Vietnam house price crash: How have rising interest rates and demand affected the Vietnamese property market?

With interest rates rising in Vietnam, could a house price crash be imminent?

Housing prices in Vietnam continued to rise in 2022 as new supply of residential properties trickled due to tight credit and persisted overlapping property regulations.

The State Bank of Vietnam’s (SBV) decision to trigger interest rate hikes to support the Vietnamese dong (VND) has further increased the cost of purchasing residential properties in the country.

What is the likelihood of Vietnam’s house price crash? We look into Vietnam’s house price history and other data that shape the outlook for Vietnam’s property prices.

What is a housing crash?

House prices fluctuate over time. A housing bubble may develop at some point when rapid demand boosts house prices higher than their actual value. If homebuilders keep building new homes after sales and demand have begun to ebb, the housing bubble could burst, resulting in a collapse in prices.

Low mortgage rates are one of the factors that boost housing demand. People typically look to buy a house for living or as an investment.

When a central bank raises its benchmark interest rate, high mortgage rates typically follow, which drives up house prices and makes it more difficult to find buyers. Meanwhile, existing homeowners may run the risk of defaulting on their mortgage when mortgage rates are high. They could go through the foreclosure process, which could result in more homes becoming available.

Economic downturns, particularly recessions that cause job losses, decreased savings and a lack of open positions, typically result in a decline in housing demand.

In Vietnam’s housing market, property owners cannot have full and legal ownership of land because land is owned collectively by the people and administered by the government. In the unitary socialist country, property owners have limited land-use rights.

Foreign homebuyers can purchase properties in the housing market in Vietnam after the Vietnamese parliament amended the Housing Law on 25 November 2014. The country’s main property markets are the capital Hanoi in the northern part and Ho Chi Minh City, the former capital, in the south.

House prices on the Vietnam real estate market are the lowest among 12 main Asian countries, based on Global Property Guide’s rank. Buyers of Vietnam’s housing properties mainly come from Hong Kong, Mainland China, Singapore and South Korea, according to the publication.

History of Vietnam house price crashes

According to Jones Lang LaSalle, Ho Chi Minh City property index as cited by Global Property Guide, rose to average $2,889 per square metre in 2019 from $1,620 in 2018.

In 2020, house prices plummeted due to the Covid-19 pandemic, which restricted travel and curbed business activities, including real-estate constructions.

The total new apartment launches in Ho Chi Minh City dropped 50% in 2020 to 14,700 year-over-year (YOY) mainly due to unresolved legal issues, according to Jones Lang LaSalle’s Q4 2020 Vietnam Property Market Review. The prices for first-hand houses available for sale from developers or known as primary market prices, dropped 14.3% to $2,475/sqm YOY.

In Hanoi, new apartment supply halved to 15,400 units, from 2019 to 2020. However, primary market prices rose by 2.8% to $ 1,531/sqm as lower bank interest rates made properties more affordable.

Vietnam’s housing market rebounded in 2021 as a widespread Covid-19 vaccine rollout allowed construction works and business activities to gradually resume. The apartment-for-sale market recorded 18,000 new units supply, with primary market prices rising 10.6% to $2,732/sqm.

Readings from various real-estate construction firms showed property prices continued to rise in 2022 on healthy demand and a slowing rate of supply amid lingering permits issues, high interest rates and limited access to credit.

According to Jones Lang LaSalle’s Q3 2022 Vietnam’s property market report, the prime market prices for apartments stood at $3,412/sqm land, a 27.2% growth YOY. In Hanoi, apartment prices stood at $1,902/sqm, a 12.14% increase YOY.

A report from Cushman & Wakefield showed apartment prices rose by 1% in Q3 2022 to $2,800/sqm in Ho Chi Minh City. There were 4,100 new units added to the apartment market, a 56% drop from the previous quarter, but a 146% rise YOY. This brought the total supply to 7,100 units in the primary market.

The average price for landed property was $12,300/sqm, up 30% from the previous quarter and 95% down YOY. There were 450 units in Q3 2022, up 350% YOY.

Hanoi apartment prices dropped to $1,858/sqm. The supply of new apartments for sale fell to 3,000 units, a 38% decrease from the previous quarter and 15% down YOY.

Sales fell to 4,600, a 15% decline quarter-over-quarter (QOQ) due to tight credit controls, making it harder for consumers to get a house loan.

