CFDs vs forex: What should traders know?

How does trading CFDs vs forex compare? Below, we’ll look into the essential similarities and differences to know between these key trading terms, from leverage to asset class information and more.

CFDs and forex: how do they compare?

CFDs (contracts for difference) and forex trading are often compared, even though they are distinct concepts. Both allow traders to speculate on financial markets, but they differ in scope and application. CFD trading offers access to a wide range of markets, including shares, commodities, and indices, while forex focuses solely on the performance of currency pairs.

With us, forex trading is undertaken as a CFD, meaning you can access global currency markets alongside other asset classes – all with the flexibility and leverage that CFDs provide. However, it’s important to remember that leverage amplifies losses as well as profits.

To clarify the distinctions between CFD and forex trading, here’s the definition of each term.

What are CFDs?

CFDs are derivatives that let you trade on price movements across various assets – like stocks, commodities, or forex – without owning them. They’re flexible, with no fixed end date, so you can keep your position open as long as you like. CFDs are popular for short to medium-term trading and allow leverage (also known as margin trading). This means you can control a larger position with a smaller outlay, though this also increases potential losses as well as profits.

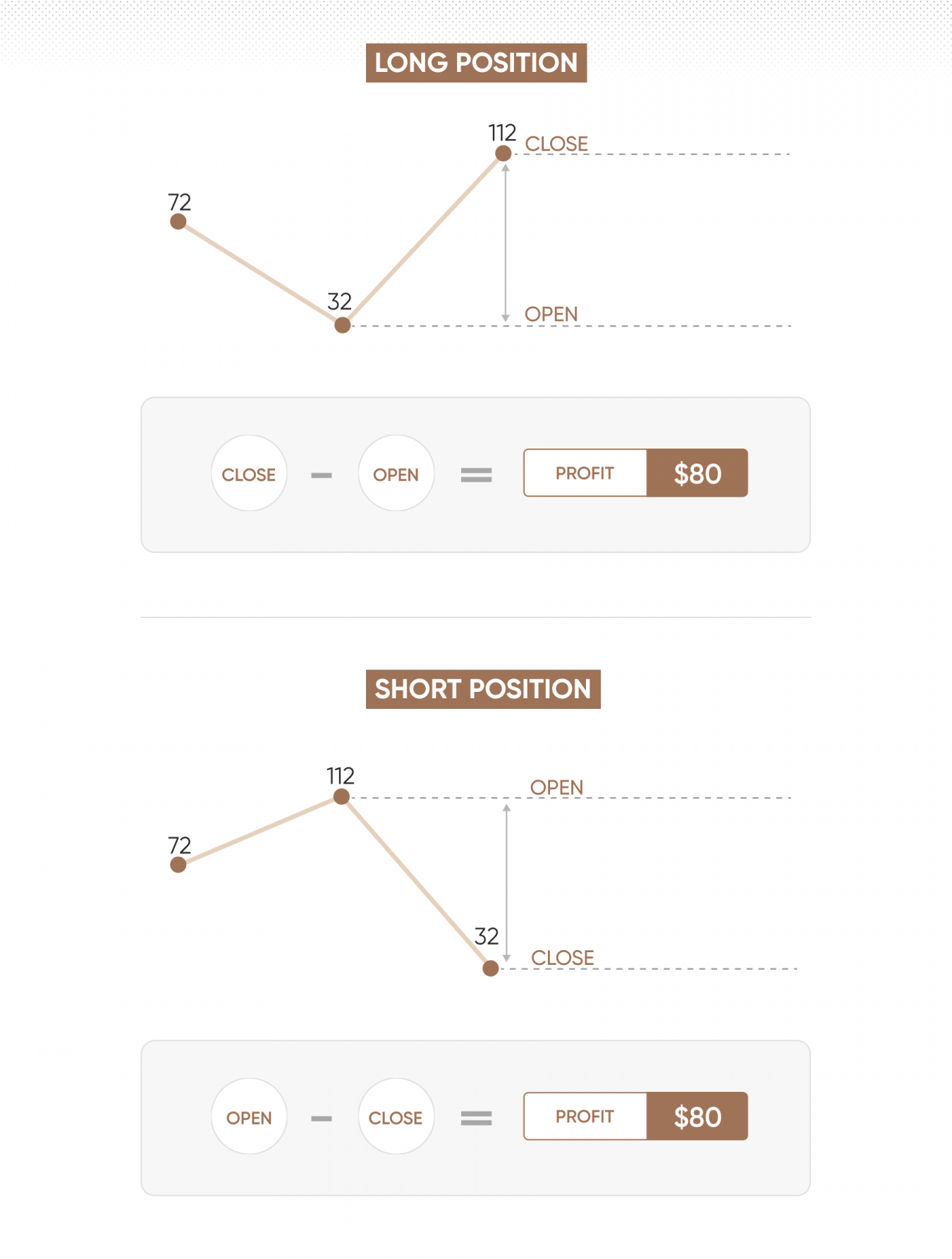

With CFDs, you have the choice of taking a position on an asset rising in price, known as a long position, or falling in price, known as a short position. Bear in mind that the below illustrations only shows the potential profit – if the price were to go in the opposite direction in each scenario, you would instead incur a loss.

Learn more about CFD trading and how it works.

What is forex?

