Bitcoin price prediction: Third-party outlook

Bitcoin is a decentralised digital asset traded globally, with prices influenced by macroeconomic conditions, regulation and market participation. Explore third-party BTC price targets and technical analysis.

Bitcoin (BTC) is trading near $82,667 in CFD terms against the US dollar on Capital.com, within an intraday range between a low of $81,486.35 and a high of $89,295.60 as of 11:03am (UTC) on 30 January 2026. Past performance is not a reliable indicator of future results.

Price action comes amid a broader risk-off tone in digital assets, with softness reported across major cryptocurrencies as Bitcoin slips toward the low-$82,000 area and altcoins such as Ether and Solana also trade lower (Saxo Bank, 30 January 2026). Macro conditions remain in focus as investors monitor US data releases and Federal Reserve policy expectations, with recent commentary highlighting the sensitivity of risk assets to movements in Treasury yields and the US dollar backdrop (CaixaBank, 30 January 2026).

Bitcoin price prediction 2026-2030: Analyst price target view

As of 30 January 2026, third-party BTC price predictions show a wide spread of potential outcomes, with targets framed around interest rates, institutional flows and evolving crypto regulation. The following summaries highlight selected third-party forecasts, providing indicative ranges and underlying assumptions rather than guarantees.

CNBC (multi-analyst roundup)

CNBC reports that Standard Chartered cut its 2026 Bitcoin price projection to around $150,000, while other experts outline a broad potential range between approximately $75,000 and $225,000 for the year. The piece notes that these views are framed amid expectations for possible interest-rate cuts, changing institutional participation and ongoing macro and regulatory uncertainty (CNBC, 7 January 2026).

Yahoo Finance / The Motley Fool (2025 targets as reference point)

An article on Yahoo Finance discussing Bitcoin forecasts for 2025 cites projections around $86,000 from one model and $111,000 from selected analysts for the end of that year. The piece frames these 2025 levels within a backdrop of ETF flows and institutional participation, while acknowledging that outcomes remain sensitive to market sentiment and macro data (Yahoo Finance, 16 December 2025).

Goldman Sachs (crypto and macro outlook)

Goldman Sachs’ digital assets team, cited in a January 2026 Forbes article, is reported to see potential for Bitcoin to approach levels near $200,000 by 2026, presented as a scenario rather than a fixed outcome. The report places this view in the context of expectations for more constructive regulation, continued ETF inflows and an environment of easier financial conditions should central banks cut rates (Forbes, 9 January 2026).

Bernstein (elongated-cycle thesis)

A January 2026 CryptoSlate feature states that Bernstein maintains a Bitcoin price target of $150,000 for 2026, alongside a separate projection for a possible peak around $200,000 in 2027. According to the article, Bernstein’s thesis assumes an elongated cycle in which ETF-led institutional buying offsets softer retail participation, with liquidity conditions and broader risk appetite identified as key variables (CryptoSlate, 23 January 2026).

Predictions and third-party forecasts are inherently uncertain, as they cannot fully account for unexpected market developments. Past performance is not a reliable indicator of future results.

BTC price: Technical overview

BTC/USD is trading near $82,667 on Capital.com as of 11:03am on 30 January 2026 (UTC), holding well below its medium- and long-term moving-average cluster, with the 20-, 50-, 100- and 200-day SMAs around 90,645, 89,617, 93,708 and 104,342 respectively. The 14-day RSI sits near 31, placing it in lower-neutral territory, while the ADX around 26 suggests an established trend backdrop rather than a range-bound market.

On the topside, the first classic pivot to watch is R1 near 93,494, with R2 around 99,492 only coming back into focus after a sustained daily close above initial resistance. On pullbacks, the classic pivot at 88,654 marks initial support, with the 100-day SMA near 93,708 acting as a notable moving-average reference, and a loss of that region would risk exposing the S1 zone around 82,656 on the downside roadmap (TradingView, 30 January 2026).

This technical analysis is for informational purposes only and does not constitute financial advice or a recommendation to buy or sell any instrument.

