DXY forecast: Will rate hikes support USD dominance?

Interest rate hikes helped the DXY surge to a 20-year high in 2022, but the index has since slid as the Fed has signalled a slowing of its monetary contraction policy. Where next for the DXY?

The US dollar (USD) emerged as the go-to safe-haven asset in 2022, supported by an aggressive tightening monetary policy by the US Federal Reserve (Fed). The central bank ratcheted up the target interest rate from 0.25% at the start of last year to 4.50% in December.

As a result, the ICE US Dollar Index (DXY), which tracks the performance of the USD against a basket of major international currencies, surged to 20-year highs.

However, as inflation in the US appears to be slowing, the Fed has shown signs of softening its aggressive stance, most recently hiking its target interest rate by a quarter of a percentage point on February 1.

The bank has promised “ongoing increases” in borrowing costs as part of its ongoing battle against inflation, which has strengthened the DXY by close to 8.5% over the past year.

US Dollar Index (DXY) live chart

With the DXY forecast in mind, let’s look at what analysts expect from the US dollar and the DXY index amid a global monetary tightening cycle.

What is the US dollar index?

The US dollar index (DXY), the so-called ‘Dixie’, is a benchmark for the international value of the USD and the world’s most recognised currency index. It was originally developed by the Fed in 1973. Today, it is maintained by the Intercontinental Exchange (ICE).

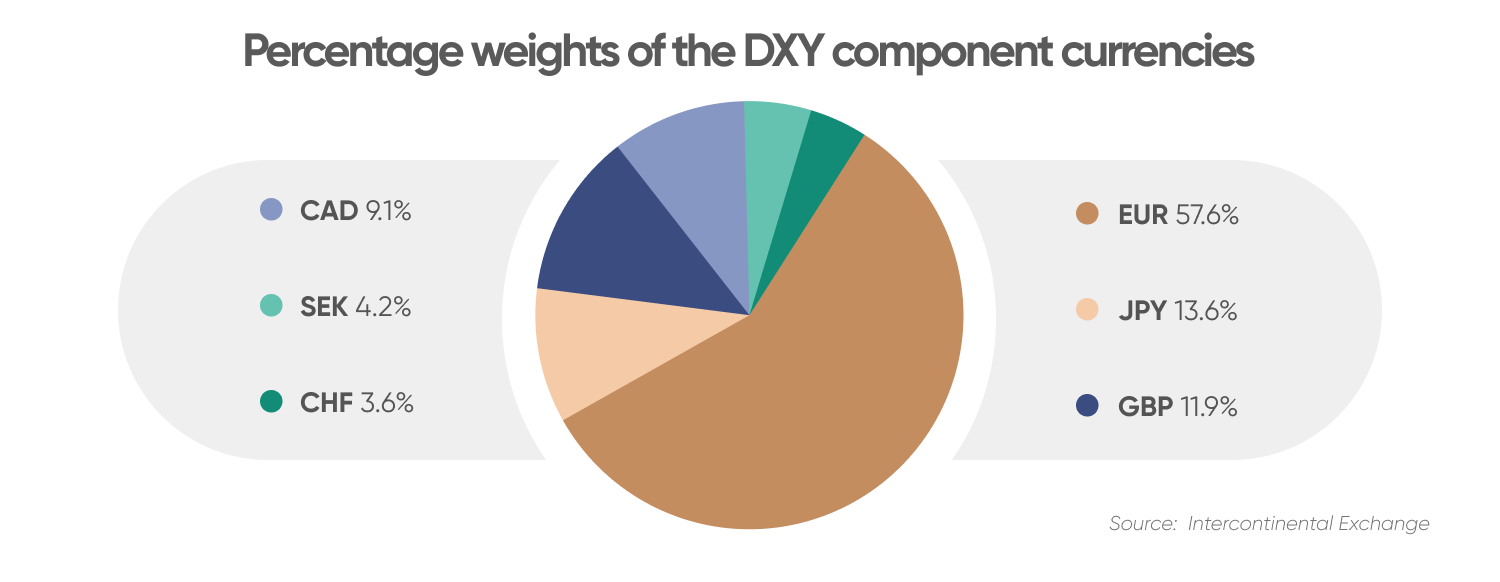

The DXY’s value is calculated by comparing the USD to six component currencies: the euro (EUR), Japanese yen (JPY), British pound (GBP), Canadian dollar (CAD), Swedish krona (SEK) and Swiss franc (CHF).

