Why Capital.com?

We share a common ethos with OvalX, putting clients at the heart of everything we do. We’re rated ‘excellent’ on Trustpilot and have over 480,000 registered clients across the globe.

Here are a few of the key resources we offer to support your trading.

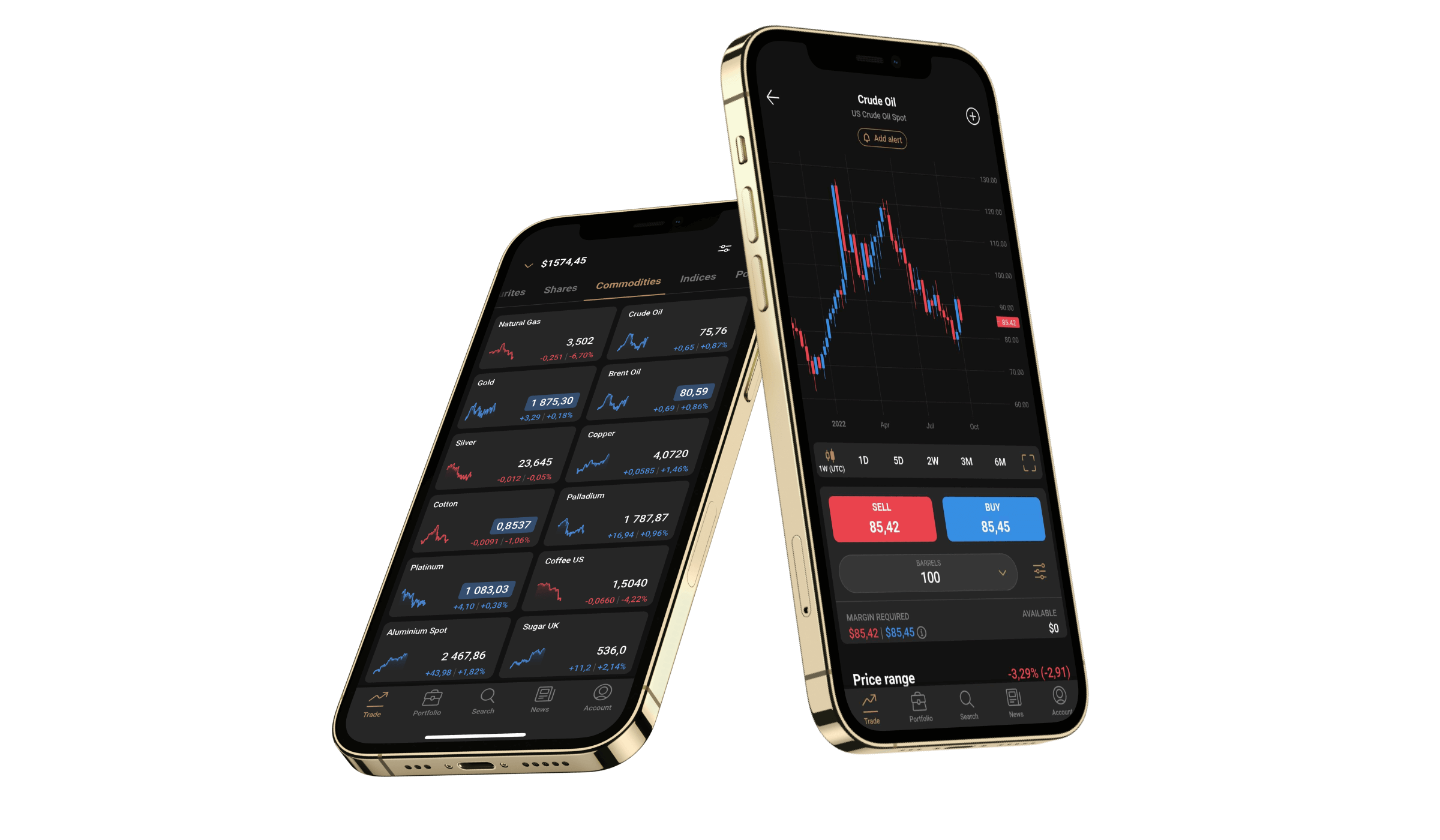

Award-winning platformWinner ‘Best Spread Betting Platform’ at the ADVFN International Financial Awards 2022 |

Smart risk-management toolsManage your exposure with guaranteed stop-losses, and take-profit orders |

24-hour supportOur friendly team is here to answer your queries around the clock |

Education for all levelsFrom quick-start videos to comprehensive market guides, we’ll help you enhance your skills |

Broad range of marketsSpread bet or trade CFDs on over 3,700 indices, currencies, commodities, shares and more |

TradingView integrationTrade on your Capital.com account straight through TradingView’s dynamic charts |

Frequently asked questions

About our products and services

Who is Capital.com?

We are a multi-award-winning spread betting and CFD platform. We have over 480,000 registered clients, and more than 75,000 active traders every month. We offer over 3,700 global markets, and around-the-clock support.