Bitcoin price history (2024–2026)

Over the past two years, BTC’s price has moved through several sharp swings, reflecting changing sentiment across the wider crypto market.

From late 2024 into early 2025, BTC traded in a broad and volatile range, with multiple pushes above $90,000 followed by fast reversals toward the mid-$80,000s as rallies faded. Into the final quarter of 2025, the coin continued to oscillate, with repeated tests of the $90,000–$94,000 area and pullbacks toward the low-$80,000s, illustrating how quickly momentum shifted as conditions evolved.

In January 2026, BTC remained choppy but biased lower from earlier highs, slipping from around $95,000–$97,000 in mid-month to $82,709.60 on 30 January 2026 as intraday ranges widened. That latest close leaves Bitcoin below the late-2025 cluster near $90,000, representing a notable drawdown from recent peaks, even as prices remain historically elevated in absolute terms.

Past performance is not a reliable indicator of future results.

Capital.com analyst view: Bitcoin

Bitcoin’s price over the most recent period has been marked by sharp swings, with the market moving from repeated tests of the $90,000 area to trading closer to the low-$80,000s on Capital.com’s feed as of 30 January 2026 (UTC). This pattern underlines how quickly conditions can change in a highly leveraged, sentiment-driven market, where brief rallies and pullbacks can both be sizeable in percentage terms and often occur within compressed timeframes.

Several factors can influence Bitcoin’s price, including shifts in broader risk appetite, changes in liquidity across major exchanges and evolving expectations around regulation and macro policy. Periods of improved sentiment or liquidity access can support prices, while tighter financial conditions, adverse headlines or position unwinding can have the opposite effect. The same features that attract some traders to Bitcoin – high volatility, continuous trading and a global investor base – also mean that losses can accumulate quickly if the market turns, and price moves do not always follow earlier patterns. Past performance is not a reliable indicator of future results.

