid-April.

The US dollar rebounded to 20.48 in early May, as the US increased the pace of interest rate hikes it started in March, but dropped to 19.56 a month later. The USD/MXN rate moved back up to 20.86 in mid-July, as the Banxico paused its own interest rate hikes.

The pair pulled back to 19.84 in mid-August as markets began anticipating the US Federal Reserve (Fed) turning dovish. Banxico raised interest rates to a record high of 8.5% with the potential for further increases.

Reports of higher-than-expected US inflation indicated that the Fed would remain on its aggressive tightening path. The dollar strengthened to 20.41 in late September, reversing most of the year’s losses. Concerns about the impact of high inflation and increasing interest rates on the global economy weighed on the peso.

The USD/MXN pair retreated again after Banixco raised its key inflation rate to 9.25%, falling below 20 to trade at 19.53 on 30 October, its lowest level since February 2020.

What is the outlook for the US dollar to Mexican peso forecast heading towards the end of the year? Will the peso be able to maintain its gains against the dollar as the slowing global economy affects export demand?

USD/MXN forecast: Will the peso hold onto its gains or retreat?

“The peso has encountered renewed turbulence as global growth concerns underpin the safe harbour dollar. Once risk aversion fades, the peso would be better positioned to perform. Fundamentally, domestic inflation will help dictate prospects for further peso-positive rate increases by Banxico. Still, the peso’s alluring yield dissipates with every rate increase by the Federal Reserve. The Fed has forecast its borrowing rates would remain higher for longer, strengthening the dollar,” according to the October USD/MXN forecast from currency exchange firm Convera.

The accelerated pace of interest rate rises in Mexico and economic stability have encouraged a carry trade, where investors borrow money in currencies with lower interest rates and invest in countries where interest rates are higher.

“Where there could be some joy for those a little more bearish on the dollar is amongst high-yielding Latam FX – especially the Mexican peso. Some have made the good point that the slower pace of Fed hikes could reduce volatility in the interest rate markets,” according to analysis by Dutch bank ING.