Not all component currencies have the same weight. The euro has the highest weight on the index at 57.6%. The Japanese yen and British pound follow at 13.6% and 11.9%, respectively. This means that changes in the USD/EUR rate will have more influence on the DXY’s value compared to changes in USD/JPY rates.

The weightage of the Canadian dollar, Swedish krona, and Swiss Franc on the index comes in at 9.1%, 4.2%, and 3.6%, respectively.

According to the ICE, there are no regular scheduled adjustments for rebalancing the DXY. It was adjusted in 1999 when the euro was introduced as the common currency of the EU. Data from ICE showed that the DXY index hit an all-time high of 164.72 in February 1985. Its all-time low stands at 70.698, reached in March 2008.

According to the ICE, the index is affected by several macroeconomic factors, including inflation and deflation in USD and component currencies, as well as recessions and economic growth in the countries of the component currencies.

Futures and options contracts based on the DXY index were introduced after 1985 allowing investors and hedge funds to make bets on their DXY predictions.

DXY index performance: Dollar strength mirrors Fed rate hike cycle

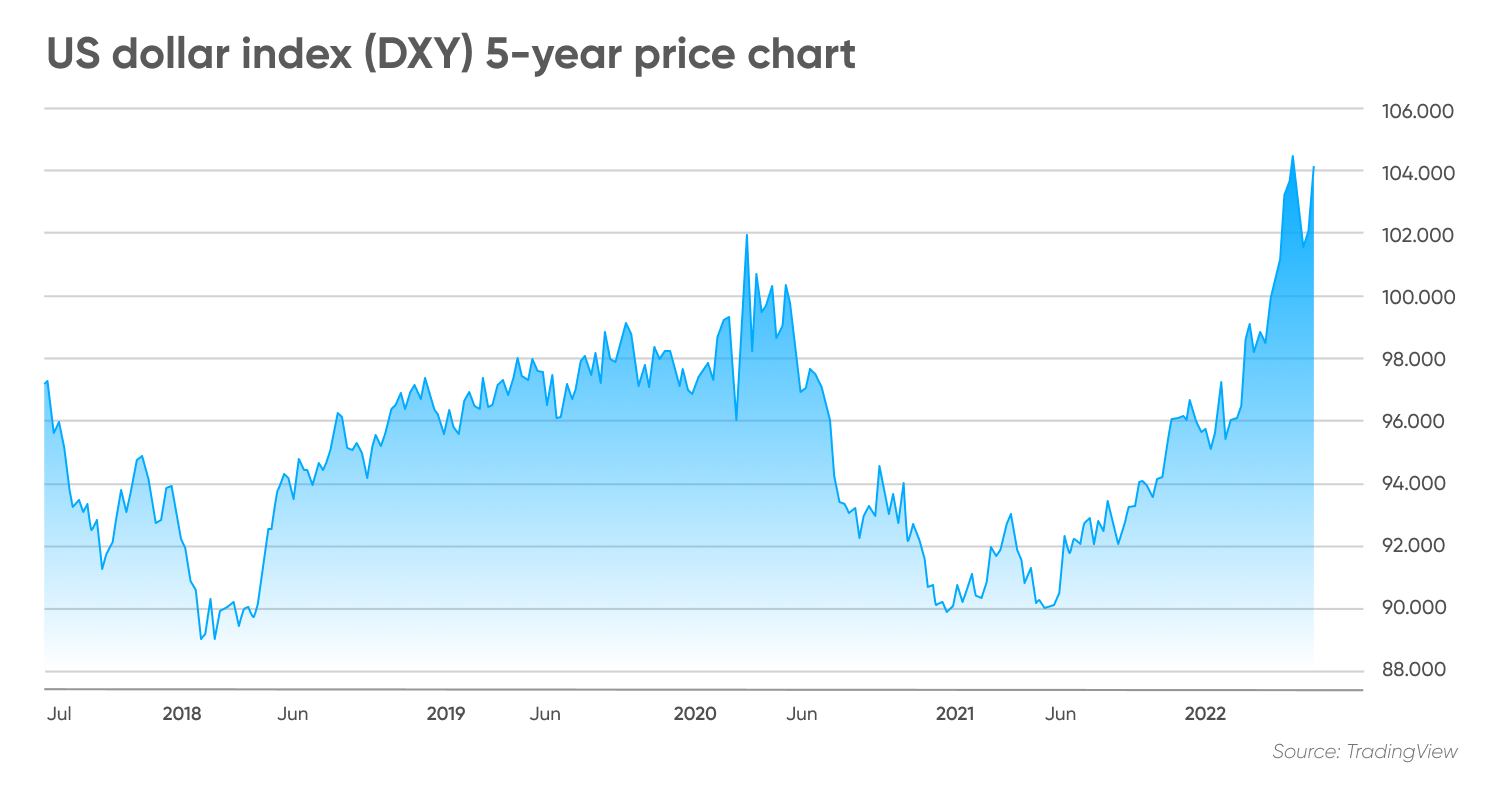

As of 17 March, historical charts show DXY rising from the start of 2021 aided by recovery in the US economy following the pandemic-induced slump.

As rising inflation captured headlines by the start of 2022, the DXY index would surge to a highest level in nearly 20 years by mid-June, supported by aggressive tightening policy in the US and relatively dovish strategies undertaken by its international peers.

Between January 2021 to mid-June 2022, the DXY gained over 17% to hit 105.788 points, its highest level since December 2002.

