What is gross domestic product (GDP)?

Gross domestic product (GDP) is arguably one of the most important economic indicators. It measures the performance of economic activity over time and is crucial in accessing economic health of a country.

Here we take a look at the GDP definition in a lot more detail, including its use cases, calculation methods, what affects GDP, and more.

Key takeaways

-

GDP is a key economic indicator that measures a country’s overall economic activity.

-

Its components include consumer and government spending, business investment and balance of trade.

-

Real GDP accounts for inflation, while nominal GDP doesn’t. Meanwhile GDP per capita divides GDP by population size.

-

There are three approaches to how to calculate GDP: expenditure method, income approach and production approach.

-

GDP can be used by traders in fundamental analysis, when watching out for a recession and keeping up-to-date with monetary policy decisions.

-

GDP doesn’t account for economic inequality, sustainability of production and non-market transactions.

What is GDP?

GDP is a broad monetary measure of a nation’s overall economic activity, valuing all the final goods and services produced in a particular period of time, typically annually or quarterly, within the country’s boundaries. Within each country, GDP is usually measured by a national governmental agency.

Importance of GDP in economics

GDP is considered to be one of the principal indicators in economics, allowing analysts to build a better picture of a nation’s financial situation. A significant change in GDP, whether negative or positive, usually reflects in the stock market.

When the economy is doing well, wages increase and a lower unemployment rate is indicated as businesses demand more labour to meet the growing economic needs. Rising GDP signifies that incomes within the country are increasing respectively as well as consumers purchasing power, and vice-versa.

GDP has a large impact on nearly everyone within that economic environment. It can affect everything from personal finances to investments to job growth.

Understanding the GDP of a given nation may be helpful for investors when making any decisions in a particular region. It is also vital when comparing a country's growth rates to find the best international opportunities. For example, an investor may choose to buy shares in companies that are located in a rapidly growing economy in the hope of higher returns.

