What is CFD trading and how does it work?

Contracts for difference (CFD) are a popular way of trading on the price of stocks and indices, commodities and forex without owning the underlying assets. Learn everything you should know about CFD trading and how to use CFDs to go long and short on assets.

What is a contract for difference (CFD)?

A contract for difference (CFD) is a type of financial derivative in finance. This guide has everything you need to know about CFD trading explained in simple terms.

So what does CFD mean in trading? CFDs allow you to speculate on various financial markets, including cryptocurrencies, stocks, indices, commodities and forex pairs. You never buy the assets, but speculate on the rise or fall in their price, usually over a short period of time.

A CFD is a contract between a broker and a trader who agree to exchange the difference in value of an underlying asset between the beginning and the end of the contract, often less than one day.

A CFD is a contract between a broker and a trader who agree to exchange the difference in value of an underlying asset between the beginning and the end of the contract, often less than one day.

A contract for difference (CFD) is:

-

A derivative – you do not own the underlying asset

-

An agreement between you and your broker

-

Based on the change in an asset's price

-

Conducted over a short time period

What are CFDs?

A contract for difference (CFD) lets you trade using just a fraction of the value of your trade, which is known as trading on margin, or leveraged trading. This allows traders to open larger positions than their initial capital may otherwise allow. Therefore, CFD trading offers greater exposure to global financial markets.

One of the benefits of CFD trading is that you can speculate on the asset’s price movements in either direction. You buy or sell a contract depending on whether you believe the asset’s price will go up or down, opening a long or a short trade, accordingly.

You should know that leverage trading can amplify your profits, but can also boost your losses.

How does CFD trading work?

When you open a contracts for difference (CFD) position, you select the number of contracts (the trade size) you would like to buy or sell. Your profit will rise in line with each point the market moves in your favour. Although, there is a risk of loss if the market moves against you.

Buy

If you think the price of an asset will rise, you would open a long (buy) position, profiting if the asset price rises in line with your expectations. However, you would risk making a loss if the asset price falls.

Sell

If you think the price of an asset will fall, you would open a short (sell) position, profiting if it falls in line with your prediction. However, once again, you would be risking making a loss if the asset price rise.