Forex trading focuses specifically on the exchange of currencies. When trading forex, traders aim to profit from fluctuations in exchange rates between currency pairs like EUR/USD or GBP/JPY. This is done by going ‘long’ or ‘short’ on these pairs depending on how you think each currency in the pair will perform relative to each other.

For example, if you’re trading EUR/USD and you think EUR will strengthen against USD, you would ‘go long’ or buy. If you think EUR will weaken against USD, you would ‘go short’ or sell.

With us, forex is traded as a type of CFD, combining the focused nature of currency trading with the flexibility and leverage that CFDs offer. Learn more about forex trading and how it works.

Why do traders choose CFDs?

Here’s an overview of why traders might choose to trade CFDs.

- Broad market access: trade shares, commodities, forex, and more from a single platform.

- Leverage (also known as margin trading): control larger positions with a smaller initial outlay, enhancing potential returns and risks.

- Flexible duration: no fixed expiration dates, allowing traders to close positions when desired.

- Diversification: easily diversify across different asset classes within one account.

- Short- and medium-term focus: may suit day trading, where people look to respond to immediate market conditions.

Why do traders choose forex?

Here’s an overview of why traders might choose to trade forex.

- High liquidity: access a market with significant trading volume, allowing quick entry and exit of positions.

- Extended trading hours: nearly 24/5 availability enables traders to respond to global events in real time.

- Leverage: control larger positions with smaller investments, enhancing both potential rewards and risks.

- Focus on currency pairs: speculate on global economic trends by tracking shifts in currency values.

- Dynamic market environment: Engage with a fast-paced market that reflects global economic activity, but requires careful risk management.

How do CFDs and forex trading differ?