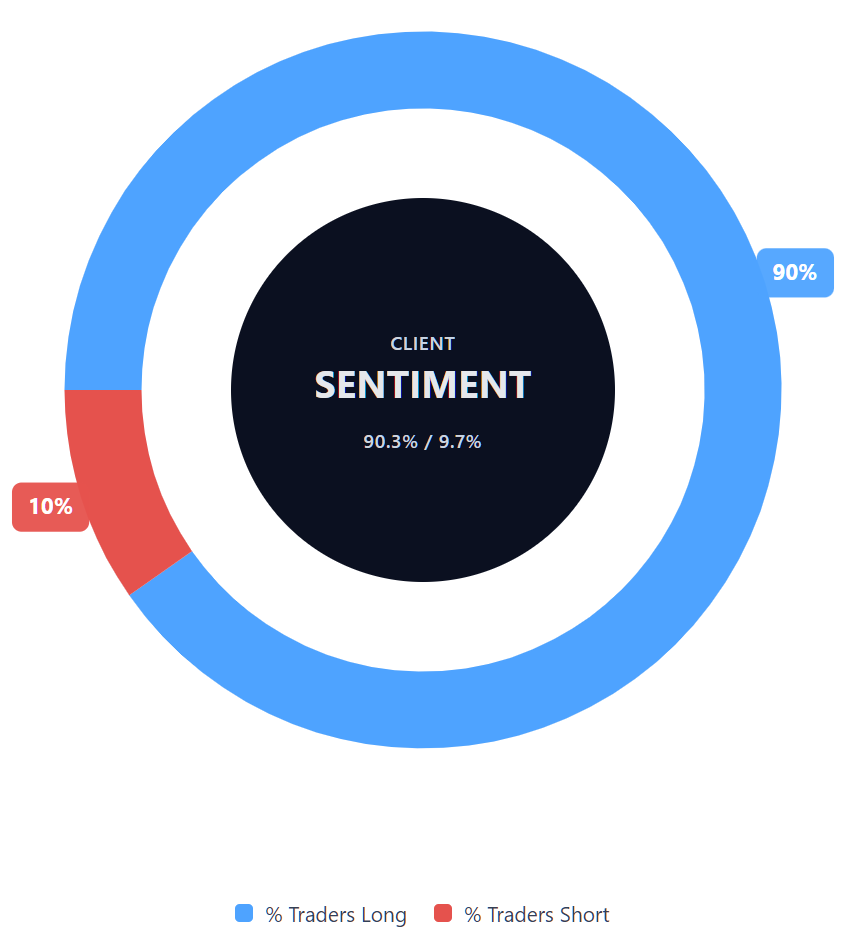

Capital.com’s client sentiment for Bitcoin CFDs

As of 30 January 2026, Capital.com client positioning in Bitcoin CFDs shows 90.3% buyers versus 9.7% sellers, indicating a heavily one-sided tilt towards long positions, with buyers ahead by around 80.7 percentage points. This snapshot reflects open CFD positions on Capital.com at a single point in time and can change as clients open and close trades.

Summary – Bitcoin (2026)

- Bitcoin traded mostly within a wide band around the $85,000–$95,000 area through late 2025, with frequent swings between local highs and lows.

- By the end of December 2025, BTC was closing slightly below its late-year highs, with several sessions clustered near the $87,000–$92,000 zone.

- Technical readings as of 30 January 2026 show price trading below the main 20-, 50-, 100- and 200-day moving averages, with RSI in lower-neutral territory and ADX pointing to an established trend environment.

- Bitcoin’s recent behaviour highlights both its appeal and its risks: high volatility and rapid repricing can create opportunities but also mean losses can build quickly. Past performance is not a reliable indicator of future results.

Past performance is not a reliable indicator of future results.

FAQ

What is the latest Bitcoin crypto price prediction?

There is no single, definitive Bitcoin price prediction. Third-party analyst forecasts for 2026 vary widely, with indicative targets ranging from around $75,000 to over $200,000, depending on assumptions around interest rates, institutional participation, regulation and broader macroeconomic conditions. These projections are presented as scenarios rather than guarantees, and analysts consistently highlight uncertainty. As a result, Bitcoin forecasts should be viewed as reference points, not as expectations of future performance.

Who owns the most Bitcoin?

Bitcoin ownership is spread across a wide range of participants, including early adopters, long-term holders, institutional investors and exchanges. Public blockchain data suggests that some of the largest known holdings are associated with early miners, investment funds and custodial platforms that hold coins on behalf of users. However, wallet addresses do not directly identify individuals, and ownership distribution can change over time as coins move between wallets and exchanges.

How many Bitcoins are there?

Bitcoin has a capped supply of 21 million coins, written into its underlying protocol. New bitcoins are introduced through a process called mining, with the rate of issuance reducing roughly every four years during events known as halvings. As of early 2026, the majority of the total supply has already been mined, while the remaining coins are expected to enter circulation gradually over several decades.

Could Bitcoin’s price go up or down?

Bitcoin’s price can move sharply in either direction and is influenced by a range of factors, including market sentiment, liquidity conditions, macroeconomic developments, regulation and technological changes. Its history shows periods of rapid gains followed by steep pullbacks, often within short timeframes. High volatility can create trading opportunities but also increases risk, and price movements do not always align with past patterns or analyst expectations.

Should I invest in Bitcoin?

Whether Bitcoin is suitable depends on your individual financial situation, objectives and risk tolerance. Bitcoin is a highly volatile asset, and losses can occur quickly, particularly when trading leveraged products such as CFDs. This content is for informational purposes only and does not constitute financial advice. You may wish to carry out your own research or seek independent professional advice before making any investment-related decisions.

Can I trade Bitcoin CFDs on Capital.com?

Trading Bitcoin CFDs on Capital.com lets you speculate on price movements without owning the underlying asset and to take long or short positions. However, contracts for difference (CFDs) are traded on margin, and leverage amplifies both profits and losses. You should ensure you understand how CFD trading works, assess your risk tolerance, and recognise that losses can occur quickly.