USD/THB forecast: Thai baht strengthens against the US dollar in anticipation of further interest rate hikes from BoT

The Thai baht has gained against the US dollar since early November. Where to next?

The Thai baht (THB) has strengthened against the US dollar (USD) since early November, as the Bank of Thailand (BoT) continued raising interest rates, indicating that it now expects inflation to be more persistent than it had previously expected.

The USD/THB exchange rate has slid back by around 8%, with a retreat in the value of the dollar against other currencies adding further momentum.

What is the outlook for the baht heading towards the end of the year and into 2023?

In this article, we look at what has been driving the USD/THB pair and some of the latest forecasts from analysts.

What drives the USD/THB pair?

The USD/THB exchange rate represents how many Thai baht – the quote currency – are needed to buy one US dollar – the base currency.

The Thai baht is one of the world’s fastest growing currencies and a major currency in southeast Asia. Thailand has one of the region’s more stable economies, with growing manufacturing and agricultural export bases and a large tourism industry. The THB is also influenced by the Chinese economy, as China is one of Thailand’s largest trading partners and a source of tourism.

The Thai baht was pegged to the US dollar for more than a decade until the Asian financial crisis in 1997, when it was floated and quickly plunged in value. It partially rebounded over the following years and the exchange rate remains volatile depending on macroeconomic drivers such as gross domestic product (GDP) growth, current account balances, interest rates, inflation and political events.

The US dollar is the global reserve currency, so its value is driven by sentiment on the health of the world economy as well as economic activity in the US. Investors tend to view the dollar as a safe haven during times of economic and geopolitical uncertainty, which has driven the currency to 20-year highs against a basket of other currencies – known as the US Dollar Index (DXY) – this year.

DXY live chart

Monetary policy on using higher interest rates to combat soaring inflation has also been a major driver for the dollar’s value. A series of interest rate hikes since March has made the currency more attractive for investors. Indications that the pace of rate hikes could slow has played a key role in the DXY weakening over the past month.

USD/THB retreats on interest rate sentiment

The USD/THB exchange rate began to climb in late February as the dollar strengthened on safe haven inflows following Russia’s invasion of Ukraine. The pair reached 34.75 in May when the US Federal Reserve hiked interest rates by 50 basis points after a 25-point rise in March. It has since raised rates by 75 basis points four times – most recently on 3 November.

![5-year USD/THB chart] 5-year USD/THB chart]](https://img.capital.com/articles/USD_THB-forecas-MCT-8092-_-1.png)

The USD/THB pair reached 36.75 in July. It retreated to 35.22 in mid-August amid market sentiment that lower inflation would slow the pace of US rate hikes. But, subsequent inflation figures were higher and the Fed indicated that such hope were premature, pushing the USD/THB pair back up. The pair reached 38.30 in October and remained around 38 until early November. USD/THB then retreated to 36 and accelerated its decline in the last week of the month below 35 to 34.70 on 2 December. It has since traded around 35.

Thailand’s central bank raised interest rates on 10 August for the first time in three years with a 25-basis point increase, up from a record low of 0.50% to 0.75%. The bank increased rates to 1% on 28 September, raising them again by 25 basis points to 1.25% on 30 November, the highest level since November 2019.

“The Thai economic recovery has continued to gain traction. Tourism and private consumption will continue to be key economic drivers going forward and help alleviate the impact of global slowdown on the Thai economy. Headline inflation is expected to be higher than the previous projection for 2023 due to domestic energy prices. However, it is still expected to decline and return to the target range within 2023,” the BoT’s monetary policy committee stated.