We were recently awarded ‘Fastest Growing Broker’ by ForexBrokers.com, and named ‘best in class’ across the categories of Education, Ease of Use, Commissions & Fees and Beginners. We also scooped ‘Most Innovative Tech’ and ‘Best Forex Broker’ by TradingView in 2022, and ‘Best Platform for New Investors’ by the Investors’ Chronicle Awards 2022.

We have locally regulated entities in the UK, Europe and Australia, and continue to expand across the globe.

What markets can I trade?

You can spread bet and trade CFDs on over 3,700 global markets, including stocks, indices, forex and commodities. Find out more about the markets available by visiting our spread betting and CFD pages.

Does Capital.com offer the same markets as OvalX?

For the most part, yes. We offer a broad range of global shares, indices, forex and commodities. However, there will be a few differences between our offerings, for example Capital.com does not offer bonds, futures or FX forwards.

You can browse our full range of markets across every asset class here.

What are the main differences between Capital.com and OvalX?

We are aligned across most of our products and services, but naturally there are a few differences:

- We differ in our margin policy - see more on this in the question below

- We price commodities differently. OvalX offer commodity futures whereas we offer spot commodities based on a different pricing algorithm

-

Capital.com doesn’t currently support MT4 accounts. See more in the MT4 question below.

With Capital.com you’ll also have:

- The option to choose your leverage, within the specified ESMA limits for retail clients

- Overnight funding rates on share trades that are based only on the leverage we provide to you, rather than on the full notional value

- Integrated TradingView access, meaning you can trade with Capital.com straight through TradingView charts

- 24/7 client service across all our written channels, including live chat and WhatsApp

How do I log in?

Once you have accepted all relevant terms and conditions and your account has been activated, you can access our platform by clicking the ‘Log in’ button on the top-right of any page on our website.

Where can I find information about how to use Capital.com’s products?

Check out our Education Hub to discover a whole suite of information to help you get started. You’ll find 11 quick-start videos on topics such as how to place a trade, how to add funds and how to place stops, plus in-depth guides to our products and the markets you can trade.

What tools does Capital.com offer to support my trading?

We offer a seamless experience on desktop and mobile, meaning you can trade anywhere there’s an internet connection. The smart tools you’ll find in our platform include:

- Advanced charts with over 75 technical indicators and extensive drawing tools

- Risk-management tools including guaranteed stop-losses and take-profits

- Personalised watchlists to help you keep track of your favourite markets

- Customisable price alerts to notify you if your market reaches your specified price conditions

- A free demo account, so you can test your strategies in the platform with zero risk

- An integrated Reuters news feed to keep you up to date with market-moving events

I have an MT4 account. How will this be affected?

MT4 accounts will not be supported as part of the transfer, so any MT4 accounts held with OvalX will be transferred to a regular Capital.com account. If you’d like to move your OvalX account but not your MT4 account, you’ll need to close your MT4 positions before the transfer.

Your Capital.com account gives you powerful, customisable charts with a broad range of indicators and annotation tools, combined with a straightforward, intuitive deal ticket. We’re also integrated with TradingView, meaning that you can place trades with us straight through TradingView’s popular charts. Find out how here.

My account has a power of attorney over it. How will this be affected?

Capital.com does not offer managed accounts or accounts with power of attorney. All accounts are execution-only. Therefore, if your account has an existing power of attorney over it, the power of attorney will not be transferred to Capital.com and you will be responsible for the management of your own positions.

Where can I find Capital.com’s fees and charges?

You can find the spreads for all our instruments on our website. You’ll also pay a small overnight funding charge for holding cash positions overnight, which is standard across the industry.

Will I be charged for deposits and/or withdrawals?

No, never.

Is Capital.com regulated?

Yes. In the UK, we are authorised and regulated by the Financial Conduct Authority (FCA reference number 793714). In Europe, we are regulated by the Cyprus Securities and Exchange Commission (registration number: 354252). In Australia, we are regulated by the Australian Securities and Investments Commission (AFSL 513393).

Is my money safe with Capital?

We take the security of client funds very seriously. We are compliant with the FCA’s Client Assets and Money (CASS) regulations, working with Eurobank and RBS to ensure retail investors’ funds are segregated from our own. We are covered by the Financial Services Compensation Scheme (FSCS), so you may be entitled to compensation of up to £85,000 if we cannot meet our obligations.

We also implement data-protection measures that are compliant with PCI Data Security Standards. This means we encrypt and protect your information through Transport Layer Security, which is replicated in real time and backed up securely on a daily basis.

Retail clients also have negative-balance protection, meaning that they can never lose more than the money on the account. We also offer stop-losses and guaranteed stop losses to help to protect your capital from adverse market moves, and take-profits to lock-in your profits.

How will Capital.com handle any complaints?

Complaints that relate to your account while it was at OvalX, before being transferred to Capital.com, will continue to be dealt with by OvalX. Please refer to OvalX’s complaints policy here. Any complaints that relate to your account after it was transferred to Capital.com will be dealt with by Capital.com. You can find more information on our complaints process here.

What is Capital.com’s margin policy?

