Block (SQ) stock forecast: Is it time to buy the dip?

Our SQ stock forecast looks at the prospects for the payments provider

Block (SQ), the US-based payments provider, has seen its share price fall 25% since the start of the year as global markets rotated away from growth stocks.

However, the technology company has been focusing on the future with the $29bn (£22.3bn) acquisition of Afterpay, the buy now, pay later business.

In this SQ stock analysis, we take a look at the outlook for Block, which rebranded from Square at the end of last year, and where its stock price is expected to go.

Block (SQ) stock analysis: Major price drivers and technical view

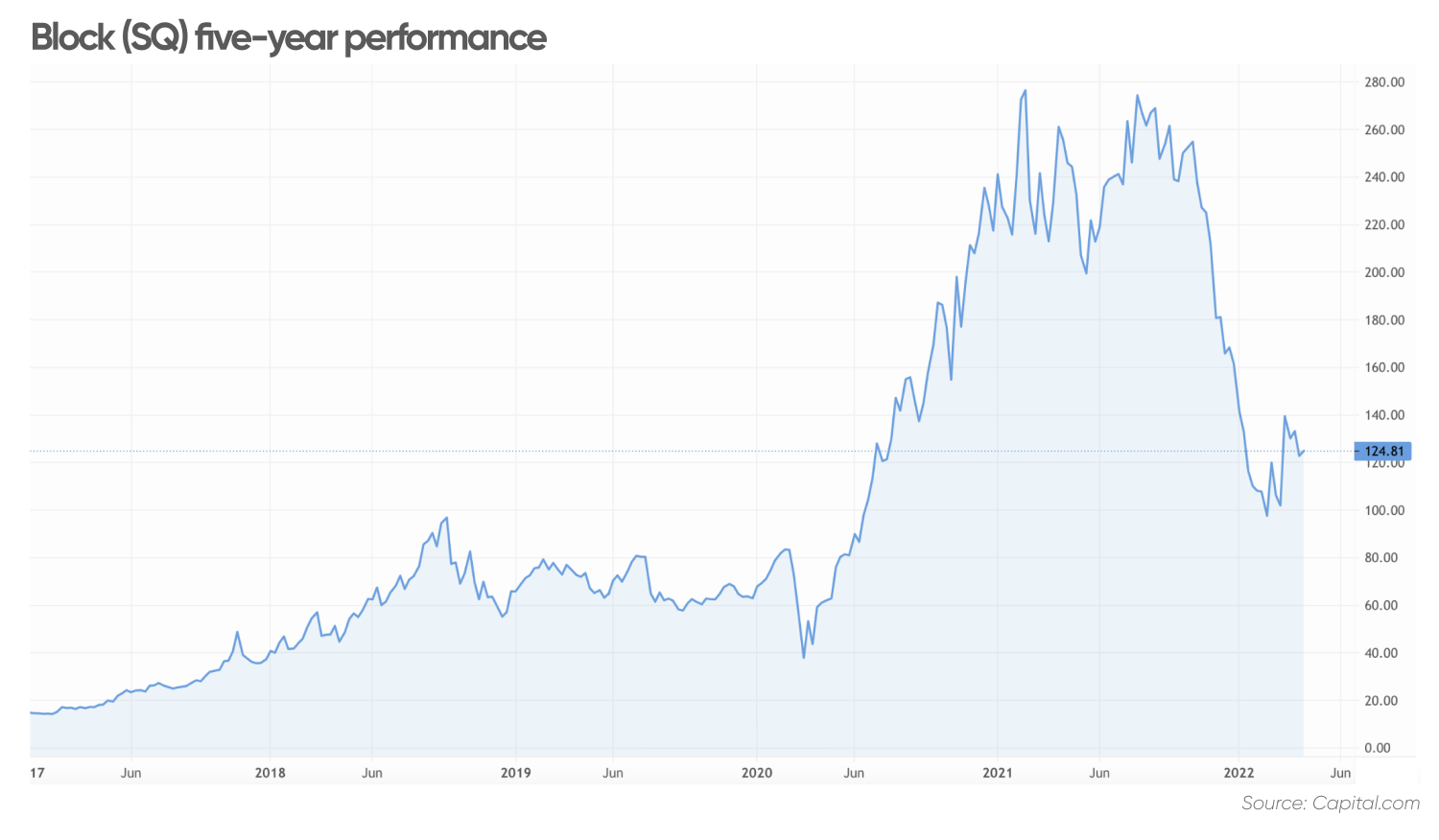

Investors in Block have had quite a journey in recent times. Over the past five years, the price has risen 628% from $16.92 to $123.22 as the market closed on 8 April 2022.

However, shorter term performances have been less positive. The SQ stock value has fallen 53% over the past year and is down 25% year-to-date in 2022.

The recent falls have been largely attributed to the global stock market rotation away from growth stocks, prompted by concerns over fiscal policy tightening.

Josh Saltman, portfolio manager of Baron FinTech Fund, commented on Block in his most recent investor letter at the end of 2021.

He said high exposure to lagging e-commerce companies and the underperformance of Block were the only material detractors from relative performance.