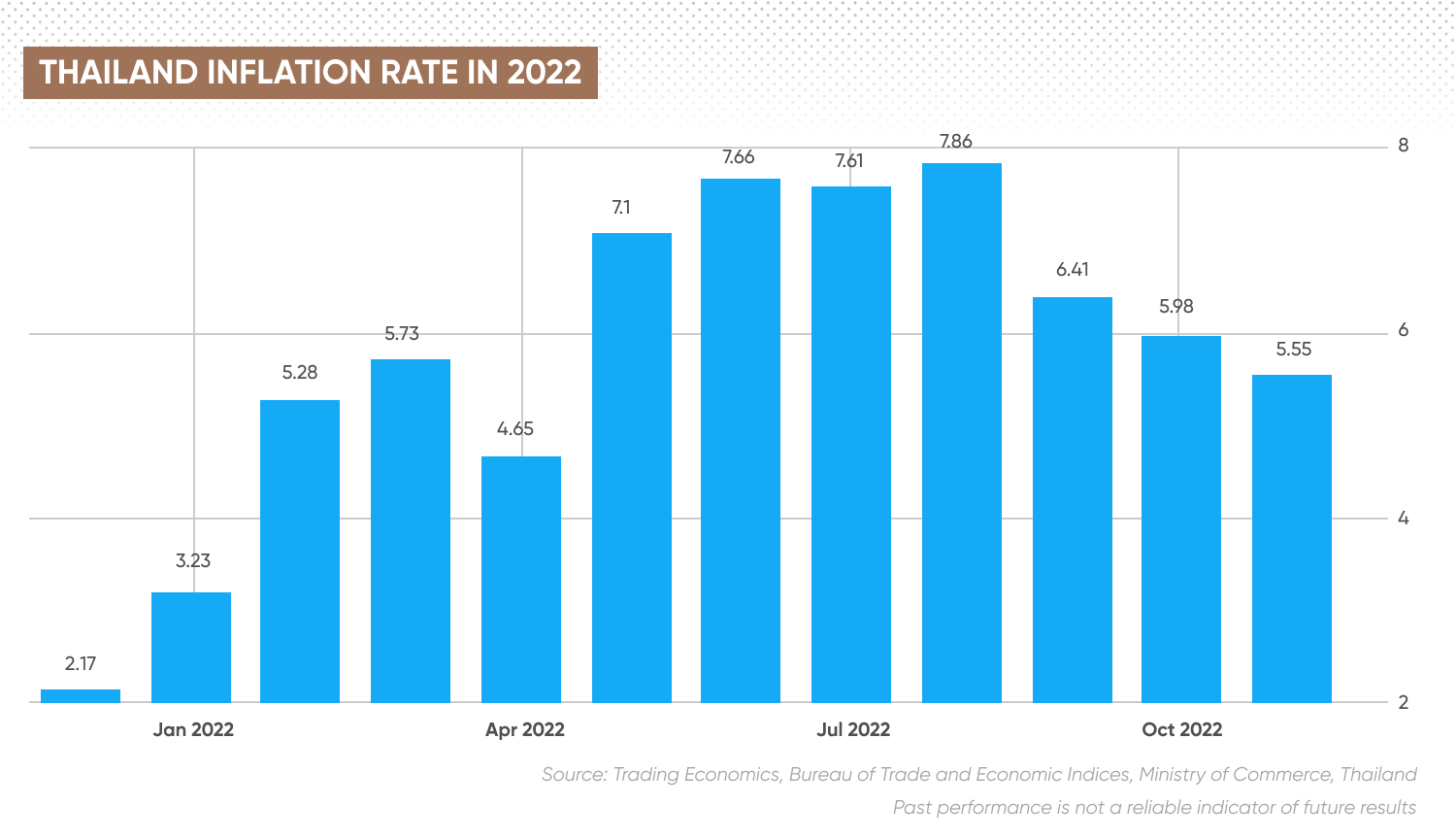

Data released on 7 December showed that Thailand's annual inflation rate rose by a less-than-expected 5.5% in November, the lowest figure since April 2022.

However, the figure still exceeded the central bank's target range of 1% to 3%. Analysts at Goldman Sachs said: "We continue to expect the BoT to continue hiking policy rates in 25 basis point increments until the policy rate reaches a terminal rate of 2.5% in Q3 next year.”

What do these factors mean for the outlook for the US dollar to Thai baht forecast?

