What are absolute return funds?

An absolute return fund, also known as a target return fund, is a fund that aims to turn a profit for its investors, regardless of the direction of the market. These differ from a relative return fund, which aims to outperform the market, even if that means making less of a loss than the average.

Key takeaways

-

Absolute return funds are funds that aim to turn a profit for its investors, regardless of the direction of the market.

-

Absolute return funds stand in contrast to relative return funds, which aim to outperform the market.

-

There is no guarantee that an absolute return fund will outperform the market, so make sure to do your own research, remember that markets can move in a direction that damages your position, and never invest nor trade with more money than you can afford to lose.

Absolute return funds can serve as an alternative to traditional bond and stock funds, as they use a variety of instruments across different asset classes.

Absolute return funds have been around for decades, with the origins of the term going back to 1949 when investor and hedge fund manager Alfred Winslow Jones established the first absolute return fund in New York.

In the past few years, the absolute return approach has become one of the fastest growing investment strategies worldwide. Typically, you will hear about absolute return funds from financial advisers and investment managers that sometimes offer them to retail clients to deliver stable returns.

How absolute return funds work

The value of assets in absolute return funds, as well as any income generated from them, varies across time. The assets are often utilised in a kind of long-short strategy, whereby assets are borrowed, sold at a price and then bought back at a lower price. This theoretically ensures a profit and helps the fund maintain profits for investors if markets are dropping. However, return is never 100% guaranteed.

Some examples of absolute return funds are John Hancock Global Absolute Return Strategies (JHAIX) and GMO Benchmark-Free Allocation (GBMFX).

| Absolute return funds | Traditional funds |

| Utilise a wide range of investment strategies | Utilise some specific investment strategies |

| Invest in a variety assets, ranging from futures contracts to currencies | Typically invest in stocks and bonds |

| Do not assess performance against benchmark indices | Assess performance against benchmark indices |

| Rely on risk-mitigation strategies, asset allocation and diversification | Explore securities within an asset class that could prove above-average returns |

Pros and cons of absolute return funds

As with all forms of investments, there are pros and cons to investing in absolute return funds. Some of the benefits can include:

-

Investments are less likely to be affected by a poorly-performing market.

-

They could hold up better than other investments in a falling market.

Some of the drawbacks include:

-

Positive performance is by no means guaranteed and, therefore, it should not be taken for granted.

-

In a market that is performing well, absolute return funds can underperform and not deliver as high a return as other funds.

Absolute return funds vs relative return funds

Absolute return funds stand in contrast to relative return funds. Relative return funds are funds which aim to deliver relative returns to investors. In other words, a relative return fund is designed to outperform the market. This means that, should the market make a loss then it is possible that the relative return fund will also make a loss.

Absolute return funds investment strategies

Absolute return investment strategies could include investing in national and international equities and fixed-income securities. This could include futures contracts and derivatives, utilisation of leverage, implementation of short selling, arbitrage and other techniques, which are not typically used by traditional bond and stock funds.

They could also include investments in unconventional assets, such as commodities, loan notes or real estate, making it very similar to hedge funds. As they have a lower correlation to traditional funds and are less dependent on the direction of the underlying assets, an absolute return fund offers investors some potentially useful diversification.