Block (SQ) stock fundamental analysis: Latest earnings

In a letter to shareholders in late February 2022, Block reported gross profit of $1.18bn in the fourth quarter of 2021, which was up 47% year-over-year.

Cash App generated gross profit of $518m, up 37% year-over-year, while its Square ecosystem generated gross profit of $657m, which was 54% more than the previous year.

For the full year of 2021, gross profit was $4.42bn, up 62% year-over-year, or 53% on a two-year CAGR basis.

The adjusted EBITDA (earnings before interest, tax, depreciation and amortisation) came in at $1.01bn, while net income attributable to common stockholders was $166m.

“Net income was $202m when excluding the gains on our equity investments of $35m and the impairment losses recorded on our investments in bitcoin of $71m,” the letter stated.

Block stock news: Acquisition of Afterpay

At the end of January 2022, Block completed the acquisition of Afterpay, the buy now, pay later firm, for $29bn.

In a statement, Block’s co-founder and CEO Jack Dorsey welcomed the Afterpay team and said everyone was eager to get to work.

Block also launched its first integration with Afterpay, providing Afterpay’s BNPL functionality to sellers in the United States and Australia that use Square Online for e-commerce.

According to Brett Horn, senior equity analyst at Morningstar, evaluating the amount paid for the acquisition is difficult.

“Afterpay is in a similar phase as Block, with the company seeing strong growth but unable to achieve profitability yet,” he said.

While the offer was 68% above his valuation for Afterpay on a standalone basis, Horn added that Block’s shares were viewed as highly overvalued at the time.

Block stock projections: What do the analysts think?

Brett Horn increased his SQ stock price target in late March 2022 to $124 from $115.

He also expects margins to “improve fairly dramatically” in the coming years as it more fully monetises its client base and scales.

“Block is a fast-growing, highly scalable business, which creates a wide range of possibilities,” he added. “This consideration is the primary factor behind our very high uncertainty rating.”

As Block’s revenue is directly tied to revenue at its merchant customers, Horn believes it’s sensitive to macroeconomic conditions.

“Its focus on micro and small merchants magnifies this dynamic, as small merchants can fail in large numbers during recessions,” he added.

Danni Hewson, financial analyst at AJ Bell, pointed out that Block’s share price is down 54% since its highs last year – albeit for understandable reasons.

With the stock looking cheap, Hewson believes investors might consider buying into it, especially as consumers seem to be still spending, despite inflationary pressures.

However, she also highlighted some concerns: “There are question marks about the company’s direction, and work on a bitcoin mining facility which has just got underway might be unsettling to more traditional investors.”

Meanwhile, Dan Dolev, senior analyst at Mizuho, said on 5 April that “Block [Square] is the fintech I’m most bullish on.” Do other Wall Street analysts agree?