Let’s look at what the latest foreign exchange predictions from analysts indicate about the direction of the USD/THB pair in the future.

USD/THB forecast: Will the THB strengthen further or retreat on USD strength?

Analysts at Hong Kong-based Hang Seng noted that if the central bank can achieve a balance between controlling inflation and supporting economic growth, it will be positive for the value of the baht. There is technical support for the USD/THB pair at 33, with resistance at 38.

Singapore-based UOB updated its USD/THB forecast in early November:

On 5 December, UOB’s weekly analysis indicated that USD/THB “is likely to weaken further; the level to watch is at 34.30, followed by 34.05… The rapid improvement in downward momentum is likely to lead to further USD/THB weakness this week… On the upside, a breach of 35.05 (minor resistance is at 34.85) would indicate that USD/THB is unlikely to weaken further”.

Analysts at Japan-based MUFG were “neutral to bearish” in their USD/THB prediction on 5 December: “We note that trade growth is now easing. Exports fell by 3.6% y/y in October versus an 8.4% increase in September. Import growth has also slowed markedly to 5.4% y/y from 20.5% prior. There may be some stabilisation from past moves. If USD/THB moves lower, we see it examining the low of 34.30 seen on 6 June.”

USD/THB forecast 2023

The bank’s USD/THB forecast for 2023 projected that the pair could trade down to 36 in the first quarter, from 36.50 at the end of 2022, and at 35.75 in the second quarter and 35.25 in the third quarter.

Malaysia-based Maybank’s analysts were cautious in their USD/THB forecast in early November, noting that “even as we are likely nearer to the trough in risk sentiments, recovery could take time. We note risk assets (including AxJ FX) receiving support from incremental bets for peak Fed hawkishness of late, but we are careful not to chase this narrative excessively. Dollar could remain in buoyant ranges into early 2023 on slow pace of decline in US price pressures and sustained haven demand (i.e., geopolitical tensions in Europe, between US-China).

The bank predicted that the USD/THB pair could trend lower, from 38.50 at the end of 2022 to 38 in the first quarter, 37 in the second quarter and 36 in the third quarter.

But the long-term USD/THB forecast 2025 from algorithm-based forecasting service Wallet Investor projected at the time of writing (8 December) that the pair could rise to 40.146 at the end of the year, from 34.712 at the start of 2023, and 36.528 at the end of next year.

The USD/THB forecast 2030 from AI Pickup, however, indicated that the pair could decline to 29.63 by the end of the decade, from 34.1 in 2023 and 28.93 in 2025.

If you are looking for a long-term USD/THB forecast, it’s important to remember that currency markets are highly volatile, making it difficult for analysts and algorithm-based forecasters to come up with accurate long-term predictions. As such, they can and do get their predictions wrong.

We recommend that you always do your own research. Look at the latest market trends, news, technical and fundamental analysis, and expert opinion before making any investment decision. Keep in mind that past performance is no guarantee of future returns. And never invest money you cannot afford to lose.

Interested in comparing the major forex pairs? Try our currency strength meter.

FAQs

Why has USD/THB been dropping?

The USD/THB pair has weakened since early November as the Thai central bank has raised interest rates to reduce the differential to US rates, while the US dollar has retreated from its highs at the prospect of a slower pace of rate hikes.

Will USD/THB go up or down?

The direction of the USD/THB pair could depend on monetary policy in the US and Thailand as well as the health of the global economy, among other factors.

When is the best time to trade USD/THB?

You can trade currency pairs, including USD/THB, around-the-clock. However, there are certain times when forex trading is most liquid. This usually occurs around the release of major economic announcements, such as trade data, inflation and interest rates, which often tends to drive volatility on forex markets higher. Keep in mind that high volatility increases risks of losses.

Is USD/THB a buy, sell or hold?

How you trade the USD/THB pair is a personal decision depending on your risk tolerance and investing strategy. Forecasts shouldn’t be used as a substitute for your own research. You should do your own research to take an informed view of the market. And never invest money that you cannot afford to lose.