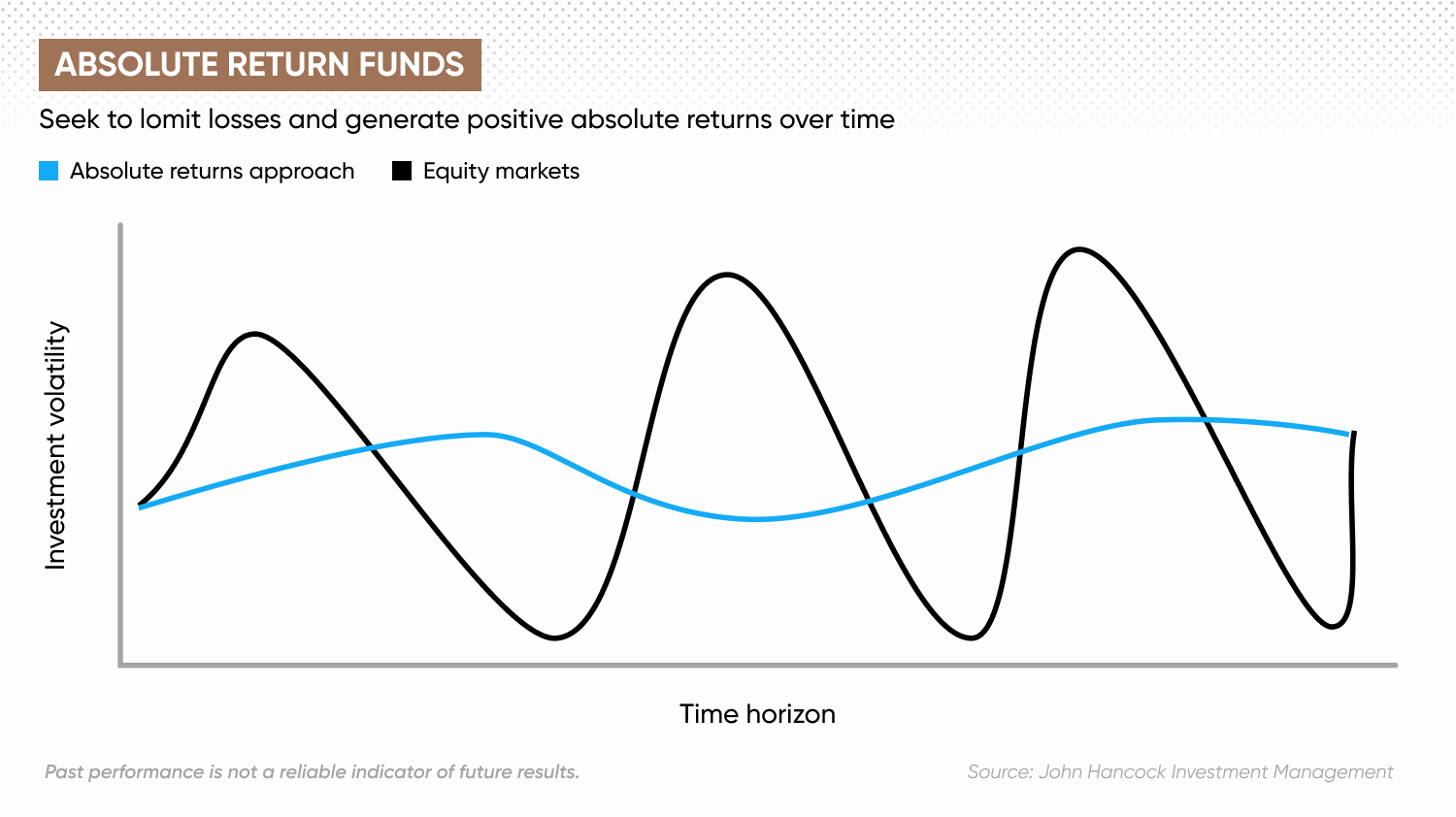

Absolute return funds are often seen as an option for people who are looking for slow yet steady annual growth with reduced exposure to volatility. Some experts suggest that these funds are best for investors who are afraid to lose money during market downturns, or for those with a known spending need in the future, such as a property purchase. However, keep in mind that investing in these tends to be more expensive due to the higher fees charged by the funds.

Conclusion

Absolute return funds are funds which aim to make investors a profit, no matter what direction the market moves in. However, a profit is by no means guaranteed. Traders considering investing in absolute return funds should do their own research and remember that markets can move against them. They should also never invest more money than they can afford to lose.

FAQs

What are absolute return funds and how do they work?

Absolute return funds are funds, which aim to deliver a profitable return, regardless of overall market conditions. Assets in the funds are often borrowed, sold at a price and then bought back at a lower price. This theoretically ensures a profit and helps the fund maintain profits for investors if markets are dropping.

What is the difference between absolute return funds and relative return funds?

Absolute return funds are designed to deliver a return that should make investors a profit, regardless of how the markets behave.

Relative return funds are designed to outperform the market. On one hand, this means that a relative return fund might well make a loss that is merely better than the average market downturn, but it can mean that an absolute return fund might not make as much money as a relative return fund when things are going well.

What are examples of absolute return funds?

Some examples of absolute return funds include the John Hancock Global Absolute Return Strategies (JHAIX) and GMO Benchmark-Free Allocation (GBMFX).