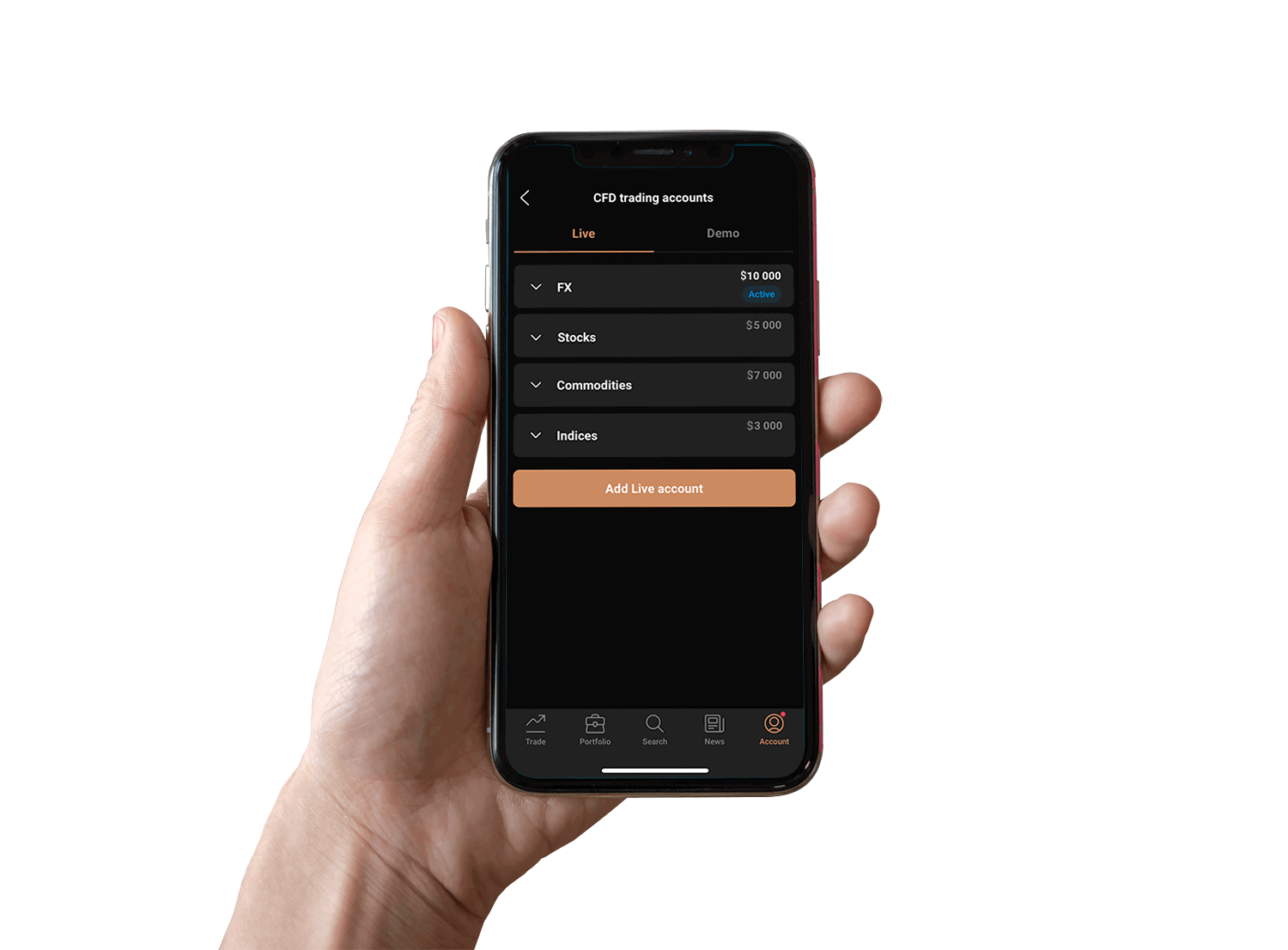

What is a CFD account?

A contract for difference (CFD) account enables you to trade on the price difference of various underlying assets using leverage. Leverage means you put up only a fraction of the amount needed to trade. This is called deposit margin.

Meanwhile, the maintenance margin (required margin) needs to be covered by equity, which is the account's balance that includes unrealised profits and losses. The maintenance margin goes up and down depending on the prices of assets you are trading. Your account’s equity must always cover the maintenance margin to keep the positions open, especially in case of running losses. Otherwise, you risk receiving a margin call.

Often you can learn to trade in a demo account, but you will need to add funds to create a CFD trading account before you can trade live.

Some regulators require that new customers pass an ‘appropriateness or suitability’ test. This often means answering some questions to demonstrate that you understand the risks of trading on margin. It’s best to thoroughly educate yourself on how leverage and margin work before trading.

What is leverage in CFD trading?

When you are trading contracts for difference (CFDs), you hold a leveraged position. This means you only put down a part of the value of your trade and borrow the remainder from your broker. How much of the value you are required to put down can vary. Remember, that leverage magnifies both profits and losses.

Leveraged trading is also referred to as trading on margin. A 10% margin means that you have to deposit only 10% of the value of the trade you want to open. The rest is leveraged.

For example, if you want to place an order for $1,000-worth of Brent crude oil and your broker offers 10:1 leverage, you will need only $100 as the initial amount to open the trade.

Spread and commission

With CFD trading, you’re always offered two prices based on the value of the underlying instrument: the buy price (ask) and the sell price (bid).

The price to buy will always be higher than the current underlying value and the sell price will always be lower. The difference between these prices is called the CFD spread. At Capital.com, this is how we make most of our money. However, we don’t charge commission for opening or closing trades.

-

The buy price (ask) is the price at which you start, or open, a long position.

-

You close your position when you sell with the current bid price.