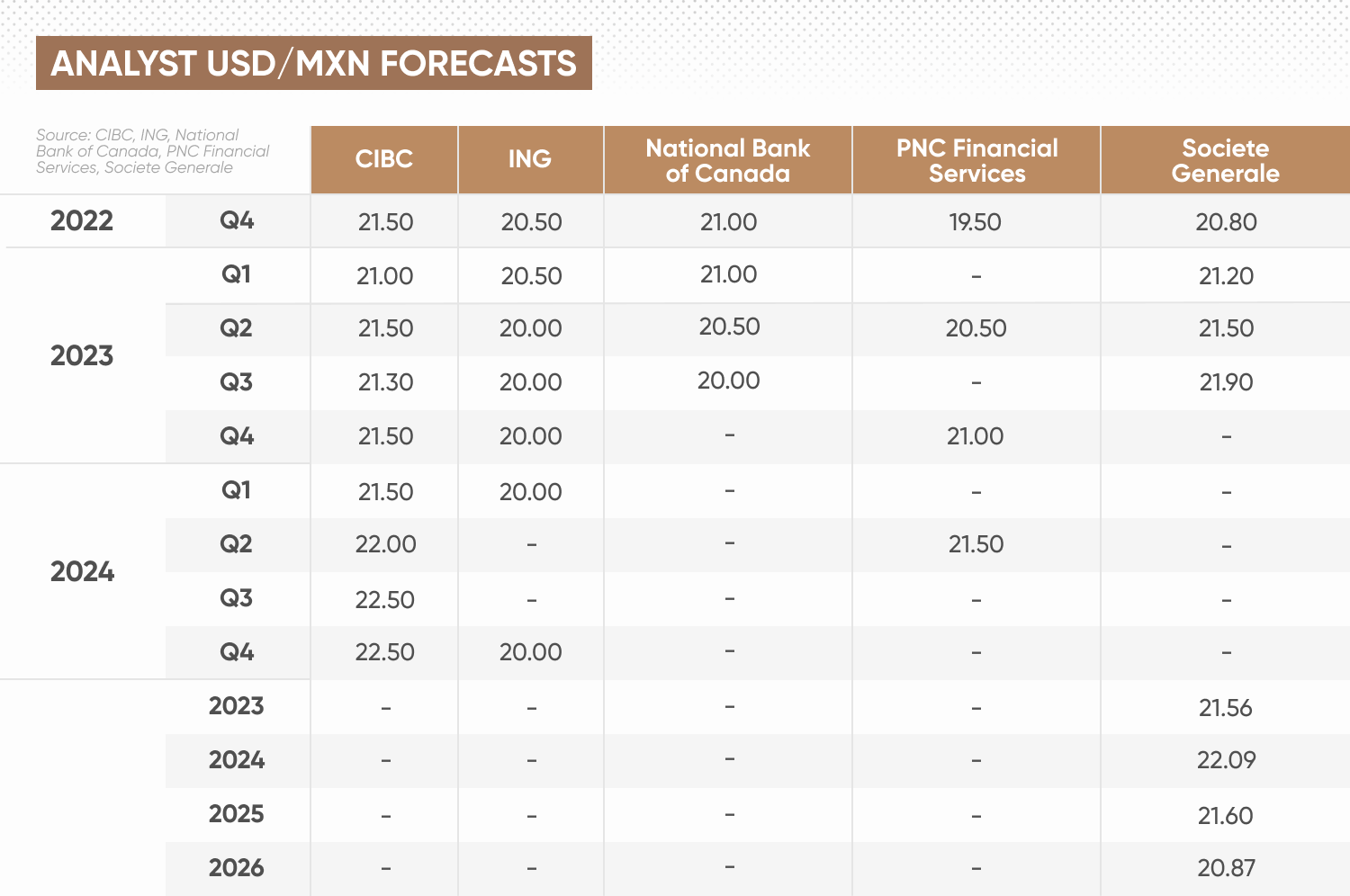

The latest USD/MXN forecast for 2023 projects the pair ending 2022 year at 20.50, then stabilising at an average of 20.00 in 2023 and 2024.

Spanish bank Santander has revised down its USD/MXN forecast, expecting the peso to remain relatively strong. According to analyst Guillermo Aboumrad, they “expect Banxico to follow the Fed this year, though most likely decoupling from the Fed in a context where markets could face a risk-on scenario with flows coming to emerging markets in anticipation of the peak in interest rates. In that case, a compression of the spread between Banxico and the Fed policy rates could lead to MXN depreciation, which could be offset by flows to fixed-income instruments in Mexico and the LatAm region.

Mexico’s exports and private consumption have rebounded above pre-Covid levels, although this is tied to the US economy, making growth “more vulnerable to US deceleration next year… The presidential elections will be held in 2024, but uncertainty on the outcome could start to build sooner and impact MXN together with low economic growth.”

At the time of writing (7 November), the USD/MXN prediction from forex firm Monex was bullish on the outlook for the peso, predicting that the pair will trade at 20.00 at the end of November, 19.80 in three months, 19.50 in six months and 19.00 in 12 months.

Conversely, French bank Societe Generale expected a stronger dollar, predicting USD/MXN could trade up from 20.80 at the end of 2022 to 21.90 by the third quarter of 2023 and average 22.09 in 2024. The bank’s USD/MXN forecast for 2025 then saw the pair dipping to 21.60.

The USD/MXN forecast for 2030 from AI Pickup’s machine learning algorithm showed the pair averaging 18.46 by the end of the decade, up from 20.19 in 2023 and a peak of 24.17 in 2026.

When considering any USD/MXN forecast, it’s important to remember that currency markets are highly volatile, making it difficult for analysts and algorithm-based forecasters to come up with accurate long-term predictions.

We recommend that you always do your own research. Look at the latest market trends, news, technical and fundamental analysis, and expert opinion before making any investment decision. Keep in mind that past performance is no guarantee of future returns. And never invest money you cannot afford to lose.