A bulk of the gains came in March and April 2022 as the index posted monthly rises of 1.6% and 4.7%, respectively, as the Fed hiked interest rates by 25 basis points (bps) in mid-March and by 50 bps in early May.

Four consecutive 75 bps hikes would follow in June, July, September and November, during this time the DXY continued to strengthen steadily, reaching a new 20-year peak of 114.78 points on 27 September.

However, cooler-than-expected inflation data.towards the end of the year as inflation towards the end of 2022 was followed by rumours that the Fed would ease its interest hikes.

October saw the start of a downtrend for the DXY and while interest rates were hiked by a further 50 bps on 14 December, the index ended 2022 103.52 points, having fallen almost 10% from its September high.

The dollar index’s performance has remained uncertain in 2023 amid an uncertain economic landscape.

As of 17 March the index stood at 103.47.

DXY forecast for 2023 and beyond

The DXY performance for 2023 and beyond could hinge on the extent to which the Fed continues tightening its monetary policy and how international peers react – especially the European Central Bank (ECB) and the Bank of Japan (BoJ).

Interest rate forecasts

Across the Atlantic, the Fed’s rate hikes prompted a host of central banks to keep up.

The Bank of England raised its key interest rate – the bank rate – by 50 basis points to 4.0% during its February meeting, pushing the cost of borrowing to the highest level since late 2008.

The move marked the 10th consecutive rate hike amid UK policymakers' efforts to combat high inflation and despite the risks of an expected economic recession this year. Meanwhile, the BoE dropped its pledge to keep increasing rates "forcefully" if needed and said inflation had probably peaked, suggesting it might start reducing the pace of rate increases soon.