-

The sell price (bid) is the price at which you open a short position

-

You close your position when you buy with the current ask price.

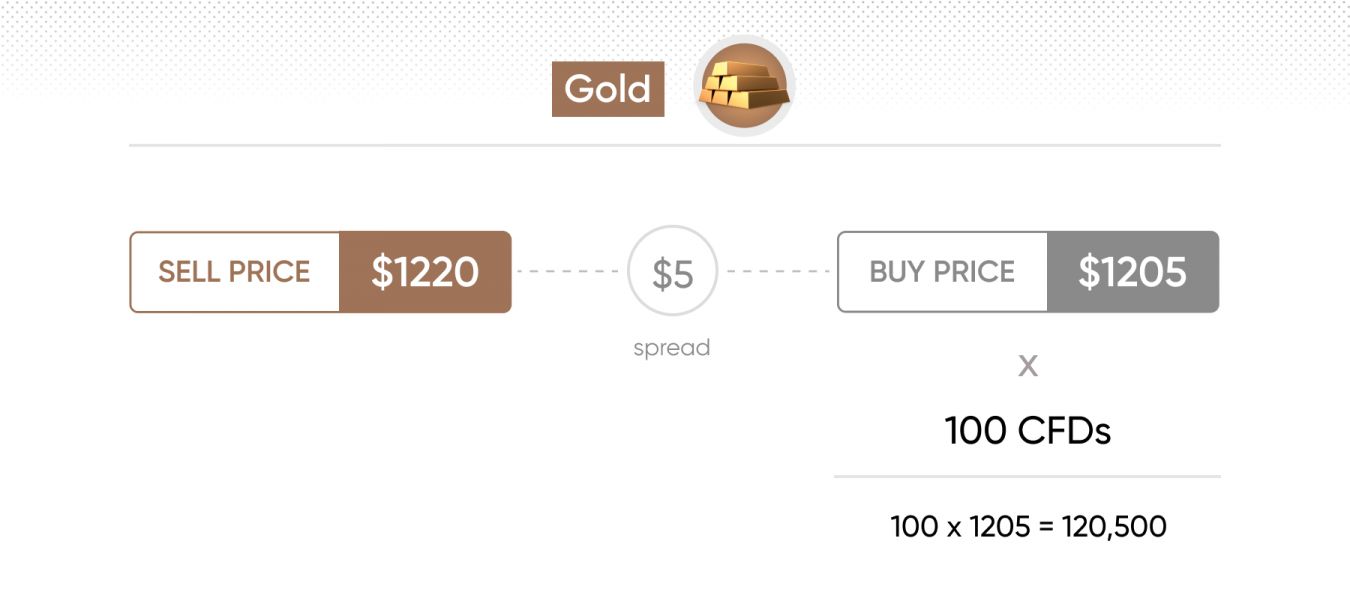

For example, if you expect the price of gold to increase you may want to open a position with a CFD on gold. Imagine the quoted price is $1,200/$1,205 (this is the bid/ask spread). You buy 100 CFDs on gold (taking a long position). The size of the position taken (the contract value) is illustrated below.

For example, if you expect the price of gold to increase you may want to open a position with a CFD on gold. Imagine the quoted price is $1,200/$1,205 (this is the bid/ask spread). You buy 100 CFDs on gold (taking a long position). The size of the position taken (the contract value) is illustrated below.