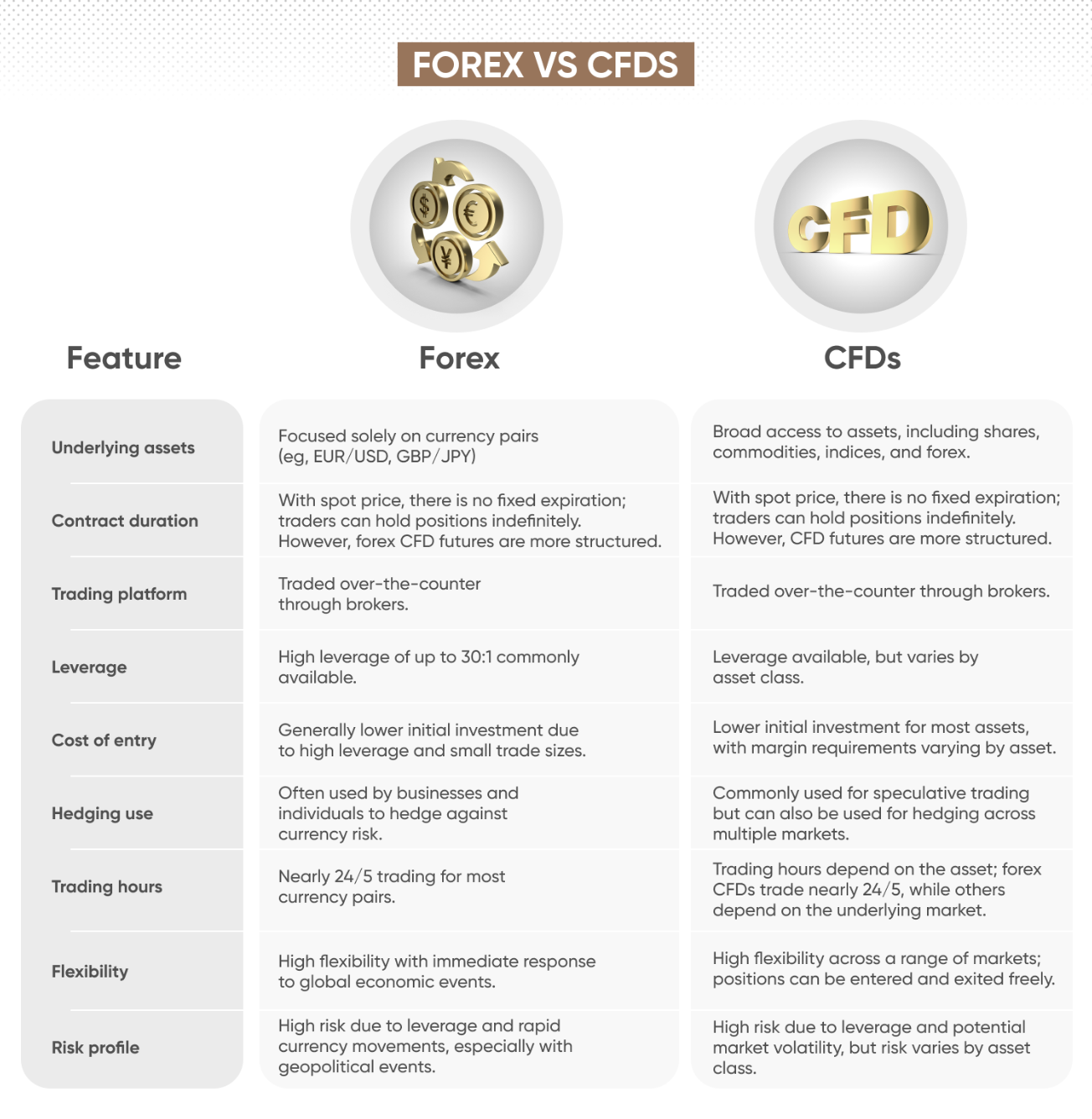

While CFDs and forex both involve speculating on price movements without owning the underlying assets, they differ in scope and structure. CFDs can cover a wide range of assets, including shares, indices, commodities, and forex pairs, offering traders access to diverse markets from one platform. As mentioned earlier, forex can be traded as a type of CFD with us, combining currency trading with the flexibility of CFD contracts, such as adjustable position durations.

Forex trading, however, is exclusively focused on currency pairs, through which traders aim to profit by predicting changes in exchange rates between the currencies in each pair. Unlike CFDs on other assets, forex trades are solely about currency movements, and the forex market operates nearly 24/5, providing continuous trading opportunities.

In essence, CFDs offer broader market access, while forex is a single, highly liquid market specifically for currency pairs, each with unique trading strategies and considerations.

Here’s more on the comparison between forex and CFDs.

How are CFDs and forex trading similar?

CFDs and forex trading share several similarities, appealing to traders seeking flexible opportunities. Both offer leverage, enabling traders to control larger positions with a smaller initial investment, which magnifies potential profits and losses.