If the equity on your account drops below 100% of the margin required, you won’t be able to open new trades or place pending orders until your margin is back up to 100%. We’ll endeavour to contact you when your equity drops below 100% and then 75% of your margin requirement, however we can not guarantee to do this. If your equity drops below 50%, we will start automatically closing your positions.

What happens during a margin close-out?

If your equity falls to 50% or less of the margin amount required, an automatic close-out applies in the following order until the equity is above 50% of the margin requirement:

- All pending orders are cancelled

- All losing open positions on open markets are closed

- All remaining positions on open markets are closed

- Everything else is closed, as soon as the markets open

You can find out more about this in our account terms and conditions.

Where can I go for further information?

For further info on our products and services, please visit our website.

If you have questions, you’re welcome to send us a request under the ‘OvalX transfer’ category. You can also email us at support@capital.com or live chat with us using the speech-bubble icon on our help centre. We’re here to help you 24 hours a day. If you would like to speak to us, please call us on +44203 097 8888 between 9am and 5pm UK time.

About the transfer

How will the transfer process work?

You will have been contacted by OvalX with details of the transfer process. If you choose to consent to the transfer to Capital.com, OvalX will assign a transfer date and notify you by email. This is also subject to you agreeing to our terms and conditions and being accepted by us as our client.

On your transfer date, any open positions will be closed at the mid-price, and all cash converted into your account’s base currency and sent to Capital.com. We will simultaneously open your new account with us, allocate the cash and reopen eligible positions at the mid-price. You will not pay any spread or commission for this. Your account with OvalX will then be closed. More information below.

How will my open positions, stop-losses/take-profits and pending orders be affected by the transfer?

We will transfer positions that are open and where the market is supported by Capital.com at the point of transfer. This will involve the closing of your positions at OvalX without spread and reopening them spread free with Capital.com. For more details please see below:

Indices, equities, FX, cryptocurrencies (daily contracts e.g. cash, spot)

Positions will be closed out by OvalX at the mid-price and reinstated at the mid-price on your account at Capital.com.

Indices, equities and FX (futures/forward contracts) and all commodities

Your positions will be closed out at the mid-price by OvalX and opened at the corresponding mid-price on Capital.com’s daily contract where offered, meaning there will be a difference between the price at which your position is closed and reopened to reflect the fair value between the contracts.

If you do not wish to have your position rolled into a daily contract, please make sure your position is closed before the end of day on the Friday before your account is due to be transferred.

Bonds and rates (futures)

These will not be supported by Capital.com. Positions will be closed by OvalX if the client has not closed them.

General notes:

- Position sizes may be adjusted to account for differences in contract sizes, price scalings and betting currencies, but the notional size of your positions at the time of opening will be unchanged.

- Any stops/limits will be transferred where possible. The levels may be adjusted to reflect any fair value adjustments between contracts. Open orders will be cancelled.

- There may be differences in spreads, funding rates, margins and trading hours. Therefore, please ensure you familiarise yourself with the markets you are trading.

- Any profit or loss on positions held by you on your OvalX account will be realised at the point of transfer. Please note that this may or may not have tax consequences and we advise that you seek your own tax advice.

-

Spread bets are only available in the UK. Retail customers in the UK are not permitted to trade cryptocurrencies.

If I agree to the transfer, when will my account be transferred?

Once you have consented to the transfer by logging into the OvalX platform and following the prompts, OvalX will work with us to agree a transfer date and then OvalX will confirm the date to you via email. It is likely to be over a weekend. Please note your transfer will also be dependent on you agreeing to our terms and conditions and passing our onboarding process.

Are there any regulatory consequences of the transfer?

Our clients have the same regulatory protections as OvalX clients. Therefore, there will not be any regulatory consequences of the transfer.

I am currently a professional client with OvalX. How will I be affected by the transfer?

Subject to you agreeing to our terms and conditions and being accepted by us as our client, we will honour your professional status. However, please note that we reserve the right to review your professional status at any time. In addition, you will be required to sign Capital.com documentation in relation to the loss of regulatory protections you have waived as a result of you continuing to be classified as a professional client. However, where your funds are currently subject to a title transfer collateral arrangement (TTCA) with OvalX, the TTCA will not be transferred to Capital.com.

What if I change my mind and no longer want to transfer?

If you have previously agreed to the transfer but no longer wish to transfer your account, you’ll need to contact OvalX to see if it’s possible to cancel. If your account has already been transferred to Capital.com, please contact us at support@capital.com and we can assist you in closing your account.

Where can I get more information about the transfer?

To find out more details about OvalX’s current status and the specific transfer arrangements in place, please read the FAQs on OvalX’s website.

Will there be new terms and conditions?

Yes. We have our own set of terms and conditions, which will apply to your account following the transfer. As part of the transfer process, you’ll need to acknowledge and accept these terms.

Are my personal details safe with Capital.com?

Please be assured that Capital.com is subject to the same laws on data protection as OvalX. OvalX and Capital.com will work to ensure that your personal details will remain secure. We will process your personal data in accordance with our privacy policy.