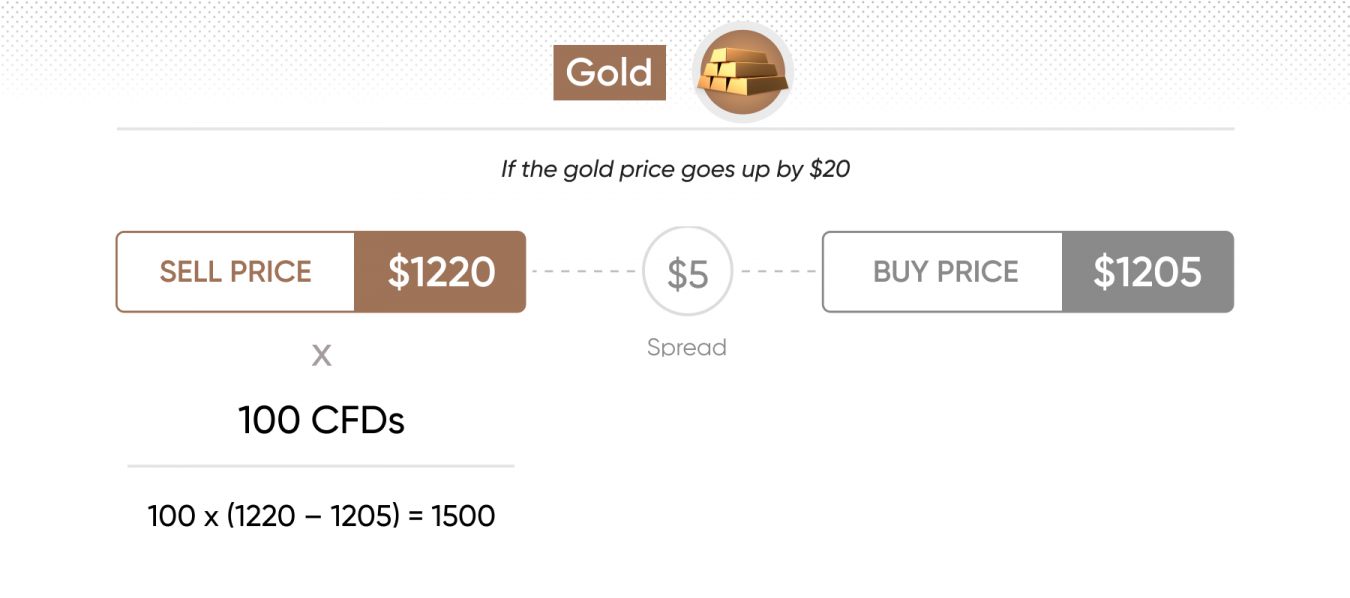

Now imagine that the price of gold increases as expected. The profit from this trade is illustrated below. Note that all trading contains risk of loss.

Now imagine that the price of gold increases as expected. The profit from this trade is illustrated below. Note that all trading contains risk of loss.

As contracts for difference are leveraged products, you can open much larger positions with a lower initial deposit than you need to buy traditional shares. For example:

|

Buying Apple |

CFD trade |

Share trade |

|

Sell / Buy Price |

135.05 / 135.10 |

135.05 / 135.10 |

|

Deal |

Buy at 135.10 |

Buy at 135.10 |

|

Deal size |

100 shares |

100 shares |

|

Funds required to open a trade |

$ 2,702 = $135.10 Buy price x 100 shares x 20% margin (Margin required) |

$13,510 (100 shares at 135.10) |

|

Close price |

Sell at 150 |

Sell at 150 |

|

Profit |

$1,490 ((150 - 135.10) x 100 shares = $1,490) |

$1,490 (15,000 – 13,510 = $1,490) |

What is the optimal investment?

CFD trading democratises the markets by providing a low entry level. Capital.com has traders who open positions worth more than $1m a time, but the minimum deposit you can trade online with is just $20.

You can open an account for free and practise in demo mode. Capital.com is a flexible and scalable solution, regardless of your, experience or the amount of spare money you want to trade with.

CFD trading may be considered a cost-effective way of entering the financial markets. With some brokers, CFD costs include a commission for trading various financial assets, however, Capital.com doesn’t take commissions for opening and closing trades, for deposits or withdrawals. However, banks or payment service providers can charge you on deposits or withdrawals.

The major CFD cost is the spread – the difference between the buy and sell price at the time you trade. There is an additional charge of an overnight funding adjustment, which is taken if a trade is kept open overnight.

What assets can you trade with CFDs?

You can trade CFDs on cryptocurrencies, shares, indices, ETFs, commodities and currencies. Capital.com provides access to thousands of different CFD assets across these classes, so you are only a few clicks away from trading the world’s most popular markets all in one place.