In the condominium market in Ho Chi Minh City, new units for sale dropped 80% to 2,851, from 15,000 units in the second quarter, but the number rose 49% YOY, according to commercial property firm CBRE. The average primary condos price rose to $2,545/sqm, up 3.4% QOQ and 12% YOY.

Factors contribute to rising home prices in Vietnam

Persistent overlapping regulations and tight access to credit have continued to constrain developers’ ability to meet housing demand in Vietnam, contributing to rising prices.

In Vietnam property news, the number of completed commercial housing projects rose 34% YOY to 4,123 units in Q3 2022, according to Vietnam’s Ministry of Construction.

However, it was only a fraction of the number of houses under construction at 324,511 units in the quarter. The number of newly licensed commercial houses was 36 projects, with 24,324 units in Q3 2022.

Let’s take a closer look at the factors that shape house prices in Vietnam.

Overlapping and inconsistencies law

According to the Vietnam’s Real Estate Association (VNREA), three overlapping laws have caused difficulties for investing in the real estate market: the Land Law, Housing Law and Real Estate Business Law.

The provisions of the land law make it harder for the issuance of site clearances, calculation for the value of land and compensation. The overlapping and unclear regulations have constrained issuance of land-use rights certificates, particularly for tourism properties such as condotels.

In September, Vietnam’s National Assembly Standing Committee began discussion of the amended Land Law. The amendment process aimed to resolve those issues and solve problems arising from land use and management, the assembly said in a statement.

Tight access to credit

Developers are also facing difficulties to access bank loans for funding construction projects. The SBV requires domestic and foreign lenders to provide more loans to priority sectors, such as agriculture and rural development, high technology companies and small-medium enterprises. It also strictly controls loans for potentially risky areas, such as real estate sectors.

The SBV has identified credit for the real estate sector as a potential risk because loans are often disbursed for long terms and in large volumes. On the other hand, the credit institutions’ capital mobilisation is often for the short term.