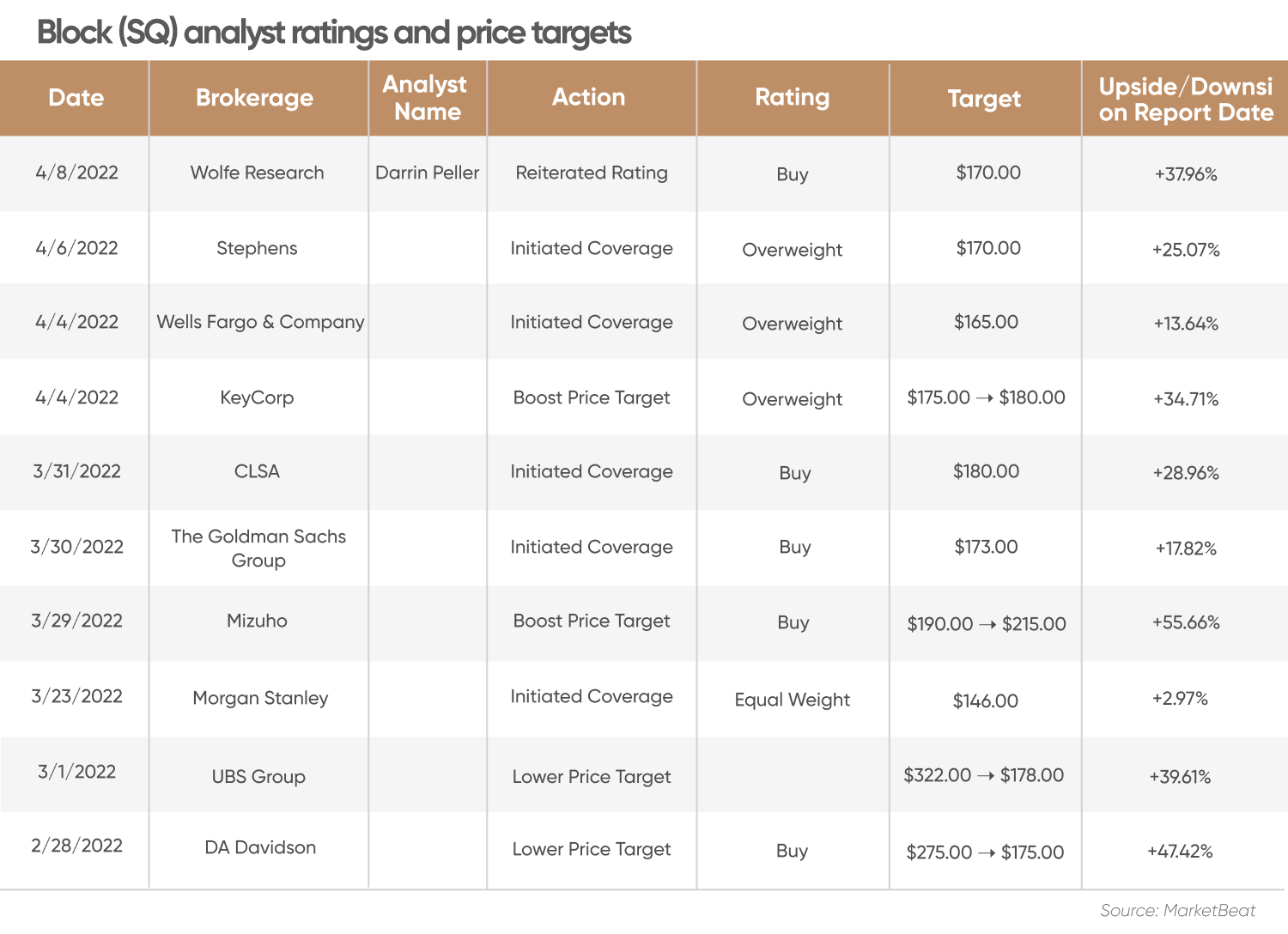

Block stock forecast: Wall Street ratings and price targets

So, is the company’s stock expected to rise or fall from the $123.22 level it was at the market close on 8 April 2022? Is the SQ stock a ‘buy’, ‘sell’, or ‘hold’?

The consensus Block stock forecast of 39 analysts compiled by MarketBeat as of 11 April put the SQ stock as a ‘buy’, with the expectation that its price will rise almost 70% to $209 over the coming year. The highest price target was set at $371 and the lowest one at $140 per share, although that would still represent a 14% premium over the current level.

Algorithm-based forecasting tool Wallet Investor supported the analysts’ bullish SQ share price forecast.

Block is “an awesome long-term (one year) investment” that could rise 58% to $203.77 over the next 12 months, said the website.

The site predicted the Square stock price could be at $214.07 by April 2023 and reach $271.54 by the same point in 2024, while the SQ stock forecast 2025 put it as high as $329.68.

Its long-term forecast took it to $387.49 by April 2026, while the five-year SQ stock projection to April 2027 could see it hit $430.32. That’s 249% higher than its current $123.22 level. Wallet Investor didn’t make projections as far ahead as 2030.

When evaluating the Block (SQ) stock potential, it’s important to bear in mind that analysts’ forecasts and algorithm-based price targets can be wrong. Projections are based on making fundamental and technical studies of the SQ stock’s historical price pattern – but past performance does not guarantee future results.

It is essential to do your own research and always remember your decision to trade depends on your attitude to risk, your expertise in the market, the spread of your investment portfolio and how comfortable you feel about losing money. You should never trade money that you cannot afford to lose.

Backdrop: What does Block do?

The company, which was formed in 2009 and went public six years later, is “creating tools to help expand access to the economy”.

The business is focused on financial services and runs five distinct businesses: Square, Cash App, Spiral, TIDAL and TBD54566975.

Square provides e-commerce solutions to help sellers run and grow their businesses, while Cash App enables people to send, spend, or invest their money in stocks or Bitcoin (BTC).

Spiral (formerly known as Square Crypto) builds and funds free, open-source Bitcoin projects, while TIDAL is a global platform for musicians that uses unique content and brings them closer to fans.

Finally, TBD54566975 is building an open developer platform to make it easier to access Bitcoin and other blockchain technologies without having to go through an institution.

FAQs

Is SQ stock a good buy?

Whether SQ is a suitable investment depends on your own investment objectives – and the opinion based on your own research. Remember, it’s important to reach your own conclusion of the company’s prospects and likelihood of achieving analysts’ targets.

Why has the Block stock price been going down?

The technology company has been affected by the global rotation out of growth stocks that has been seen during 2022.

Where will SQ stock be in 5 years?

The stock might rise 249% to $430.32 over the next five years to April 2027, according to the algorithmic forecasts of Wallet Investor (as of 11 April). However, no one knows for sure. The stock price can be affected by a wide number of variables.

Will SQ stock go up or down?

This will depend on many factors – some of which may be out of the company’s control. The consensus view of Wall Street analysts, compiled by MarketBeat as of 11 April, was that the SQ stock could rise almost 70% to $209 over the coming year to April 2023.

How high can SQ stock go?

The highest price target set by analysts, tracked by MarketBeat as of 11 April, suggested the price could hit $371 in one year’s time, which is much higher than the average price target set at $209 per share. Algorithm-based forecaster Wallet Investor estimated that the SQ stock could rise as high as $262.678 by the end of April 2023. The average price target was set at $214.072.