Both also involve paying a spread, though the amount varies between forex and other CFDs. With forex CFDs and other CFDs, overnight funding applies for holding positions longer than a day, but the rate is calculated differently depending on what asset class you’re trading.

Find out more on our charges and fees page.

Both markets allow speculation on price movements without owning the underlying assets, enabling traders to go long (buy) or short (sell). They also provide low barriers to entry, with accessible platforms and minimal deposit requirements.

These shared traits make CFDs and forex popular among traders, offering leveraged, accessible trading, though each has unique risks and opportunities.

How is forex traded with CFDs?

When forex is traded with CFDs, traders are speculating on the exchange rate movements between currency pairs without actually owning the currencies. A forex CFD mirrors the price changes of a currency pair, such as EUR/USD, allowing traders to profit from price fluctuations in either direction.

With CFD forex trading, traders can use leverage, which means they only need to put down a portion of the full trade value. This allows for potentially greater exposure, though it also amplifies both gains and losses. Additionally, forex CFDs provide the flexibility to go long (if expecting a currency to appreciate) or short (if anticipating a depreciation).

By trading forex through CFDs, traders can take advantage of the liquidity and 24/5 access of the forex market, with the added benefit of flexible position sizes and no fixed contract expirations.

Which is better out of CFDs vs forex for derivative traders?

For derivative traders, whether CFDs or forex is better depends on individual trading goals and market preferences. CFDs offer broad market access, covering various asset types like stocks, commodities, indices, and forex itself, allowing for diversification within a single account. This flexibility can benefit traders looking to speculate across multiple markets, each with unique drivers and opportunities.

Forex trading, on the other hand, is focused solely on currency pairs, providing deep liquidity and nearly 24/5 trading hours. For traders primarily interested in global currencies and economic trends, forex offers a highly specialised market with fewer variables than CFDs.

Remember though that forex can be traded as CFDs, allowing traders to speculate on forex movements without owning the currencies themselves. This is often done using the same fundamental and technical analysis approach.

In short, CFDs are ideal for traders who value market variety and flexibility, while forex may be better for those who prefer a focused, liquid market centred on currency movements. Each has unique advantages, so the choice largely depends on the trader’s strategy and preferred assets.

Trading CFDs and forex with us

When you trade CFDs and forex with us, you can speculate long or short on the price of a wide range of markets. To prepare, read up on the trading essentials, and inform your positions with the latest trading news and analysis from our expert analysts. Also, it’s advisable to ensure your risk management strategy is good enough to prepare you for potential volatility, and learn about how to improve your trading psychology to maximise your confidence in the markets.

If you want to master forex trading try our step-by-step forex course and explore potential profits and losses on your forex CFD trades with our free forex profit calculator.

FAQs

Is forex CFD trading?

Not exactly. Forex trading and CFD trading are both types of derivative trading, but they’re not the same. Forex trading is the direct trading of currency pairs, while trading forex with CFDs is a way to speculate on currency price movements without owning the actual currencies. In CFD forex trading, you use a CFD to mirror the forex market's price movements.

What is a CFD in forex?

A CFD (Contract for Difference) in forex allows you to trade currency pairs without owning the underlying currencies. It’s a contract between you and the broker to exchange the difference in the currency pair's price from when you open the trade to when you close it. This lets you go long or short on currency pairs and trade with leverage.

Can you trade forex without CFDs?

Yes, you can trade forex directly without using CFDs. This involves buying and selling actual currency pairs on the forex market. Many brokers offer direct forex trading accounts specifically for this purpose, which may have different margin requirements and costs compared to CFD trading.

What is the difference between CFD and forex?

The main difference is that CFDs are contracts that allow you to trade on price movements across various asset types, including forex, stocks, commodities, and indices. Forex trading is exclusively focused on currency pairs. You can trade forex directly or via CFDs, but CFDs also enable trading on other markets, making them a broader trading instrument.