High interest rates

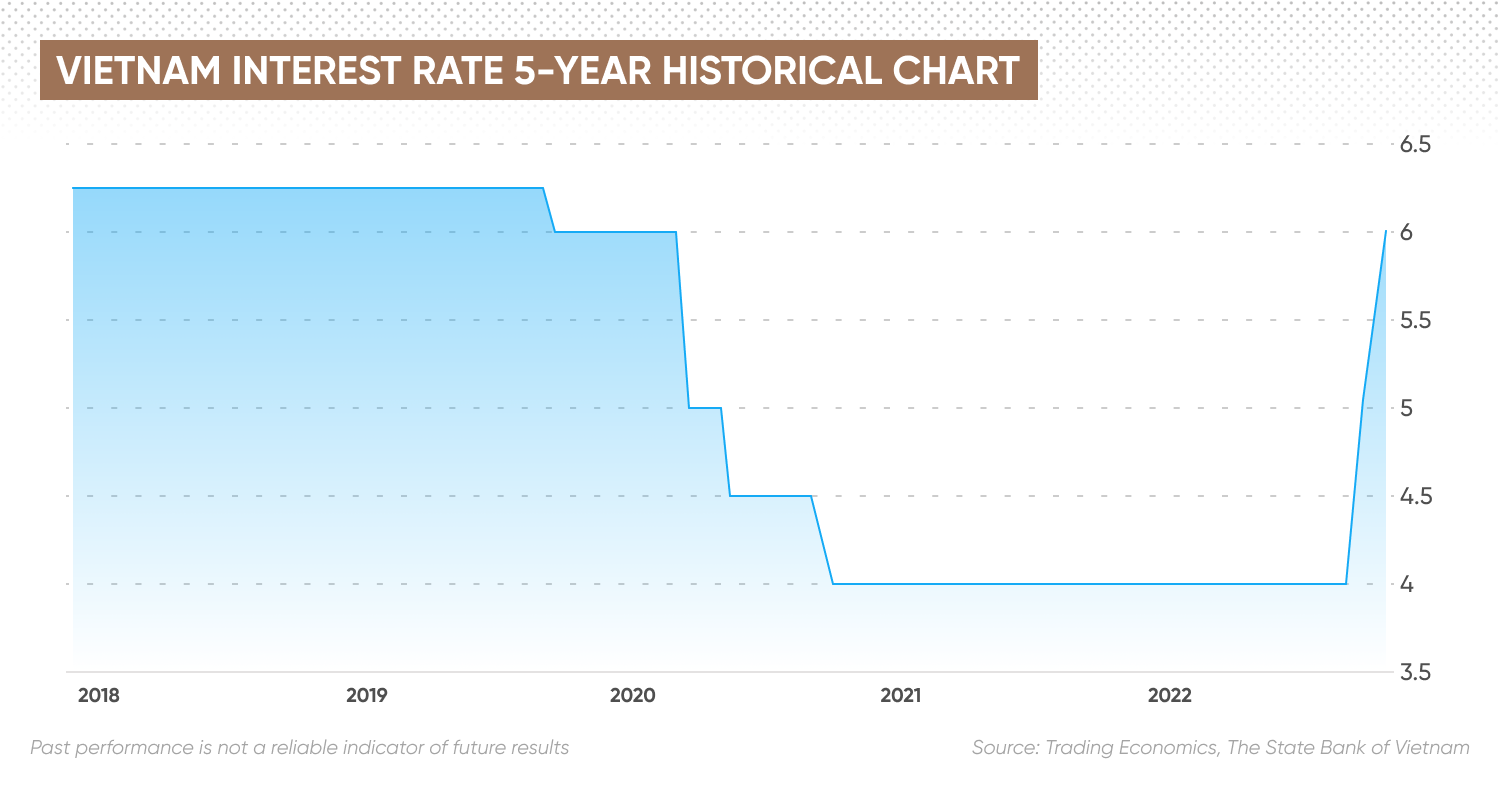

After leaving its policy rates unchanged since 2020, the SBV began its tightening cycle in September by raising its policy rate by 100 basis points (bps) to 5% in September to shore up its currency, the Vietnamese dong.

The rate hike came as the US Federal Reserve’s (Fed) aggressive rate hikes since March has strengthened the US dollar (USD) against emerging countries’ currencies, including the VND. In October, the SBV implemented another 100 bps hike, lifting the policy rate to 6%.

The USD/VND, the exchange rate for the US dollar to Vietnamese dong, has gained 9.26% year-to-date (YTD), hitting VND 24,790, as of 28 November.

Vietnam housing market predictions for 2022 and beyond

With legal hurdles unlikely to resolve anytime soon and high interest rates, what is the outlook for Vietnam’s housing prices? What is the possibility of a Vietnam house price crash?

Vietnam’s Ministry of Construction forecast that the average price of apartments in Ho Chi Minh City could grow at an annual rate of 4%, reaching VND62m ($2,502)/sqm in 2024, from VND58m currently.

While not providing a detailed forecast on Vietnam’s property market, property consultants Savills said:

Jones Lang LaSalle forecast the new apartment supply for 2022 in Ho Chi Minh City and Hanoi could be adjusted downward due to legal issues and macroeconomic uncertainties, noting:

“Rising interest rates will also drive away highly leveraged investors, leaving only owner-occupiers and investors with strong financial capabilities. Since policies have been set to focus on maintaining market stability and investment demand has slowed, the selling price is expected to rise at a slower rate.

“At the same time, demand may be dampened as many buyers will cautiously watch the interest rate movement. Hence, it is expected that in the near term, developers will continue to apply more attractive incentives to drive market demand.”

The company forecast total apartment supply in Ho Chi Minh City at 17,700 units in 2022, compared to 18,000 in 2021. In Hanoi, new supply was expected at 2,500 units, lower than the Q3 level.

Final thoughts on Vietnam’s housing prices

Property firms and Vietnam’s Ministry of Constructions did not provide estimates for Vietnam’s housing market beyond 2022. Remember that analysts’ predictions for a potential Vietnam house price crash may not be accurate. Always do your own research before trading, looking at the most recent news, technical and fundamental analysis, and a variety of analysts’ commentary.

Please keep in mind that past results do not guarantee future results. In addition, never trade with money that you cannot afford to lose.

FAQs

Does Vietnam have a housing crisis?

Legal uncertainties, tight credit and high interest rates have constrained new housing supply, raising prices in Vietnam’s housing market.

Is there a housing bubble in Vietnam?

Property firms mentioned in this article did not forecast or suggest there is a housing or real estate bubble in Vietnam. However, these forecasts could be inaccurate. Always do your own research before making any investment decision. Remember to never invest money you cannot afford to lose.

Is now a good time to buy a property in Vietnam?

Like any other investment assets, buying a property comes with risks. Whether or not it is a good time to buy a property in Vietnam depends on your investment portfolio, your knowledge on the Vietnam’s property market and your risk profile. Remember to do your own research before investing. Never trade money you cannot afford to lose.