Understanding GDP components

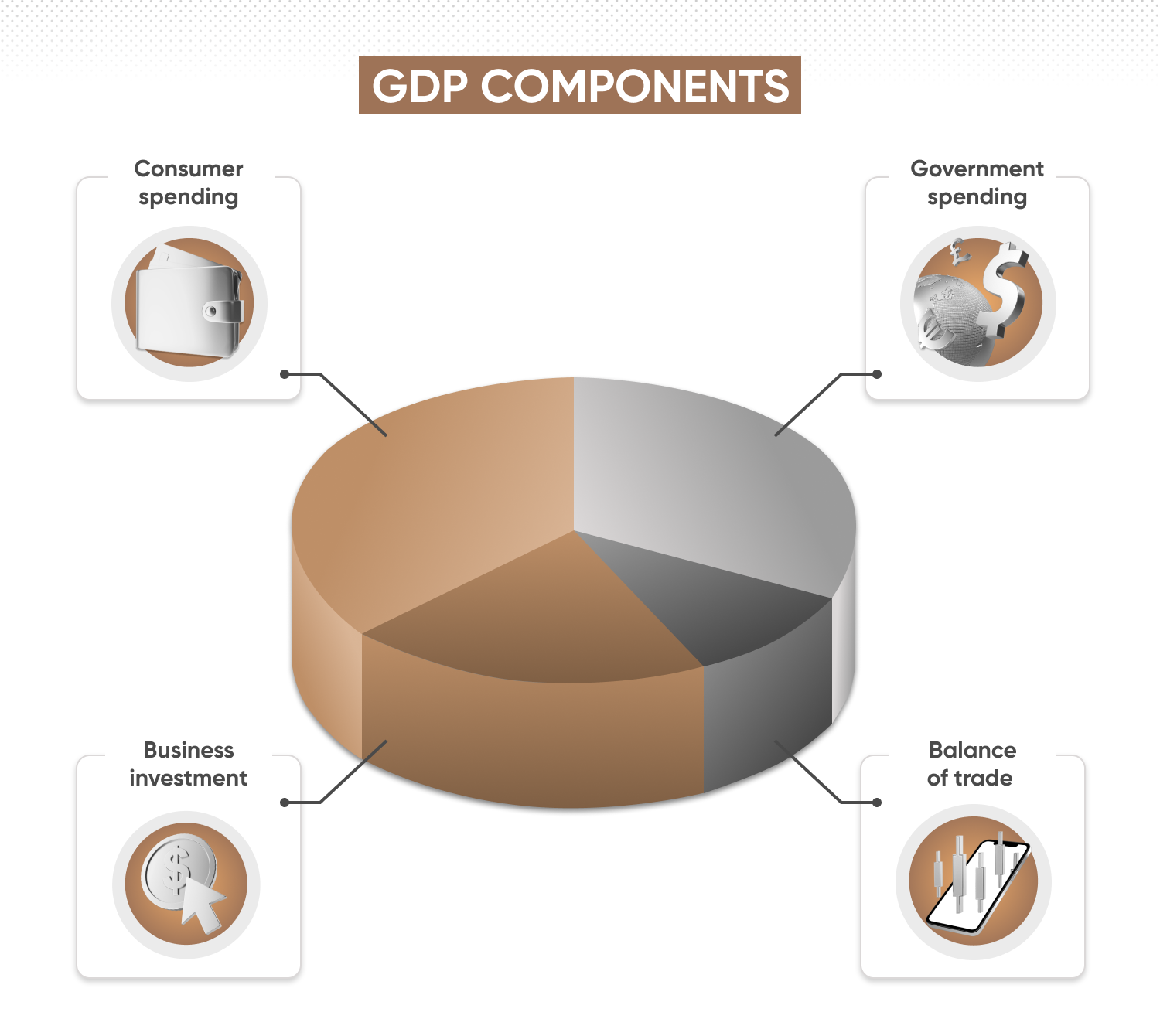

Commonly, the components of GDP include personal consumer and government spending, business investment and the balance of trade. These are the biggest drivers of the GDP calculation.

-

Consumer spending: Also known as personal consumption expenditures, this is the measure of spending on goods and services by consumers.

-

Government spending: It’s everything that is spent from a government’s budget within a public sector on items such as education, healthcare, defence, and more, depending on the country.

-

Business investment: Any spending by private businesses and nonprofit companies on assets to produce goods and services is considered business investment.

-

Balance of trade: The difference in value between a country’s imports and exports is what constitutes the balance of trade. If exports exceed imports, the country is in a trade surplus. On the contrary, if imports exceed exports, it’s in a trade deficit.

Real vs nominal GDP

As there are, in fact, a few ways to measure a country's gross domestic product, it is important to know what types of GDP there are. Economists typically use two types of GDP for measurements: nominal and real.

Nominal GDP is a country's economic output, the value of the final goods and services produced in a given year without an adjustment for inflation.

Real GDP, on the other hand, is equal to the economic output adjusted for the effects of inflation. It’s calculated using the GDP price deflator, which is the difference in prices between the base and the current years.

Nominal GDP is usually higher than real GDP as inflation is typically a positive number. Once nominal GDP is higher than real GDP, significant inflation is indicated, and, conversely, when real GDP is higher than the nominal, it indicates deflation in a given economy.

For this reason, economists use an adjustment for inflation to find, what’s called, an economy’s real GDP. By adjusting the output of any given year for the price levels that prevailed in a reference year, also known as the base year, economists adjust GDP for inflation.

GDP per capita

Another variation from traditional GDP is GDP per capita. It's a measure of a country's output using its GDP and dividing that figure by the population. It works out what the economic output is per person on average.

Economists and politicians will often use this figure to compare the relative performance of different countries.

It can be used to show if the value of goods and services in a particular economy is growing or shrinking over time as it accounts for the variable of changing population size.

GDP per capita can be used as a proxy for living standards as it can approximate average income – but it is a very rough measure.

One way of thinking about it is to think of the GDP as a cake and the population determines the number of slices you have to cut the cake into – the GDP per capita is the size of the slice. For example, two countries may have a similar GDP but if one has three times the population of the other the same amount has to be shared out among three times as many people as smaller slices of cake. It gives you a relative measure between the two countries.

This figure only gives an average and does not account for the great wealth of a few and the poverty of many.

Calculating gross domestic product (GDP)

GDP can be determined in three different ways. These are the income approach, the expenditure approach and the production approach.

Expenditure approach

The expenditure method is based on the principle that all the products and services must be purchased by somebody. It means the value of the total production output has to be equal to people's total expenditures in buying goods.

It calculates GDP as the total value of personal consumption expenditure, gross domestic private investment, government spending and net of exports over imports within the economy during a given period.

Here is the formula for calculating GDP in this method:

GDP = C + I + G +NX

C = All private consumption and consumer spending in the economy, including durable goods, nondurable goods, and services.

I = All of a country’s investment in capital equipment, housing, and more.

G = All of the country’s government spending, including government salaries, construction, maintenance and spending in public services.

NX = Balance of trade, which is a country’s exports minus imports.

Income approach

The income approach is based on the principle that all expenditures in an economy should equal the total income generated by the production of all economic goods and services.

It calculates GDP as the total income received by all economic entities within the country, in the form of factor income, such as profit, wages, rental income, dividend income and interest income.

When using this method, the GDP calculation formula would be:

GDP = Total national income + Sales taxes + Depreciation + Net foreign factor income

Total national income = Value of total items produced in a country by its residents, and income received by its residents, including government and consumer spending.

Sales taxes: Taxes charged by a government on goods and services sales.