Profit and loss

Once you’ve identified an opportunity and you’re ready to trade, you can open a position. From this point, your CFD profits or losses will move in line with the underlying asset’s price in real time.

You'll be able to monitor open positions on the platform and close them when you want.

Profit and loss can be calculated by multiplying the number of contracts you hold by the difference in price. Your profit to loss ratio, often abbreviated to P&L, can be defined using the following formula:

P&L = number of CFDs x (closing price – opening price)

P&L can be calculated for any individual position, but if you have more than one open position, the P&Ls are aggregated to form the total P&L or UPL (unrealised profit and loss).

What is the contract length of CFDs?

Most CFD trades have no fixed expiry date, meaning that the CFD contract length is unlimited. A trade is typically closed by placing an opposite order of the same size – for example, closing a buy trade of 100 CFDs by selling 100 CFDs, unless hedging mode is used, which allows holding opposing positions simultaneously.

However, if you want to hold a trade open overnight, your position will be subject to an overnight funding adjustment.

Advanced strategies for risk management using CFDs

CFDs are complex instruments. Trading them involves a high degree of risk. The value of a trade can rise and fall. You may suffer losses if the market moves against your expectations. Therefore, CFD risk management is one of the crucial points to consider and implement in your trading practice.

Once your account is set up and you’ve devised a trading plan, it is important to determine how much you are willing to risk to formulate an appropriate CFD risk management strategy. If you are risk-averse, then you will be looking for opportunities with lower risk-to-reward (R-R) ratios.

For instance, if you are looking for slow and steady growth, asset classes with higher volatility should form a proportionally small part of your portfolio. While diversification can help balance risk across asset classes, it’s important to manage the number of open positions carefully to avoid negatively impacting your margin level. Always ensure your portfolio aligns with your risk tolerance and trading strategy.

Stop-loss and take-profit

You could consider setting up limit orders to automatically close a position at a given profit level. Take-profit orders reduce the likelihood of you holding on to a profitable trade for too long and seeing the price fall again. Trade with your head and not your heart.

Similarly, you can place stop-losses to mitigate CFD risks and restrict potential losses. A stop-loss is triggered at the level indicated priorly by a trader and will be executed at the next available price quotes. Note, however, that in case of volatile markets, lack of liquidity or big orders sizes can result in slippage. A guaranteed stop-loss can protect against slippage, yet it comes at a fee.

Stops and limits are crucial risk management tools available for most traders. You may also consider guaranteed stop-losses, which provide greater security in more volatile markets, but also require a fee to use.

Margin calls, margin closeouts and negative balance protection

In order to keep positions open, a trader must meet the maintenance margin requirement – the maintenance margin must be covered by the account’s overall equity.

The value maintained in a margin account acts as collateral for credit. If the account equity falls below the maintenance margin, Capital.com notifies you via a ‘margin call’. This is where you will either need to top up your balance or close some of your positions in order to reduce your exposure.

If you do not act and the close out level is reached, a gradual close-out procedure will take place on your positions. This is known as margin closeout.

Capital.com provides negative balance protection (NBP) for CFD accounts. If after margin close out your balance falls into negative, the NBP mechanism will bring your account back to zero.

Consider employing risk-management techniques in every trade. Exercise caution when trading CFDs on assets that have a history of being highly volatile. Consider whether you understand how CFDs work and whether you can afford the risks that come with CFD trading.