Capital.com analyst Justin McQueen’s weekly forex forecast saw the pound vulnerable to further weakness, signalling potential strength for the USD in the GBP/USD pair:

“The main point from the BoE decision was the change in guidance in which they stated that if there were to be evidence of more persistent pressures, then further tightening would be required. This signals that the end of the tightening cycle is near, perhaps just one more 25bps hike, but equally, should data print on the weaker side, most notably wages and services inflation, there is a chance that there will be no more hikes in this current cycle. As such, with markets this pricing in hikes from the BoE, a continued dovish repricing leaves GBP vulnerable to further downside.”

The Swiss franc gained nearly 2% against the US dollar on 16 June as the Swiss National Bank (SNB) delivered its first rate hike in 15 years.

The SNB surprised markets with a 50 bps hike in a bid to stay ahead of the ECB. In early June last year, the ECB announced that it would start its rate hike cycle with a 25 bps hike in July, followed by a 25 bps or 50 bps hike in September. Dutch lender ING Group commented on the move:

Since embarking on the tightening cycle in June, the SNB has raised its policy rate to 1%, most recently hiking by 50 bps in its December meeting, bringing borrowing costs to their highest level since 2008. The bank has outlined that additional rises in the SNB policy rate might be necessary to ensure price stability over the medium term.

The BoJ is under increasing pressure in Asia to join its international peers to pivot from its dovish policy. The Japanese government has urged the BoJ to take "necessary measures appropriately" having seen the yen fall to a 24-year low of over 135 against the USD. The BoJ's position is likely hinged on the departure of current governor Haruhiko Kuroda, who has presided over the bank's loose stance.

ING Group’s FX analyst Francesco Pesole weighed in on the situation in Japan in a piece on January 6:

"It is too early to draw conclusions on this, and both data and market dynamics may have a bigger say on potential BoJ policy changes than the new governor: for now, however, markets may be more reluctant to add bearish Japanese government bond (JGB) positions, and USD/JPY could find some support."

DXY forecasts

Pesole’s outlook for the DXY in the near future saw the index hovering around the 103 mark:

In the longer term, strategists at investment bank Morgan Stanley saw the DXY ending 2023 at 98 – down from a previous forecast of 104. In a note cited by Reuters in mid-January, a group of analysts led by James K Lord wrote:

In a note made available to Capital.com, Australian bank Westpac’s senior economist Elliot Clarke looked even further, although refraining from making DXY forecasts for 2025 or 2030:

“The consequence for the US dollar is that we continue to see it as being near its peak for this cycle,” said Clarke while adding that the DXY index was forecast to trend towards an additional 5% decline by the end of 2023. The economist added:

A year-long outlook from data aggregator TradingEconomics saw the index grow to 106.10 by the end of this quarter and to 110.81 in 12 months’ time.

Elsewhere, the Economy Forecast Agency’s long-term DXY forecast for 2025 expected the DXY index to close at about 111.47 in 2025.

When looking at DXY forecasts for 2023 and beyond, it’s important to keep in mind that analysts’ predictions can be wrong. Economic DXY predictions shouldn’t be used as substitutes for your own research. Always conduct your own due diligence before trading. Never invest or trade money you cannot afford to lose.

Interested in comparing the major forex pairs? Try our currency strength meter.

FAQs

Is DXY a good investment?

Whether the DXY index is a good investment for you or not will depend on your portfolio composition, investment goals and risk profile, among other factors. Different trading strategies will suit different investment goals with short or long-term focus. You should do your own research. And never invest what you cannot afford to lose.

Will DXY go up?

Analysts at Morgan Stanley and Westpac cited in this article saw the index declining over the coming year. Forecast websites TradingEconomics and the Economy Forecast Agency, however, saw the DXY gaining strength and rising closer to the 110 mark.

However, analysts' and forecast platforms’ DXY predictions can be wrong and have been inaccurate in the past. Always do your own research before investing. Remember to never invest more money than you can afford to lose.

Should I invest in DXY?

Only you can decide whether the DXY is a suitable investment for you. It is important to always conduct your own due diligence before investing. Remember to never invest or trade money you cannot afford to lose.