Depreciation: Any depreciation of the value of assets that occurred in an economy.

Net foreign factor income: Income earned by foreign companies or individuals within a country.

Production approach

The production or value-added approach is the most direct of the three. It consists of summing the gross value added of all industries in the country.

In other words, it calculates GDP as the sum of the value added by all services and goods during their production within the economy during a given period.

The GDP formula here goes as follows:

GDP = Gross value of output - Value of intermediate consumption

Gross value of output = Value of the total sales of goods and services plus value of changes in the inventories

Value of intermediate consumption = Value of goods and services transformed or used by the production process. In other words, the wear and tear of assets here is recorded as consumption.

GDP calculation example

For our GDP calculation example, let’s choose the expenditure approach and imagine that we are calculating a quarterly GDP based on the following metrics:

Consumption (C) = $200m

Investment (I) = $55m

Government spending (G) = $120m

Balance of trade (NX) = Exports - Imports = $45m - $50m = -$5m

Following the expenditure formula, the result should be as follows:

GDP = C + I + G +NX = $200m + $55m + $120m + (-$5m) = $370m

Uses of GDP

Here are some of the examples on how gross domestic product can be used by traders:

-

Fundamental analysis of stocks: GDP is considered a high-impact indicator in fundamental analysis and can be handy in evaluating the economic environment a company is operating in that’s likely to influence its performance.

-

Fundamental analysis of forex markets: Foreign exchange (forex) markets tend to reflect the economic dynamics of their corresponding countries, hence GDP readings could be a major driver.

-

Recession watch: In theory two quarters of negative GDP growth constitutes a technical recession. Hence GDP is highly observed during economic downturns.

-

Monetary policy: GDP is also watched closely by central banks as it informs their decisions in monetary policy such as whether to rise or cut interest rates, expand or taper bond-buying programmes, and more.

Limitations of GDP

Although GDP is an important indicator to evaluate economic health of a country, there are a number of factors that GDP does not reflect. For example, GDP does not account for:

-

Income equality: GDP fails to indicate how evenly wealth is distributed in an economy.

-

Non-market transactions: GDP doesn’t account for any non-market transactions, for example those within a household such as food preparation and child care services.

-

Sustainability: High production is not always sustainable, and can involve polluting or damaging the environment. GDP does not reflect how sustainable a country’s production is.

Therefore, to complement GDP analysis, investors and traders may look into alternative metrics such as Human Development Index (HDI), Genuine Progress Indicator (GPI), Happy Planet Index (HPI), and other data such as country sustainability reports and greenhouse gas emissions.

Conclusion

Although GDP is a lagging indicator, meaning that it looks at how the economy has already performed, it’s a key tool in a trader’s arsenal. GDP can help traders evaluate the economic health of countries (or regions) where stocks or currencies operate, watch out for recessions, and help understand monetary policy. It's a key indicator in assessing the macroeconomic environment.

The key drivers of GDP are its components: consumer and government spending, business investment and balance of trade, which is the difference between exports and imports.

Traders can use nominal and real GDP, with the latter one including inflationary effects into calculation. There is also a GDP per capita that takes into account a country’s population.

To calculate GDP, a trader can choose between expenditure, income and value-added approach.

There are, however, limitations of GDP as an economic indicator. For example, it doesn’t reflect the level of inequality, sustainability of production and doesn’t account for non-market transactions.

FAQs

What affects GDP?

GDP is affected by its key components: consumer and government spending, business investment and balance of trade, which is the difference between exports and imports. Any change in those components would have an impact on the final GDP calculation.

What is a simple definition of GDP?

GDP is an indicator of a nation’s overall economic activity, valuing all the final goods and services produced in a particular period of time, typically annually or quarterly, within the country’s boundaries.

Which country has the highest GDP?

In 2022, the countries with the highest GDP were the US, China, Japan, Germany and India.

Is a high GDP good?

A high GDP means that the economic activity in the country is high, however it should be seen in the context of the population size through GDP per capita, and other indicators such as equality and sustainability indices. It’s also important to evaluate the GDP trend over time - whether it’s growing or declining, and keep in mind the difference between nominal and real GDP.

What is GDP used for?

GDP can be used to evaluate a country’s economic health. It’s a useful indicator in fundamental analysis of stocks and currency markets. It’s also used by central banks and policymakers, and is important when watching out for a recession.

What are examples of GDP?

GDP of a country measures overall economic activity, valuing all the final goods and services produced in a particular period of time, typically annually or quarterly, within the country’s boundaries. The components of GDP may include spending by households on final goods and services, such as food, rent, medical care, and automobiles; spending on capital equipment, inventories, and structures, such as factories, machinery, homes, and office buildings, and more. In the US, for instance, the GDP was worth $23.315 trillion in 2021, according to the World Bank.