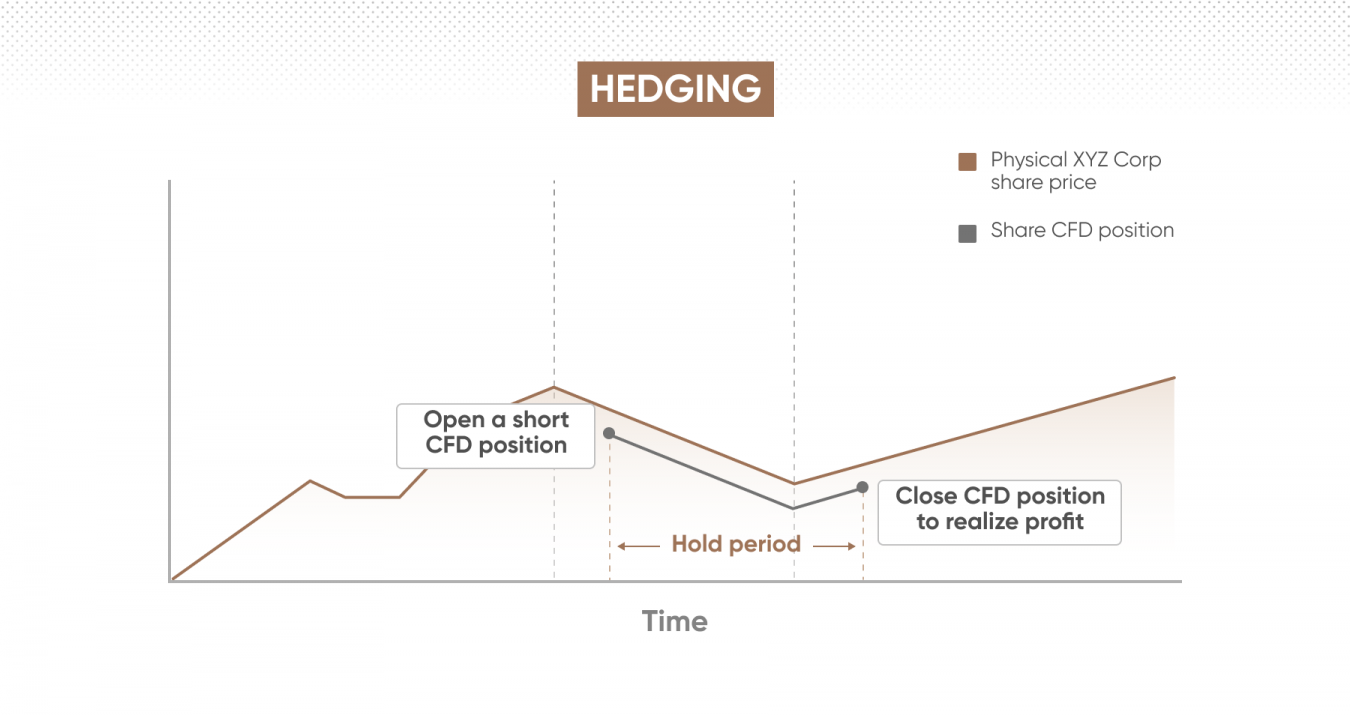

Hedging

Hedging in trading is a crucial risk-management strategy used by experienced traders, but it does not necessarily protect the orders to be closed out at one point.

A hedge is a risk management technique used to reduce losses. You hedge to protect your profits or capital, especially in times of uncertainty. The idea is that if one investment goes against you, your hedge position goes in your favour.

CFD hedging provides an opportunity to protect your existing portfolio due to the fact that you can sell short by speculating on a price downtrend.

For example, you have a portfolio of blue chip shares. You want to hold them for a certain period of time. You believe the market is about to experience a short dip, and are concerned how this will affect the value of your portfolio.

With CFD trading, you can short-sell the market in order to hedge against this downtrend possibility. If the market slides, what you lose on your portfolio may be offset by the gain from your short hedge. If the market rises, then you will lose on your hedge but gain on your main position.

Why trade with Capital.com?

Discover trading excellence with Capital.com

Intuitive platform

Get the tools you need to trade with confidence, including the latest TradingView charts, timely market insights and updates from Newsquawk, and more.

TradingView and MT4

Seamlessly integrate our smart platform with elite third-party software.

Comprehensive education

Improve your trading knowledge with our free guides and courses.

Free demo account

Refine your strategies and develop your skills with zero risk to your capital.

Rapid withdrawals

98.62% of withdrawals are processed within 24 hours, according to our internal server data from 2024.